- Home

- »

- Pharmaceuticals

- »

-

Biosimilars Market Size, Share And Trends Report, 2030GVR Report cover

![Biosimilars Market Size, Share & Trends Report]()

Biosimilars Market Size, Share & Trends Analysis By Product (Recombinant Glycosylated Proteins, Recombinant Non-Glycosylated Proteins), By Application (Rheumatoid Arthritis, Oncology), By Region And Segment Forecasts 2023 - 2030

- Report ID: 978-1-68038-916-6

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global biosimilars market size was valued at USD 21.8 billion in 2022 and is expected to grow at a compound annual growth rate(CAGR) of 15.9% over the forecast period. The cost-effectiveness of biosimilar drugs and the high prevalence of chronic disorders globally are some major factors contributing to market growth. In addition, these drugs are comparatively easy to produce since they require less investment in research and development while providing similar results. This can help in cutting down expenditure on health. Moreover, the reduction in production cost and increasing demand can encourage producers to shift tobiosimilars due to increased profits, which can give a further boost to this market. Biosimilars may contain a bit different substances and combinations of medical ingredients but are considered alike to their reference biologics when it comes to effectiveness and safety.

Several regulations are in place to assess the compatibility and safety of biosimilar drugs. For instance, FDA’s Abbreviated New Drug Application Process requires applicants to scientifically prove that the performance of their product is similar to the reference biologics. It can be demonstrated by proving that their product takes a similar time to reach the bloodstream as the original product. Such regulations can help in building trust in these drugs and expand their market share.Moreover, the increasing prevalence of chronic or non-communicable diseases across the globe is also expected to drive the market. According to a statistic released by the World Health Organization in September 2022, non-communicable diseases, such as cancer, diabetes, and heart diseases, cause 41 million deaths every year out of which 77% of deaths belong to low- and middle-income countries.

However, due to the lack of awareness and high costs, many patients from these countries cannot afford the necessary treatments. Since biosimilars offer similar results and are cheaper than reference biologics, they can be used to increase access to life-saving treatments for patients in these countries and lead to an increase in its customer segment.The regulations with respect to producing biosimilars require about 8 years of exclusivity and the patent expiration of several products further creates an opportunity for the players in the market. An article released in February 2020 by MJH life sciences, The Center for Biosimilars suggests 20 oncology biologics are expected to expire by 2023, which can give a further boost to the market growth during the forecast period.

The U.S. FDA had already approved three cancer-related biosimilars in 2022, which are expected to hit the market in 2023.These growing opportunities in this market are also encouraging key players to increase their investment in the research and development of biosimilars. For instance, according to an article published in Business Today in April 2022, Biocon Biologics had been planning to increase their R&D expenses by 10% to 15% to advance their pipeline of biosimilar molecules. The step is expected to help it strengthen its future position in the market. Currently, there is a boom in the pharmaceutical industry to develop biosimilar medications.

Over 700 clinical trials for biosimilars are being conducted worldwide for different indications including genitourinary, endocrinology, immunology, oncology, and other chronic diseases. The main objective of these trials is to determine the efficacy, similarity, and immunogenicity of a biosimilar drug. For instance, in April 2022, Amgen reported positive outcomes from the phase III study of its biosimilar candidate (abp 654) to Stelara (ustekinumab). Several leading companies, such as Hospira, Celltrion, Pfizer, Inc., Samsung Bioepis, and Biocon, have announced positive outcomes from the clinical trials of their biosimilar candidates. These results have a positive outreach in the market and are expected to boost market growth during the forecast period.

The COVID-19 pandemic had adversely affected the market. The pandemic led to disruptions of supply chains across the world, which restricted the supply of essential ingredients including Active Pharmaceutical Ingredient (API) needed to produce drugs. Many countries including the U.S. depended on China for the supply of these ingredients and it being the center of origin for COVID-19, the country was adversely impacted, which compelled it to block its supply to other countries. According to an article by Lazuline Bio, 70% of pharmaceutical production in India is dependent on China, and India supplies 18% of its total volume of APIs to the U.S. However, the supply chain was highly disrupted owing to the restrictions imposed by the governments of various nations.

