- Home

- »

- Renewable Chemicals

- »

-

Biolubricants Market Size, Share And Growth Report, 2030GVR Report cover

![Biolubricants Market Size, Share, & Trends Report]()

Biolubricants Market Size, Share, & Trends Analysis Report By Source (Vegetable Oil, Animal Oil), By Application (Transportation, Industrial), By End-use (Industrial, Commercial Transportation), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-013-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Biolubricants Market Size & Trends

The global biolubricants market size was valued at USD 2,461.2 million in 2022 and is anticipated to grow at a CAGR of 5.3% from 2023 to 2030, owing to increasing application in the transportation & manufacturing industries. Growing demand for lubricants with superior product characteristics such as constant viscosity, high flash points, biodegradability, and lower emission levels are driving favorable growth in various industrial applications owing to stringent emission guidelines and regulatory frameworks. Increasing R&D initiatives by key participants coupled with technological innovations are expected to introduce new avenues for lubricant applications. Furthermore, the market is fueled by the increasing supply of high-performance, cost-competitive green base oils, in the context of government regulations driving such products. Along with these factors, the major drivers propelling the demand for lubricants are rising environmental concerns and stringent government regulations, especially in Europe and North America, over the usage of synthetic lubricants.

The expansion of the automotive sector, particularly in emerging regions such as India, China, South Africa & Brazil is also expected to drive the consumption of sustainable products that contribute to higher fuel efficiency & lower carbon emissions from vehicles. Biolubricant production remains highly dependent on the supply of vegetable & animal oils that are by-products of other industrial processes. Complex processing technologies also increase the initial cost of production, which may hamper its growth over the forecast period.

Plant-based oils have displayed great potential as a substitute for conventional mineral oils since they are structurally similar to the long-chained hydrocarbons found in mineral oils. These oils are thus increasingly being utilized for biolubricant production owing to their advantageous characteristics such as renewability, non-toxicity, economic & environmental friendliness among others. Some of the commonly used plants are soybean, rapeseed, and canola.

Increasing R&D efforts to explore opportunities for biolubricant formulation via animal oils & fats is likely to boost segment growth over the forecast period. These oils & fats offer lucrative potential in sectors that currently primarily utilize petrochemical lubricants such as healthcare.

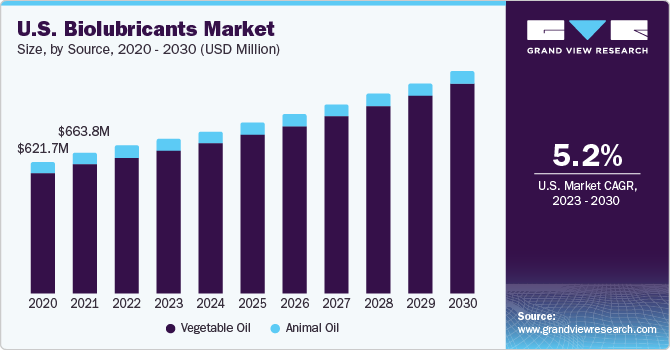

Source Insights

The vegetable oil segment accounted for the largest revenue share of 89.3% in 2022. Biolubricants derived from vegetable oils and animal fats are experiencing a surge in popularity due to their eco-friendly characteristics and wide acceptance. These lubricants are increasingly recognized for their positive environmental impact, leading to growing adoption in various industries. Vegetable oils possess exceptional lubricity, surpassing that of mineral oil. Some of the other properties of vegetable oil are high viscosity index and high flash point.

The animal oil segment is expected to grow at a CAGR of 3.2% during the forecast period. Animal oil, such as rendered fats or oils from animal byproducts, is derived from renewable sources, making it an environmentally sustainable option for biolubricants. Utilizing animal oil helps reduce dependence on non-renewable resources. Animal oil-based biolubricants offer excellent lubricating properties and compatibility with various applications and equipment. They can provide effective lubrication, protection, and durability, supporting optimal performance and reducing maintenance needs.

Application Insights

The transportation segment held the largest revenue share of 62.1% in 2022. Within this segment, automotive engine oils dominate the industry, since these oils exceed the performance of conventional engine oils. Furthermore, bio-based engine oils display a higher inherent biodegradation rate, low toxicity to aquatic organisms, and very low levels of bioaccumulation that are boosting their application in the sector.

Transmission fluids are also one of the major application sectors of biolubricants. These liquids enhance the performance of brake band friction, valve operation, gear lubrication, and torque conversion. Transmission fluids have additional uses as hydraulic fluids and lubricants in power steering and 4WD transfer cases respectively. Increased use of transmission fluids in automotive manufacturing is expected to have a positive impact on the market.

The industrial segment is expected to grow at a CAGR of 4.8% over the forecast period. Process oils occupied a significant portion of the industrial application segment. These oils are widely utilized in technical & chemical industries to improve production processes. Growing demand for specialty chemicals in emerging economies of Asia Pacific is expected to drive the consumption of these oils.

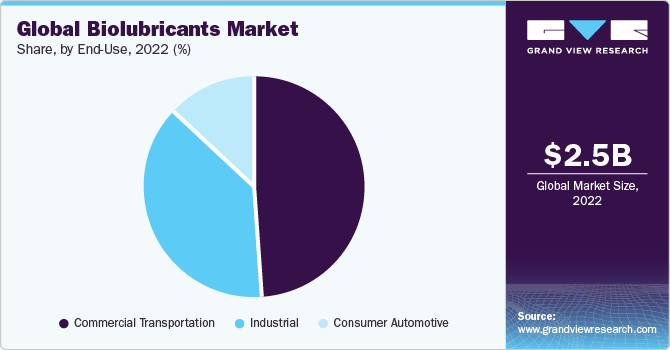

End-use Insights

The commercial transportation segment accounted for the largest revenue share of 48.7% in 2022 owing to growing awareness regarding fuel efficiency & maintenance in heavy and light-duty trucks. Improvement in vehicle quality is directly proportional to a reduction in the environmental impact of these vehicles, which has garnered high popularity for these lubricants in the segment.

The consumer automotive segment is expected to grow at the fastest CAGR of 4.9% over the forecast period. Rising passenger car sales in emerging economies have also fostered product demand in the consumer automotive segment. Consumers are increasingly investing in advanced technologies & performance-enhancing products to comply with fuel efficiency regulations. Additionally, investments by the private sector and numerous automobile companies that are working toward manufacturing ultra-low emission vehicles to meet transitioning regulatory standards are also expected to foster the demand for biolubricants over the forecast period.

Regional Insights

North America dominated the biolubricants market and accounted for the largest revenue share of 35.2% in 2022. A revitalized automotive industry in the U.S. & Canada, along with increasing regulatory intervention from the U.S. government that has specified a minimum renewable content for various products are expected to drive bio-based lubricant consumption.

The U.S. Air Force is also encouraging plant-derived biodegradable products as a strategic & fundamental approach to national security, which is another driving force for the market. North America is also likely to benefit from an abundance of soybean & rapeseed feedstock as a result of high biodiesel production in the region.

Asia Pacific is expected to grow at a CAGR of 5.6% during the forecast period. The region is home to some of the largest automobile manufacturing hubs. Countries such as China, India, Indonesia, and Southeast Asia are increasingly manufacturing and exporting passenger cars and other vehicles to developed regions.

The shift of production facilities to Asian countries owing to favorable government regulations and low labor costs is expected to further increase automotive spending and industrialization. Further, a shift in trend towards sustainable vehicles with greater efficiency is anticipated to boost the production and demand for biolubricants in the region. Innovation and R&D investments to promote novel lubricant applications are further expected to complement regional demand over the forecast period.

Key Companies & Market Share Insights

Major oil refining companies, which are traditionally involved in conventional lubricant production are increasingly supplying biodegradable lubricants for transportation applications. A majority of small and medium companies are focused on biolubricants R&D. Some prominent players in the global biolubricants market include:

-

TotalEnergies

-

Exxon Mobil Corporation

-

Shell plc

-

CASTROL LIMITED

-

PETRONAS Lubricants International

-

Kluber Lubrication

-

Emery Oleochemicals

-

Chevron Corporation

-

Albemarle Corporation

-

FUCHS

Recent Developments

-

In April 2023, Exxon Mobil unveiled its plan to allocate approximately USD 110 million towards the establishment of a lubricants production facility in India. The proposed plant is projected to commence operations at the end of 2025. The facility aims for a production capacity of up to 159 million liters of finished lubricants per year. This strategic investment aims to cater to the rising domestic demand from various sectors including manufacturing, steel, power, mining, and construction, as well as the commercial and passenger vehicle industries.

-

In July 2022, Chevron Corporation introduced a new synthetic grease formulated with biodegradable synthetic esters that fully comply with the 2013 Vessel General Permit (VGP) regulations set by the U.S. Environmental Protection Agency (EPA) for environmentally acceptable lubricants (EALs). This innovative product not only satisfies the stringent requirements for marine applications but also demonstrates versatility across diverse sectors such as forestry, agriculture, and construction vehicles. Notably, the synthetic grease exhibits excellent biodegradability and possesses optimal flow characteristics, making it highly compatible with contemporary centralized lubrication systems.

-

In May 2020, FUCHS and BASF entered a collaborative effort to conduct a comprehensive sustainability assessment and develop more environmentally friendly lubricant products. Through a recent joint execution of an Eco-Efficiency Analysis (EEA) for various mineral oil-based hydraulic fluids, FUCHS and BASF's global business unit Fuel and Lubricant Solutions have successfully established a compelling argument for a thorough and evidence-based assessment of the sustainability aspects pertaining to hydraulic fluids and lubricants. This partnership aims for a holistic approach to sustainability and drives the creation of lubricant products that align with environmentally responsible practices.

Biolubricants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,587.2 million

Revenue forecast in 2030

USD 3.73 billion

Growth Rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

TotalEnergies; Exxon Mobil Corporation; Shell plc; CASTROL LIMITED; PETRONAS Lubricants International; Kluber Lubrication; Emery Oleochemicals; Chevron Corporation; Albemarle Corporation; FUCHS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biolubricants Market Report Segmentation

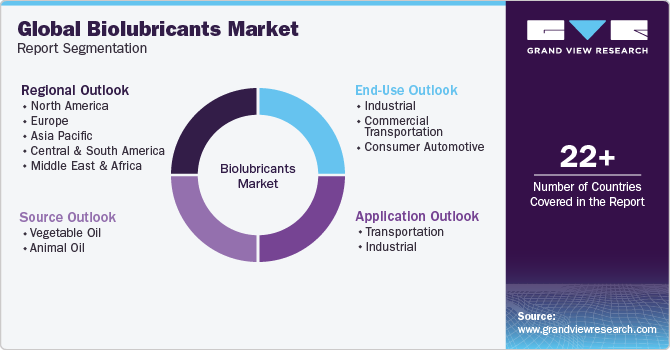

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biolubricants market based on source, end-use, application, and region:

-

Source Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Vegetable Oil

-

Animal Oil

-

-

End-Use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Industrial

-

Commercial Transportation

-

Consumer Automotive

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Transportation

-

Automotive Engine Oils

-

Gear Oils

-

Hydraulic Oils

-

Transmission Fluids

-

Greases

-

Chainsaw Oils

-

Others

-

-

Industrial

-

Process Oils

-

Demolding Oils

-

Industrial Gear Oils

-

Industrial Greases

-

Metal Working Fluids

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Southeast Asia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biolubricants market size was estimated at USD 2,461.2 million in 2022 and is expected to reach USD 2,587.2 million in 2023.

b. The global biolubricants market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 3.73 billion by 2030.

b. North America dominated the biolubricants market with a share of 35.1% in 2022. This is attributable to increasing regulatory intervention from the U.S. government that has specified a minimum renewable content for various products.

b. Some key players operating in the biolubricants market include Total S.A., UBL, Shell, ExxonMobil, Chevron and British Petroleum.

b. Key factors that are driving the biolubricants market growth include superior characteristics of biolubricants such as constant viscosity, high flash points, biodegradability, and lower emission levels.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."