- Home

- »

- Medical Devices

- »

-

Breast Pump Market Size, Share And Trends Report, 2030GVR Report cover

![Breast Pump Market Size, Share & Trends Report]()

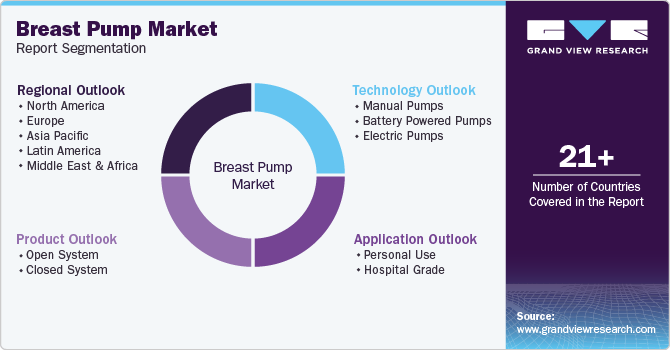

Breast Pump Market Size, Share & Trends Analysis Report By Product (Open System, Closed System), By Technology (Manual Pumps, Electric Pumps), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-215-0

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Breast Pump Market Size & Trends

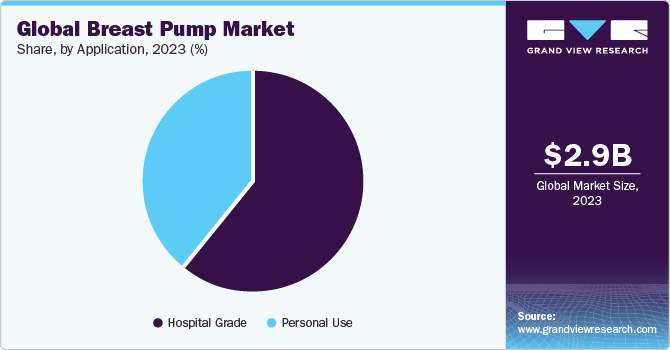

The global breast pump market size was estimated at USD 2.94 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. The key factors driving market growth include rising global women's employment rates, improved healthcare infrastructure in emerging economies, and government initiatives to support working mothers. The International Labor Organization (ILO) reports that there has been visible progress in terms of employment opportunities and gender equality over the last 20 years. The ILO initiated the 2030 United Nations Agenda, which declares that the genders of youth and the disabled population are likely to have equal pay without discrimination to achieve gender equality and empower all women and girls to attain productive employment, gender equality, and economic development.

Growing consumer awareness and supportive government initiatives are anticipated to propel the global demand for breast pumps. For instance, The Baby Friendly Hospital Initiative (BFHI), which promotes evidence-based practices for breastfeeding success, was established by the United Nations Children's Fund (UNICEF) and the World Health Organization (WHO) to enhance breastfeeding rates and assist families in achieving their breastfeeding goals. Similarly, most insurance plans must now cover specified breastfeeding help and supplies, such as breast pumps, as part of the Affordable Care Act. Therefore, such initiatives are expected to increase the usage of these products. As a result, purchasing these products becomes easier for end-users, leading to rising demand for breast pumps.

Governments of various countries are encouraging mothers to breastfeed babies up to 6 months. Moreover, many international agencies are arranging campaigns to raise awareness about breastfeeding. Various market players, such as Medela LLC, Laura & Co., Newell Brands, and Ameda, & universities, including Washington University & Fudan University, are raising awareness among women about breastfeeding and its benefits by arranging campaigns and providing informative magazines. These factors are expected to drive the breast pump market.

The breast pump helps improve accessibility to perform tasks in daily living. A breast pump is covered under Medicare but does not cover disposable items. Medicare Part-B beneficiaries pay 20% of the approved cost of the product, and Medicare pays the remaining 80%. Better coverage and reimbursement policies for breast pump products are also likely to help boost the market growth. In addition, the rising number of elderly care centers because of the increasing geriatric population base globally is projected to drive the market further.

Furthermore, increasing breastfeeding complications among women are expected to create demand for breast pumps in the near term. Breastfeeding complications include poor attachment, breast engorgement, and nipple pain in women. Thus, breastfeeding becomes more difficult because of these issues among women. According to Nemours, a non-profit children's health organization, most women discontinue breastfeeding their newborn babies too soon, resulting in an increase in the need for breast pumps.

Besides, engorgement is expected to be one of the major factors driving demand for breast pumps during the forecast period. Excess milk must be removed to avoid engorgement. The only two methods for eliciting surplus milk from the breasts in a healthy way are the hand expression method and breast pumps. When the baby is suckling, mothers may experience acute nipple pain as a result of inadequate attachment. As a result, poor attachment is another factor driving up demand for breast pumps.

In addition, social media platforms, such as YouTube, Facebook, and Instagram, have enabled individuals to access information about breast pumps and related accessories. Several companies provide information on these platforms. For instance, Spectra Baby USA runs a page called Spectra Baby USA - Pumping for Mom Support, which supports and provides information about breast pumps. Such factors are expected to boost the demand for breast pumps during the forecast period.

Many companies are launching new breast pumps in the market. For instance, in January 2023, Medela introduced its inaugural in-bra wearable breast pump solution, known as the Freestyle Hands-free breast pump. This new pump showcases a collection of exceptionally lightweight, comfortable, and discreet cups. These cups connect seamlessly to a portable pump motor, providing users with an unparalleled hands-free pumping experience. These factors are expected to propel the wearable breast pumps market over the forecast period.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The breast pump market is characterized by a moderate-to-high degree of growth. Key drivers include the rising awareness of breastfeeding benefits, increasing global women's employment rates, improved healthcare infrastructure in emerging economies, and government initiatives to support working mothers. Ongoing advancements in breast pump technology, such as the development of electric and battery-operated pumps, dual pumps for simultaneous expression, and smart pump features, have made breast pumping more convenient and efficient, driving the market growth. Some countries have implemented policies and initiatives to support breastfeeding, including workplace accommodations for nursing mothers. Such initiatives contribute to the adoption of breast pumps as a means to balance work and breastfeeding.