Product Insights

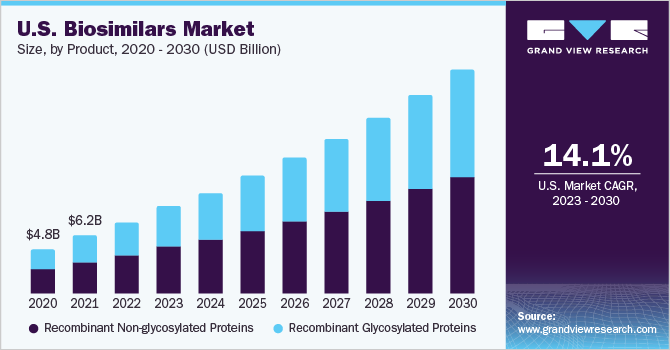

On the basis of the product, the market is segmented into recombinant non-glycosylated proteins and glycosylated proteins. The recombinant non-glycosylated proteins segment accounted for the largest revenue share of 54.9% in 2022 owing to the increasing regulatory approvals for biosimilars by various governments. For instance, the U.S. Food and Drug Administration has already approved biosimilars named Yuflyma (adalimumab-aaty) and Idacio (adalimumab-aacf) in May 2023 and December 2022 respectively for the reference product Humira (adalimumab), which is an important drug that facilitates treatment of Rheumatoid Arthritis (RA). Moreover, the increasing prevalence of chronic diseases, such as diabetes can also drive market growth for this segment.

According to the International Diabetes Federation’s Atlas 2021, 537 million adults across the world were living with diabetes, whereas as per the facts released by the American Heart Association, the age-adjusted prevalence rate for cardiovascular disease was 7354.1 per 100,000 people in 2020. The recombinant glycosylated proteins segment is expected to grow at the fastest CAGR of 14.9% over the forecast period. Biologics, such as erythropoietin (EPO), Humira, and Neulasta, have been beneficial in the treatment of chronic disease and with their patent expiration, many players are competing to enter the biosimilars market, which can significantly drive market growth with improved access to treatments. Moreover, technological advancements in the recombinant glycosylated proteins segment have also led to the emergence of several therapies, such as modified proteins and soluble receptors, that can further add to the growth of this segment.

Application Insights

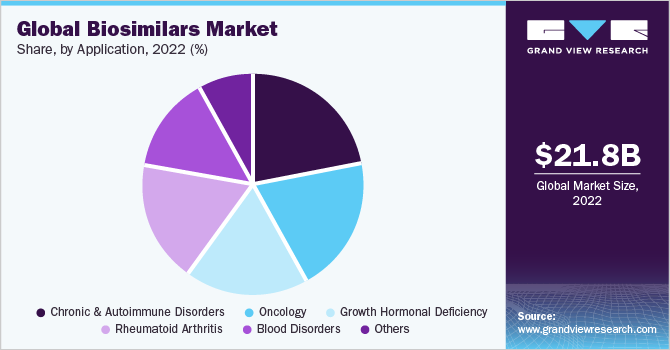

On the basis of applications, the market has been segmented into oncology, chronic and autoimmune disorders, rheumatoid arthritis, growth hormonal deficiency blood disorders, and chronic and autoimmune disorders. The chronic and autoimmune disorders segment accounted for the largest revenue share of around 21.6% in 2022 due to the increasing prevalence of and awareness regarding autoimmune diseases. As per the National Institute of Environmental Health Sciences, approximately 24 million people in the U.S. are inflicted by autoimmune diseases. The oncology application segment is estimated to grow at the fastest CAGR of 17.0% over the forecast period.

The increasing number of cancer cases worldwide is expected to be the major driver for market growth. According to the statistics released by the World Cancer Research Fund International, nearly 18.1 million people were suffering from cancer in 2020. The development of biosimilars for the treatment of cancer can provide cost-effective treatment options for patients in low- and middle-income countries where the death rates for cancer patients are higher. Increasing accessibility to affordable treatment can further boost the market.

