- Home

- »

- Pharmaceuticals

- »

-

Biomarkers Market Size, Share And Growth Report, 2030GVR Report cover

![Biomarkers Market Size, Share & Trends Report]()

Biomarkers Market Size, Share & Trends Analysis Report By Type (Efficacy, Validation), By Product, By Application (Drug Discovery & Development, Personalized Medicine), By Disease, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-979-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Biomarkers Market Size & Trends

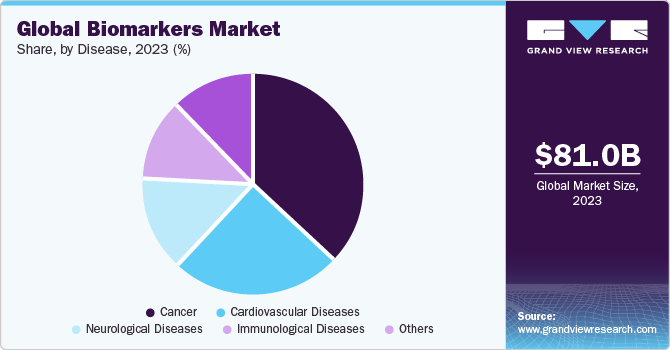

The global biomarkers market size was estimated at USD 81.04 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.36% from 2024 to 2030. The rising prevalence of cancer, significance of companion diagnostics, investments in research, and significant innovations owing to ongoing research are anticipated to drive market growth. For instance, in February 2023, National Institutes of Health announced funding of USD 4 million to Eastern Virginia Medical School (EVMS) for research and development of biomarker for early detection of aggressive prostate cancer.

Increase in the prevalence of fatal diseases has been observed over the past few years, which includes cancer, diabetes, cardiovascular disorders, and other chronic diseases. One of the major factors leading to an increase in their prevalence is lifestyle changes. According to the American Cancer Society, in 2022, an estimated 1.9 million new cancer cases are expected to be registered in the U.S., accounting for 609,360 deaths. Breast and lung cancers were observed as the most common ones worldwide. According to the World Health Organization (WHO), in 2022, an estimated 236,740 new cases of lung cancer were expected to be reported in the U.S., accounting for 130,180 deaths.

The use of biomarkers in infectious disease diagnosis is anticipated to become increasingly common in the upcoming years. For instance, as per Frontiers in Microbiology in 2020 , potential MicroRNA-based biomarkers have been identified for the diagnosis of infections such as influenza infections, rhinoviruses, HIV, tuberculosis, malaria, Ebola, and Hendra virus. These are aimed at facilitating early onset of infectious diseases. Biomarkers are also under study for the diagnosis of SARS-CoV-2. They have a high prognostic potential, which is projected to play a crucial role in the diagnosis of asymptomatic cases that hinder the tracking of pandemic cases. Furthermore, the high stability despite freeze and thaw cycles gives them an added advantage.

Innovative treatments that combine biomarkers with new or existing medicines are continuously being launched. For instance, biomarkers can now be used for the treatment of neurological diseases to track brain health by measuring molecules. Recent developments are making treatment of neurological diseases easier, for example, the development of biomarker signatures. This has resulted in noninvasive testing, faster drug development, and early diagnosis. R&D is leading to the discovery of novel biomarkers.

The emergence of digital biomarker which assists pharmaceutical companies with contextual and supplementary information to conclude clinical trial decisions is further propelling growth of the market. IXICO plc, a digital technology-based company that has expertise in neurosciences, is collaborating with biopharmaceutical companies to validate clinically digital biomarkers and use them in regulatory compliant clinical trials. Another new biomarker technology published in PLOS Journal in June 2021 is bowel cancer relapse detection biomarkers with the help of ctDNA. This can be used as a prognostic tool that predicts the recurrence with a 100% accuracy rate, thereby enabling better treatment.

Leading players are focusing on introducing programs that can increase the commercialization of biomarker-based products. For instance, in November 2022, NeoGenomics, under the sponsorship of ImmunoGen, launched a novel biomarker testing program for patients with Epithelial Ovarian Cancer (EOC). This initiative targeted FRα in patients with platinum-resistant EOC and increased patient access to FDA-approved ImmunoGen's ADC, ELAHERE. Similarly, in April 2021, Amgen launched a Biomarker Assist Program for metastatic Non-Small Cell Lung Cancer (NSCLC) patients and increased access to testing.

Market Concentration & Characteristics

Market growth stage is high and the pace is accelerating. The biomarkers market is characterized by a high degree of innovation fueled by rapid technological advancements. R&D is leading to the discovery of novel biomarkers. For instance, as per Nature Journal in 2020 , tetranectin is a potential biomarker for heart failure diagnosis. Similarly, in 2020, sTNFR2 was revealed as a novel biomarker for the diagnosis of acute adult T-cell leukemia/lymphoma. The market is likely to witness lucrative growth over the forecast period due to such discoveries and technological advancements.

