- Home

- »

- Food Safety & Processing

- »

-

Bottling Line Machinery Market Size Report, 2022-2030GVR Report cover

![Bottling Line Machinery Market Size, Share, & Trends Report]()

Bottling Line Machinery Market Size, Share, & Trends Analysis Report By Application (Beverages, Processed Food), By Technology, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-919-8

- Number of Pages: 214

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

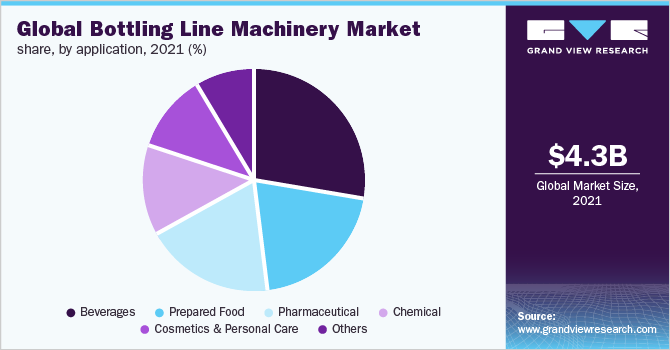

The global bottling line machinery market was valued at USD 4.33 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030. The rising prominence of beverage products with unique tastes, colors, and textures is expected to boost the demand for botting line machinery over the forecast period.

Increase in demand for healthy beverages and pharmaceuticals due to the COVID-19 pandemic had a positive impact on the growth of the market. Companies operating in the beverages and pharmaceutical industries adopted new and automated lines to meet this growing demand for their products thereby boosting machinery demand.

Growing urban population in the U.S. has influenced food preferences, which, in turn, is favoring processing & packaging industry. Moreover, chemical industry players in the U.S. are keen on expanding and building capacity, creating demand for packaging. This is expected to positively impact the industry over the forecast period.

Food and beverage industry players are resorting to contract manufacturing on account of advantages such as lower upfront investment for the client, minimum storage and warehouse needs, high industry expertise, and time & cost saving. Furthermore, COVID-19 pandemic had resulted in capacity constraints which are expected to be met through contract manufacturing which is expected to augment industry growth.

The pharmaceutical industry players are incorporating technology in bottling lines to reduce costs and enhance profit margins which is likely to increase the demand for bottling line machinery. Technological breakthroughs are expected to help manufacturers to produce products in novel formulations and sizes to respond to sustainability and convenience demands as trend-driven SKU proliferation intensifies.

Several new players are joining the competitive bottling line machinery industry while the existing companies are exploring new opportunities. These existing companies are developing enhanced and novel machines by integrating artificial intelligence (AI) and industry 4.0, the market is characterized by high intensity of competitive rivalry.

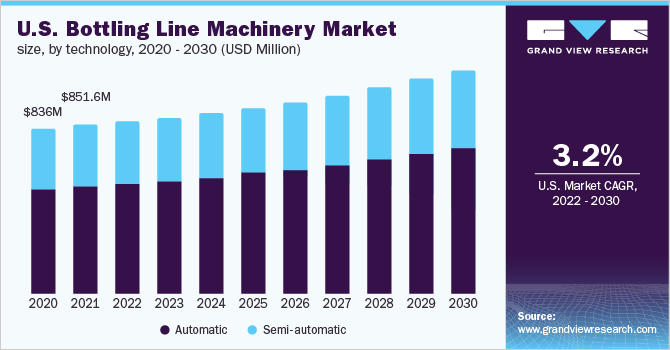

Technology Insights

Automatic technology led the industry and accounted for 64.2% of the global revenue share in 2021. Increased compliance with legal and customer specifications coupled with rising efficient operations and consistency are some of the factors responsible for driving the demand for automatic segment over the forecast period.

Manufacturers of processed food products are presently adopting automated food technologies to enhance their conventional packaging technologies to deliver high-quality packaged products. Some players offering automatic machinery include Tetra Laval Group, Coesia S.p.A., Zhangjiagang King Machine Co., Ltd, and Hiemens Bottling Machines.

The demand for semi-automatic segment is estimated to witness growth at a CAGR of 4% from 2022 to 2030, in terms of revenue. Key factors driving the market include low initial capital and operational costs for making machinery with semi-automatic technology, suitable for labor-intensive countries such as China, Brazil, and India with easy availability of low-cost labor.

The usage of semi-automatic machinery allows continuous improvements in processes that present an opportunity to change or upgrade a process as and when required. Semi-automatic machinery offers operational flexibility and can manage a wide range of technology sizes and specifications, while automatic machinery is better in the production standard products.

Application Insights

The beverages segment led the market and accounted for over 25.2% of the global revenue in 2021 on account of the consumer dietary shifts amidst the COVID-19 pandemic and rise in demand for sports, low-calorie, and other nutritional drinks. Moreover, increase in collaboration of private label brands and beverage manufacturers is also likely to boost growth.

Chemical manufacturing plants produce both, flammable and inflammable liquids such as organic and inorganic solvents with a variety of acidities and viscosities which requires careful packaging. Handling and filling such chemicals into filling jars, bottles, and cans requires safe chemical filling and handling equipment and is likely to boost the demand for this product.

The demand for bottling line machinery in pharmaceutical industry is expected grow at a CAGR of 5.2% over the forecast period owing to the introduction of new technology and highly cost-effective and efficient manufacturing methods. The surged demand for new medicines and treatment methods globally is expected to fuel the usage of this product in pharmaceutical applications.

The equipment consumption in the cosmetics industry is expected to increase significantly over the forecast period owing to the increasing demand for anti-aging creams, lotions, and face packs across the globe. Moreover, changing consumer preferences towards organic products is expected to increase the production of cosmetics thereby boosting the demand for packaging equipment.

Regional Insights

Asia Pacific led the market and accounted for over 27.2% of the global revenue in 2021. Rising food & beverage and pharmaceutical contract manufacturing coupled with growing chemical production in countries such as India, Vietnam, Malaysia and Thailand are expected to augment the bottling line machinery market in the region.

The demand for innovative packaging and new technology development in Europe for food and beverage products is increasing. Moreover, the rising consumption of premium alcoholic products and the introduction of healthy juices and smoothies are some of factors for beverage industry growth which is likely to augment the demand in the region.

Pharmaceutical manufacturing sector is expanding rapidly due to the increased demand for drugs in the U.S. This can be attributed to the rising geriatric population, increasing number of disease incidences, and the ongoing COVID-19 crisis. Moreover, chemical industry players are keen on expanding and building capacity, creating demand for packaging which is likely to boost the demand in the country.

Key Companies & Market Share Insights

COVID-19 has caused major market players to take actions in securing their future. These include implementing automation to ensure uniformity of their operations and increase their productivity and efficiency. Moreover, companies operating in the beverages and pharmaceutical industries adopted new and automated lines to meet the growing demand during the pandemic.

Market players are currently focusing on technology development with a renewed focus on technological integration. Creating self-sufficiency in pharmaceutical production, reducing reliance on production from China, and increasing competition in the packaging equipment market is expected to positively impact over the forecast period. Some prominent players in the global bottling line machinery market include:

-

Krones AG

-

KHS Group

-

The Tetra Laval Group

-

SMI S.p.A.

-

OPTIMA packaging group GmbH

-

ProMach

-

Zhangjiagang King Machine Co., Ltd

-

Sacmi Imola S.C.

-

Coesia S.p.A.

-

Syntegon Technology GmbH

-

Hiemens Bottling Machines

-

APACKS

-

Barry-Wehmiller Group, Inc.

-

IC Filling Systems

-

Serac Group

Bottling Line Machinery Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.48 billion

Revenue forecast in 2030

USD 6.41 billion

Growth Rate

CAGR of 4.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE; South Africa

Key companies profiled

3M Krones AG; KHS Group; The Tetra Laval Group; SMI S.p.A.; OPTIMA packaging group GmbH; ProMach; Zhangjiagang King Machine Co., Ltd; Sacmi Imola S.C.; Coesia S.p.A.; Syntegon Technology GmbH; Hiemens Bottling Machines; APACKS; Barry-Wehmiller Group, Inc.; IC Filling Systems; Serac Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bottling line machinery market on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Automatic

-

Semi-automatic

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Beverages

-

Alcoholic

-

Non-alcoholic

-

-

Prepared Food

-

Pharmaceutical

-

Cosmetics & Personal Care

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

U.K.

-

-

Asia Pacific

-

Australia

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bottling line machinery market size was estimated at USD 4.33 Billion in 2021 and is expected to reach USD 4.48 Billion in 2022

b. The global bottling line machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.6% from 2022 to 2030 to reach USD 6.41 billion by 2030

b. The Asia Pacific dominated the bottling line machinery market with a revenue share of 37.4% in 2021, on account of several factors including a surge in domestic pharmaceutical production and growing beverage contract manufacturing in India

b. Some of the key players operating in the bottling line machinery market include Krones AG, KHS Group, OPTIMA packaging group GmbH, ProMach, Sacmi Imola S.C., Coesia S.p.A., Syntegon Technology GmbH, Hiemens Bottling Machines

b. The key factors that are driving the bottling line machinery market include packaging equipment market boost due to the growing food and beverage industry coupled with rapid technological advancements

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."