Regional Insights

North America dominated the market with the largest revenue share of 40.4% in 2022 owing to a strong regulatory framework for biosimilars and the presence of major players in the region. Moreover, the region has relatively easy access to biosimilars. According to the U.S. Generic Biosimilars Saving Report 2021, 31 biosimilars had been approved and 20 have been launched in the U.S., which has resulted in an increment of nearly 10 million days of therapy. The 20 biosimilars launched in the U.S. are priced 30% lesser than the biologics and have resulted in lowering the cost for both biosimilars and biologics. This cost reduction is expected to provide a further boost for biosimilars in this region.

Asia Pacific is expected to grow at the fastest CAGR of 18.4% over the forecast period. The presence of key players, such as Dr. Reddy’s Laboratories, Biocon, Pfizer Inc., and Celltrion, has helped in the development and commercialization of biosimilars in this region. For instance, in August 2019, Dr. Reddy’s Laboratories launched a biosimilar of Roche’s Avastin in India, which facilitates the treatment of various types of cancers. Similar developments in the market coupled with increased health expenditure are expected to propel the growth of biosimilars in this region. According to the World Bank data retrieved in April 2023, health expenditure in China as a percentage of GDP has increased from 4.98% in 2015 to 5.59% in 2020.

Key Companies & Market Share Insights

The market is highly competitive, with the presence of a large number of global and local players. Since biosimilars help in the reduction of costs and lead to increased profit margins, it has encouraged new players to enter the market. Several players are focusing on seeking regulatory approvals, launching new products, increasing spending on research and development, and regional expansion to strengthen their position in the market. For instance, in January 2020, Pfizer Inc. launched a biosimilar for Roche cancer drug Rituxan (rituximab) in Japan. Rituxan is the first biosimilar launched by Pfizer Inc. in Japan, which has helped the company to enter the Japanese market and the cost for Rituxan will be 24% lower than its reference biologics resulting in increased profit margin. Such opportunities are expected to further boost the market growth. Some of the prominent players in the global biosimilars market include:

-

Amgen Inc.

-

F Hoffman-La Roche Ltd.

-

Sandoz International GmbH

-

Dr. Reddy’s Laboratories Ltd.

-

Teva Pharmaceutical Industries Ltd.

-

Pfizer Inc.

-

Samsung Biopis

-

Biocon

-

Viatris Inc.

-

Celltrion Healthcare Co.,Ltd.

-

AbbVie Inc.

Biosimilars Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.20 billion

Revenue forecast in 2030

USD 76.20 billion

Growth rate

CAGR of 15.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Amgen Inc.; FHoffman-La Roche Ltd.; Sandoz International GmbH; Dr. Reddy’s Laboratories; Teva Pharmaceutical Industries Ltd; Pfizer Inc.; Samsung Biopis; Biocon; Viatris Inc.; Celltrion Healthcare Co.,Ltd; AbbVie Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosimilars Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the biosimilars market based on product, application, and region:

-

Product Outlook (Revenue in USD Billion, 2018 - 2030)

-

Recombinant Non-glycosylated Proteins

-

Recombinant Glycosylated Proteins

-

-

Application Outlook (Revenue in USD Billion, 2018 - 2030)

-

Oncology

-

Blood Disorders

-

Growth Hormonal Deficiency

-

Rheumatoid Arthritis

-

Chronic and Autoimmune Disorders

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biosimilars market size was estimated at USD 21.8 billion in 2022 and is expected to reach USD 27.20 billion in 2023.

b. The global biosimilars market is expected to grow at a compound annual growth rate of 15.9% from 2023 to 2030 to reach USD 76.20 billion by 2030.

b. Recombinant non-glycosylated proteins held the largest revenue share of 55.18% due to increased regulatory approvals and rise in chronic diseases such as diabetes, cancer, arthritis, Alzheimer’s disease, chronic kidney disease, and chronic pain diseases.

b. Major market players in the biosimilars market include Amgen Inc.; F. Hoffmann-La Roche Ltd.; Sandoz International GmbH; Dr. Reddy’s Laboratories Ltd.; Teva Pharmaceutical Industries Ltd.; Pfizer Inc.; Samsung Bioepis; Biocon; and Mylan N.V.

b. The cost-effectiveness of biosimilar drugs and the high prevalence of chronic disorders globally are some major factors contributing to biosimilars market growth.

