- Home

- »

- Medical Devices

- »

-

Blood Warmer Market Size, Share & Growth Report, 2030GVR Report cover

![Blood Warmer Market Size, Share & Trends Report]()

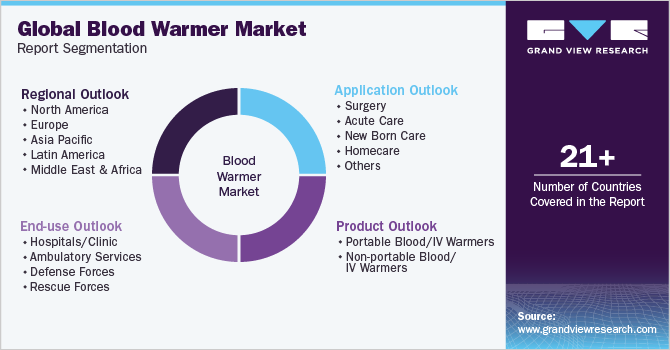

Blood Warmer Market Size, Share & Trends Analysis Report By Product (Portable, Non-portable Blood Warmers), By Application (Surgery, Acute Care, New Born Care, Homecare), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-141-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global blood warmer market size was valued at USD 1.05 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.47% from 2023 to 2030.Increasing number of surgeries and trauma cases, rising cases of hypothermia as well as increasing geriatric and infant population are the major factors driving the growth of the blood warmers market. Moreover, the outbreak of COVID-19 has significantly increased the hospital admission rate globally. High fever is one of the basic symptoms of patients who may be suffering from COVID-19. As a result, use of warm blankets and sterile fluids has increased due to increasing number of patients in hospitals and clinics, this is in turn expected to propel market growth.

The COVID-19 pandemic had a positive impact on the blood and IV fluid warmers market. The demand for infusion therapy grew with the rise in the number of COVID-19 patients. This was one of the key factors driving up demand for blood/ IV warmer devices, which are used to raise fluids to body temperature, speed up patient recovery, and reduce the danger of transfusion shock. Moreover, the introduction of next-generation blood warmer products to support various therapies, such as continuous renal replacement and organ support therapies, is one of the major factors fueling market growth. Various factors such as increasing demand for early treatment of hypothermia and growing armed forces personnel worldwide are likely to boost the need for blood warmers in the global healthcare industry. As a result of these reasons, the market is likely to expand in the approaching years.

The market is predicted to grow over the forecast period due to an increase in number of surgeries and trauma cases around the world. Trauma is a major cause of death worldwide, with around 5 million people dying every year as a result of traumatic injury. According to the Association for Safe International Road Travel (ASIRT) 2018, every year, between 20 million and 50 million individuals are injured or disabled in traffic accidents, with 1.35 million related deaths. According to WHO, road traffic injuries are estimated to be the ninth leading cause of mortality globally. In addition, hypothermia is one of the leading causes of death in patients who have suffered physical trauma. For instance, out of the few million occurrences of IV-induced hypothermia reported in the U.S., 75.0% occur in ambulatory settings. Portable blood warmers have been in high demand in the U.S. and EU since 2010, owing to the risk of cold-stored blood/IV-induced hypothermia, which is expected to drive the market throughout the forecast period.

Moreover, growing demand for blood warmers from nontraditional end users operating in harsh cold environments, including military activities, rescue services, and ambulatory care, is likely to drive market growth. According to Belmont Medical Technologies in 2020, early intervention by helicopter Emergency Medical Service (EMS) providers can dramatically minimize the chances of hypothermia, reducing or even stopping the trauma triad of death and other problems. For instance, in December 2020, Danish MedTech Company MEQU released the Power Pack, a new battery for its M Warmer System, a compact blood and IV fluid-warming system. The system is commonly used in prehospital emergency settings, such as ambulances, rescue helicopters, and rapid response vehicles. Special Forces and/or military in the UK, the U.S, the Netherlands, Germany, France, Sweden, and Denmark have all purchased the M Warmer System, as it enables blood transfusions at the point of injury in remote locations or battlefields. According to the same source, the addition of blood and IV fluid warmers to ambulatory services and EMS has been linked to a 22% reduction in admission hypothermia. Thus, growth in ambulatory and military sectors is likely to propel the market growth in the near future.