The industry is also characterized by a high level of partnership and collaboration activity by the leading players. It is one of the most adopted strategies by the players to enhance early commercialization of their products and improve the availability of products. For instance, in March 2023, Koneksa extended its partnership with SSI Strategy to scale and accelerate the adoption of digital biomarkers.

The biomarker segment is witnessing rapid technological advancements and high demand for personalized medicine. Thus, to ensure patient access to these new technologies, a reimbursement framework needs to be worked upon to meet the changing market scenario. This will potentially encourage manufacturers to invest in new products as reimbursement policies have a direct impact on the development and growth of diagnostic & prognostic tools.

The market players undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. This is the most prominently adopted strategy by the companies to attract more customers. For instance, in July 2022, the U.S. FDA granted Breakthrough Device Designation to Elecsys Amyloid Plasma Panel for early detection of Alzheimer’s disease. Roche is the first IVD manufacturer to receive Breakthrough Device Designation for a blood-based biomarker test for Alzheimer’s.

Type Insights

The safety segment held the largest revenue share of 37.62% in 2023. Safety biomarkers can be used to customize therapies for patients, due to high risk of adverse reactions. They can predict or detect exposure effects or adverse drug events. Increase in the use of safety biomarkers in drug discovery & development is anticipated to boost market growth.Furthermore, an increase in population at high risk of developing various diseases, such as cancer, cardiovascular conditions, and kidney disorders, is expected to positively influence the market. Growing awareness of routine health checkups and lower drug attrition rates, which have been linked to biomarker-based therapies, are driving segment growth.

The efficacy biomarkers segment is expected to grow at the fastest CAGR from 2024 to 2030. Efficacy biomarkers aid in predicting patient responses to a specific drug. Despite the challenges in research, several findings have been reported on efficacy biomarkers. For instance, ATPase-copper Transporting β Polypeptide (ATP7B) is a biomarker used for detection of ovarian cancer. Furthermore, collaborative efforts between companies and academic institutes are expected to enhance the discovery of biomarkers. For instance, in June 2023, the National Cancer Institute announced the launch of ComboMatch platform trial which helps researchers to test efficacy of treatment combinations.

Product Insights

The consumables segment led the market in 2023. The growing emphasis on personalized and precision medicine has led to a growing need for biomarkers to identify specific disease markers and tailor treatment plans accordingly. This drives the demand for consumables used in biomarker discovery and validation. Moreover, the rising prevalence of chronic diseases such as cardiovascular diseases, cancer, and neurodegenerative disorders have led to an increase in consumption of consumables further driving market growth.

The services segment is anticipated to exhibit a lucrative CAGR over the projected period. Biomarkers are used in clinical trials for patient stratification, monitoring treatment responses, and assessing safety. Biomarker services support the design, implementation, and analysis of clinical trials, ensuring that biomarkers are effectively utilized for decision-making in drug development. Moreover, clinical laboratories and diagnostic service providers offer biomarker-based diagnostic testing services for various diseases. These services help in the accurate and reliable detection of biomarkers, contributing to early disease diagnosis and monitoring.

Application Insights

The drug discovery & development segment dominated the market in 2023. Biomarkers can be beneficial for accelerating drug development for certain diseases by predicting drug efficacy more easily than conventional clinical endpoints. Hence, they can help in identifying candidates that are likely to fail, thereby reducing drug development costs. Therefore, key players operating in this segment are focused on using biomarkers in drug development, which is leading to strategic alliances and thus driving the market.For instance, in June 2022, InterVenn Biosciences collaborated with the Foundation for the National Institutes of Health’s Biomarker Consortium and the Worldwide Innovative Network (WIN) Consortium, which aims to advance clinical trials, improve patient care, enhance precision oncology, and accelerate biomarker discovery.

The diagnostics segment is projected to register the fastest CAGR from 2024 to 2030. The increasing research focused on identification of new diagnostic biomarkers is fueling this growth. For instance, in February 2022, Japanese scientists found two new diagnostic tissue biomarkers, PHGDH and TRIM29, indicated for malignant pleural mesothelioma. These can be used to diagnose mesothelioma quickly and help doctors in differentiating between mesothelioma and other cancers.R&D in the segment confirms the development of novel biomarkers for early-stage detection of diseases such as Alzheimer's.

Disease Insights

The cancer segment led the market in 2023 and is expected to retain its dominance from 2024 to 2030. The growth of this segment is attributed to an increase in demand for rapid & accurate diagnostic tools and rise in global incidence of cancer. According to Global Cancer Observatory, about 19.3 million new cancer cases were recorded in 2020, while around 10 million cancer deaths were reported in the same year. In addition, growth in research activities for discovery and development of novel cancer biomarkers is widening the scope for market growth. In June 2022, researchers from the Tokyo University of Agriculture and Technology developed a novel technique based on DNA computation for the identification of cancer miRNA patterns. By using low concentrations of the target biomarkers, the new technique can be a promising tool for early cancer diagnosis.

