- Home

- »

- Clinical Diagnostics

- »

-

Blood Group Typing Market Size & Share Report, 2026GVR Report cover

![Blood Group Typing Market Size, Share & Trends Report]()

Blood Group Typing Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Techniques (PCR-based & Microarray, Assay-based), By Test Type, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-977-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

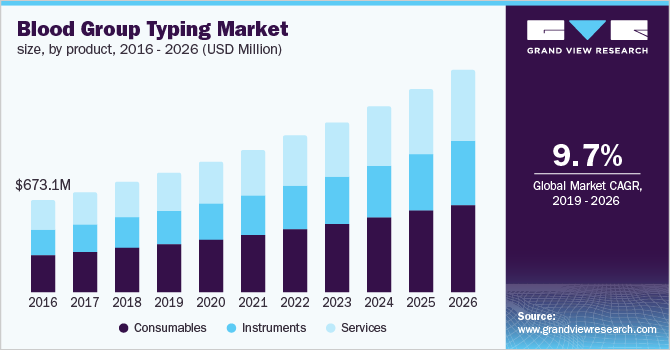

The global blood group typing market size to be valued at USD 3.44 billion by 2026, expanding at a compound annual growth rate (CAGR) of 9.7% during the forecast period. Rising use of blood group typing in prenatal testing and forensic sciences, rising number of blood transfusions due to the number of road accidents, and increasing demand for blood and related products are some of the factors expected to facilitate the growth. Blood group typing is a mandatory testing procedure before blood transfusions to measure blood compatibility between the donor and the recipient, as well as for the determination of the Rh factor. Rising usage of these tests for the diagnosis of Hemolytic Disease of the Newborn (HDN) is anticipated to further drive the market growth.

Major healthcare and biotechnology companies operating in this industry focus on developing novel products and technologies for analyzing the blood group types at the molecular level. For instance, the flexible DNA microarray platform that allows the processing of genotypes and blood samples is used by the blood banks for extensive screening at low prices.

Moreover, companies are increasingly focusing on the development of products that are capable of efficient blood testing workload management. For instance, in November 2016, Immucor’s PreciseType HEA test received the Food and Drug Administration (FDA) approval for its application in the detection of sickle cell traits in blood donors. Several regulatory bodies such as the FDA are involved in the development and implementation of national policies for universal access to safe blood.

Scientists also engage in various research activities to develop sensitive donor screening tests for the detection of potential bioterrorism agents and newly evolved diseases in blood donations. Additionally, the FDA, along with various government agencies and organizations in the U.S., is preparing adequate blood inventories in case of emergencies. A rise in such government initiatives associated with blood safety can be acknowledged as the key factor driving the market for blood group typing.

However, some of the factors such as poor blood service infrastructure, lack of awareness and skilled professionals, and the risk of transmissible diseases such as hepatitis B and HIV may hamper the market growth in the forthcoming years.

Blood Group Typing Market Trends

The increasing demand for precise identification of individual blood groups in hospitals and laboratories is the key driver for market growth. Moreover, a rising number of blood banks globally is anticipated to fuel the market demand. According to the World Health Organisation (WHO), approximately 13,300 blood donation centers across 169 countries have reported a total of 106 million contributions in 2022.

Moreover, the surging demand for blood transfusion due to increasing emergency cases and chronic diseases, along with the rising number of surgical processes, are likely to boost the market. Furthermore, the rise in voluntary blood donation has contributed to the industry’s growth. As per the WHO, around 118.54 million donations were collected globally in 2018, of which 40% were from developed countries, which carry 16% of the global population.

A lack of awareness regarding the health benefits of donating blood, such as a lower risk of developing cancer and heart attack, and improved liver health, is likely to hamper the industry growth. However, organizations are trying to create new and improved testing methods to evaluate blood samples at the molecular level, which provides significant growth potential for the industry. Blood banks, for example, are already employing the adaptable DNA microarray technology to analyze genotypes and blood samples, in order to provide cost-effective screening.

Products Insights

Consumables segment held the largest market share in 2018 and is anticipated to lead the blood group typing market throughout the forecast period due to the increase in surgical procedures such as organ transplantation and the use of serological fluids and reagents in laboratories. The growth can also be attributed to the high blood donation rates leading to increased blood sample analysis. Additionally, the development of new molecular diagnostic test reagents and kits focused on reducing the turnaround time needed for conclusive outcomes is expected to further facilitate the growth.

Test Type Insights

The antibody screening segment held the largest market share in 2018 and is projected to continue dominating over the forecast period due to the increasing demand for early diagnosis and rising prevalence of chronic disorders. Moreover, the increasing incidence of Transfusion Transmitted Infections (TTIs), particularly in lower-middle-income and low-income nations is one of the major factors driving the segment growth. The ABO tests segment held the second-largest market share in 2018, due to the growing use of this test for blood grouping. In terms of revenue, the antigen typing and the HLA typing segment accounted for around 35% market share in the same year.

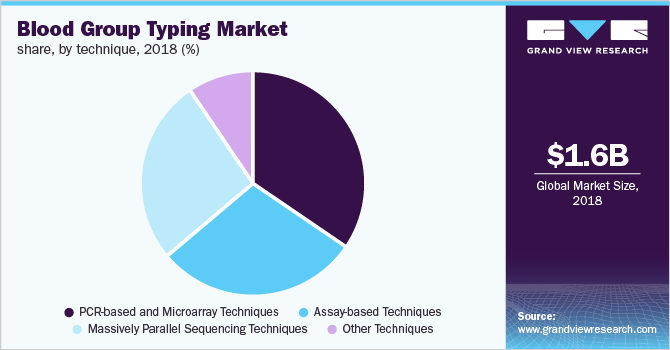

Technique Insights

The PCR-based and microarray segment accounted for the largest share in the market for blood group typing in 2018 due to increasing R&D activities focused on antibody-antigen interactions and the high prevalence of chronic diseases, such as sickle cell anemia, aplastic anemia, traumatic injuries, and leukemia.

