- Home

- »

- Healthcare IT

- »

-

Blockchain Technology In Healthcare Market Report, 2030GVR Report cover

![Blockchain Technology In Healthcare Market Size, Share & Trends Report]()

Blockchain Technology In Healthcare Market Size, Share & Trends Analysis Report By Network Type, By Application (Clinical Data Exchange & Interoperability, Claims Adjudication & Billing), By End User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-889-3

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

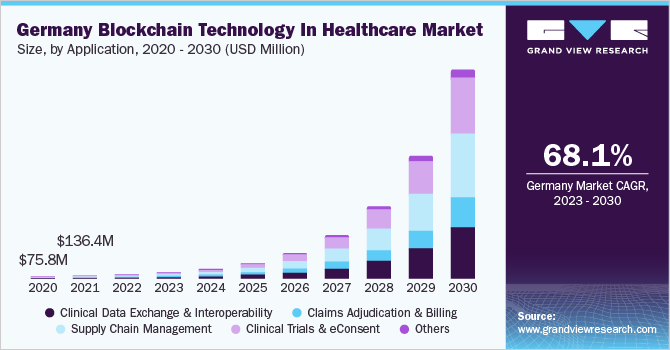

The global blockchain technology in healthcare market size was valued at USD 1.97 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 68.40% from 2023 to 2030. The increasing incidence of information leaks and data breaches, coupled with the rising requirement to curb these issues, are attributed to the market growth. Strategic initiatives by the key players, high demand to reduce drug counterfeiting, and the need for efficient health data management systems are the major factors leading to the adoption of the technology.

In October 2021, MDS Mexico, for instance, launched a blockchain technology based COVID-19 testing service to ensure the authenticity of vaccination certificates. The COVID-19 pandemic boosted the adoption and demand for blockchain solutions in healthcare. Although blockchain continues to be considered an emerging technology, market stakeholders have presented several use cases and proposals to increase awareness and adoption of blockchain to improve health outcomes.

In April 2020, IBM launched the IBM Rapid Supplier Connect, a blockchain-based network, to connect healthcare organizations and governments with non-traditional suppliers of devices, equipment, and supplies to combat COVID-19. In China, hospitals implemented blockchain to ensure timely delivery and accurate tracking of medications to COVID-19 patients’ homes.

As per OECD, a new blockchain application has emerged called Research Foundry to facilitate the management of permissions and consent for the sharing of and access to health data, software code, metadata, and other products connected with healthcare R&D. Furthermore, rising investment in the development of efficient healthcare record systems, wearable devices cryptography, and medical examination systems is anticipated to provide this market with lucrative opportunities in the near future.

Growing disease prevalence is expected to create a huge amount of data, boosting demand for data management. Moreover, leveraging blockchain technology in healthcare records will ensure that the data cannot be altered to ensure data integrity. Rising investment by major market players in this technology is further leading to market growth. For instance, in March 2018, IBM launched a low-cost platform especially for startups, to build any blockchain projects. Such initiatives are likely to encourage innovations and new healthcare organizations to adopt the technology, fostering market growth.

Synaptic Health Alliance is a partnership of leading healthcare companies focused on advancing data sharing between providers. The alliance consists of established healthcare companies such as Humana, Quest Diagnostics, and Optum. Synaptic believes blockchain has the potential to increase efficiency and lower costs in many areas within healthcare.

HMS Holdings has also stated that there is a place for blockchain in its business. The company has spoken with providers of supporting technology from many large technology companies to achieve this goal. Cerner, Allscripts, and athenahealth have also demonstrated interest in the area. Blockchain has the potential to reshape how healthcare organizations address longstanding issues and this is estimated to fuel the market growth.

Network Type Insights

The global market by network type was dominated by the public segment in 2022, which accounted for 56.4% of the revenue share. Blockchain technology in the healthcare market includes public, private, and other network types. The key factor causing the high share of the public segment is the increasing usage of the public networks for data management. Currently, Ethereum, a public network, is one of the most commonly used technology in healthcare. It is also known as “permission-less” blockchain system. Low cost and access to a larger database are the major factors leading to the growth of these public networks.

