- Home

- »

- Medical Devices

- »

-

Bone Grafts And Substitutes Market Size Report, 2030GVR Report cover

![Bone Grafts And Substitutes Market Size, Share & Trends Report]()

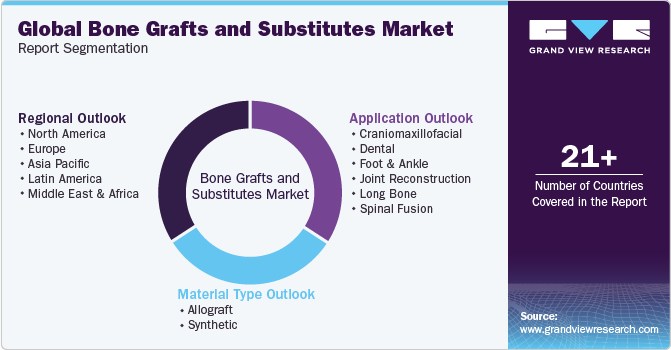

Bone Grafts And Substitutes Market Size, Share & Trends Analysis Report By Material Type, By Application (Craniomaxillofacial, Dental, Foot & Ankle, Joint Reconstruction, Long Bone), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-154-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Market Size & Trends

The global bone grafts and substitutes market size was valued at USD 2.96 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. Increasing demand for synthetic substitutes and a rising number of product approvals by regulatory authorities in various regions is anticipated to fuel market growth during the forecast period. For instance, in May 2023, Locate Bio, a UK- based orthobiologics company, received a U.S. FDA clearance for its breakthrough device designation for LDGraft. This device program can treat patients with degenerative disc disease (DDD). Furthermore, various benefits and advantages from bone grafts and substitutes, such as biocompatibility, safety, and osteoconductivity to fractured bones, have propelled the adoption of these products in recent years.

Furthermore, factors such as rising incidence of facial fractures and growing demand for minimally invasive surgeries due to sports injuries, falls, and road accidents are projected to propel the demand for bone graft alternatives over the forecast period. For instance, according to The Johns Hopkins University in the U.S.,around 30 million children participate in sports annually, and over 3.5 million sports injuries are reported annually. Similarly, according to the Centers for Disease Prevention and Control, (CDC) 1 in 4 or over 14 million adults aged 65 and above reported injuries due to falls annually.

Moreover, rising need for minimally invasive procedures and the growing geriatric population drive market growth. People become more susceptible to age-related conditions such as bone degeneration and osteoporosis as they age. Consequently, there is a greater need for bone graft substitutes to address these conditions. Additionally, advancements in medical technology have led to the development of innovative products that improve surgical outcomes, reduce surgical time, and enhance patient safety. For instance, according to the World Health Organization (WHO), 1 in 6 people across the globe will be aged 60 years or above by 2030.

Furthermore, supportive regulatory framework and growing efforts from market participants to develop new products with better bioactivity, biocompatibility, and suitable mechanical properties is further driving market expansion. For instance, in October 2020, Graftys received Medical Device Single Audit Program (MDSAP) certification for its Sterile Calcium Phosphate Resorbable Bone Void Fillers and related delivery systems in Australia, Brazil, Canada, and U.S. Similarly, in March 2022, Molecular Matrix, Inc. announced the commercial launch of Osteo-P Synthetic Bone Graft Substitute for use in the musculoskeletal system. This product is developed by using HCCP technology that is very beneficial in bone regeneration and repair.

Market Dynamics

Rising adoption of minimally invasive procedures is further escalating the demand for bone grafts and substitutes. Surgeons are choosing minimally invasive procedures instead of open or traditional approaches owing to various benefits associated with MIS such as quick procedure, less recovery time, shorter hospital stays and less incisions. According to data from the American Academy of Orthopedic Surgeons (AAOS), the number of minimally invasive orthopedic procedures performed in U.S. has been increasing steadily over the years. Some of the commonly performed minimally invasive orthopedic procedures in U.S. are, arthroscopy, spine surgeries, fracture repair and joint replacement procedures. Thus, rising number of MIS is anticipated to drive the global bone grafts and substitutes market at significant pace.

The increasing incidence of bone disorders due to road accidents and sports injuries is driving the market for bone grafts and substitutes. Bone grafts can be used for the following purposes:

-

To repair a broken bone

-

To repair previously injured bone that has not healed.