Additionally, the growing usage of PCR-based techniques for determining rare blood group types coupled with rising awareness regarding the microarray-based approach is the key factor responsible for the large market share of the segment. In terms of revenue, the assay-based technique and massively parallel sequencing segments collectively accounted for slightly more than 50% share in 2018.

Regional Insights

North America held the largest market share in 2018 owing to a growing number of transfusions in high-income countries, such as the U.S. According to the World Health Organization (WHO) data in 2019, 42% of the blood donations come from high-income countries. According to the Centers for Disease Control and Prevention (CDC), around 18 million prenatal visits took place in the U.S. in 2015. This encourages demand for blood group typing during prenatal testing. Also, market players undertaking new product launches by the key market players are expected to contribute to regional growth.

Asia Pacific is anticipated to exhibit the fastest CAGR over the forecast period due to the rising prevalence of chronic diseases requiring the need for blood group typing. Rising incidence of infectious disease is a major concern in this region, driving industry growth. Also, the growing number of road accidents and trauma cases in countries, such as India is expected to trigger the adoption of these tests in the region.

Key Companies & Market Share Insights

Although the global industry is moderately concentrated and fragmented due to the presence of numerous local as well as multinational companies, it is highly competitive as the market is in its growth phase. The key participants operating in this space include Grifols, S.A.; Merck KGaA; Bio-Rad Laboratories, Inc.; Immucor, Inc.; Novacyt Group; Danaher Corporation; Agena Bioscience, Inc.; Ortho Clinical Diagnostics; and Quotient, Ltd.

Bio-Rad Laboratories, Inc.; Grifols, S.A.; Immucor, Inc.; and Merck KGaA held the largest market share in 2018 due to the wide geographical presence and an extensive product portfolio. Additionally, these companies are adopting various strategies such as mergers and acquisitions, new product development, regional expansions, and strategic partnerships to gain a competitive advantage.

Recent Developments

-

In April 2022, Grifols, a global pioneer in plasma-derived pharmaceuticals, announced its acquisition of Tiancheng (Germany) Pharmaceutical Holdings AG's 100% share capital. Grifols' acquisition of Biotest AG, which is majorly owned by Tiancheng (Germany) Pharmaceutical Holdings AG,allows it to accelerate and broaden its product range, boost patient access to plasma medicines, operate the largest private European network of plasma facilities (87 sites), and increase business and margin expansion

-

In February 2022, Grifols announced a collaboration with Endpoint Health, Inc., a pharmaceuticals company focused on solving urgent problems in immune-driven critical care, to market and develop an Antithrombin III (AT-III) medication to treat sepsis

-

In June 2021, Bio-Rad Laboratories announced a partnership with Seegene, to manufacture and commercialize molecular diagnostic equipment for infectious diseases

-

In August 2021, Danaher Corporation completed its acquisition of Aldevron. Post the acquisition, within Danaher's Life Science department, Aldevron will function as a separate operating business and brand

-

In May 2022, Quidel Corporation collaborated with Ortho Clinical Diagnostics Holdings plc, resulting in QuidelOrtho, a notable name in the IVD space

Blood Group Typing Market Report Scope

Report Attribute

Details

Revenue forecast in 2026

USD 3.44 billion

Growth rate

CAGR of 9.7% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, test type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Russia, Japan, China, India, Australia, South Korea, Singapore, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Grifols, S.A.; Merck KGaA; Bio-Rad Laboratories, Inc.; Immucor, Inc.; Novacyt Group; Danaher Corporation; Agena Bioscience, Inc.; Ortho Clinical Diagnostics; Quotient, Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Group Typing Market Segmentation

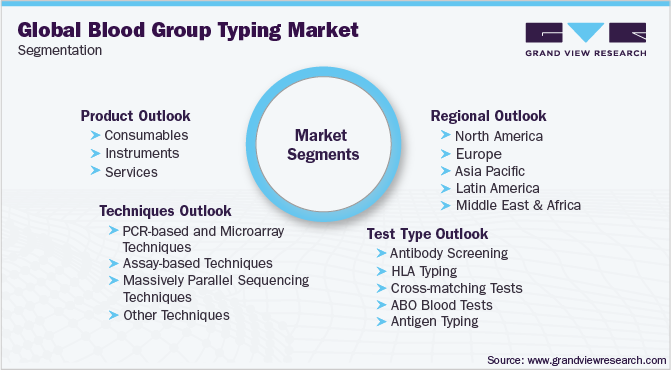

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For this study, Grand View Research has segmented the global blood group typing market report based on the product, technique, test type, and region

-

Product Outlook (Revenue, USD Million, 2015 - 2026)

-

Consumables

-

Instruments

-

Services

-

-

Technique Outlook (Revenue, USD Million, 2015 - 2026)

-

PCR-based and Microarray Techniques

-

Assay-based Techniques

-

Massively Parallel Sequencing Techniques

-

Other Techniques

-

-

Test Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Antibody Screening

-

HLA Typing

-

Cross-matching Tests

-

ABO Blood Tests

-

Antigen Typing

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."