Key strategies implemented by players in the breast pump industry are new product launches, expansion, acquisitions, partnerships, and other strategies. In August 2023, Lansinoh launched its new Lansinoh Wearable Pump. S imilarly, in April 2022, Ardo Medical, Inc. introduced a breast pump with 250 mmHG double pumping, known as Ardo Alyssa. It is a hospital-grade breast pump with NICU capabilities.

The breast pump industry is witnessing a substantial degree of innovation driven by rapid technological advancements and the increasing adoption of advanced products. Ongoing advances in breast pump technology, such as the development of electric and battery-operated pumps, dual pumps for simultaneous expression, and smart pump features, have made breast pumping more convenient and efficient, driving the market growth. Integration of smart technology into breast pumps allows mothers to track pumping sessions, milk production, and feeding patterns through mobile apps. These apps may also provide tips, reminders, and personalized insights. Lately, wearable breast pumps have gained popularity, offering mothers the flexibility to pump discreetly and without being tethered to a traditional pump. These devices are often compact and quiet and allow hands-free pumping, enhancing convenience for on-the-go mothers.As technology advances, further improvements and innovations will likely emerge in the market.

Regulations play a crucial role in shaping the breast pump sector, ensuring the safety, efficacy, and quality of these devices. Regulatory agencies set standards and requirements to ensure the safety and quality of breast pumps. Manufacturers must comply with these standards to obtain regulatory approval or certification for their products. This helps build trust among consumers regarding the safety and reliability of breast pumps.Stringent regulatory requirements can act as barriers to entry for new companies in the market. Regulation compliance often involves significant research, development, and testing investments to meet the specified safety and performance standards. Regulatory requirements may drive innovation in breast pump design and technology. Companies often invest in research and development to create products that meet regulatory standards and offer additional features to enhance user experience and clinical efficacy. Furthermore, regulations may need to adapt to emerging technologies, such as smart breast pumps with connectivity features. Data privacy, security, and usability issues may become subjects of regulatory consideration as these technologies advance.

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies may acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. In January 2023, International Biomedical has announced the acquisition of Ameda, Inc. The company is expected to hire in Operations roles as it consolidates this acquisition and develops new growth initiatives.

Companies in the breast pump market are strategically focusing on regional expansion to capitalize on emerging opportunities and broaden their market presence. This entails establishing a stronger footprint in key geographical areas through partnerships, acquisitions, and localized marketing strategies. By tailoring their products and services to meet regional healthcare needs, breast pump firms aim to enhance accessibility and responsiveness, ensuring a more comprehensive and effective market penetration. For instance, in January 2024, Annabella announced its seed funding of USD 8.5 million and its entrance into the U.S. market.Annabella has sold approximately 4,000 breast pumps in Israel since February 2023. This expansion demonstrates Annabella's product excellence, illustrated by its patented, FDA-cleared breast pump, which provides mothers with a product comparable to breastfeeding while emphasizing efficiency and comfort.

The seed funding is expected to be utilized to fuel next-generation product development and expand into the US market. Thus, regional expansion is critical for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

Product Insights

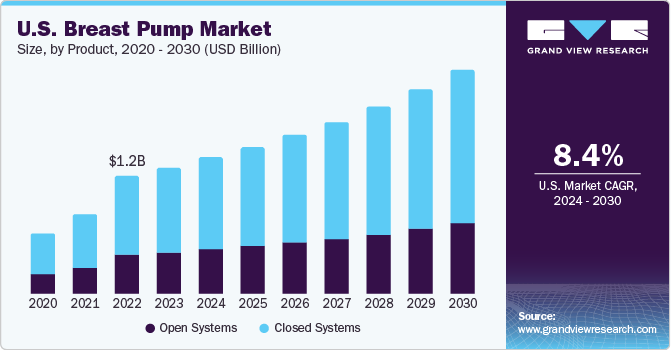

The closed system segment held the largest market revenue share of 65.7% in 2023 and is anticipated to witness the fastest growth rate over the forecast period. The growth is mainly owing to their higher usage rates as these systems are relatively more hygienic and contamination-free. Closed breast pumps are rapidly substituting open systems; their revenue share is expected to increase by 2030.

Closed system breast pumps contain a lid or a layer, which acts as a barrier between a collection kit and the pumping unit or a motor that prevents the contamination of collected milk. This protective layer also prevents the milk particles from entering the pump tubing or motor. These devices provide better safety for the child’s health, ensure maximum removal of impurities, and are easy to clean. Introduction of portable instruments such as Ameda HygieniKit is expected to drive market growth over the next few years.

On the other hand, open type of breast pumps lacks barriers that prevent overflowing and entry of milk into the pump machinery. They are less expensive than closed systems. When milk enters the tubing or pump mechanisms, it becomes difficult for users to clean. Inadequate cleaning before use causes mold and bacteria to grow in the pump systems, putting babies at risk of getting sick. In addition, with nursing mothers preferring hygiene over cost while purchasing breast pumps, the market of open type breast pumps is expected to witness sluggish growth over the forecast period.

Technology Insights

The electric pumps segment held the largest market in 2023 and is expected to witness the fastest growth rate during the forecast period. Electric breast pumps are powered by a motor and supply suction through plastic tubing to a horn that fits over the nipple. It provides a lot more suction, making pumping significantly faster, and allows pumping of both breasts at the same time.

Working mothers prefer using electric pumps as they can quickly extract more milk. The double pumping model decreases the time taken compared to a standard pump. Electric pumps can often be quite heavy and noisy, but manufacturers continue to use advanced technology, creating lighter pumps that generate less noise. Electric pumps are also available for rent for mothers who cannot afford to buy a new pump and require them for short durations.

Some key brands in this segment include Purely Yours Ultra Breast Pump by Ameda AG and Isis iQ Duo Breast Pump by Philips AVENT, respectively. Technological advancements with the introduction of portable instruments, such as the Platinum electric breast pump by Ameda and Electric swing breast pumps by Medela, are expected to drive market growth over the next few years.

Application Insights

Based on application, the market has been segmented into personal use and hospital grade. The hospital grade segment held the largest share in 2023 and is anticipated to witness the fastest growth rate over the forecast period. Hospital-grade breast pumps have powerful motors and are typically used in hospitals, but they can also be rented monthly for personal use. These breast pumps operate on a "closed system," which means that barriers are in place to prevent milk and other fluids from entering the motor. This lessens contamination and ensures that they are safe for multiple users.

