- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Botanical Supplements Market Size Report, 2020-2028GVR Report cover

![Botanical Supplements Market Size, Share & Trends Report]()

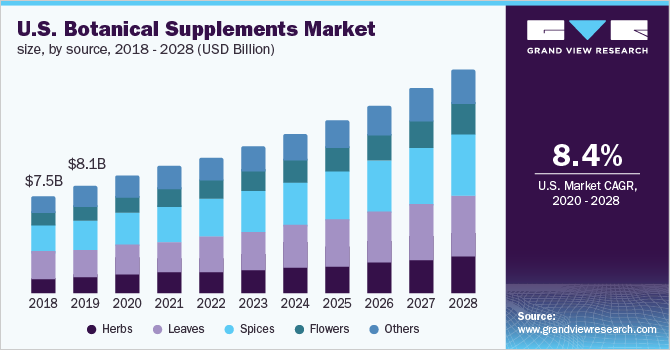

Botanical Supplements Market Size, Share & Trends Analysis Report By Source (Herbs, Leaves, Spices, Flowers), By Form (Tablets, Liquid), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-086-6

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

The global botanical supplements market size was valued at USD 27.47 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2020 to 2028. The market is expected to grow exponentially as different producers continue to innovate on the production of botanicals with a broad range of amino acids and aim for specific functions, such as weight loss and muscle repair. Rising health consciousness increased concerns over diet, and enhanced care towards preventive healthcare have made consumers turn towards health imparting herbal supplements. Several manufacturers come out with alternative therapies to relieve women from frequent problems such as insomnia and menopausal hot flashes. Herbal offerings such as fish oils, detoxes, and probiotic drinks, and other herbal supplements are on the rise. Consumers becoming comfortable with supplementation, high-income levels, and world-class infrastructure for sports and fitness are expected to fuel the demand for botanical supplements.

Sports nutrition and health markets are rife with ingredients that can assist various aspects of athletic performance. Several factors of athletic training can be benefited by these herbal ingredients for athletes who are looking to improve their performance. Moreover, the presence of key players such as GlanbiaPlc, Blackmores Limited, and The Himalaya Drug Company and mass retailers such as Walmart that are offering their private labeled botanical supplements is expected to benefit the market growth.

The consumption of herbal supplements in the U.S. is driven mostly by growing awareness regarding preventive health and immunity-boosting products, according to a new survey by Nutritional Outlook. During the COVID-19 pandemic, it is observed that immunity moved to third place, after overall wellness/disease prevention and gut/digestive health. Consumers are becoming more conscious about preventive health care. Consumers have been advised by the governments and health bodies to use various herbal supplements incorporating health-beneficial ingredients such as turmeric/curcumin, fenugreek, and Tinosporacordifolia to boost their immunity against various infections. Furthermore, the COVID-19 pandemic has encouraged the consumers for dietary changes, and a majority of the consumers are opting for herbal supplements owing to their high health benefits and lesser side effects. On the back of these factors, the global market has witnessed exponential growth during the COVID-19 pandemic.

The U.S. has witnessed increasing demand for herbal supplements over the past few years owing to the growing awareness among consumers regarding the medicinal properties and health benefits of herbal supplements. The American Botanical Council stated that sales of ashwagandha in 2018 grew in both the U.S. natural retail and mainstream channels. Moreover, ashwagandha was known as the seventh bestselling botanical supplement in the U.S. natural channel, rising with a 16.9% year-0n-year growth rate. In addition, it has been among the primary 40 top-selling ingredients in natural and herbal retail stores since 2015.

Source Insights

The leaves segment led the market and accounted for over 25.0% share of the global revenue in 2020. The shift in lifestyles and the growing trend of exploring and experiencing novel foods have led to the growth in the demand for leave-based herbal supplements. Increasing research and developments for various herbal plants for their immunity-boosting and other health benefits. Herbal leaves are the most extensively used ingredient among other sources of botanical ingredients.

The increased use of herbal leaves has coincided with augmented consumer familiarity and interest in Ayurveda, a traditional medicine system of India. Additionally, it is extensively being used as a food ingredient (for instance, in curries), basil has been used medicinally in Ayurveda to address a variety of health issues, including joint pain, inflammation, ulcers, kidney, liver disorders, and respiratory conditions among others.

Form Insights

The tablets segment led the market and accounted for over 30.0% share of the global revenue in 2020. Growing consumers’ inclination towards tablets and capsules owing to the ease in consumption has led to market growth. Furthermore, the high growth of the pharmaceutical industry in emerging countries, such as China and India, has led to the demand for tablets in the herbal supplements industry.

The powder segment is anticipated to remain one of the major form segments over the forecast period as nutraceutical companies are spending on the production of energy-mix products for health and wellness applications. The growth of the powder segment is attributed to the growing demand for energy-mix powders among bodybuilders and athletes. Furthermore, producers of dietary products including Amway incorporated powder form products under the name, NUTRILITE that can be consumed with drinks as well as milk products. The gummies segment presents a considerable growth opportunity for the manufacturers on account of being appetizing than any other traditional pills.

Application Insights

The energy and weight management segment led the market and accounted for over 20.0% share of the global revenue in 2020. This is due to the growing trend of online weight loss programs and government initiatives for promoting a healthy diet. The alarming increase has been witnessed in the incidence of health problems such as cardiovascular diseases, cancer, and diabetes in developed economies in the last few years.

Sedentary lifestyles, rising disposable income, and changes in food habits in Western Europe and North America increase people's inclination to develop health problems, such as cancer and diabetes. Therefore, an increase in the incidence of health disorders has fostered the adoption of energy and weight-management products. Moreover, a rise in fitness consciousness in emerging countries such as India and China owing to improvement in lifestyle is likely to offer lucrative business growth opportunities for the global energy and weight management diet industry. Growing cases of gastrointestinal disorders are also projected to contribute to industry growth. Furthermore, rising health consciousness is expected to encourage the utilization of plant-based protein supplements derived from spirulina and pumpkin seed. This trend will boost the industry's expansion.

Moreover, increased consumers’ inclination towards the intake of botanical supplements has created a steady growth in the current years due to rising disposable income in emerging countries. With the increasing working population and a rise in the prevalence of chronic diseases, consumers in the Asia Pacific region are willing to spend more on cardiac health herbal supplements. Therefore, this has resulted in the strong growth of the cardiac health supplements market and is projected to fuel the industry growth during the forecast period.

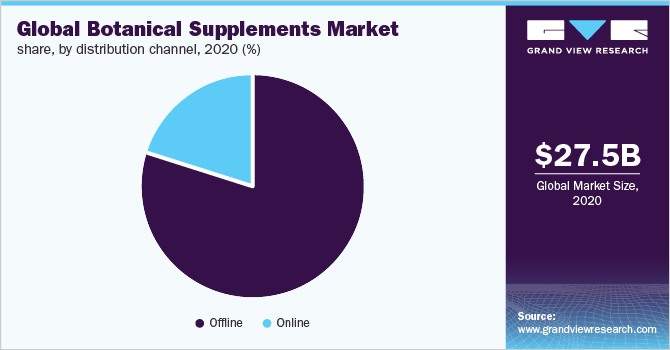

Distribution Channel Insights

The offline distribution channel segment dominated the market with a revenue share of more than 75.0% in 2020. The growing prevalence of self-medication for the treatment of significant health conditions and the rising demand for herbal supplements in daily consumption has offered momentum to the growth of the offline segment.

The growth of the offline distribution channel segment is attributed to the rising awareness regarding general health concerns and the growth of the pharmaceutical industry. The increasing trend among consumers to opt for offline drug purchases for a range of minor ailments without doctor proliferation of information available and consultation in distinguished media concerning the functions of herbal supplements have propelled the growth of the industry in major regions.

Regional Insights

North America dominated the market and accounted for over 30.0% share of the global revenue in 2020. The increasing awareness regarding supplements infused with botanical ingredients, coupled with the growing consumption of dietary supplements, is the significant factor propelling the industry growth in the region.

Furthermore, the region is expected to witness significant growth due to the rising awareness, the rise of veganism, and massive levels of obesity, which is a diet devoid of any animal-based products. The growing geriatric population in North American countries has led to considerable expenditure on healthcare services.

Asia Pacific is anticipated to register the highest growth rate of 10.1% from 2020 to 2028. The regional market growth is attributed to the high inclination towards botanical/herb products in Asian countries such as India, China, and Japan. The region is also one of the key producers and exporters of herbs across the globe. The increasing demand for medicinal and herbal ingredients is a key factor fueling the market growth in the region.

Key Companies & Market Share Insights

The industry is characterized by several large- and small-scale companies. Acquisitions, expansions, and new product launches are the significant strategies adopted by the key players to ensure their growth in the industry. Furthermore, effective distribution channels are anticipated to support companies to reinforce their market position. Additionally, major companies are focusing on strengthening their presence by incorporating their business operations across the value chain and implementing marketing strategies, such as new product launches and personalized nutrition. Some prominent players in the global botanical supplements market include:

-

Dabur India

-

NBTY Inc.

-

Ricola AG.

-

Mondelez International

-

Procter and Gamble

-

Nutraceutical International Company

-

BASF SE

-

The Himalaya Drug Company

-

Glanbia Nutritionals

-

Botanicalife International of America, Inc.

-

Blackmores Limited

Botanical Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 29.91 billion

Revenue forecast in 2028

USD 55.18 billion

Growth Rate

CAGR of 9.1% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

Dabur India; NBTY Inc.; Ricola AG.; Mondelez International; Procter and Gamble; Nutraceutical International Company; BASF SE; The Himalaya Drug Company; Glanbia Nutritionals; Botanicalife International of America, Inc.; Blackmores Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global botanical supplements market report on the basis of source, form, application, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2028)

-

Herbs

-

Leaves

-

Spices

-

Flowers

-

Others

-

-

Form Outlook (Revenue, USD Million, 2017 - 2028)

-

Powder

-

Liquid

-

Tablets

-

Capsules

-

Gummies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global botanical supplements market size was estimated at USD 27.47 billion in 2020 and is expected to reach USD 29.91 billion in 2021.

b. The global botanical supplements market is expected to grow at a compound annual growth rate of 9.1% from 2020 to 2028 to reach USD 55.18 billion by 2028.

b. Leaves as a source dominated the botanical supplements market as of 2020 with a share of 28.61% and are expected to advance at a substantial CAGR of 10.1% through 2028.

b. Some of the key players in the botanical supplements market are Dabur India, NBTY Inc., Ricola AG., Mondelez International, Procter and Gamble, Nutraceutical International Company, BASF SE, The Himalaya Drug Company, and Blackmores Limited

b. The key factors that are driving the botanical supplements market include growing awareness among consumers concerning the health benefits coupled with the high demand for plant-based preventive health products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."