Table of Contents

Chapter 1. Biosimilars Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Application

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline.

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Biosimilars Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Biosimilars Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook.

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing emphasis on cutting down healthcare expenditure

3.4.1.2. Cost-effectiveness of biosimilar drugs

3.4.1.3. Positive outcome in the ongoing clinical trials

3.4.1.4. R&D investments are increasing.

3.4.1.5. Patent expiration of biologics to boost the biosimilars market

3.4.2. Market restraint analysis

3.4.2.1. High manufacturing complexities and costs

3.4.2.2. Presence of non-original biologics and biobetters

3.5. Biosimilars Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

Chapter 4. Biosimilars Market: Product Estimates & Trend Analysis

4.1. Biosimilars Market: Key Takeaways

4.2. Biosimilars Market: Movement & Market Share Analysis, 2022 & 2030

4.3. Recombinant Non-glycosylated Proteins

4.3.1. Recombinant non-glycosylated proteins market estimates and forecasts, 2018 to 2030 (USD Billion)

4.3.2. Human growth hormone

4.3.2.1. Human growth hormone market estimates and forecasts, 2018 to 2030 (USD Billion)

4.3.3. Granulocyte colony-stimulating factor

4.3.3.1. Granulocyte colony-stimulating factor market estimates and forecasts, 2018 to 2030 (USD Billion)

4.3.4. Interferons

4.3.4.1. Interferons market estimates and forecasts, 2018 to 2030 (USD Billion)

4.3.5. Insulin

4.3.5.1. Insulin market estimates and forecasts, 2018 to 2030 (USD Billion)

4.4. Recombinant Glycosylated Proteins

4.4.1. Recombinant glycosylated proteins market estimates and forecasts, 2018 to 2030 (USD Billion)

4.4.2. Erythropoietin

4.4.2.1. Erythropoietin market estimates and forecasts, 2018 to 2030 (USD Billion)

4.4.3. Monoclonal antibodies

4.4.3.1. Monoclonal antibodies market estimates and forecasts, 2018 to 2030 (USD Billion)

4.4.4. Follitropin

4.4.4.1. Follitropin market estimates and forecasts, 2018 to 2030 (USD Billion)

Chapter 5. Biosimilars Market: Application Estimates & Trend Analysis

5.1. Biosimilars Market: Key Takeaways

5.2. Biosimilars Market: Movement & Market Share Analysis, 2022 & 2030

5.3. Oncology

5.3.1. Oncology market estimates and forecasts, 2018 to 2030 (USD Billion)

5.4. Blood Disorders

5.4.1. Blood disorders market estimates and forecasts, 2018 to 2030 (USD Billion)

5.5. Growth Hormonal Deficiency

5.5.1. Growth hormonal deficiency market estimates and forecasts, 2018 to 2030 (USD Billion)

5.6. Chronic And Autoimmune Disorders

5.6.1. Chronic and autoimmune disorders market estimates and forecasts, 2018 to 2030 (USD Billion)

5.7. Others

5.7.1. Others market estimates and forecasts, 2018 to 2030 (USD Billion)

Chapter 6. Biosimilars Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Biosimilars Market by Region: Key Marketplace Takeaway

6.3. North America

6.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.3.2. U.S.

