- Home

- »

- Clinical Diagnostics

- »

-

Blood Testing Market Size, Share & Growth Report, 2030GVR Report cover

![Blood Testing Market Size, Share & Trends Report]()

Blood Testing Market Size, Share & Trends Analysis Report By Test Type (Glucose, Lipid, COVID-19, A1C, CRP, Vitamin D, ALT, AST, Thyroid Stimulating Hormone, PSA, Cortisol), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-897-8

- Number of Pages: 129

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

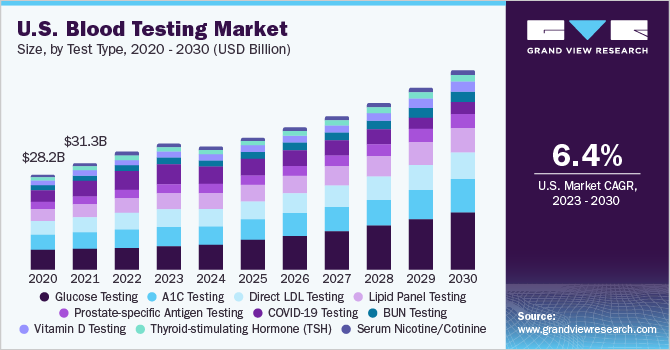

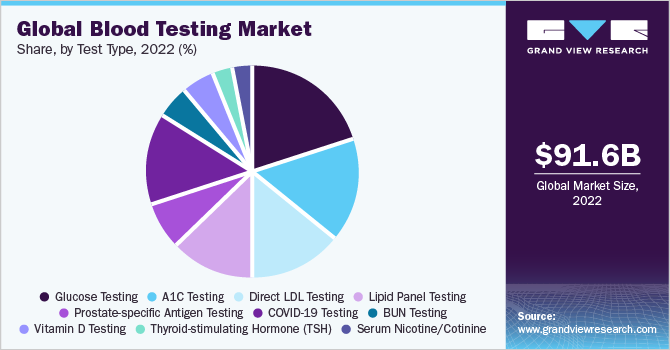

The global blood testing market size was estimated at USD 91.61 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.23% from 2023 to 2030. The growth of the market can be attributed to the increased medical spending by government and regulatory bodies. These entities are actively involved in promoting regular diagnostic examinations among patients, thereby driving the demand for blood testing services during the forecast period. Furthermore, ongoing research activities in developed countries are another key factor fueling the growth of the market. In September 2020, researchers at the National Center for Global Health and Medicine in Japan successfully developed a blood test capable of providing early warning signs for severe COVID-19 cases. The effectiveness of these tests has been evaluated through the deployment of 500 prototype machines.

Such initiatives contribute to the growth and advancement of the regional market of Asia. The market growth is driven by factors, such as increasing cases of infectious disorders, including blood and bloodstream infections. Infectious diseases contribute significantly to the global burden of mortality and illness. Conditions, such as sepsis and bloodstream infections, fall under this category. Blood culture tests play a crucial role in identifying the causative infectious agent responsible for bloodstream infections. For instance, according tothe International Labour Organization, the prevalence rate of blood-borne diseases, such as HIV, accounted for 34 million cases globally.

Around 69% of the affected people live in Sub-Saharan Africa. This is expected to boost the demand for blood culture testing in the coming years. The increasing prevalence of chronic diseases and high demand for health assessment products is another major factor driving the growth of the market. A rise in chronic diseases has created a favorable environment for boosting market growth. Furthermore, the increasing incidence of infectious diseases presents a lucrative opportunity. In addition, there is a growing trend of patient awareness and preference for home diagnostic tests and self-testing. This trend has led to increased adoption of various products in blood testing procedures.

For instance, the Accu-Chek Active Blood Glucose Meter. It is a home glucose testing kit that enables individuals to monitor their blood glucose levels conveniently at home.The outbreak of COVID-19 had a significant impact on the market worldwide. With a rise in the number of COVID-19 cases, there was a surge in the demand for blood testing to perform diagnostic routines for COVID-19. This trend is expected to continue during the forecast period. For instance, a study published in May 2022, titled COVID-19 Diagnosis by routine blood tests by using machine learning (ML), demonstrated the development of the ML model for COVID-19 analysis.