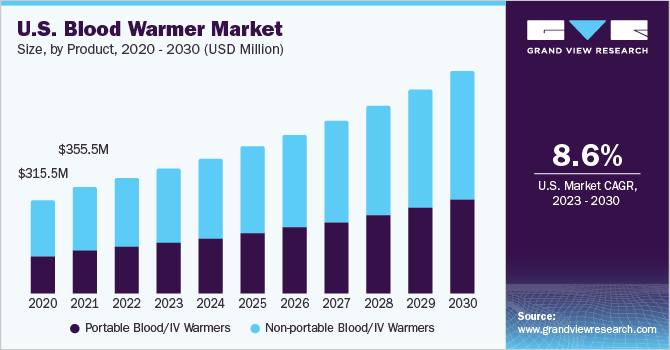

U.S. dominated the overall blood warmers market with the highest shares of 89.19% in 2022.Increasing number of hypothermia-related cases, along with growing prevalence of chronic conditions such as thyroid & diabetes, is a key factor leading to increased demand for blood warmers. For instance, according to CDC’s National Diabetes Statistics Report for 2020, in 2018, about 34.2 million people in the U.S. had diabetes. In addition, rising number of surgeries is expected to boost the market, as blood warmers play an important role in surgical units. For instance, as per American Society for Aesthetic Plastic Surgery, surgical procedures accounted for 77% of the total expenditure in 2017 in the U.S. Thus, these factors are expected to positively impact the market during the forecast period. Moreover, favorable reimbursement structure is another major factor contributing to growth of the blood/ IV warmers market in the U.S.

Furthermore, the COVID-19 pandemic has also created various opportunities for local manufacturers. The supply chain of major players was interrupted as a result of movement restrictions at international borders. Hence, local firms were able to enter the market and address the unmet end-user demands. For instance, in September 2021, according to QinFlow, the Warrior line, which is a portable IV fluid and blood warming solution for complete range of emergency care, can now safely and effectively warm rapid irregular flows like those produced by CODAN's revolutionary high-flow hand pump. This innovative hand pump is meant to provide blood more effectively to the sickest patients, particularly in prehospital settings when quick infusion choices are restricted, which is expected to drive its market in the near future.

Product Insights

Non-portable blood-IV fluid warmers segment held the largest market share of 55.26% in 2022. Growing incidence of road accidents, mishaps, gunshot wounds, and other injuries is expected to drive segment growth. In addition, increasing rate of hospitalization due to various medical disorders, rising aging population, and improving financing for healthcare infrastructure in developing economies are all likely to propel blood warmers market. Furthermore, surgical procedures and hospital stays are the biggest factors that drive the need for infusion of IV solutions or blood transfusion. blood warmers have traditionally played an essential role in minimizing mortality among citizens of industrialized countries due to transfusion/infusion caused hypothermia, which drives the segment growth.

However, portable blood warmers segment is expected to grow at the highest CAGR of 8.96% from 2023 to 2030. The demand is expected to remain slightly higher than non-portable devices in the forthcoming years. A majority of the demand comes from ambulatory/paramedic services, rescue forces, and defense sectors. In addition, growing demand from remote clinics and emergency centers is also expected to drive the segment growth. Furthermore, volume demand for portable blood-IV warmers remains slightly higher than non-portable blood warmers. Majority of the demand for portable blood warmers is from paramedic/ambulatory services, defense sectors, and rescue forces. In addition, growing demand from emergency centers and remote clinics is also expected to fuel the market for portable blood-IV warmers in future.

End-use Insights

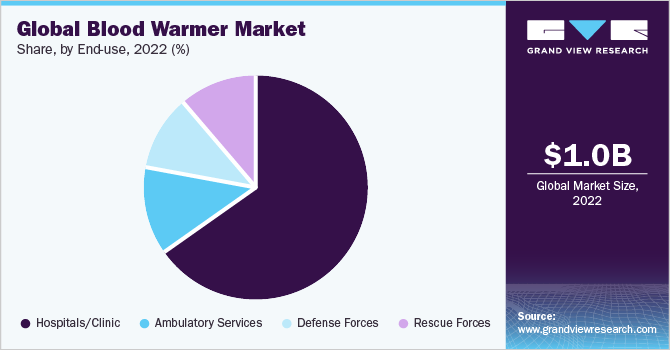

In 2022, hospitals/clinic segment dominated the market with a share of 65.29%. The demand for blood warmers has increased as surgical operations have become more common around the world. These products assist surgeons in keeping a patient's body temperature at optimal ranges and avoiding hypothermia on the operating table. Blood/IV warming devices are commonly employed in hospitals because they can heat a larger volume of blood or IV solutions while also being more affordable & easier to maintain. Moreover, companies are focusing on the development of customized hemodialysis machines with a variety of interventions. This is likely to have an influence on the end-user experience. Furthermore, hospitals are considered significant buyers because they have long-term contracts with providers of blood and IV fluid warming machines, which gives them higher negotiation leverage and makes them a larger market for product after-sales services.

However, ambulatory services segment is expected to grow at the highest CAGR of 9.46% during the forecast period. Blood warmers are being ordered by government agencies in a number of countries to provide good treatment in emergency scenarios, which is projected to drive segment growth in the near future. For instance, in March 2021, MEQU, a medical technology business, won a public tender to offer portable blood warmers to the Norwegian National Air Ambulance Services. Most of the time, air ambulance services deal with crisis circumstances. Before administering to the patient, all solutions should be warmed up. Hence, ambulance services are equipped with blood warmers to facilitate this practice. Such initiatives are expected to drive segment demand.

Regional Insights

North America dominated the blood warmers market with the largest revenue share of 40.76% in 2022. The presence of key participants, huge investments by governments for development of innovative medical devices, and presence of favorable reimbursement scenario are supplementing the growth of market in the region. Moreover, increased spending on the defense sector in addition to the spending on search and rescue emergency services has resulted in a growing demand for blood warmers. The geographical location of this region results in extremely cold weather patterns that render the region prone to cyclones, blizzards, and heavy snow. Numerous fatalities attributed to extreme snow/frost-related incidents are anticipated to drive the market in the region. Thus, North America is expected to dominate the overall regional market during the forecast period.

However, Asia Pacific region is estimated to witness the highest growth of CAGR 8.71% in the blood warmers market over the forecast period. Presence of a large patient pool, along with growing need for technologically advanced & cost-efficient healthcare solutions in the region, is expected to present significant growth opportunities in the market. Moreover, rising elderly population and growing burden of chronic diseases are among factors expected to boost the demand for blood warmers in Asia Pacific in the coming years. According to WHO (Non-Communicable Diseases [NCD} Burden in the South-East Asia Region), approximately 8.5 million people die every year due to various NCDs in the region. This represents the fact that 62% of all deaths in this region occur due to NCDs. Moreover, the rising number of surgeries in Asia Pacific owing to the larger population and increasing incidence of accidental injuries are some of the key factors driving the market.

Key Companies & Market Share Insights

The key market players are focusing on the launch of innovative products, growth strategies, and technological advancements. For instance, in July 2021, MEQU received a public tender to supply portable blood and IV fluid warming devices (M Warmer System) to the Ministry of Defense, in collaboration with UK partner Fenton Pharmaceuticals (MOD). In addition, in Australia and New Zealand, HKM Group easily formed partnerships and maintained connections with the military, EMS, police, hospitals, and specialty emergency providers. HKM's MilTac and emergency products are hand-picked and among the most cutting-edge innovations in patient care.

Furthermore, major companies are working on providing innovative products, mergers & acquisitions, and comprehensive services to increase/maintain end-user confidence. For instance, in January 2022, QinFlow Inc. received a group buy agreement from Premier, Inc. for blood and fluid warming products. This arrangement will give healthcare organizations access to their next-generation blood warming technology, which has been fine-tuned to suit the stringent requirements of emergency departments, intensive care units, operating rooms, and trauma bays. Thus, blood warmers market is expected to grow rapidly in the coming years. Some prominent players in the global blood warmer market include:

-

Stryker Corporation

-

Gentherm Medical

-

Belmont Medical

-

3M

-

ICU Medical

-

Vyaire Medical, Inc.,

-

The Surgical Company PTM

-

Life Warmer

-

MEQU

-

Estill Medical Technologies, Inc.

-

Smisson-Cartledge Biomedical

Blood Warmer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.14 billion

Revenue forecast in 2030

USD 2.01 billion

Growth rate

CAGR of 8.47% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA)

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, South Korea, Australia, Brazil, Mexico, Argentina, Colombia, South Africa, UAE, Saudi Arabia

Key companies profiled

Stryker Corporation, Gentherm Medical, Belmont Medical, 3M, ICU Medical, Vyaire Medical, Inc., The Surgical Company PTM, Life Warmer, MEQU, Estill Medical Technologies, Inc., Smisson-Cartledge Biomedical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global blood warmer market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Blood/IV Warmers Device

-

Non-portable Blood/IV Warmers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Acute Care

-

New Born Care

-

Homecare

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Clinic

-

Ambulatory Services

-

Defense Forces

-

Rescue Forces

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global blood warmer market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.14 billion in 2023.

b. The global blood warmer market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 2.01 billion by 2030.

b. North America dominated the blood warmer market with a share of 40.76% in 2022. This is attributable to the high cost of medical devices, increasing healthcare expenditure, extreme climate conditions, increasing incidence of surgical procedures/hospital visits, and high defense/rescue forces spending.

b. Some key players operating in the blood warmers market include Stryker Corporation, Gentherm Medical, Belmont Medical, 3M, ICU Medical, Vyaire Medical, Inc., The Surgical Company PTM, Life Warmer, MEQU, Estill Medical Technologies, Inc., Smisson-Cartledge Biomedical.

b. Key factors that are driving the blood warmers market growth include increasing demand from ambulatory services and military/defense sectors, growth in the number of surgical procedures performed globally, and increasing incidence of road accidents and mishaps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."