6.3.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.3.3. Canada

6.3.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4. Europe

6.4.1. UK

6.4.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.2. Germany

6.4.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.3. France

6.4.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.4. Italy

6.4.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.5. Spain

6.4.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.6. Sweden

6.4.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.7. Norway

6.4.7.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.4.8. Denmark

6.4.8.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5. Asia Pacific

6.5.1. Japan

6.5.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5.2. China

6.5.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5.3. India

6.5.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5.4. Australia

6.5.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5.5. Thailand

6.5.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.5.6. South Korea

6.5.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.6. Latin America

6.6.1. Brazil

6.6.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.6.2. Mexico

6.6.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.6.3. Argentina

6.6.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.7. MEA

6.7.1. Saudi Arabia

6.7.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.7.2. South Africa

6.7.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.7.3. UAE

6.7.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

6.7.4. Kuwait

6.7.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Market Participant Categorization

7.2.1. Amgen Inc.

7.2.1.1. Company overview

7.2.1.2. Financial performance

7.2.1.3. Product benchmarking

7.2.1.4. Strategic initiatives

7.2.2. F Hoffman La Roche Ltd.

7.2.2.1. Company overview

7.2.2.2. Financial performance

7.2.2.3. Product benchmarking

7.2.2.4. Strategic initiatives

7.2.3. Sandoz International GmbH

7.2.3.1. Company overview

7.2.3.2. Financial performance

7.2.3.3. Product benchmarking

7.2.3.4. Strategic initiatives

7.2.4. Dr. Reddy’s Laboratories Ltd.

7.2.4.1. Company overview

7.2.4.2. Financial performance

7.2.4.3. Product benchmarking

7.2.4.4. Strategic initiatives

7.2.5. Teva Pharmaceutical Industries Ltd.

7.2.5.1. Company overview

7.2.5.2. Financial performance

7.2.5.3. Product benchmarking

7.2.5.4. Strategic initiatives

7.2.6. Pfizer Inc.

7.2.6.1. Company overview

7.2.6.2. Financial performance

7.2.6.3. Product benchmarking

7.2.6.4. Strategic initiatives

7.2.7. Samsung Biopis

7.2.7.1. Company overview

7.2.7.2. Financial performance

7.2.7.3. Product benchmarking

7.2.7.4. Strategic initiatives

7.2.8. Biocon

7.2.8.1. Company overview

7.2.8.2. Financial performance

7.2.8.3. Product benchmarking

7.2.8.4. Strategic initiatives

7.2.9. Viatris Inc.

7.2.9.1. Company overview

7.2.9.2. Financial performance

7.2.9.3. Product benchmarking

7.2.9.4. Strategic initiatives

7.2.10. Celltrion Healthcare Co., Ltd

7.2.10.1. Company overview

7.2.10.2. Financial performance

7.2.10.3. Product benchmarking

7.2.10.4. Strategic initiatives

7.2.11. AbbVie Inc.

7.2.11.1. Company overview

7.2.11.2. Financial performance

7.2.11.3. Product benchmarking

7.2.11.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 3 North America biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 4 North America biosimilars market, by region, 2018 - 2030 (USD Billion)

Table 5 U.S. biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 6 U.S. biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 7 Canada biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 8 Canada biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 9 Europe biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 10 Europe biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 11 Europe biosimilars market, by region, 2018 - 2030 (USD Billion)

Table 12 Germany biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 13 Germany biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 14 UK biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 15 UK biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 16 France biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 17 France biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 18 Italy biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 19 Italy biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 20 Spain biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 21 Spain biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 22 Sweden biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 23 Sweden biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 24 Norway biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 25 Norway biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 26 Denmark biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 27 Denmark biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 28 Asia Pacific biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 29 Asia Pacific biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 30 Asia Pacific biosimilars market, by region, 2018 - 2030 (USD Billion)

Table 31 China biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 32 China biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 33 Japan biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 34 Japan biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 35 India biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 36 India biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 37 Thailand biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 38 Thailand biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 39 South Korea biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 40 South Korea biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 41 Latin America biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 42 Latin America biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 43 Latin America biosimilars market, by region, 2018 - 2030 (USD Billion)