The immunological diseases segment is expected to attain the fastest CAGR from 2024 to 2030. This is mainly attributed to the increase in research aided with the rising prevalence of immunological diseases. For instance, in May 2023, according to article published by Boston Children’s Hospital, researchers have identified immune biomarkers that have helped in predicting COVID-19 severity and are mostly likely to help in future pandemics.Furthermore, increasing R&D in the renal biomarkers segment is anticipated to fuel the segment’s growth. For instance, in May 2022, researchers from the University of Houston, with the help of immunoproteomics-based discovery studies, reported potential biomarkers related to lupus nephritis related to clinical parameters, such as renal pathology indices. These biomarkers for lupus nephritis can be used to provide more reliable clinical blood tests for the disease, replacing kidney biopsy, which is a currently used invasive test.

Regional Insights

North America led the market with a revenue share of 43.94% in 2023, due to high disease burden, technological advancements, increased consumer awareness, supportive government initiatives, and improvements in healthcare infrastructure. Local presence of key players is anticipated to increase the penetration of novel biomarkers. Major players operating in the market include Abbott; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific, Inc.; and Bio-Rad Laboratories, Inc.; Many academic institutions, research centers, and universities are collaborating with key market players to develop biomarkers for diagnosing and monitoring numerous diseases. Increasing efforts for the development of digital biomarkers and increasing investments as well as collaboration activities are anticipated to drive growth.

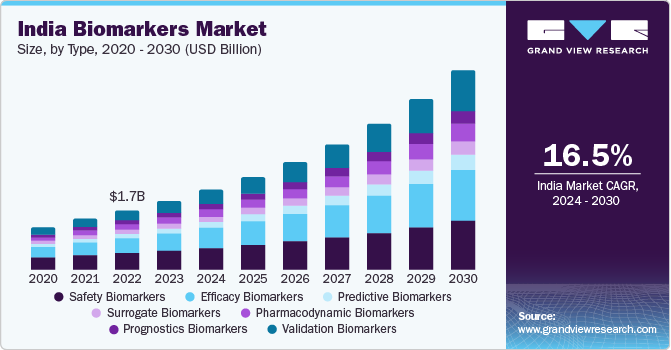

Asia Pacific is anticipated to attain the fastest CAGR from 2024 to 2030. Factors such as high prevalence of cancer, surge in funding for discovery, low cost of clinical trials in developing nations, and rising research initiatives are expected to support regional growth. Several advancements in R&D by biopharmaceutical companies are expected to positively impact the market. For instance, in December 2021, Denovo Biopharma LLC announced the discovery of a novel genetic marker for a gene therapy-based medicine. This would facilitate treatment for patients with recurrent high-grade glioma, an unmet medical need with estimated survival of less than a year.

Key Companies & Market Share Insights

Some of the leading market players include F. Hoffmann-La Roche AG, Abbott, QIAGEN, and PerkinElmer Incorporated. Key players are focusing on geographic expansions and gaining market approvals for innovative products. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Atlas Genetics Ltd.; Hologic, Inc.;Myriad Genetics, Inc.; and Genomic Health, Inc. are some of the emerging market participants. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Biomarkers Companies:

- F. Hoffmann-La Roche AG

- Epigenomics AG

- Abbott

- Thermo Fisher Scientific Inc

- General Electric

- Eurofins Scientific

- Johnson & Johnson Services, Inc.

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In October 2023, Labcorp announced the launch of tri-biomarkers blood test for diagnosis of Alzheimer’s disease.

-

In October 2023, Mindray announced the launch of high-sensitivity NT-proBNP and troponin I (hs-cTnI) cardiac biomarkers. The launch is expected to enhance the company’s product portfolio of cardiac biomarkers used in the management and diagnosis of cardiovascular diseases.

-

In August 2023 , Quest Diagnostics entered into partnership with Envision Sciences for the commercial launch of novel prostate cancer biomarker test for identification of severe and aggressive forms of the disease.

-

In February 2023, Cardio Diagnostics Holdings Inc. announced the launch of PrecisionCHD, a epigenetic-genetic blood test for early diagnosis of coronary heart disease.

Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 91.52 billion

Revenue forecast in 2030

USD 194.21 billion

Growth rate

CAGR of 13.36% from 2023 to 2030

Historical data

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG.; Abbott; Epigenomics AG; General Electric; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Biomarkers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the biomarkers market report based on type, product, application, disease, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumable

-

Services

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Drug Discovery & Development

-

Personalized Medicine

-

Disease Risk Assessment

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Cardiovascular Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Neurological Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Immunological Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Others

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomarkers market size was valued at USD 81.04 billion in 2023 and is expected to reach USD 91.52 billion by 2024.

b. The global biomarkers market is expected to grow at a compound annual growth rate of 13.36% from 2024 to 2030 to reach USD 194.21 billion by 2030.

b. Cancer dominated the disease segment in 2023 with 37.45% of the market share, driven by a heightened demand for accurate and rapid diagnostic tools as well as a sharp growth in prevalence on a global scale.

b. Some key players operating in the biomarkers market include Abbott; Qiagen; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Johnson & Johnson Services, Inc; and Epigenomics AG.