The Private segment is estimated to grow at the fastest rate of about 70% in the coming years. For instance, the Linux foundation’s Hyperledger Fabric is an implementation of the private network. They offer privacy, fast transactions, and high security. Therefore, they are designed and used for precise enterprise needs. The major factors leading to the growth of the private sector are data management and recording aspects along with the increase in demand for highly secured supply chain networks. Furthermore, the future aspects with regards to technological advancements are expected to fuel the adoption of blockchain in healthcare.

Application Insights

The supply chain management application segment accounted for over 25% of share of the blockchain technology in the healthcare market in 2022. Blockchain applications help preserve data integrity. The technology also helps pharmaceutical companies to facilitate interoperability with the Internet of Things (IoT) devices. It also helps them recruit candidates for clinical trials and regulate the drug supply chain. Blockchain can transform the healthcare sector by lowering operational costs, data corruption, and healthcare process optimization.

The clinical trials & eConsent segment is expected to grow at a notable rate during the forecast period. Leveraging the technology in clinical trials facilitates efficient data management and security. Integration of the blockchain technology also allows clinicians to securely connect internally. Information changes or alterations over the blockchain are not allowed, which is anticipated to fuel market growth in the coming years. The adoption of blockchain technology in medical records ensures data integrity. Similar concepts can be applied to clinical trials, where the records are an important part of legalities.

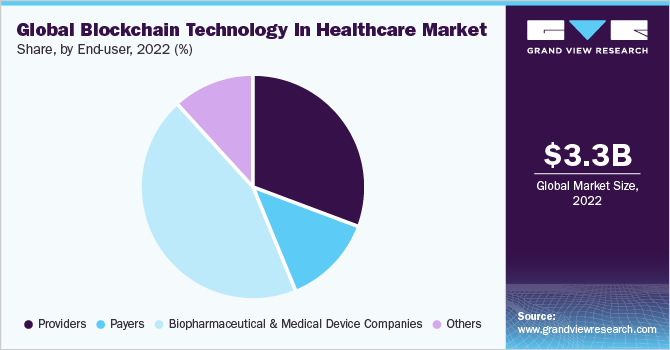

End-User Insights

By end-user, the biopharmaceutical & medical device companies segment held the largest market share of over 40% in 2022. This is attributable to large R&D budgets, the need to secure data exchange and interoperability, and a large amount of data management done by these companies in areas such as drug discovery and development.

The rising adoption of technology for essential functions such as verifying the authenticity of the returned drug, counterfeit prevention, compliance with the pharmaceutical supply chain, transparency, and traceability in clinical trials, and improving reliability and quality of clinical trial data is also estimated to contribute to the large share of the segment.

The hospital segment is expected to grow at a considerable rate owing to the growing adoption of the technology in hospitals, such as the Massachusetts General Hospital (MGH). Healthcare institutions and hospitals are now working on storing the patient’s data to safeguard the smooth working of the system. This not only helps in classifying new and old patients but also leverages existing records to complement the doctor’s appointment. Moreover, the technology will prevent the exposure of vital information, such as payment details, addresses, and phone numbers, to data breaches and cyberattacks.

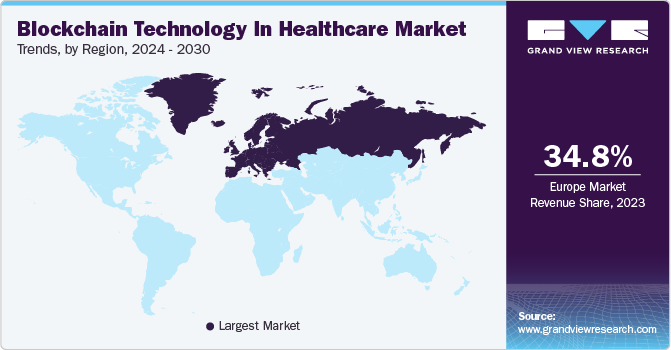

Regional Insights

Europe held the dominant share of about 35% in 2022, due to various initiatives taken by regional governments to avoid a data breach. For instance, in 2018, the EU government implemented the General Data Protection Regulation (GDPR). Implementation of GDPR coupled with the enormous growth of blockchain technology is expected to provide businesses with more opportunities in the region.