These breast pumps provide several benefits; for example, they are more powerful and effective than many personal-use pumps. They are beneficial for mothers who have medical issues that necessitate using a high-powered pump or whose babies have difficulty latching and nursing. Therefore, owing to the advantages offered by hospital-grade pumps, the segment is expected to grow significantly over the forecast period.

Regional Insights

North America accounted for the highest market share in 2023. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and quick adoption of advanced products are projected to boost the region’s growth further. The region is continuously developing cost-efficient and advanced patient devices to capture a huge market share. In addition, the rise in the number of hospitals and the growing geriatric population are factors responsible for the regional market growth.

The U.S. held the largest share of North America breast pump market in 2023. Some factors responsible for its dominance are increasing awareness about the availability of breast pumps, growing number of employed women, and high disposable income. For instance, as per a report by the U.S. Bureau Of Labor Statistics, unemployment rate of women in the U.S. has decreased from 13.9% in 2020 to 3.3% in 2023 .

Europe breast pump market is growing at a significant CAGR over the forecast period, owing to growing birth rate and rising women employment in the region. For instance, as per the report by Eurostat in March 2023, about 4.09 million babies were born in Europe in 2021. Working women face challenges in managing and providing necessary nutrition to their babies, which may increase neonatal mortality if not adequately catered for. Breast pumps make it easier for working mothers to feed their babies properly. Moreover, rising awareness among target consumers, i.e., lactating mothers, about the benefits of breastfeeding is expected to create growth opportunities for the Europe breast pump market in the coming years. High disposable income and technological advancements are also prominent driving factors for the regional market.

The UK breast pump market is still in a nascent stage and thus has many growth opportunities owing to increasing awareness and supportive government initiatives. Various initiatives, such as the Baby Friendly Initiative (BFI) launched in 1991, are providing framework for NHS trusts to implement best practices in supporting breastfeeding. Moreover, increasing number of milk banks in the UK is also expected to boost the demand for breast pumps. For instance, as per data published by the European Milk Bank Association (EMBA), there are about 15 breast milk banks in the UK in 2021 that provide premature infants with donor milk.

Key Breast Pump Company Insights

Breast pump markettrends are shaping industry leaders’ strategies. Heavy investments in research and development for technological innovations reflect a commitment to connected healthcare solutions. Top players are adapting to the shift towards user comfort through technological advancements and innovative products. Technological advancements in the breast pump market have been continuous, with the emergence of smart and connected devices. These innovative breast pumps enable users to monitor and manage their pumping sessions via mobile apps. The prevalence of Bluetooth connectivity, data tracking capabilities, and customizable features has risen.

Key Breast Pump Companies:

The following are the leading companies in the breast pump market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these breast pump companies are analyzed to map the supply network.

- Ameda (Magento, Inc.)

- Hygeia Health

- Medela AG

- Koninklijke Philips N.V.

- Lansinoh Laboratories, Inc.

- Pigeon Corporation

- Motif Medical

- Chiaro Technology Limited (Elvie)

- Willow Innovations, Inc.

- Spectra Baby USA

Recent Developments

-

In November 2023, Pigeon officially unveiled the much-anticipated release of its second-generation GoMini Electric Breast Pump, known as the GoMini Plus.

-

In August 2023, Lansinoh introduced the Lansinoh Wearable Pump as part of their commitment to "Stand with the Mothers," offering support to new moms through products and resources to simplify their journey.

-

In February 2023, Madela AG and Sarah Wells partnered to add the Allie sling bag to Madela’s Freestyle Hands-free Breast Pump portfolio for breastfeeding parents.

-

In January 2023, Willow Innovations, Inc. launched the first breast pump companion app, Willow 3.0, for Apple Watch. The Willow 3.0 pumps have a smartwatch companion app that allows breastfeeding parents to easily track, control, and view their pumping sessions.

-

In September 2022, Willow Innovations, Inc. introduced its line-up known as Pump Anywhere bags and cases accessory aligned to its popular breast pumps. These thoughtfully designed cases help provide a stress-free pumping experience.

Breast Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.16 billion

Revenue forecast in 2030

USD 5.20 billion

Growth Rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ameda (Magento, Inc.); Hygeia Health; Medela AG; Koninklijke Philips N.V.; Lansinoh Laboratories, Inc.; Pigeon Corporation; Motif Medical; Chiaro Technology Limited (Elvie); Willow Innovations, Inc.; Spectra Baby USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Pump Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast pump market report based on product, technology, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Open System

-

Closed System

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Pumps

-

Battery Powered Pumps

-

Electric Pumps

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Use

-

Hospital Grade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast pump market size was estimated at USD 2.94 billion in 2023 and is expected to reach USD 3.16 billion in 2024.

b. The global breast pump market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 5.20 billion by 2030.

b. North America dominated the breast pump market with a share of 52.55% in 2023. This is attributable to high women employment rates, healthcare expenditure, sophisticated healthcare infrastructure, and patient awareness levels.

b. Some key players operating in the breast pump market include Medela Inc., Philips, Ameda, Hygeia Medical Group, Whittlestone, and Lansinoh Laboratories.

b. Key factors that are driving the breast pump market growth include a favorable change in reimbursement policies, technological advancements, increasing patient disposable income and awareness levels, and growing female employment rates.