b. The increasing prevalence of chronic diseases, advancements in the techniques used for the development of biomarker-based diagnostics, and the growing geriatric population are factors likely to boost the biomarkers market significantly throughout the forecast period.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Product

1.2.3. Application

1.2.4. Disease

1.2.5. Regional scope

1.2.6. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for Primary Interviews in North America

1.4.5.2. Data for Primary Interviews in Europe

1.4.5.3. Data for Primary Interviews in Asia Pacific

1.4.5.4. Data for Primary Interviews in Latin America

1.4.5.5. Data for Primary Interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type and product outlook

2.2.2. Application and disease outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Biomarkers Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing funding for biomarkers

3.2.1.2. Increasing prevalence for chronic diseases

3.2.1.3. Technological advancement

3.2.1.4. Growing importance of companion diagnostics

3.2.2. Market restraint analysis

3.2.2.1. Lack of reimbursement policies for biomarkers

3.2.2.2. High capital investment and lengthy timelines for biomarker development

3.2.3. Market opportunity analysis

3.2.3.1. Emergence of personalized medicine

3.2.3.2. Emerging economies

3.2.4. Market challenge analysis

3.2.4.1. Challenges associated with biomarkers validation

3.2.4.2. Technical issues related to sample collection and storage

3.3. Biomarkers Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.3.3. Pricing Analysis

3.3.3.1. Selling price of biomarker by top players

Chapter 4. Biomarkers Market: Type Estimates & Trend Analysis

4.1. Type Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Biomarkers Market by Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Safety biomarkers

4.4.1.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2. Efficacy biomarkers

4.4.2.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3. Predictive biomarkers

4.4.3.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.4. Surrogate biomarkers

4.4.4.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.5. Pharmacodynamic biomarkers

4.4.5.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

4.4.6. Prognostics biomarkers

4.4.6.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.7. Validation biomarkers

4.4.7.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. Biomarkers Market: Product Estimates & Trend Analysis

5.1. Product Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Biomarkers Market by Product Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Consumables

5.4.1.1. Consumables market estimates and forecasts, 2018 to 2030 (USD Million)

5.4.2. Services

5.4.2.1. Services market estimates and forecasts, 2018 to 2030 (USD Million)

5.4.3. Software

5.4.3.1. Software market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. Biomarkers Market: Application Estimates & Trend Analysis

6.1. Application Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Biomarkers Market by Application Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Diagnostics

6.4.1.1. Diagnostics market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.2. Drug Discovery and Development

6.4.2.1. Drug discovery and development market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.3. Personalized Medicine

6.4.3.1. Personalized medicine market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.4. Disease Risk Assessment

6.4.4.1. Disease risk assessment market estimates and forecasts, 2018 to 2030 (USD Million)

6.4.5. Others

6.4.5.1. Others market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. Biomarkers Market: Disease Estimates & Trend Analysis

7.1. Disease Market Share, 2023 & 2030

7.2. Segment Dashboard

7.3. Global Biomarkers Market by Disease Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4.1. Cancer

7.4.1.1. Cancer market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.2. Safety biomarkers

7.4.1.2.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.3. Efficacy biomarkers

7.4.1.3.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.4. Predictive biomarkers

7.4.1.4.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.5. Surrogate biomarkers

7.4.1.5.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.6. Pharmacodynamic biomarkers

7.4.1.6.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.7. Prognostics biomarkers

7.4.1.7.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.1.8. Validation biomarkers

7.4.1.8.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2. Cardiovascular Diseases

7.4.2.1. Cardiovascular diseases market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.2. Safety biomarkers

7.4.2.2.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.3. Efficacy biomarkers

7.4.2.3.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.4. Predictive biomarkers

7.4.2.4.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.5. Surrogate biomarkers

7.4.2.5.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.6. Pharmacodynamic biomarkers

7.4.2.6.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.7. Prognostics biomarkers

7.4.2.7.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.2.8. Validation biomarkers

7.4.2.8.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)Neurological Diseases

7.4.3.1. Neurological diseases market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.2. Safety biomarkers

7.4.3.2.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.3. Efficacy biomarkers

7.4.3.3.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.4. Predictive biomarkers

7.4.3.4.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.5. Surrogate biomarkers

7.4.3.5.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.6. Pharmacodynamic biomarkers

7.4.3.6.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.7. Prognostics biomarkers

7.4.3.7.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.3.8. Validation biomarkers

7.4.3.8.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4. Immunological Diseases

7.4.4.1. Immunological diseases market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.2. Safety biomarkers

7.4.4.2.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.3. Efficacy biomarkers

7.4.4.3.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.4. Predictive biomarkers

7.4.4.4.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.5. Surrogate biomarkers

7.4.4.5.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.6. Pharmacodynamic biomarkers

7.4.4.6.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.7. Prognostics biomarkers

7.4.4.7.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.4.8. Validation biomarkers

7.4.4.8.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5. Others

7.4.5.1. Others market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.2. Safety biomarkers

7.4.5.2.1. Safety biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.3. Efficacy biomarkers

7.4.5.3.1. Efficacy biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.4. Predictive biomarkers

7.4.5.4.1. Predictive biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.5. Surrogate biomarkers

7.4.5.5.1. Surrogate biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.6. Pharmacodynamic biomarkers

7.4.5.6.1. Pharmacodynamic Biomarkers Market Estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.7. Prognostics biomarkers