Table 44 Brazil biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 45 Brazil biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 46 Mexico biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 47 Mexico biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 48 Argentina biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 49 Argentina biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 50 Middle East and Africa biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 51 Middle East and Africa biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 52 Middle East and Africa biosimilars market, by region, 2018 - 2030 (USD Billion)

Table 53 South Africa biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 54 South Africa biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 55 Saudi Arabia biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 56 Saudi Arabia biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 57 UAE biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 58 UAE biosimilars market, by application, 2018 - 2030 (USD Billion)

Table 59 Kuwait biosimilars market, by product, 2018 - 2030 (USD Billion)

Table 60 Kuwait biosimilars market, by application, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Biosimilars market outlook

Fig. 9 Biosimilars competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Biosimilars market driver impact

Fig. 15 Biosimilars market restraint impact

Fig. 16 Biosimilars market strategic initiatives analysis

Fig. 17 Biosimilars market: Product movement analysis

Fig. 18 Biosimilars market: Product outlook and key takeaways

Fig. 19 Recombinant non-glycosylated proteins market estimates and forecasts, 2018 - 2030

Fig. 20 Recombinant glycosylated proteins market estimates and forecasts, 2018 - 2030

Fig. 21 Biosimilars market: Application movement analysis

Fig. 22 Biosimilars market: Application outlook and key takeaways

Fig. 23 Oncology market estimates and forecasts, 2018 - 2030

Fig. 24 Blood disorders market estimates and forecasts, 2018 - 2030

Fig. 25 Growth hormonal deficiency market estimates and forecasts, 2018 - 2030

Fig. 26 Rheumatoid arthritis market estimates and forecasts, 2018 - 2030

Fig. 27 Chronic and autoimmune disorders market estimates and forecasts, 2018 - 2030

Fig. 28 Others market estimates and forecasts, 2018 - 2030

Fig. 29 Global biosimilars market: Regional movement analysis

Fig. 30 Global biosimilars market: Regional outlook and key takeaways

Fig. 31 North America market estimates and forecasts, 2018 - 2030

Fig. 32 U.S. market estimates and forecasts, 2018 - 2030

Fig. 33 Canada market estimates and forecasts, 2018 - 2030

Fig. 34 Europe. market estimates and forecasts, 2018 - 2030

Fig. 35 UK market estimates and forecasts, 2018 - 2030

Fig. 36 Germany market estimates and forecasts, 2018 - 2030

Fig. 37 France market estimates and forecasts, 2018 - 2030

Fig. 38 Italy market estimates and forecasts, 2018 - 2030

Fig. 39 Spain market estimates and forecasts, 2018 - 2030

Fig. 40 Sweden market estimates and forecasts, 2018 - 2030

Fig. 41 Norway market estimates and forecasts, 2018 - 2030

Fig. 42 Denmark market estimates and forecasts, 2018 - 2030

Fig. 43 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 44 Japan market estimates and forecasts, 2018 - 2030

Fig. 45 China market estimates and forecasts, 2018 - 2030

Fig. 46 India market estimates and forecasts, 2018 - 2030

Fig. 47 Australia market estimates and forecasts, 2018 - 2030

Fig. 48 Thailand market estimates and forecasts, 2018 - 2030

Fig. 49 South Korea market estimates and forecasts, 2018 - 2030

Fig. 50 Latin America market estimates and forecasts, 2018 - 2030

Fig. 51 Brazil market estimates and forecasts, 2018 - 2030

Fig. 52 Mexico market estimates and forecasts, 2018 - 2030

Fig. 53 Argentina market estimates and forecasts, 2018 - 2030

Fig. 54 Middle East and Africa. market estimates and forecasts, 2018 - 2030

Fig. 55 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 56 South Africa market estimates and forecasts, 2018 - 2030

Fig. 57 UAE market estimates and forecasts, 2018 - 2030

Fig. 58 Kuwait market estimates and forecasts, 2018 - 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Biosimilars Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Biosimilars Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Biosimilars Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- North America Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- U.S.