Table of Contents

Chapter 1 Breast Pump Market: Methodology

1.1 Market Segmentation & Scope

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.2 Volume Price Analysis (Model 2)

1.6.2.1 Approach 2: Volume Price Analysis

1.7 List of Secondary Sources

1.8 List of Primary Sources

1.9 List of Abbreviations

Chapter 2 Breast Pump Market: Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

Chapter 3 Breast Pump Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 User Perspective Analysis

3.3.1 Consumer Behavior Analysis

3.3.2 Market Influencer Analysis

3.4 List of Key End-users

3.5 Regulatory Framework

3.6 Market Dynamics

3.6.1 Market driver analysis

3.6.1.1 Presence of favorable demographics

3.6.1.2 Increasing global women employment rates

3.6.1.3 Presence of government initiatives aimed at improving consumer awareness levels

3.6.1.4 Improving healthcare infrastructure in emerging economies

3.6.2 Market restraint analysis

3.6.2.1 High prices of breast pumps

3.6.2.2 Lack of awareness and less penetration in low and middle income countries

3.7 Breast Pump Market Analysis Tools

3.7.1 Industry Analysis - Porter’s

3.7.2 Swot Analysis, By Pest

Chapter 4. Breast Pump Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Breast Pump Market: Product Movement Analysis & Market Share, 2023 & 2030

4.3. Open System

4.3.1. Open System Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Closed System

4.4.1. Closed System Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Breast Pump Market: Technology Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Breast Pump Market: Technology Movement Analysis & Market Share, 2023 & 2030

5.3. Manual Pumps

5.3.1. Manual Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Battery Powered Pumps

5.4.1. Battery Powered Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Electric Pumps

5.5.1. Electric Pumps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Breast Pump Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Breast Pump Market: Application Movement Analysis & Market Share, 2023 & 2030

6.3. Personal Use

6.3.1. Personal Use Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Hospital Grade

6.4.1. Hospital Grade Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Breast Pump Market: Regional Estimates & Trend Analysis

7.1. Regional Outlook

7.2. Breast Pump Market: Regional Movement Analysis & Market Share, 2023 & 2030

7.3. North America

7.3.1. North America Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.2. U.S.

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Regulatory Scenario

7.3.2.4. Reimbursement Scenario

7.3.2.5. U.S. Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.3.3. Canada

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Scenario

7.3.3.4. Reimbursement Scenario

7.3.3.5. Canada Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Europe

7.4.1. Europe Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.2. UK

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Regulatory Scenario

7.4.2.4. Reimbursement Scenario

7.4.2.5. UK Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.3. Germany

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Scenario

7.4.3.4. Reimbursement Scenario

7.4.3.5. Germany Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.4. France

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Scenario

7.4.4.4. Reimbursement Scenario

7.4.4.5. France Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.5. Italy

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Scenario

7.4.5.4. Reimbursement Scenario

7.4.5.5. Italy Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.6. Spain

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Scenario

7.4.6.4. Reimbursement Scenario

7.4.6.5. Spain Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.7. Denmark

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Scenario

7.4.7.4. Reimbursement Scenario

7.4.7.5. Denmark Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.8. Sweden

7.4.8.1. Key Country Dynamics

7.4.8.2. Competitive Scenario

7.4.8.3. Regulatory Scenario

7.4.8.4. Reimbursement Scenario

7.4.8.5. Sweden Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4.9. Norway

7.4.9.1. Key Country Dynamics

7.4.9.2. Competitive Scenario

7.4.9.3. Regulatory Scenario

7.4.9.4. Reimbursement Scenario

7.4.9.5. Norway Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Asia Pacific

7.5.1. Asia Pacific Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.2. Japan

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Scenario

7.5.2.4. Reimbursement Scenario

7.5.2.5. Japan Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.3. China

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Scenario

7.5.3.4. Reimbursement Scenario

7.5.3.5. China Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.4. India

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Scenario

7.5.4.4. Reimbursement Scenario

7.5.4.5. India Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.5. South Korea

7.5.5.1. Key Country Dynamics

7.5.5.2. Competitive Scenario

7.5.5.3. Regulatory Scenario

7.5.5.4. Reimbursement Scenario

7.5.5.5. South Korea Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.6. Australia

7.5.6.1. Key Country Dynamics

7.5.6.2. Competitive Scenario

7.5.6.3. Regulatory Scenario

7.5.6.4. Reimbursement Scenario

7.5.6.5. Australia Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.7. Thailand

7.5.7.1. Key Country Dynamics

7.5.7.2. Competitive Scenario

7.5.7.3. Regulatory Scenario

7.5.7.4. Reimbursement Scenario

7.5.7.5. Thailand Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Latin America

7.6.1. Latin America Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.2. Brazil

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Scenario

7.6.2.4. Reimbursement Scenario

7.6.2.5. Brazil Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.3. Mexico

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Scenario

7.6.3.4. Reimbursement Scenario

7.6.3.5. Mexico Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.4. Argentina

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Scenario

7.6.4.4. Reimbursement Scenario

7.6.4.5. Argentina Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.2. South Africa

7.7.2.1. Key Country Dynamics

7.7.2.2. Competitive Scenario

7.7.2.3. Regulatory Scenario

7.7.2.4. Reimbursement Scenario

7.7.2.5. South Africa Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.3. Saudi Arabia

7.7.3.1. Key Country Dynamics

7.7.3.2. Competitive Scenario

7.7.3.3. Regulatory Scenario

7.7.3.4. Reimbursement Scenario

7.7.3.5. Saudi Arabia Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.4. UAE

7.7.4.1. Key Country Dynamics

7.7.4.2. Competitive Scenario

7.7.4.3. Regulatory Scenario

7.7.4.4. Reimbursement Scenario

7.7.4.5. UAE Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.5. Kuwait

7.7.5.1. Key Country Dynamics

7.7.5.2. Competitive Scenario

7.7.5.3. Regulatory Scenario

7.7.5.4. Reimbursement Scenario

7.7.5.5. Kuwait Breast Pump Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Market Participant Categorization

8.2. Key Company Profiles

8.2.1. Ameda (Magento, Inc.)

8.2.1.1. Company Overview

8.2.1.2. Financial Performance

8.2.1.3. Product Benchmarking

8.2.1.4. Strategic Initiatives

8.2.2. Hygeia Health

8.2.2.1. Company Overview

8.2.2.2. Financial Performance

8.2.2.3. Product Benchmarking

8.2.2.4. Strategic Initiatives

8.2.3. Medela AG

8.2.3.1. Company Overview

8.2.3.2. Financial Performance

8.2.3.3. Product Benchmarking

8.2.3.4. Strategic Initiatives

8.2.4. Koninklijke Philips N.V.

8.2.4.1. Company Overview

8.2.4.2. Financial Performance

8.2.4.3. Product Benchmarking

8.2.4.4. Strategic Initiatives

8.2.5. Lansinoh Laboratories, Inc.

8.2.5.1. Company Overview

8.2.5.2. Financial Performance

8.2.5.3. Product Benchmarking

8.2.5.4. Strategic Initiatives

8.2.6. Pigeon Corporation

8.2.6.1. Company Overview

8.2.6.2. Financial Performance

8.2.6.3. Product Benchmarking

8.2.6.4. Strategic Initiatives

8.2.7. Motif Medical

8.2.7.1. Company Overview

8.2.7.2. Financial Performance

8.2.7.3. Product Benchmarking

8.2.7.4. Strategic Initiatives

8.2.8. Chiaro Technology Limited (Elvie)

8.2.8.1. Company Overview

8.2.8.2. Financial Performance

8.2.8.3. Product Benchmarking

8.2.8.4. Strategic Initiatives

8.2.9. Willow Innovations, Inc.

8.2.9.1. Company Overview

8.2.9.2. Financial Performance

8.2.9.3. Product Benchmarking

8.2.9.4. Strategic Initiatives

8.2.10. Spectra Baby USA

8.2.10.1. Company Overview

8.2.10.2. Financial Performance

8.2.10.3. Product Benchmarking

8.2.10.4. Strategic Initiatives

8.3. Heat Map Analysis/ Company Market Position Analysis

8.4. Estimated Company Market Share Analysis, 2023

8.5. List of Other Key Market Players

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviation

Table 3 Global breast pump market, by region, 2018 - 2030 (USD Million)

Table 4 Global breast pump market, by product, 2018 - 2030 (USD Million)

Table 5 Global breast pump market, by technology, 2018 - 2030 (USD Million)

Table 6 Global breast pump market, by application, 2018 - 2030 (USD Million)

Table 7 North America breast pump market, by country, 2018 - 2030 (USD Million)

Table 8 North America breast pump market, by product, 2018 - 2030 (USD Million)

Table 9 North America breast pump market, by technology, 2018 - 2030 (USD Million)

Table 10 North America breast pump market, by application, 2018 - 2030 (USD Million)

Table 11 U.S. breast pump market, by product, 2018 - 2030 (USD Million)

Table 12 U.S. breast pump market, by technology, 2018 - 2030 (USD Million)

Table 13 U.S. breast pump market, by application, 2018 - 2030 (USD Million)

Table 14 Canada breast pump market, by product, 2018 - 2030 (USD Million)

Table 15 Canada breast pump market, by technology, 2018 - 2030 (USD Million)

Table 16 Canada breast pump market, by application, 2018 - 2030 (USD Million)

Table 17 Europe breast pump market, by country, 2018 - 2030 (USD Million)

Table 18 Europe breast pump market, by product, 2018 - 2030 (USD Million)

Table 19 Europe breast pump market, by technology, 2018 - 2030 (USD Million)

Table 20 Europe breast pump market, by application, 2018 - 2030 (USD Million)

Table 21 UK breast pump market, by product, 2018 - 2030 (USD Million)

Table 22 UK breast pump market, by technology, 2018 - 2030 (USD Million)

Table 23 UK breast pump market, by application, 2018 - 2030 (USD Million)

Table 24 Germany breast pump market, by product, 2018 - 2030 (USD Million)

Table 25 Germany breast pump market, by technology, 2018 - 2030 (USD Million)

Table 26 Germany breast pump market, by application, 2018 - 2030 (USD Million)

Table 27 France breast pump market, by product, 2018 - 2030 (USD Million)

Table 28 France breast pump market, by technology, 2018 - 2030 (USD Million)

Table 29 France breast pump market, by application, 2018 - 2030 (USD Million)

Table 30 Italy breast pump market, by product, 2018 - 2030 (USD Million)

Table 31 Italy breast pump market, by technology, 2018 - 2030 (USD Million)

Table 32 Italy breast pump market, by application, 2018 - 2030 (USD Million)

Table 33 Spain breast pump market, by product, 2018 - 2030 (USD Million)

Table 34 Spain breast pump market, by technology, 2018 - 2030 (USD Million)

Table 35 Spain breast pump market, by application, 2018 - 2030 (USD Million)

Table 36 Denmark breast pump market, by product, 2018 - 2030 (USD Million)

Table 37 Denmark breast pump market, by technology, 2018 - 2030 (USD Million)

Table 38 Denmark breast pump market, by application, 2018 - 2030 (USD Million)

Table 39 Sweden breast pump market, by product, 2018 - 2030 (USD Million)

Table 40 Sweden breast pump market, by technology, 2018 - 2030 (USD Million)

Table 41 Sweden breast pump market, by application, 2018 - 2030 (USD Million)

Table 42 Norway breast pump market, by product, 2018 - 2030 (USD Million)

Table 43 Norway breast pump market, by technology, 2018 - 2030 (USD Million)

Table 44 Norway breast pump market, by application, 2018 - 2030 (USD Million)

Table 45 Asia Pacific breast pump market, by country, 2018 - 2030 (USD Million)

Table 46 Asia Pacific breast pump market, by product, 2018 - 2030 (USD Million)

Table 47 Asia Pacific breast pump market, by technology, 2018 - 2030 (USD Million)

Table 48 Asia Pacific breast pump market, by application, 2018 - 2030 (USD Million)

Table 49 China breast pump market, by product, 2018 - 2030 (USD Million)

Table 50 China breast pump market, by technology, 2018 - 2030 (USD Million)

Table 51 China breast pump market, by application, 2018 - 2030 (USD Million)

Table 52 Japan breast pump market, by product, 2018 - 2030 (USD Million)

Table 53 Japan breast pump market, by technology, 2018 - 2030 (USD Million)

Table 54 Japan breast pump market, by application, 2018 - 2030 (USD Million)

Table 55 India breast pump market, by product, 2018 - 2030 (USD Million)

Table 56 India breast pump market, by technology, 2018 - 2030 (USD Million)

Table 57 India breast pump market, by application, 2018 - 2030 (USD Million)

Table 58 Australia breast pump market, by product, 2018 - 2030 (USD Million)

Table 59 Australia breast pump market, by technology, 2018 - 2030 (USD Million)

Table 60 Australia breast pump market, by application, 2018 - 2030 (USD Million)

Table 61 Thailand breast pump market, by product, 2018 - 2030 (USD Million)

Table 62 Thailand breast pump market, by technology, 2018 - 2030 (USD Million)

Table 63 Thailand breast pump market, by application, 2018 - 2030 (USD Million)

Table 64 South Korea breast pump market, by product, 2018 - 2030 (USD Million)

Table 65 South Korea breast pump market, by technology, 2018 - 2030 (USD Million)

Table 66 South Korea breast pump market, by application, 2018 - 2030 (USD Million)

Table 67 Latin America breast pump market, by country, 2018 - 2030 (USD Million)

Table 68 Latin America breast pump market, by product, 2018 - 2030 (USD Million)

Table 69 Latin America breast pump market, by technology, 2018 - 2030 (USD Million)

Table 70 Latin America breast pump market, by application, 2018 - 2030 (USD Million)

Table 71 Brazil breast pump market, by product, 2018 - 2030 (USD Million)

Table 72 Brazil breast pump market, by technology, 2018 - 2030 (USD Million)

Table 73 Brazil breast pump market, by application, 2018 - 2030 (USD Million)

Table 74 Mexico breast pump market, by product, 2018 - 2030 (USD Million)

Table 75 Mexico breast pump market, by technology, 2018 - 2030 (USD Million)

Table 76 Mexico breast pump market, by application, 2018 - 2030 (USD Million)

Table 77 Argentina breast pump market, by product, 2018 - 2030 (USD Million)

Table 78 Argentina breast pump market, by technology, 2018 - 2030 (USD Million)

Table 79 Argentina breast pump market, by application, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa breast pump market, by country, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa breast pump market, by product, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa breast pump market, by technology, 2018 - 2030 (USD Million)

Table 83 Middle East & Africa breast pump market, by application, 2018 - 2030 (USD Million)

Table 84 South Africa breast pump market, by product, 2018 - 2030 (USD Million)

Table 85 South Africa breast pump market, by technology, 2018 - 2030 (USD Million)

Table 86 South Africa breast pump market, by application, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia breast pump market, by product, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia breast pump market, by technology, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia breast pump market, by application, 2018 - 2030 (USD Million)

Table 90 UAE breast pump market, by product, 2018 - 2030 (USD Million)

Table 91 UAE breast pump market, by technology, 2018 - 2030 (USD Million)

Table 92 UAE breast pump market, by application, 2018 - 2030 (USD Million)

Table 93 Kuwait breast pump market, by product, 2018 - 2030 (USD Million)

Table 94 Kuwait breast pump market, by technology, 2018 - 2030 (USD Million)

Table 95 Kuwait breast pump market, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Breast Pump Market, Market Segmentation

Fig. 7 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 8 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 9 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 10 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 11 Porter’s Five Forces Analysis

Fig. 12 Regional Marketplace: Key Takeaways

Fig. 13 Global Breast Pump Market, for Open System, 2018 - 2030 (USD Million)

Fig. 14 Global Breast Pump Market, for Closed System, 2018 - 2030 (USD Million)

Fig. 15 Global Breast Pump Market, for Manual Pumps, 2018 - 2030 (USD Million)

Fig. 16 Global Breast Pump Market, for Battery Powered Pumps, 2018 - 2030 (USD Million)

Fig. 17 Global Breast Pump Market, for Electric Pumps, 2018 - 2030 (USD Million)

Fig. 18 Global Breast Pump Market, for Personal Use, 2018 - 2030 (USD Million)

Fig. 19 Global Breast Pump Market, for Hospital Grade, 2018 - 2030 (USD Million)

Fig. 20 Regional Outlook, 2021 & 2030

Fig. 21 North America Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 22 U.S. Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 23 Canada Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 24 Europe Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 25 Germany Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 26 UK Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 27 France Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 28 Italy Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 29 Spain Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 30 Denmark Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 31 Sweden Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 32 Norway Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 33 Asia Pacific Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 34 Japan Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 35 China Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 36 India Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 37 Australia Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 38 South Korea Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 39 Thailand Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 40 Latin America Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 41 Brazil Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 42 Mexico Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 43 Argentina Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 44 Middle East and Africa Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 45 South Africa Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 46 Saudi Arabia Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 47 UAE Breast Pump Market, 2018 - 2030 (USD Million)

Fig. 48 Kuwait Breast Pump Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Breast Pump Product Outlook (Revenue, USD Million, 2018 - 2030)

- Open System

- Closed System

- Breast Pump Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Manual Pumps

- Battery Powered Pumps

- Electric Pumps

- Breast Pump Application Outlook (Revenue, USD Million, 2018 - 2030)

- Personal Use

- Hospital Grade

- Breast Pump Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Breast Pump Market, by Product

- Open system

- Closed system

- North America Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- North America Breast Pump Market, by Application

- Personal use

- Hospital grade

- U.S.

- U.S. Breast Pump Market, by Product

- Open system

- Closed system

- U.S. Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- U.S. Breast Pump Market, by Application

- Personal use

- Hospital grade

- U.S. Breast Pump Market, by Product

- Canada

- Canada Breast Pump Market, by Product

- Open system

- Closed system

- Canada Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Canada Breast Pump Market, by Application

- Personal use

- Hospital grade

- Canada Breast Pump Market, by Product

- North America Breast Pump Market, by Product

- Europe

- Europe Breast Pump Market, by Product

- Open system

- Closed system

- Europe Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Europe Breast Pump Market, by Application

- Personal use

- Hospital grade

- Germany

- Germany Breast Pump Market, by Product

- Open system

- Closed system

- Germany Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Germany Breast Pump Market, by Application

- Personal use

- Hospital grade

- Germany Breast Pump Market, by Product

- UK

- UK Breast Pump Market, by Product

- Open system

- Closed system

- UK Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- UK Breast Pump Market, by Application

- Personal use

- Hospital grade

- UK Breast Pump Market, by Product

- France

- France Breast Pump Market, by Product

- Open system

- Closed system

- France Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- France Breast Pump Market, by Application

- Personal use

- Hospital grade

- France Breast Pump Market, by Product

- Spain

- Spain Breast Pump Market, by Product

- Open system

- Closed system

- Spain Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Spain Breast Pump Market, by Application

- Personal use

- Hospital grade

- Spain Breast Pump Market, by Product

- Italy

- Italy Breast Pump Market, by Product

- Open system

- Closed system

- Italy Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Italy Breast Pump Market, by Application

- Personal use

- Hospital grade

- Italy Breast Pump Market, by Product

- Denmark

- Denmark Breast Pump Market, by Product

- Open system

- Closed system

- Denmark Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Denmark Breast Pump Market, by Application

- Personal use

- Hospital grade

- Denmark Breast Pump Market, by Product

- Sweden

- Sweden Breast Pump Market, by Product

- Open system

- Closed system

- Sweden Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Sweden Breast Pump Market, by Application

- Personal use

- Hospital grade

- Hospital grade

- Sweden Breast Pump Market, by Product

- Norway

- Norway Breast Pump Market, by Product

- Open system

- Closed system

- Norway Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Norway Breast Pump Market, by Application

- Personal use

- Hospital grade

- Norway Breast Pump Market, by Product

- Europe Breast Pump Market, by Product

- Asia Pacific

- Asia Pacific Breast Pump Market, by Product

- Open system

- Closed system

- Asia Pacific Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Asia Pacific Breast Pump Market, by Application

- Personal use

- Hospital grade

- Japan

- Japan Breast Pump Market, by Product

- Open system

- Closed system

- Japan Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Japan Breast Pump Market, by Application

- Personal use

- Hospital grade

- Japan Breast Pump Market, by Product

- China

- China Breast Pump Market, by Product

- Open system

- Closed system

- China Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- China Breast Pump Market, by Application

- Personal use

- Hospital grade

- China Breast Pump Market, by Product

- India

- India Breast Pump Market, by Product

- Open system

- Closed system

- India Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- India Breast Pump Market, by Application

- Personal use

- Hospital grade

- India Breast Pump Market, by Product

- Australia

- Australia Breast Pump Market, by Product

- Open system

- Closed system

- Australia Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Australia Breast Pump Market, by Application

- Personal use

- Hospital grade

- Australia Breast Pump Market, by Product

- Thailand

- Thailand Breast Pump Market, by Product

- Open system

- Closed system

- Thailand Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Thailand Breast Pump Market, by Application

- Personal use

- Hospital grade

- Thailand Breast Pump Market, by Product

- South Korea

- South Korea Breast Pump Market, by Product

- Open system

- Closed system

- South Korea Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- South Korea Breast Pump Market, by Application

- Personal use

- Hospital grade

- South Korea Breast Pump Market, by Product

- Asia Pacific Breast Pump Market, by Product

- Latin America

- Latin America Breast Pump Market, by Product

- Open system

- Closed system

- Latin America Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Latin America Breast Pump Market, by Application

- Personal use

- Hospital grade

- Brazil

- Brazil Breast Pump Market, by Product

- Open system

- Closed system

- Brazil Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Brazil Breast Pump Market, by Application

- Personal use

- Hospital grade

- Brazil Breast Pump Market, by Product

- Mexico

- Mexico Breast Pump Market, by Product

- Open system

- Closed system

- Mexico Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Mexico Breast Pump Market, by Application

- Personal use

- Hospital grade

- Mexico Breast Pump Market, by Product

- Argentina

- Argentina Breast Pump Market, by Product

- Open system

- Closed system

- Argentina Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Argentina Breast Pump Market, by Application

- Personal use

- Hospital grade

- Argentina Breast Pump Market, by Product

- Latin America Breast Pump Market, by Product

- Middle East & Africa

- Middle East & Africa Breast Pump Market, by Product

- Open system

- Closed system

- Middle East & Africa Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Middle East & Africa Breast Pump Market, by Application

- Personal use

- Hospital grade

- South Africa

- South Africa Breast Pump Market, by Product

- Open system

- Closed system

- South Africa Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- South Africa Breast Pump Market, by Application

- Personal use

- Hospital grade

- South Africa Breast Pump Market, by Product

- Saudi Arabia

- Saudi Arabia Breast Pump Market, by Product

- Open system

- Closed system

- Saudi Arabia Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Saudi Arabia Breast Pump Market, by Application

- Personal use

- Hospital grade

- Saudi Arabia Breast Pump Market, by Product

- UAE

- UAE Breast Pump Market, by Product

- Open system

- Closed system

- UAE Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- UAE Breast Pump Market, by Application

- Personal use

- Hospital grade

- UAE Breast Pump Market, by Product

- Kuwait

- Kuwait Breast Pump Market, by Product

- Open system

- Closed system

- Kuwait Breast Pump Market, by Technology

- Manual pumps

- Battery powered pumps

- Electric pumps

- Kuwait Breast Pump Market, by Application

- Personal use

- Hospital grade

- Kuwait Breast Pump Market, by Product

- Middle East & Africa Breast Pump Market, by Product

- North America

Breast Pump Market Dynamics

Drivers: Surge In Women Employment Rates

Increase in women’s employment rate is expected to be a high-impact rendering driver of the breast pumps market. Working women have a relatively high disposable income and less time to breastfeed their babies and, thus, are regarded as ideal customers of breast pumps and accessories. As per the ILO, there has been visual progress in terms of employment opportunities and gender equality over the past 20 years. ILO initiated 2030 UN agenda, which announces that both the genders of youth and disabled population are likely to have equal pay without discriminations to achieve gender equality and to empower all women and girls, for achieving productive employment, gender equality, and economic development. Thus, increasing global women employment rates and government initiatives in support of employed mothers is expected to drive the demand for breast pumps over the forecast period.

Drivers: Growing Awareness About The Breastfeeding Accessories

Growing consumer awareness and supportive initiatives being undertaken by governments across the world are anticipated to propel the demand for breastfeeding accessories. For instance, insurance companies in the U.S. have to cover the cost of equipment and services that promote breastfeeding, such as breast pumps & accessories and lactation counseling. Such initiatives by government are expected to increase the usage of these products. As a result, the purchase of breast pumps becomes easier for end users; hence, the demand for breast pumps is propelling in the market. In addition, various market players, such as Medela LLC, Laura & Co., Newell Brands, and Ameda, & universities, including Washington University and Fudan University, are raising awareness among women about breastfeeding and its benefits by arranging campaigns and providing informative magazines. This is expected to boost the demand for breast pumps over the forecast period.

Restraints: High Prices Of Breast Pumps

Pricing of breast pumps is one of the major factors restraining market growth. The average price for manual breast pumps is USD 40.0 in North America and USD 35.0 and USD 20.0 in Europe and Asia, respectively. Battery-powered pumps cost, on an average, USD 150.0, USD 120.0, and USD 90.0 in North America, Europe, and Asia, respectively. Such high pricing of breast pumps, which are not so technology-oriented and complex in design, hinders the sale of such products. This is particularly true in developing nations where the overall purchasing power of consumers is low. However, manufacturers are now focusing on adopting pricing strategies that may fuel the uptake of these devices, especially by large middle-class population and dual income households. Pricing is expected to have a medium impact on the global market during the forecast period.

What Does This Report Include?

This section will provide insights into the contents included in this breast pump market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Breast pump market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Breast pump market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the breast pump market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for breast pump market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of breast pump market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Breast Pump Market Categorization:

The breast pump market was categorized into four segments, namely product (Open System, Closed System), technology (Manual Pumps, Battery Powered Pumps, Electric Pumps), application (Personal Use, Hospital Grade), and regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The breast pump market was segmented into product, technology, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The breast pump market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into thirty-eight countries, namely, the U.S.; Canada; the UK.; Germany; France; Italy; Spain; Greece; Poland; Denmark; Sweden; Norway; Finland; Netherlands; Switzerland; Belgium; Japan; China; Thailand; Myanmar; India; Singapore; Australia; Indonesia; South Korea; Malaysia; Vietnam; Brazil; Mexico; Argentina; Colombia; Peru; Venezuela; South Africa; Saudi Arabia; Turkey; Kuwait; UAE

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Breast pump market companies & financials:

The breast pump market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

MEDELA AG - Medela AG is involved in development and supply of breast pumps & medical vacuum solutions and has pioneered the 2- Phase Expression technology. The company designs breast pumps to meet requirements of nursing mothers, and its products are available in manual- & hospital-grade and double- & single-electric models. It offers a range of breastfeeding accessories, including nursing pads, milk collection, and storage bags as well as breast care products. Medela has a worldwide distribution network across 90 countries, with 12 subsidiaries in the U.S., Spain, UK, Russia, Japan, Italy, Canada, Germany, Sweden, Switzerland, Benelux, and France. The company manufactures its key products in Switzerland and the U.S. and distributes them through pharmacies, hospitals, independent nursery retailers, chemists, and retail chains.

-

KONINKLIJKE PHILIPS N.V. - Royal Philips is a diversified company operating in the areas of healthcare, consumer lifestyle, and lighting. It serves applications such as energy efficient lighting solutions & new lighting, acute care, home healthcare, and cardiac care. Philips Consumer Lifestyle includes health & wellness, personal care, and domestic appliances. The mother and childcare segment under health & wellness is called Philips AVENT, which is mainly involved in designing and manufacturing breastfeeding products, since its incorporation in 1984. The product range consists of breastfeeding, bottlefeeding, toddler feeding, baby monitoring, and other newborn baby products.

-

AMEDA, INC. (MAGENTO, INC.) - Ameda AG is a privately-held company that provides breastfeeding products such as breast pumps, breast care accessories, and milk collection & storage accessories. The company’s product line assists mothers in establishment of milk supply to milk feeding & collection. The company offers a range of electric and manual breast pumps designed for use by single as well as multiple users. In addition, Ameda offers breastfeeding education and provides support for lactation professionals. The company’s corporate office is located in Illinois, U.S.

-

HYGEIA HEALTH - Hygeia Health is headquartered in California and provides breastfeeding products. The company’s portfolio comprises breast pumps, washable nursing pads, milk storage bags, and transitional supplement feeders. It manufactures double electric and manual breast pumps, which comply with the WHO’s International Code of Marketing of Breastmilk Substitutes and are endorsed by La Leche League International (LLLI).

-

FREEMIE - Freemie is a breast pump manufacturer & distributor that manufactures wearable, versatile, and safe breast pumps & accessories. Its product range includes Cups, Fitmie, Pumps, and other parts. It uses safe materials to engineer breast pumps and other accessories. All products are free from BPA, DEHP, BPS, PVC, latex, or phthalates and are safe for baby & mother. The company’s breast pump tools are manufactured and engineered at its Silicon Valley facility.

-

SPECTRA BABY USA - Spectra Baby USA majorly deals with breast pumps and breastfeeding accessories. The company has a team of lactation consultants, fellow mothers, and registered nurses to provide better customer service to the buyers. In addition, it incorporates innovative and technologically advanced features to provide enhanced comfort to mothers. The company has a manufacturing unit in Korea and market its products across the globe.

-

PIGEON CORPORATION - Pigeon Corporation majorly deals with specialized mother care and baby care products. The company operates through 10 business segments—breastfeeding, nursing bottle & nipples, cleaning & sterilizing, baby skin care, baby hygiene, baby oral care, dental care, weaning, pacifiers & teethers, and maternity products. Breast pumps are marketed under breastfeeding segment. The company sells its products across the globe. Lansinoh Laboratories, Inc. is a subsidiary of Pigeon Corporation, and is global supplier of premium products in breastfeeding segment, including breast pumps, nipple care, breast milk storage, nursing pads, bottles, and accessories. The company also operates in the segment of birth preparation, postpartum, education, and support to pregnant women. The company’s product line is available in more than 25,000 retail stores in the U.S.

-

EVENFLO - Evenflo majorly deals with specialized mother care and baby care products. The company designs and manufactures various products related to child seats & strollers as well. It operates through five business segments: car seats, wheels, home, carriers, and feeding. The breast pumps are marketed under feeding segment. The company sells its product across the globe.

-

WILLOW - Willow is a global company that majorly deals in marketing and distribution of baby care products. The company has offices in Manila, Sydney, New York, Melbourne, Seattle, Tel Aviv, and London. It also offers a well-known software platform, WillowTwin, and a professional service, WillowDigital digital. The company operates through three business segments: willow pump, milk container, and milk bags. It markets breast pumps under willow pump product segment.

-

ARDO MEDICAL AG - Ardo is a Swiss family run company that majorly deals with marketing, distribution, and manufacturing of products related to new born babies. The company operates through three business segments: mother & child, suction technology, and obstetrics. The company markets its breast pumps under the mother & child business segment. It sells its products across the globe.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Breast Pump Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Breast Pump Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."