The model was constructed and cross-verified using routine blood test data from 5,333 patients with numerous viral and bacterial infections, as well as 160 COVID-19-positive patients. This research highlights the utilization of blood testing in the diagnosis of COVID-19 and further supports the positive impact of COVID-19 on the market. These factors are expected to contribute positively to the market growth during the forecast period. However, market growth can be hindered by the presence of stringent regulatory approval processes. For instance, in the United States, the U.S. Food and Drug Administration (FDA) regulates the development of commercial tests, considering them as medical devices.

The FDA is responsible for approving the use of clinical laboratory tests, which adds complexity to the market landscape. In addition, the lack of awareness about the advancements in technologies and processes related to blood testing poses a challenge to growth. The potential benefits and innovations in blood testing may not reach their full potential due to limited awareness among healthcare providers and end-users. These factors, including regulatory hurdles and limited awareness, act as constraints on the growth of the market. Addressing these challenges through streamlined regulatory processes and increasing awareness about the latest developments in blood testing can help overcome these obstacles and drive market growth.

Test Type Insights

Based on type, the glucose testing segment dominated the market with a revenue share of 16.63% in 2022 owing to the high penetration of these tests in the global market. Moreover, in recent years, there has been a noticeable increase in the prevalence of diabetes, and numerous reports have indicated that this trend is expected to continue in the future. Furthermore, a report by the International Diabetes Federation in December 2021 highlighted that around 537 million adults aged between 20 and 79 years were sufferingfrom diabetes in 2021. Furthermore, it is projected that the total number of diabetic individuals will reach 783 million by 2045.

This substantial increasewill drive the demand for blood glucose testing, consequently contributing to the growth of the market. Technological advances in these glucometers, such as Bluetooth capabilities and wireless connectivity, further enhance the adoption of these products. Some examples of smart glucose monitoring products include Dario Health Smart Meter, iHealth Align, iHealth Smart, and Glooko. In addition to glucometer manufacturers, major service providers in this market include Mayo Clinic, LabCorp America, and Quest Diagnostics. Consumables essential for glucose testing include test strips, lancets, syringes, diabetes testing kits, and other related items.

The A1C testing segment is expected to experience substantial growth over the projection period. A1C testing, also called glycated hemoglobin testing, is anticipated to have a significant market expansion due to its high level of convenience. This blood test provides valuable information about average blood sugar levels, making it useful for both monitoring diabetes treatment and diabetes diagnosis. A1C tests are particularly beneficial in point-of-care settings as they offer a long-term assessment of blood sugar control.

The market offers a range of rapid or OTC tests, as well as prescription tests, which utilize POC testing devices to monitor glycated sugar levels in the blood.The global market for blood testing has been propelled by the outbreak of the SARS-CoV-2 virus worldwide. Many key players are actively involved in developing or have already introduced serology tests or COVID-19 antibody tests that utilize a blood sample from suspected individuals. Established players, such as bioMérieux SA, Biocan Diagnostics, Inc., Beckman Coulter, Inc., Abbott Laboratories, Bio-Rad Laboratories, Inc., and Cellex, Inc., have significantly contributed to the growth of this segment by establishing a strong market presence for their products.

Regional Insights

North America dominated the market with a share of over 43.17% in 2022. The growth of the region is expected to be fueled by an increase in strategic initiatives undertaken by government bodies and key players to encourage plasma donations in the region. Efforts are being made by blood donation centers across the country to enhance the collection of plasma from individuals who have recovered from the disease. The regional growth is being propelled by various factors including the implementation of new government initiatives, advancements in healthcare infrastructure, and technological advancements.

Regulatory bodies, such as the FDA and the Federal Trade Commission, play a crucial role in the regulation of diagnostic tests. In the United States, the introduction of Clinical Laboratory Improvement Amendments (CLIA) is expected to enhance the utilization of testing.The Asia Pacific region is expected to experience the highest CAGR during the forecast period. The increasing incidence of chronic diseases in countries, such as China and India,isa significant driver of regional market growth. Moreover, several multinational companies are making substantial investments in this region. For instance, in October 2021, Siemens Healthineers announced the launch of its new manufacturing facility for COVID-19 and molecular assays in India.