7.4.5.7.1. Prognostics biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

7.4.5.8. Validation biomarkers

7.4.5.8.1. Validation biomarkers market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 8. Biomarkers Market: Regional Estimates & Trend Analysis

8.1. Regional Market Share Analysis, 2023 & 2030

8.2. Regional Market Dashboard

8.3. Global Regional Market Snapshot

8.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

8.5. North America

8.5.1. U.S.

8.5.1.1. Key country dynamics

8.5.1.2. Regulatory framework/ reimbursement structure

8.5.1.3. Competitive scenario

8.5.1.4. U.S. market estimates and forecasts, 2018 to 2030 (USD Million)

8.5.2. Canada

8.5.2.1. Key country dynamics

8.5.2.2. Regulatory framework/ reimbursement structure

8.5.2.3. Competitive scenario

8.5.2.4. Canada market estimates and forecasts, 2018 to 2030 (USD Million)

8.6. Europe

8.6.1. UK

8.6.1.1. Key country dynamics

8.6.1.2. Regulatory framework/ reimbursement structure

8.6.1.3. Competitive scenario

8.6.1.4. UK market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.2. Germany

8.6.2.1. Key country dynamics

8.6.2.2. Regulatory framework/ reimbursement structure

8.6.2.3. Competitive scenario

8.6.2.4. Germany market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.3. France

8.6.3.1. Key country dynamics

8.6.3.2. Regulatory framework/ reimbursement structure

8.6.3.3. Competitive scenario

8.6.3.4. France market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.4. Italy

8.6.4.1. Key country dynamics

8.6.4.2. Regulatory framework/ reimbursement structure

8.6.4.3. Competitive scenario

8.6.4.4. Italy market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.5. Spain

8.6.5.1. Key country dynamics

8.6.5.2. Regulatory framework/ reimbursement structure

8.6.5.3. Competitive scenario

8.6.5.4. Spain market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.6. Norway

8.6.6.1. Key country dynamics

8.6.6.2. Regulatory framework/ reimbursement structure

8.6.6.3. Competitive scenario

8.6.6.4. Norway market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.7. Sweden

8.6.7.1. Key country dynamics

8.6.7.2. Regulatory framework/ reimbursement structure

8.6.7.3. Competitive scenario

8.6.7.4. Sweden market estimates and forecasts, 2018 to 2030 (USD Million)

8.6.8. Denmark

8.6.8.1. Key country dynamics

8.6.8.2. Regulatory framework/ reimbursement structure

8.6.8.3. Competitive scenario

8.6.8.4. Denmark market estimates and forecasts, 2018 to 2030 (USD Million)

8.7. Asia Pacific

8.7.1. Japan

8.7.1.1. Key country dynamics

8.7.1.2. Regulatory framework/ reimbursement structure

8.7.1.3. Competitive scenario

8.7.1.4. Japan market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.2. China

8.7.2.1. Key country dynamics

8.7.2.2. Regulatory framework/ reimbursement structure

8.7.2.3. Competitive scenario

8.7.2.4. China market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.3. India

8.7.3.1. Key country dynamics

8.7.3.2. Regulatory framework/ reimbursement structure

8.7.3.3. Competitive scenario

8.7.3.4. India market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.4. Australia

8.7.4.1. Key country dynamics

8.7.4.2. Regulatory framework/ reimbursement structure

8.7.4.3. Competitive scenario

8.7.4.4. Australia market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.5. South Korea

8.7.5.1. Key country dynamics

8.7.5.2. Regulatory framework/ reimbursement structure

8.7.5.3. Competitive scenario

8.7.5.4. South Korea market estimates and forecasts, 2018 to 2030 (USD Million)

8.7.6. Thailand

8.7.6.1. Key country dynamics

8.7.6.2. Regulatory framework/ reimbursement structure

8.7.6.3. Competitive scenario

8.7.6.4. Thailand market estimates and forecasts, 2018 to 2030 (USD Million)

8.8. Latin America

8.8.1. Brazil

8.8.1.1. Key country dynamics

8.8.1.2. Regulatory framework/ reimbursement structure

8.8.1.3. Competitive scenario

8.8.1.4. Brazil market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.2. Mexico

8.8.2.1. Key country dynamics

8.8.2.2. Regulatory framework/ reimbursement structure

8.8.2.3. Competitive scenario

8.8.2.4. Mexico market estimates and forecasts, 2018 to 2030 (USD Million)

8.8.3. Argentina

8.8.3.1. Key country dynamics

8.8.3.2. Regulatory framework/ reimbursement structure

8.8.3.3. Competitive scenario

8.8.3.4. Argentina market estimates and forecasts, 2018 to 2030 (USD Million)

8.9. MEA

8.9.1. South Africa

8.9.1.1. Key country dynamics

8.9.1.2. Regulatory framework/ reimbursement structure

8.9.1.3. Competitive scenario

8.9.1.4. South Africa market estimates and forecasts, 2018 to 2030 (USD Million)

8.9.2. Saudi Arabia

8.9.2.1. Key Country Dynamics

8.9.2.2. Regulatory framework/ reimbursement structure

8.9.2.3. Competitive scenario

8.9.2.4. Saudi Arabia market estimates and forecasts for 2018 to 2030 (USD Million)

8.9.3. UAE

8.9.3.1. Key country dynamics

8.9.3.2. Regulatory framework/ reimbursement structure

8.9.3.3. Competitive scenario

8.9.3.4. UAE market estimates and forecasts, 2018 to 2030 (USD Million)

8.9.4. Kuwait

8.9.4.1. Key country dynamics

8.9.4.2. Regulatory framework/ reimbursement structure

8.9.4.3. Competitive scenario

8.9.4.4. Kuwait market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company/Competition Categorization

9.3. Vendor Landscape