North America is expected to command the second-largest market share during the forecast period. Increasing demand for medical record safety is the major reason for regional growth. Though investment in developing technologies in the U.S. healthcare sector is growing, the issues associated with Electronic Medical Records are also on the rise. This upsurges the demand for safe, secure, and managed data sharing between companies, due to which major players and other healthcare organizations are investing in the blockchain market.

MEA region is expected to grow the fastest at a rate of about 69% from 2023 to 2030. For instance, UnitedHealth Group, in April 2018, announced its collaboration with MultiPlan, Quest Diagnostics, and Humana to leverage the potential of blockchain to exchange financial and other healthcare information securely. As a result, it is anticipated to have a positive impact on market growth over the forecast period.

Key Companies & Market Share Insights

The global market is highly competitive in nature. Technological collaborations, initiatives by key companies, government initiatives, and emerging startups are expected to propel market growth. Currently, the industry is in its nascent stage and healthcare companies together with tech companies are working on the methods to leverage blockchain at various stages. Some of the major players have entered into collaborations to improve their own platforms or portfolio.

For instance, in December 2018, Change Healthcare acquired PokitDok to extend the capabilities and technology of its Intelligent Healthcare Network by leveraging PokitDok's DokChain technology as well as blockchain use cases. In January 2021, UnitedHealth Group's Optum announced its decision to acquire Change Healthcare to simplify core administrative, clinical, and payment processes. Some of the key players in the blockchain technology in the healthcare market include:

-

IBM

-

PATIENTORY INC.

-

Guardtime

-

iSolve, LLC

-

Solve.Care

-

Oracle

-

Change Healthcare

-

BurstIQ

-

Medicalchain SA

-

Blockpharma

Blockchain Technology In Healthcare Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 3.27 billion

The revenue forecast in 2030

USD 126.02 billion

Growth rate

CAGR of 68.40% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Network type, application, end-user, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Estonia; Switzerland; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; UAE

Key companies profiled

IBM; PATIENTORY INC.; Guardtime; iSolve LLC; Solve.Care; Oracle; Change Healthcare; BurstIQ; Medicalchain SA; Blockpharma

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

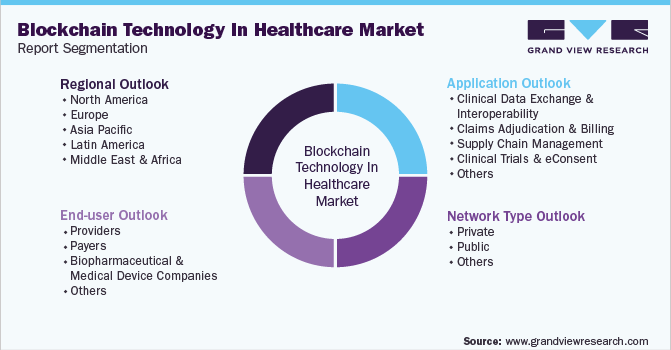

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the blockchain technology in healthcare market on the basis of network type, application, end user, and region:

-

Network Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Private

-

Public

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Clinical Data Exchange & Interoperability

-

Claims Adjudication & Billing

-

Supply Chain Management

-

Clinical Trials & eConsent

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Providers

-

Payers

-

Biopharmaceutical & Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Switzerland

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blockchain technology in healthcare market size was estimated at USD 1.97 billion in 2022 and is expected to reach USD 3.27 billion in 2023.

b. The global blockchain technology in healthcare market is expected to grow at a compound annual growth rate of 68.40% from 2023 to 2030 to reach USD 126.02 billion by 2030.

b. Europe dominated the blockchain technology in healthcare market in 2021. This is attributable to implementation of GDPR coupled with the enormous growth of blockchain technology.

b. Some key players operating in the blockchain technology in healthcare market include IBM, PATIENTORY INC., Guardtime, iSolve, LLC, Solve.Care, Oracle, Change Healthcare, BurstIQ, Medicalchain SA, and Blockpharma.

b. Key factors that are driving the blockchain technology in healthcare market growth include increasing incidence of information leaks and data breach coupled with the rising requirement to curb these issues, strategic initiatives by the key players, high demand to reduce drug counterfeit, need for efficient health data management system & rising investment in the development of efficient healthcare record system, wearable devices cryptography, and medical examination systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."