- U.S. Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- U.S. Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- U.S. Biosimilars Market, By Product

- Canada

- Canada Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Canada Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Canada Biosimilars Market, By Product

- North America Biosimilars Market, By Product

- Europe

- Europe Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Europe Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- UK

- UK Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- UK Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- UK Biosimilars Market, By Product

- Germany

- Germany Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Germany Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Germany Biosimilars Market, By Product

- France

- France Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- France Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- France Biosimilars Market, By Product

- Italy

- Italy Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Italy Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Italy Biosimilars Market, By Product

- Spain

- Spain Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Spain Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Spain Biosimilars Market, By Product

- Sweden

- Sweden Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Sweden Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Sweden Biosimilars Market, By Product

- Norway

- Norway Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Norway Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Norway Biosimilars Market, By Product

- Denmark

- Denmark Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Denmark Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Denmark Biosimilars Market, By Product

- Europe Biosimilars Market, By Product

- Asia Pacific

- Asia Pacific Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Asia Pacific Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- China

- China Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- China Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- China Biosimilars Market, By Product

- Japan

- Japan Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Japan Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Japan Biosimilars Market, By Product

- India

- India Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- India Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- India Biosimilars Market, By Product

- Australia

- Australia Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Australia Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Australia Biosimilars Market, By Product

- Thailand

- Thailand Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Thailand Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Thailand Biosimilars Market, By Product

- South Korea

- South Korea Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- South Korea Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- South Korea Biosimilars Market, By Product

- Asia Pacific Biosimilars Market, By Product

- Latin America

- Latin America Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Latin America Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Brazil

- Brazil Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Brazil Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Brazil Biosimilars Market, By Product

- Mexico

- Mexico Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Mexico Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Mexico Biosimilars Market, By Product

- Argentina

- Argentina Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Argentina Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Argentina Biosimilars Market, By Product

- Latin America Biosimilars Market, By Product

- Middle East and Africa

- Middle East and Africa Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Middle East and Africa Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Saudi Arabia

- Saudi Arabia Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Saudi Arabia Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Saudi Arabia Biosimilars Market, By Product

- South Africa

- South Africa Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- South Africa Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- South Africa Biosimilars Market, By Product

- UAE

- UAE Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- UAE Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- UAE Biosimilars Market, By Product

- Kuwait

- Kuwait Biosimilars Market, By Product

- Recombinant Non-glycosylated Proteins

- RecombinantGlycosylated Proteins

- Kuwait Biosimilars Market, By Application

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Chronic & Autoimmune Disorders

- Others

- Kuwait Biosimilars Market, By Product

- Middle East and Africa Biosimilars Market, By Product

- North America

Biosimilars Market Dynamics

Driver: Increasing prevalence of chronic diseases

Cancer is considered as one of the major cause of illness and has both social and economic impact on individuals. According to report published by WHO in 2018 over 9.6 million deaths were caused due to cancer globally. The same source estimated that about 1 in 6 deaths are caused due to cancer. Over 70% of deaths occur in middle- and low-income countries. Cancer is estimated to cost more than USD 4.5 billion in direct health system costs. During 2016-18 Australia received a funding of USD 252 million to enhance cancer research projects as well as cancer related programs. Also, in December 2019, the government of U.S. raised a funding of USD 2.6 billion in order to increase medical research and also an increase of USD 296 million for cancer research funding was provided by the government. In addition, rise in the Medicare caps for the U.S. territories and Puerto Rico for two years is quite critical in helping various cancer patient treatment and also the follow up care.

Driver: Cost-effectiveness of biosimilar drugs

Rapid growth of biotechnology industry has created the demand for safe and cost-effective medicines in an effort to curtail the existing healthcare expenditure. Biosimilars have proven to be less expensive than comparator’s (originator’s) drugs as due to cost-effective manufacturing processes. Various studies indicate towards the fact that biosimilars, which are derivatives of living organisms fit the cost-effectiveness ratio. Biosimilars have been proven to be of slightly lower or almost equal effectivity in comparison to their respective reference biopharmaceuticals. Two key factors that are anticipated to healthcare industry due to the advent of biosimilars are decreased unit cost of biologics and increased volume of biosimilar drugs.

Restraint: High manufacturing complexities and costs

Biologics are complex and large molecules that have specific effects. In many cases they are antibodies or proteins such as G-CSF. One of the main concerns to be observed is that some modifications might occur during the process of manufacturing that is most of the times undetectable and lead to altered immunogenicity, efficacy, or toxicity. Due to this many physicians are worried to prescribe biosimilars rather than biologics to their patients as the physician would not know whether the biosimilar is suitable for the patient until and unless the drug loses its efficacy suddenly or until the patient develops toxicity due to biosimilars. The cost of development of biosimilars is much higher than of generics that are chemical based.

What Does This Report Include?

This section will provide insights into the contents included in this biosimilars market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Biosimilars market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Biosimilars market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the biosimilars market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for biosimilars market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of biosimilars market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Biosimilars Market Categorization:

The biosimilars market was categorized into three segments, namely product (Recombinant Glycosylated Proteins, Recombinant Non-Glycosylated Proteins), application (Rheumatoid Arthritis, Oncology), and regions (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The biosimilars market was segmented into product, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc. were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The biosimilars market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; and Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Biosimilars market companies & financials:

The biosimilars market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Amgen, Inc. - Amgen, Inc. is a biotechnology company focused on discovery, development, manufacture, and delivery of innovative human therapeutics. The company’s product portfolio consists of drugs for therapeutic areas, such as cardiovascular disease, inflammation, nephrology, neuroscience, oncology, bone health, and biosimilars.

-

Biocon - Biocon is a biopharmaceutical company that specializes in manufacturing, discovering, developing, and producing biotherapeutics. It focuses on R&D of various therapeutic solutions in the segments of diabetes, cancer, cardiovascular, metabolics, oncology, immunology, and nephrology.

-

Teva Pharmaceutical Industries Ltd. - Teva Pharmaceutical Industries Ltd. develops, produces, and markets generic & specialty medicines. It operates through two business segments: Generic Medicines and Specialty Medicines.

-

Mylan N.V. - Mylan N.V. is a pharmaceutical company that offers over 7,500 products, including branded generics, specialty pharmaceutical products, prescription generics, and OTC & brand name drugs. This company is involved in research, manufacturing, supply chain, and development of pharmaceuticals & active pharmaceutical ingredients.

-

Dr. Reddy's Laboratories Ltd. - Dr. Reddy's Laboratories Ltd. is a multinational pharmaceutical company, with a presence across 25 countries. The company focuses on synthetic organic chemistry, analytical chemistry, process engineering, formulations development, polymorphism, biopharmaceutics, and regulatory science.

-

Sandoz (Pharmaceuticals Division of Novartis) - Sandoz represents the pharmaceuticals division of Novartis. It is a producer & manufacturer of pharmaceuticals in the fields of biosimilars, generic injectables, ophthalmics, dermatology, antibiotics, cardiovascular, metabolism, central nervous system, pain, gastrointestinal, respiratory, and hormonal therapy.

-

Celltrion, Inc. - Celltrion, Inc. is a biopharmaceutical company that produces biosimilar antibody therapeutics and biopharmaceuticals. Its two major segments are biopharmaceuticals and chemical medicines. It focuses on biosimilar monoclonal antibodies and novel drugs for various therapeutic areas, including oncology & autoimmune diseases.

-

AbbVie, Inc. - AbbVie, Inc. is a research-based specialty biopharmaceutical company. It is a spinoff from Abbott Laboratories in 2013 and is known for Humira, which is used for the treatment of arthritis. Its operations are based on one business segment—pharmaceutical products. Its product portfolio includes treatments for metabolic diseases, neurological disorders such as Parkinson’s disease, oncology, virology, chronic autoimmune diseases in rheumatology, gastroenterology, and dermatology.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Biosimilars Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Biosimilars Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."