9.3.1. List of key distributors and channel partners

9.3.2. Key customers

9.3.3. Key company market share analysis, 2023

9.3.4. F. Hoffmann-La Roche Ltd.

9.3.4.1. Company overview

9.3.4.2. Financial performance

9.3.4.3. Product benchmarking

9.3.4.4. Strategic initiatives

9.3.5. Abbott

9.3.5.1. Company overview

9.3.5.2. Financial performance

9.3.5.3. Product benchmarking

9.3.5.4. Strategic initiatives

9.3.6. Epigenomics AG

9.3.6.1. Company overview

9.3.6.2. Financial performance

9.3.6.3. Product benchmarking

9.3.6.4. Strategic initiatives

9.3.7. General Electric

9.3.7.1. Company overview

9.3.7.2. Financial performance

9.3.7.3. Product benchmarking

9.3.7.4. Strategic initiatives

9.3.8. Johnson & Johnson Services, Inc.

9.3.8.1. Company overview

9.3.8.2. Financial performance

9.3.8.3. Product benchmarking

9.3.8.4. Strategic initiatives

9.3.9. Thermo Fisher Scientific Inc.

9.3.9.1. Company overview

9.3.9.2. Financial performance

9.3.9.3. Product benchmarking

9.3.9.4. Strategic initiatives

9.3.10. Bio-Rad Laboratories, Inc.

9.3.10.1. Company overview

9.3.10.2. Financial performance

9.3.10.3. Product benchmarking

9.3.10.4. Strategic initiatives

9.3.11. Siemens Healthineers AG

9.3.11.1. Company overview

9.3.11.2. Financial performance

9.3.11.3. Product benchmarking

9.3.11.4. Strategic initiatives

9.3.12. QIAGEN

9.3.12.1. Company overview

9.3.12.2. Financial performance

9.3.12.3. Product benchmarking

9.3.12.4. Strategic initiatives

9.3.13. Merck KGaA

9.3.13.1. Company overview

9.3.13.2. Financial performance

9.3.13.3. Product benchmarking

9.3.13.4. Strategic initiatives

9.3.14. PerkinElmer Inc.

9.3.14.1. Company overview

9.3.14.2. Financial performance

9.3.14.3. Product benchmarking

9.3.14.4. Strategic initiatives

9.3.15. Agilent Technologies, Inc.

9.3.15.1. Company overview

9.3.15.2. Financial performance

9.3.15.3. Product benchmarking

9.3.15.4. Strategic initiatives

9.3.16. Eurofins Scientific

9.3.16.1. Company overview

9.3.16.2. Financial performance

9.3.16.3. Product benchmarking

9.3.16.4. Strategic initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 North America Biomarkers Market, By Country, 2018 - 2030 (USD Million)

Table 4 North America Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 5 North America Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 6 North America Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 7 North America Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 8 U.S. Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 9 U.S. Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 10 U.S. Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 11 U.S. Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 12 Canada Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 13 Canada Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 14 Canada Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 15 Canada Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 16 Europe Biomarkers Market, By Country, 2018 - 2030 (USD Million)

Table 17 Europe Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 18 Europe Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 19 Europe Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 20 Europe Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 21 Germany Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 22 Germany Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 23 Germany Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 24 Germany Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 25 UK Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 26 UK Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 27 UK Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 28 UK Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 29 France Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 30 France Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 31 France Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 32 France Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 33 Spain Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 34 Spain Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 35 Spain Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 36 Spain Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 37 Italy Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 38 Italy Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 39 Italy Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 40 Italy Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 41 Denmark Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 42 Denmark Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 43 Denmark Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 44 Denmark Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 45 Norway Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 46 Norway Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 47 Norway Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 48 Norway Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 49 Sweden Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 50 Sweden Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 51 Sweden Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 52 Sweden Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 53 Asia Pacific Biomarkers Market, By Country, 2018 - 2030 (USD Million)