The new facility in Gujarat will focus on developing antigen, antibody (serology testing), and RT PCR tests for COVID-19 in India.Furthermore, the market growth in Europe is driven by factors including an increase in donation activities. The European region has the highest percentage of countries with haemovigilance systems, which monitor and enhance the safety of transfusions. In Asia Pacific, the market growth is supported by the densely populated regions, such as China and India, where there is a growing demand for frequent check-ups due to the rising incidence of diseases, such as diabetes, cancer, and liver disease. On the other hand, the countries in Latin America, Middle East, and Africa are expected to witness slower growth compared to other regions due to a reluctance to adopt new technologies.

Key Companies & Market Share Insights

Key players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some of such endeavors. For instance, in March 2023, TruDiagnostic, a health data organization, entered into a partnership with NADMED, a Finnish company specializing in nicotinamide adenine dinucleotide diagnostics. This collaboration aims to introduce an advanced diagnostic test kit called Q-NADMED, which enables the measurement of NAD+ and NADH levels in blood samples. The test has diverse clinical applications and is specifically targeted at patients in the United States.Some of the key players in the global blood testing market include:

-

Abbott

-

F. Hoffmann-La Roche AG

-

Bio-Rad Laboratories, Inc.

-

bioMerieux SA

-

Quest Diagnostics

-

Biomerica, Inc.

-

Becton, Dickinson and Company

-

Siemens Healthineers

-

Danaher Corporation

-

Trinity Biotech Plc

Blood Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 98.48 billion

Revenue forecast in 2030

USD 160.50 billion

Growth rate

CAGR of 7.23% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Russia; Turkey; Japan; China; India; Australia; Thailand; South Korea; Indonesia; Brazil; Mexico; Argentina; ; South Africa; Saudi Arabia; UAE; Kuwait; Nigeria

Key companies profiled

Abbott Diagnostics; Bio-Rad Laboratories Inc.; Roche Diagnostics; Quest Diagnostics; Danaher Corp.; Becton Dickinson & Company; Biomerica, Inc.; bioMérieux S.A.; Siemens Healthcare; Trinity Biotech PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood testing market report on the basis of test type, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Testing

-

A1C Testing

-

Direct LDL Testing

-

Lipid Panel Testing

-

Prostate-specific Antigen Testing

-

COVID-19 Testing

-

BUN Testing

-

Vitamin D Testing

-

Thyroid-stimulating Hormone (TSH)

-

Serum Nicotine/Cotinine

-

High sensitivity CRP Testing

-

Testosterone Testing

-

ALT Testing

-

Cortisol Testing

-

Creatinine Testing

-

AST Testing

-

Other Blood Tests

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

Turkey

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global blood testing market size was estimated at USD 91.61 billion in 2022 and is expected to reach USD 98.48 billion in 2023.

b. The global blood testing market is expected to grow at a compound annual growth rate of 7.23% from 2023 to 2030 to reach USD 160.50 billion by 2030.

b. North America dominated the blood testing market with a share of 43.17% in 2022. Key factors attributing to the growth of the market include the constantly increasing geriatric population, advanced technological facilities, and the introduction of advanced point-of-care blood tests.

b. Some key players operating in the blood testing market include Abbott/Alere; Bio-Rad Laboratories Inc.; F. Hoffmann-La Roche Ltd; Quest Diagnostics; Danaher (Beckman Coulter Inc. and Radiometer); Becton Dickinson & Company; Biomerica, Inc.; BioMerieux S.A.; Siemens Healthineers; Trinity Biotech PLC; and Nipro Diagnostics/Trividia Healthcare.

b. Key factors that are driving the blood testing market growth include increasing patient awareness regarding self-testing, increasing demand for at-home diagnostic tests, and early detection of chronic ailments.

b. The glucose testing segment dominated the global blood testing market and accounted for the largest revenue share of 16.63% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."