-

Spinal fusion (in case of an unstable spine)

-

Bone regeneration

-

To heal the bone around surgical implantation (joint & knee replacement)

Spinal fusion surgery is mostly performed among all the above-mentioned bone grafting procedures. According to a study published by NCBI in October 2022, the prevalence of Adult Spinal Deformities (ASD) is around 68% in the geriatric population. The burden of ASD is higher in people as compared to other chronic conditions such as diabetes, arthritis, chronic lung disease, and congestive heart failure. The common causes of spinal fusion injury are trauma, falls, collisions, and road traffic accidents. According to the American Association for the Surgery of Trauma, more than 3 million nonfatal injuries are reported in the U.S. every year. An increase in trauma incidents is anticipated to contribute to the market growth during the forecast period.

Market Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The bone graft & substitutes market is characterized by a moderate degree of growth owing to significant R&D activities and rising funding. For instance, TherageniX, a University of Nottingham spin-out developing a dry powder gene therapy formulation for enhancing bone grafts with its collaborator. TherageniX received funding of £995,000 from Innovate UK to develop the Company’s gene therapy in a powder.

The global bone grafts and substitute market is characterized by a high degree of innovation, with new technologies and methods being developed and numerous types of bone graft substitutes being introduced at regular intervals. For instance, in December 2023, OSSIO, a U.S.-based company, received a U.S. FDA clearance for its OSSIOfiber b io-integrative bone fixation technology. This innovative technology is specifically designed for orthopedic surgeries in children and teenagers. The OSSIOfiber implants are used to fix bone grafts, fragments, comminuted fractures, arthrodesis, osteotomies, and bone fractures in pediatric patients.

Several market players engage in merger and acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in July 2023, Biocomposites, a medical devices company that aids in regenerating bone and managing infections in bone and soft tissue, acquired a minority share in Renovos, a biologics company. This acquisition aims to advance Renovite towards pre-market approval as a carrier for trauma, orthopaedic, and spine applications.

Stringent regulatory guidelines issued by various regulatory agencies, such as the U.S. FDA, limit the market growth. For instance, in March 2022, U.S. FDA rejected OsteoLife Biomedical LLC’s Flexo-Membrane, Freeze-Dried Particulate Bone products, and Flexo-Plate. The FDA found significant contamination due to the presence of Bacillus, Stenotrophomonas maltophilia, and Pseudomonas aeruginosa post-processing.

Various companies in the bone grafts and substitute market are adopting this strategy to maintain a competitive edge and to be ahead of the newly evolving landscape in the market. For instance, in October 2021, AlloSource announced the launch of AlloMend Extra Large Acellular Dermal Matrix, increasing its AlloMend product line.

Major players in the market are adopting various strategies including partnerships, collaborations, mergers and acquisitions to expand their footprints in global markets. For instance, in August 2022, Orthofix Medical, Inc. entered into a partnership with CGBio for the commercialization and development of Novosis rhBMP-2 for Canada and U.S. markets.

Material Type Insights

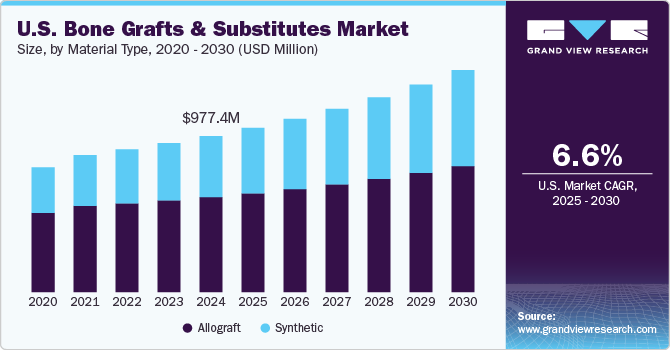

By material type, market is segmented intoallograft,synthetic, composites, polymers, and bone morphogenic proteins (BMP). Allograft segment held the largest revenue share of 60.3% in 2023 in the material type segment and is anticipated to witness significant growth opportunities during the forecast period. The allograft adoption is significantly increasing owing to its properties such as osteoconductivity, and immediate structural support. In addition, positive patient outcomes with allograft products and various recent launches of allografts have supported the segment expansion. Also, allografts do not require other surgery to harvest bone, which turns in rapid wound healing, lesser surgery time, and higher success rates. For instance, according to a study published by NCBI in February 2022, bone fusion with allograft showed a success rate between the range of 87% and 94.3%.

Synthetic segment is projected to exhibit the fastest growth over the forecast period. The robust growth of the segment is owing to the products’ lesser risk of disease transmission, better biocompatibility, and better acceptance among patients when compared to allografts. The synthetic segment is further classified into ceramic, composite, polymers, and BMP. The segment is also expected to be driven by the rising burden of orthopedic disorders coupled with increasing demand for synthetic products in the developed countries.

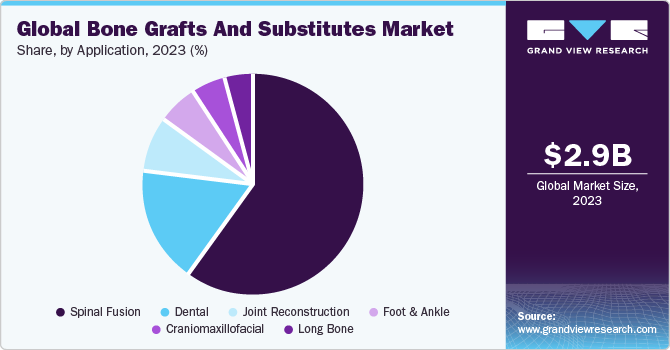

Application Insights

By application, market is divided into dental, craniomaxillofacial, joint reconstruction, foot & ankle, long bone, and spinal fusion. Spinal fusion segment held the largest market share in 2023. The increasing adoption of bone graft materials for spondylosyndesis and rising geriatric population prone to number of orthopedic ailments are responsible for higher revenue share of the segment. The geriatric population is steadily increasing. According to the U.S. Census Bureau, in 2022, the country had geriatric population of around 56 million, accounting for 16.9% of the country’s total population, and this number is projected to surpass 73.1 million in 2030. This indicates that more than one in five people will be of retirement age. Thus, the high number of elderly populations is fueling demand for orthopedic solutions.

Dental segment is anticipated to witness fastest CAGR growth over the forecast period. Rising adoption of grafts for dental procedures is likely to provide lucrative opportunities for the dental segment throughout the forecast period. The grafts are used as scaffolds and fillers to facilitate bone formation and promote healing. The increasing acceptance of dental implant surgical procedures along with advanced techniques such as bone grafts and bone regeneration are projected to boost market growth. Moreover, the rising success rates of dental implants is also resulting into the high demand for bone grafts & substitutes in the market.

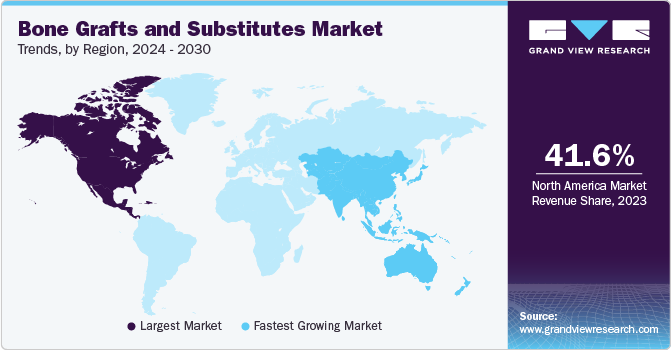

Regional Insights

North America dominated the global bone grafts and substitutes market with a revenue share of 41.6% in 2023. Rising geriatric population and increasing incidence of sports injuries & fatal accidents are among the key factors boosting the demand for bone grafts and substitutes in North America. In addition, the presence of well-established healthcare infrastructure, supportive reimbursement policies, and many orthopedic surgeons performing surgeries with bone grafts are further fueling adoption of such products in the region. For instance, according to Definitive Healthcare, LLC, the U.S. currently has 24,350 orthopedic surgeons. In addition, healthcare funding in Canada has increased, accounting for 11% of the total GDP. Moreover, an increase in sports-related injuries is expected to boost the market during the forecast period.

Asia Pacific is projected to witness fastest growth over the forecast period from 2024 to 2030. Presence of larger patient pool with range of orthopedic conditions, rising investments by market participants to expand their presence in the region are expected to drive APAC market. For instance, in October 2021, CoreBone raised USD 3.7 million in investment for expanding its activity in China and commercializing bioactive bone graft material for orthopedic and dental treatments.

Key Companies & Market Share Insights

The industry is marked by the presence of various large and small businesses operators. It is competitive and dominated by participants such as Orthofix, Stryker, Nuvasive, Medtronic, DePuy Synthes, and Wright Medical, among others. Key players are emphasizing on executing innovative strategies like market penetration, mergers and acquisitions, partnerships, and distribution agreements to bolster their revenue. For instance, in In October 2021, the company announced the launch of AlloMend Extra Large Acellular Dermal Matrix, increasing its AlloMend product line.

Key Bone Grafts And Substitutes Companies:

- AlloSource

- DePuy Synthes (Johnson & Johnson Inc.)

- Baxter

- NuVasive, Inc.

- Smith + Nephew

- Medtronic

- Orthofix US LLC

- TBF

- OST Laboratories

- Zimmer Biomet

- Geistlich Pharma AG

- Stryker

- Biobank

Some of the innovators in the bone grafts and substitutes market are:

-

Stryker Corporation: Vitoss is the present synthetic bone graft market leader and has been used in over 425,000 implantations worldwide. It is meant to fill bone gaps and voids in the skeletal system, specifically at the pelvis or posterolateral spine.

-

Depuy Synthes: The top product is chronOS Bone Void Filler. This filler has been used in clinics in Europe for over 20 years. It is replaced with bone in 6 to 18 months. The compressive strength of the product is approximated to that of the human cancellous bone. ChronOS can be used in bony voids or caps that are not intrinsic to the stability of a bony structure.

-

Baxter International Inc: Actifuse is a biosimulative scaffold bone graft substitute made up of silicate-substituted calcium phosphate that is devised to fill gaps in the skeletal system that are not inherent to the strength of the bony structure. When compared to the gold standard of iliac crest autograft care, Actifuse demonstrated comparable bone fusion rates. Actifuse is versatile and resistant to irrigation, and it contains 0.8% silicon, which has been shown in both preclinical and clinical studies to successfully accelerate bone formation.

Recent Developments

-

In October 2023, Orthofix Medical Inc. announced the 510k approval and full commercial launch of OsteoCoveTM, an innovative bioactive synthetic graft. OsteoCove, which comes in putty and strip form, offers exceptional bone-forming qualities for various orthopedic and spine procedures.

-

In February 2023, NuVasive, Inc. received FDA approval for Modulus Cervical interbody implant, which expanded its C360 product portfolio further.

-

In June 2022, Medtronic received FDA approval for ligament-augmenting implant further expanding its spine surgery portfolio.

-

In March 2022, Zimmer Biomet entered into an agreement with Biocomposites for distribution of genex bone graft substitutes.

Bone Grafts and Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.12 billion

Revenue forecast in 2030

USD 4.54 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, application, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark, Norway, Sweden, Japan; China; India; South Korea; Australia, Brazil; Mexico; Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AlloSource, Baxter, DePuy Synthes (Johnson & Johnson Inc.), Medtronic, NuVasive, Inc., Orthofix US LLC, Smith + Nephew, Stryker., OST Laboratories, Zimmer Biomet, Geistlich Pharma AG, TBF, Biobank

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone Grafts and Substitutes Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the bone grafts and substitutes market on the basis of material type, application, and region:

-

Material Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Synthetic

-

Ceramics

-

HAP

-

β-TCP

-

α-TCP

-

Bi-phasic Calcium Phosphates (BCP)

-

Others

-

-

Composites

-

Polymers

-

Bone Morphogenic Proteins (BMP)

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot & Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global bone graft and substitutes market size was estimated at USD 2.96 billion in 2023 and is expected to reach USD 3.1 billion in 2024.

b. The global bone graft and substitutes market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 4.54 billion by 2030.

b. The allograft material type segment dominated the bone graft and substitutes market in 2023. This is attributable to properties such as immediate structural support and osteoconductivity. Moreover, allografts do not require another surgery to harvest bone, which results in reduced surgery time and rapid wound healing.

b. Some key players operating in the bone graft and substitutes market include DePuy Synthes; Medtronic PLC; Nuvasive, Inc.; Orthofix Holdings, Inc.; Wright Medical Group N.V.; AlloSource, Inc.; and Stryker Corp.

b. Key factors that are driving the bone graft and substitutes market growth include the increasing number of spinal fusion surgeries, target population, and adoption of allografts.

Table of Contents

Chapter 1 Bone Grafts And Substitutes Market: Research Methodology & Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Material Type

1.2.2. Application

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2 Bone Grafts And Substitutes Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Material type outlook

2.2.2. Application outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3 Bone Grafts And Substitutes Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising incidence of bone & joint disorders

3.2.1.2. Advent of biocompatible synthetic graft

3.2.1.3. Rising demand for dental bone grafts

3.2.1.4. Technological advancement

3.2.1.5. Rising geriatric population

3.2.2. Market restraint analysis

3.2.2.1. Stringent regulatory guidelines

3.2.2.2. Risk of disease transmission

3.2.2.3. High cost of bone grafts and substitutes

3.3. Bone Graft & Substitutes Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Bone Graft & Substitutes Market: Material Type Estimates & Trend Analysis

4.1. Material Type Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Bone Graft & Substitutes Market by Material Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Allograft

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2. Demineralized Bone Matrix

4.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.3. Others

4.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Synthetic

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2. Ceramics

4.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2.2. HAP

4.4.2.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2.3. β-TCP

4.4.2.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2.4. α-TCP

4.4.2.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2.5. Bi-phasic Calcium Phosphates (BCP)

4.4.2.2.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2.6. Others

4.4.2.2.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.3. Composites

4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.4. Polymers

4.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.5. Bone Morphogenic Proteins (BMP)

4.4.2.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Bone Graft & Substitutes Market: Application Estimates & Trend Analysis

5.1. Application Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Bone Graft & Substitutes Market by Application Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Craniomaxillofacial

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Dental

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Foot & Ankle

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. Joint Reconstruction

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5. Long Bone

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6. Spinal Fusion

5.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Bone Graft & Substitutes Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

6.8.3. Argentina

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. AlloSource

7.3.1.1. Company overview

7.3.1.2. Financial performance

7.3.1.3. Product benchmarking

7.3.1.4. Strategic initiatives

7.3.2. Baxter

7.3.2.1. Company overview

7.3.2.2. Financial performance

7.3.2.3. Product benchmarking

7.3.2.4. Strategic initiatives

7.3.3. DePuy Synthes (Johnson & Johnson Inc.)

7.3.3.1. Company overview

7.3.3.2. Financial performance

7.3.3.3. Product benchmarking

7.3.3.4. Strategic initiatives

7.3.4. Medtronic

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. NuVasive, Inc.

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Orthofix US LLC

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Smith + Nephew

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. Stryker

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Biobank

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. OST Laboratories

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Zimmer Biomet

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. Geistlich Pharma AG

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. TBF

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America bone graft & substitutes market, by region, 2018 - 2030 (USD Million)

Table 3 North America bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 4 North America bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 5 U.S. bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 6 U.S. bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 7 Canada bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 8 Canada bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 9 Europe bone graft & substitutes market, by region, 2018 - 2030 (USD Million)

Table 10 Europe bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 11 Europe bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 12 Germany bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 13 Germany bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 14 UK bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 15 UK bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 16 France bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 17 France bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 18 Italy bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 19 Italy bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 20 Spain bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 21 Spain bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 22 Denmark bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 23 Denmark bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 24 Sweden bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 25 Sweden bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 26 Norway bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 27 Norway bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 28 Asia Pacific bone graft & substitutes market, by region, 2018 - 2030 (USD Million)

Table 29 Asia Pacific bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 30 Asia Pacific bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 31 China bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 32 China bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 33 Japan bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 34 Japan bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 35 India bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 36 India bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 37 South Korea bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 38 South Korea bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 39 Australia bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 40 Australia bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 41 Thailand bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 42 Thailand bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 43 Latin America bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 44 Latin America bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 45 Brazil bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 46 Brazil surgical ablation market, by application, 2018 - 2030 (USD Million)

Table 47 Mexico bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 48 Mexico bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 49 Argentina bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 50 Argentina bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 51 MEA bone graft & substitutes market, by region, 2018 - 2030 (USD Million)

Table 52 MEA bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 53 MEA bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 54 South Africa bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 55 South Africa bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 56 Saudi Arabia bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 57 Saudi Arabia bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 58 UAE bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 59 UAE bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

Table 60 Kuwait bone graft & substitutes market, by material type, 2018 - 2030 (USD Million)

Table 61 Kuwait bone graft & substitutes market, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Bone graft & substitutes market: market outlook

Fig. 14 Bone graft & substitutes competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Bone graft & substitutes market driver impact

Fig. 20 Bone graft & substitutes market restraint impact

Fig. 21 Bone graft & substitutes market strategic initiatives analysis

Fig. 22 Bone graft & substitutes market: Material Type movement analysis

Fig. 23 Bone graft & substitutes market: Material Type outlook and key takeaways

Fig. 24 Allograft market estimates and forecast, 2018 - 2030

Fig. 25 Demineralized bone matrix market estimates and forecast, 2018 - 2030

Fig. 26 Others market estimates and forecast, 2018 - 2030

Fig. 27 Synthetic market estimates and forecast, 2018 - 2030

Fig. 28 Ceramics market estimates and forecast, 2018 - 2030

Fig. 29 HAP market estimates and forecast, 2018 - 2030

Fig. 30 β-TCP market estimates and forecast, 2018 - 2030

Fig. 31 α-TCP market estimates and forecast, 2018 - 2030

Fig. 32 Bi-phasic Calcium Phosphates (BCP) market estimates and forecast, 2018 - 2030

Fig. 33 Others market estimates and forecast, 2018 - 2030

Fig. 34 Composites market estimates and forecast, 2018 - 2030

Fig. 35 Polymers market estimates and forecast, 2018 - 2030

Fig. 36 Bone Morphogenic Proteins (BMP) market estimates and forecast, 2018 - 2030

Fig. 37 Bone graft & substitutes market: Application movement Analysis

Fig. 38 Bone graft & substitutes market: Application outlook and key takeaways

Fig. 39 Craniomaxillofacial market estimates and forecasts, 2018 - 2030

Fig. 40 Dental market estimates and forecasts,2018 - 2030

Fig. 41 Foot & ankle market estimates and forecasts,2018 - 2030

Fig. 42 Joint reconstruction market estimates and forecasts,2018 - 2030

Fig. 43 Long bone market estimates and forecasts,2018 - 2030

Fig. 44 Spinal fusion market estimates and forecasts,2018 - 2030

Fig. 45 Global bone graft & substitutes market: Regional movement analysis

Fig. 46 Global bone graft & substitutes market: Regional outlook and key takeaways

Fig. 47 Global bone graft & substitutes market share and leading players

Fig. 48 North America market share and leading players

Fig. 49 Europe market share and leading players

Fig. 50 Asia Pacific market share and leading players

Fig. 51 Latin America market share and leading players

Fig. 52 Middle East & Africa market share and leading players

Fig. 53 North America: SWOT

Fig. 54 Europe SWOT

Fig. 55 Asia Pacific SWOT

Fig. 56 Latin America SWOT

Fig. 57 MEA SWOT

Fig. 58 North America, by country

Fig. 59 North America

Fig. 60 North America market estimates and forecasts, 2018 - 2030

Fig. 61 U.S.

Fig. 62 U.S. market estimates and forecasts, 2018 - 2030

Fig. 63 Canada

Fig. 64 Canada market estimates and forecasts, 2018 - 2030

Fig. 65 Europe

Fig. 66 Europe market estimates and forecasts, 2018 - 2030

Fig. 67 UK

Fig. 68 UK market estimates and forecasts, 2018 - 2030

Fig. 69 Germany

Fig. 70 Germany market estimates and forecasts, 2018 - 2030

Fig. 71 France

Fig. 72 France market estimates and forecasts, 2018 - 2030

Fig. 73 Italy

Fig. 74 Italy market estimates and forecasts, 2018 - 2030

Fig. 75 Spain

Fig. 76 Spain market estimates and forecasts, 2018 - 2030

Fig. 77 Denmark

Fig. 78 Denmark market estimates and forecasts, 2018 - 2030

Fig. 79 Sweden

Fig. 80 Sweden market estimates and forecasts, 2018 - 2030

Fig. 81 Norway

Fig. 82 Norway market estimates and forecasts, 2018 - 2030

Fig. 83 Asia Pacific

Fig. 84 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 85 China

Fig. 86 China market estimates and forecasts, 2018 - 2030

Fig. 87 Japan

Fig. 88 Japan market estimates and forecasts, 2018 - 2030

Fig. 89 India

Fig. 90 India market estimates and forecasts, 2018 - 2030

Fig. 91 Thailand

Fig. 92 Thailand market estimates and forecasts, 2018 - 2030

Fig. 93 South Korea

Fig. 94 South Korea market estimates and forecasts, 2018 - 2030

Fig. 95 Australia

Fig. 96 Australia market estimates and forecasts, 2018 - 2030

Fig. 97 Latin America

Fig. 98 Latin America market estimates and forecasts, 2018 - 2030

Fig. 99 Brazil

Fig. 100 Brazil market estimates and forecasts, 2018 - 2030

Fig. 101 Mexico

Fig. 102 Mexico market estimates and forecasts, 2018 - 2030

Fig. 103 Argentina

Fig. 104 Argentina market estimates and forecasts, 2018 - 2030

Fig. 105 Middle East and Africa

Fig. 106 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 107 South Africa

Fig. 108 South Africa market estimates and forecasts, 2018 - 2030

Fig. 109 Saudi Arabia

Fig. 110 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 111 UAE

Fig. 112 UAE market estimates and forecasts, 2018 - 2030

Fig. 113 Kuwait

Fig. 114 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 115 Market share of key market players - Bone graft & substitutes marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Global Bone Graft & Substitutes Material Type Outlook (Revenue, USD Million, 2018 - 2030

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Global Bone Graft & Substitutes Application Outlook (Revenue, USD Million, 2018 - 2030)

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Global Bone Graft & Substitutes Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- North America Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- U.S.

- U.S. Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- U.S. Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- U.S. Bone Graft & Substitutes Market by Material Type

- Canada

- Canada Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Canada Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Canada Bone Graft & Substitutes Market by Material Type

- North America Bone Graft & Substitutes Market by Material Type

- Europe

- Europe Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Europe Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Germany

- Germany Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Germany Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Germany Bone Graft & Substitutes Market by Material Type

- UK

- UK Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- UK Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- UK Bone Graft & Substitutes Market by Material Type

- France

- France Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- France Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- France Bone Graft & Substitutes Market by Material Type

- Italy

- Italy Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Italy Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Italy Bone Graft & Substitutes Market by Material Type

- Spain

- Spain Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Spain Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Spain Bone Graft & Substitutes Market by Material Type

- Denmark

- Denmark Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Denmark Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Denmark Bone Graft & Substitutes Market by Material Type

- Sweden

- Sweden Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Sweden Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Sweden Bone Graft & Substitutes Market by Material Type

- Norway

- Norway Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Norway Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Norway Bone Graft & Substitutes Market by Material Type

- Europe Bone Graft & Substitutes Market by Material Type

- Asia Pacific

- Asia Pacific Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Asia Pacific Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- China

- China Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- China Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- China Bone Graft & Substitutes Market by Material Type

- India

- India Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- India Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- India Bone Graft & Substitutes Market by Material Type

- Japan

- Japan Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Japan Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Japan Bone Graft & Substitutes Market by Material Type

- South Korea

- South Korea Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- South Korea Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- South Korea Bone Graft & Substitutes Market by Material Type

- Australia

- Australia Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Australia Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Australia Bone Graft & Substitutes Market by Material Type

- Asia Pacific Bone Graft & Substitutes Market by Material Type

- Latin America

- Latin America Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Latin America Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Brazil

- Brazil Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Brazil Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Brazil Bone Graft & Substitutes Market by Material Type

- Mexico

- Mexico Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Mexico Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Mexico Bone Graft & Substitutes Market by Material Type

- Argentina

- Argentina Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Argentina Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Argentina Bone Graft & Substitutes Market by Material Type

- Latin America Bone Graft & Substitutes Market by Material Type

- MEA

- MEA Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- MEA Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- South Africa

- South Africa Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- South Africa Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- South Africa Bone Graft & Substitutes Market by Material Type

- Saudi Arabia

- Saudi Arabia Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Saudi Arabia Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Saudi Arabia Bone Graft & Substitutes Market by Material Type

- UAE

- UAE Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- UAE Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- UAE Bone Graft & Substitutes Market by Material Type

- Kuwait

- Kuwait Bone Graft & Substitutes Market by Material Type

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

- Ceramics

- Allograft

- Kuwait Bone Graft & Substitutes Market by Application

- Craniomaxillofacial

- Dental

- Foot & Ankle

- Joint Reconstruction

- Long Bone

- Spinal Fusion

- Kuwait Bone Graft & Substitutes Market by Material Type

- MEA Bone Graft & Substitutes Market by Material Type

- North America

Bone Grafts And Substitutes Market Dynamics

Driver: Rising Demand For Dental Bone Grafts

The rising popularity of dental implant surgery among people with the advance surgical techniques such as bone grafts and bone regeneration is expected to propel the market growth. The success rates of dental implants is also fueling the market. The American Academy of Implant Dentistry has reported a success rate of 95% in the implant dentistry segment. According to the American Dental Association report, around 95-98% success rate has been reported for dental implant surgeries. Around 5 million implant procedures are performed in the U.S. alone every year. The use of biocompatible and synthetic dental bone grafts is also boosting the market. TCp, which provides higher Osteoconductivity, is mostly used as synthetic scaffold in dentistry. In May 2018, Dentsply Sirona entered into an agreement with Datum Dental, Ltd. for the distribution of OSSIX brand for bone and tissue regeneration for dentistry.

Driver: Technological Advancement

The increasing adoption of minimally invasive surgeries (MIS) is also fueling the bone grafts & substitutes market. Surgeons prefer MIS over open surgery as it provides many advantages including less pain, reduced post-operative duration and less injury to the tissue. According to Minim Invasive Surg, approximately 400,000 spinal fusion cases are performed in the U.S. annually and it has turn out to be one of the most commonly performed and well-established treatment options for spine trauma, degenerative disorders, tumors, and structural abnormalities. Moreover, ceramic based synthetic bone grafts have also impacted the market positively. These grafts constitute of HAP and tricalcium phosphate, and are found to be more effective than traditional DBM.

Restraint: Risk Of Disease Transmission

The limited supply and major drawbacks associated with autografts is increasing the market for allografts and other synthetic substitutes, which is a major market restraint. Allografts have the risk for disease transmission. According to the Journal of Bone and Joint Surgery America, the risk of infection is approximately 12%. So, a number of cases require resection graft and at times amputation to control infection. There is risk of blood loss or hematomas, infection, or some deformity, resulting in longer procedures, which may hinder the growth of bone graft and substitutes market.

What Does This Report Include?

This section will provide insights into the contents included in this bone grafts and substitutes market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Bone grafts and substitutes market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Bone grafts and substitutes market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the bone grafts and substitutes market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for bone grafts and substitutes market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of bone grafts and substitutes market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Bone Grafts And Substitutes Market Categorization:

The bone grafts and substitutes market was categorized into three segments, namely material type (Allograft, Synthetic), application (Craniomaxillofacial, Dental, Foot & Ankle, Joint Reconstruction, Long Bone, Spinal Fusion), regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The bone grafts and substitutes market was segmented into material type, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The bone grafts and substitutes market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-two countries, namely, the U.S.; Canada; the UK; Germany; Italy; France; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Bone grafts and substitutes market companies & financials:

The bone grafts and substitutes market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

AlloSource: AlloSource is a U.S. based company with a wide product portfolio. Its products include cellular, skin, bone, cartilage, and soft-tissue allografts. The company uses allografts with the advanced technology of cells in sports medicine, spine, foot & ankle, trauma, orthopedic, reconstructive, and wound care procedures.

-

Baxter: Baxter is a multinational company that provides a wide portfolio of essential healthcare products such as acute and chronic dialysis therapies, parenteral nutrition therapies, sterile Intravenous (IV) solutions, bone repair technologies, and surgical hemostat & sealant products.

-

DePuy Synthes: DePuy Synthes is a multinational organization involved in consumer goods, healthcare, medical devices, and pharmaceuticals.

-

Medtronic: Involved in medical devices, Medtronic delivers value-based procedural systems and therapeutic level offerings on a global scale.

-

NuVasive, Inc.: NuVasive develops minimally invasive surgical products and procedures for spinal surgeries. Its products and services help treat lumbar spinal stenosis, degenerative disc disease, degenerative spondylolisthesis, early-onset scoliosis, cervical disc degeneration, and limb length discrepancy.

-

Orthofix Medical, Inc.: Orthofix Medical is a medical device company specializing in musculoskeletal products and therapies. It operates under two main business units—Global Spine and Global Extremities.

-

Smith+Nephew: Smith+Nephew offers its products to customers in several emerging and established markets. The company operates via three global franchises: Advanced Wound Management, Orthopedics, and Sports Medicine & ENT.

-

Stryker: Stryker is one of the global leaders in bone grafts & substitutes market. Stryker offers a wide portfolio of products and services in healthcare segments, including orthopedics, spine & neurotechnology, and medical & surgical devices.

-

Wright Medical Group N.V.: Wright Medical Group offers surgical solutions for the lower and upper extremities, wound care, and biologics markets.

-

Biobank: Biobank is involved in the preservation, transformation, and distribution of bone allografts. It controls all tissue bank activities, from tissue collection to issuance of safe bone grafts.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Bone Grafts And Substitutes Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2017 to 2022, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Bone Grafts And Substitutes Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research