Table 54 Asia Pacific Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 55 Asia Pacific Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 56 Asia Pacific Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 57 Asia Pacific Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 58 Japan Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 59 Japan Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 60 Japan Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 61 Japan Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 62 China Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 63 China Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 64 China Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 65 China Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 66 India Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 67 India Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 68 India Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 69 India Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 70 South Korea Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 71 South Korea Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 72 South Korea Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 73 South Korea Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 74 Australia Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 75 Australia Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 76 Australia Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 77 Australia Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 78 Thailand Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 79 Thailand Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 80 Thailand Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 81 Thailand Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 82 Latin America Biomarkers Market, By Country, 2018 - 2030 (USD Million)

Table 83 Latin America Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 84 Latin America Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 85 Latin America Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 86 Latin America Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 87 Brazil Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 88 Brazil Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 89 Brazil Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 90 Brazil Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 91 Argentina Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 92 Argentina Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 93 Argentina Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 94 Argentina Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 95 Mexico Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 96 Mexico Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 97 Mexico Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 98 Mexico Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 99 Middle East and Africa Biomarkers Market, By Country, 2018 - 2030 (USD Million)

Table 100 Middle East and Africa Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 101 Middle East and Africa Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 102 Middle East and Africa Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 103 Middle East and Africa Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 104 South Africa Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 105 South Africa Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 106 South Africa Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 107 South Africa Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 108 Saudi Arabia Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 109 Saudi Arabia Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 110 Saudi Arabia Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 111 Saudi Arabia Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 112 Kuwait Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 113 Kuwait Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 114 Kuwait Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 115 Kuwait Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

Table 116 UAE Biomarkers Market, By Type, 2018 - 2030 (USD Million)

Table 117 UAE Biomarkers Market, By Product, 2018 - 2030 (USD Million)

Table 118 UAE Biomarkers Market, By Application, 2018 - 2030 (USD Million)

Table 119 UAE Biomarkers Market, By Disease, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary Interviews in North America

Fig. 5 Primary Interviews in Europe

Fig. 6 Primary Interviews in APAC

Fig. 7 Primary Interviews in Latin America

Fig. 8 Primary Interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Biomarkers market: market outlook

Fig. 14 Tumor ablation competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Biomarkers market driver impact

Fig. 20 Biomarkers market restraint impact

Fig. 21 Biomarkers market strategic initiatives analysis

Fig. 22 Biomarkers market: Type movement analysis

Fig. 23 Biomarkers market: Type outlook and key takeaways

Fig. 24 Safety biomarkers market estimates and forecast, 2018 - 2030

Fig. 25 Efficacy biomarkers agents estimates and forecast, 2018 - 2030

Fig. 26 Predictive biomarkers market estimates and forecast, 2018 - 2030

Fig. 27 Surrogate biomarkers estimates and forecast, 2018 - 2030

Fig. 28 Pharmacodynamic biomarkers market estimates and forecast, 2018 - 2030

Fig. 29 Prognostics biomarkers estimates and forecast, 2018 - 2030

Fig. 30 Validation biomarkers estimates and forecast, 2018 - 2030

Fig. 31 Biomarkers market: Product movement analysis

Fig. 32 Biomarkers market: Product outlook and key takeaways

Fig. 33 Consumables market estimates and forecast, 2018 - 2030

Fig. 34 Services estimates and forecast, 2018 - 2030

Fig. 35 Software market estimates and forecast, 2018 - 2030

Fig. 36 Biomarkers market: Disease movement analysis

Fig. 37 Biomarkers market: Disease outlook and key takeaways

Fig. 38 Diagnostics market estimates and forecast, 2018 - 2030

Fig. 39 Drug discovery and development estimates and forecast, 2018 - 2030

Fig. 40 Personalized medicine market estimates and forecast, 2018 - 2030

Fig. 41 Disease risk assessment estimates and forecast, 2018 - 2030

Fig. 42 Others market estimates and forecast, 2018 - 2030

Fig. 43 Biomarkers market: Disease movement analysis

Fig. 44 Biomarkers market: Disease outlook and key takeaways

Fig. 45 Cancer market estimates and forecast, 2018 - 2030

Fig. 46 Cardiovascular diseases estimates and forecast, 2018 - 2030

Fig. 47 Neurological diseases market estimates and forecast, 2018 - 2030

Fig. 48 Immunological diseases estimates and forecast, 2018 - 2030

Fig. 49 Others market estimates and forecast, 2018 - 2030

Fig. 50 Global ophthalmic drugs market: Regional movement analysis

Fig. 51 Global ophthalmic drugs market: Regional outlook and key takeaways

Fig. 52 Global ophthalmic drugs market share and leading players

Fig. 53 North America market share and leading players

Fig. 54 Europe market share and leading players

Fig. 55 Asia Pacific market share and leading players

Fig. 56 Latin America market share and leading players

Fig. 57 Middle East & Africa market share and leading players

Fig. 58 North America: SWOT

Fig. 59 Europe SWOT

Fig. 60 Asia Pacific SWOT

Fig. 61 Latin America SWOT

Fig. 62 MEA SWOT

Fig. 63 North America, by country

Fig. 64 North America

Fig. 65 North America market estimates and forecasts, 2018 - 2030

Fig. 66 U.S. key country dynamics

Fig. 67 U.S. market estimates and forecasts, 2018 - 2030

Fig. 68 Canada key country dynamics

Fig. 69 Canada market estimates and forecasts, 2018 - 2030

Fig. 70 Europe

Fig. 71 Europe market estimates and forecasts, 2018 - 2030

Fig. 72 UK key country dynamics

Fig. 73 UK market estimates and forecasts, 2018 - 2030

Fig. 74 Germany key country dynamics

Fig. 75 Germany market estimates and forecasts, 2018 - 2030

Fig. 76 France key country dynamics

Fig. 77 France market estimates and forecasts, 2018 - 2030

Fig. 78 Italy key country dynamics

Fig. 79 Italy market estimates and forecasts, 2018 - 2030

Fig. 80 Spain key country dynamics

Fig. 81 Spain market estimates and forecasts, 2018 - 2030

Fig. 82 Denmark key country dynamics

Fig. 83 Denmark market estimates and forecasts, 2018 - 2030

Fig. 84 Sweden key country dynamics

Fig. 85 Sweden market estimates and forecasts, 2018 - 2030

Fig. 86 Norway key country dynamics

Fig. 87 Norway market estimates and forecasts, 2018 - 2030

Fig. 88 Asia Pacific

Fig. 89 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 90 China key country dynamics

Fig. 91 China market estimates and forecasts, 2018 - 2030

Fig. 92 Japan key country dynamics

Fig. 93 Japan market estimates and forecasts, 2018 - 2030

Fig. 94 India key country dynamics

Fig. 95 India market estimates and forecasts, 2018 - 2030

Fig. 96 Thailand key country dynamics

Fig. 97 Thailand market estimates and forecasts, 2018 - 2030

Fig. 98 South Korea key country dynamics

Fig. 99 South Korea market estimates and forecasts, 2018 - 2030

Fig. 100 Australia key country dynamics

Fig. 101 Australia market estimates and forecasts, 2018 - 2030

Fig. 102 Latin America

Fig. 103 Latin America market estimates and forecasts, 2018 - 2030

Fig. 104 Brazil key country dynamics

Fig. 105 Brazil market estimates and forecasts, 2018 - 2030

Fig. 106 Mexico key country dynamics

Fig. 107 Mexico market estimates and forecasts, 2018 - 2030

Fig. 108 Argentina key country dynamics

Fig. 109 Argentina market estimates and forecasts, 2018 - 2030

Fig. 110 Middle East and Africa

Fig. 111 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 112 South Africa key country dynamics

Fig. 113 South Africa market estimates and forecasts, 2018 - 2030

Fig. 114 Saudi Arabia key country dynamics

Fig. 115 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 116 UAE key country dynamics

Fig. 117 UAE market estimates and forecasts, 2018 - 2030

Fig. 118 Kuwait key country dynamics

Fig. 119 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 120 Market share of key market players- Biomarkers marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Biomarkers Type Outlook (Revenue, USD Million, 2018 - 2030)

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Biomarkers Product Outlook (Revenue, USD Million, 2018 - 2030)

- Consumables

- Services

- Software

- Biomarkers Application Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Biomarkers Disease Outlook (Revenue, USD Million, 2018 - 2030)

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Biomarkers Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- North America Biomarkers Market, By Product

- Consumables

- Services

- Software

- North America Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- North America Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- U.S.

- U.S. Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- U.S. Biomarkers Market, By Product

- Consumables

- Services

- Software

- U.S. Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- U.S. Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- U.S. Biomarkers Market, By Type

- Canada

- Canada Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Canada Biomarkers Market, By Product

- Consumables

- Services

- Software

- Canada Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Canada Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Canada Biomarkers Market, By Type

- North America Biomarkers Market, By Type

- Europe

- Europe Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Europe Biomarkers Market, By Product

- Consumables

- Services

- Software

- Europe Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Europe Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- UK

- UK Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- UK Biomarkers Market, By Product

- Consumables

- Services

- Software

- UK Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- UK Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- UK Biomarkers Market, By Type

- Germany

- Germany Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Germany Biomarkers Market, By Product

- Consumables

- Services

- Software

- Germany Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Germany Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Germany Biomarkers Market, By Type

- France

- France Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- France Biomarkers Market, By Product

- Consumables

- Services

- Software

- France Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- France Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- France Biomarkers Market, By Type

- Italy

- Italy Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Italy Biomarkers Market, By Product

- Consumables

- Services

- Software

- Italy Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Italy Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Italy Biomarkers Market, By Type

- Spain

- Spain Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Spain Biomarkers Market, By Product

- Consumables

- Services

- Software

- Spain Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Spain Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Spain Biomarkers Market, By Type

- Denmark

- Denmark Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Denmark Biomarkers Market, By Product

- Consumables

- Services

- Software

- DenmarkBiomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- DenmarkBiomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Immunological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Others

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cancer

- Denmark Biomarkers Market, By Type

- Sweden

- Sweden Biomarkers Market, By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Sweden Biomarkers Market, By Product

- Consumables

- Services

- Software

- Sweden Biomarkers Market, By Application

- Diagnostics

- Drug discovery & development

- Personalized Medicine

- Disease Risk Assessment

- Others

- Sweden Biomarkers Market, By Disease

- Cancer

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Cardiovascular Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

- Neurological Diseases

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers