- Home

- »

- Consumer F&B

- »

-

Bubble Food & Beverages Market Size, Share Report, 2030GVR Report cover

![Bubble Food & Beverages Market Size, Share & Trends Report]()

Bubble Food & Beverages Market Size, Share & Trends Analysis Report By Product (Desserts, Bubble Tea), By Source (Tapioca-based, Bursting Bubble), By Distribution Channel (Off-trade, On-trade), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-949-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global bubble food & beverages market size was valued at USD 4.05 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2022 to 2030. The increasing consumption of convenient boba-based snacks and drinks is driving the market growth. This trend is particularly strong among millennials and generation Z. In addition, the rising demand for healthy beverages over carbonated drinks has bolstered the demand for bubble tea. It is made by using tea, such as green tea, black tea, oolong tea, etc. with milk as a base including boba (chewy balls) and fruit jelly. Moreover, social media has played an important role in making bubble tea popular globally. The recent COVID-19 outbreak has negatively impacted the market growth. This is due to the global delay in the supply of boba, which is a key ingredient in bubble tea.

Several boba suppliers in the U.S. were running low on tapioca. Their shipments of fully formed boba came from Taiwan, while supplies of cassava root, which is used to make tapioca, came from Thailand and islands in the Pacific Ocean. They reported that these shipments had been backed up for several months and that the companies’ existing stockpile of tapioca was running low. The availability of bursting boba as well as bubble snacks & beverages in different combinations-of taste & texture, condiments & toppings, as well as an assortment of flavors has driven their popularity across the globe. Market players are gaining consumer insights to understand the immersive boba experience and what consumers want at the moment, which is boding well for market growth.

The demand for boba is high in Southeast Asia, which augmented bubble tea orders on GrabFood in the region by an impressive rate of 3,000% in 2018. Due to increasing consumer demand, GrabFood reached nearly 4,000 bubble tea outlets, which was a 200% growth in outlets for the region, as per a blog published on the Grab in May 2019. The easy availability of snacks and beverages, such as cold coffee boba tea, and avocado bubble tea, through various sales channels, especially online stores, has contributed to the market growth in terms of value sales. In addition, the introduction of bubble brinks premixes, such as pineapple bubble tea premix, bubble tea fruit pearls, and chocolate tea premix, is anticipated to offer immense growth opportunities for the market.

Increasing investments in research & development, coupled with the rising consumer awareness about the benefits associated with products containing organic, vegan, and natural tapioca pearls have encouraged manufacturers to launch new products. For instance, in August 2019, beauty brand Botanist expanded its product portfolio to the bubble tea segment with its offering of blue-hued boba tea made with pea-based milk at its in-store café in the Harajuku district of Tokyo. In October 2021, Del Monte Foods, Inc. launched Joyba Bubble Tea in various flavors including strawberry lemonade green tea, raspberry dragon fruit black tea, mango passionfruit green tea, and cherry hibiscus tea.

An increasing number of health-conscious consumers have shown a preference for bursting boba that is free from caffeine, gluten, egg, dairy, and nuts. To capitalize on these trends, many companies are providing healthy beverages and extending their offerings in bubble teas, bursting boba, and toppings. For instance, California-based Bossen Store offers a range of boba teas in various forms like powders, syrups, and sweeteners & creamers; bursting boba in flavors like kiwi, dragon fruit, green apple, chili pepper, lychee, mango, orange, pomegranate, strawberry, peach, and passion fruit, along with ready-to-serve toppings for fast, easy drinks.

Product Insights

The bubble tea segment dominated the global market in 2021 and accounted for the largest share of more than 52.7% of the overall revenue. The segment is also expected to register the fastest CAGR during the forecast period. Bubble tea, popularly known as boba tea, is increasingly becoming trendy in the beverages industry. This is attributed to its distinct flavor and its availability in different flavors, which, in turn, is propelling its demand. It is made from pure loose-leaf tea blends, coffee, or fruits, and even innovative ingredients, such as rose, taro, or coconut water. The most preferred types of boba teas include milk tea, black tea, fresh fruit tea, smoothies or milkshakes, fresh milk, and salted cream. The dessert segment accounted for the second-largest revenue share in 2021.

The availability of a wide range of desserts made with boba pearls, such as shaved ice desserts, boba waffles, and boba wheel pie, is anticipated to bolster the segment growth. Furthermore, consumers are keen on trying new pudding flavors at high-end restaurants and cafés, owing to which, chefs are using boba pearls to enhance the flavors of iced and hot desserts. This scenario is boosting the consumption of boba-based desserts. Despite the rising consumer demand for bubble tea and desserts, there has been significant growth in the demand for drinks, juices, and cocktails infused with boba pearls in the market. Several QSRs and foodservice outlets are adding boba pearls-infused beverages in real fresh fruit and not-sweetened fruit flavors to their menu, which, in turn, is bolstering the demand for bubble beverages.

Source Insights

The tapioca-based segment dominated the global market in 2021 and accounted for the maximum share of more than 65.5% of the overall revenue. Tapioca is obtained from cassava root and is an integral ingredient to make tapioca boba pearls. Moreover, there is a high demand for vegan food & beverages, which, in turn, is further boosting the demand for tapioca-based boba-infused with a variety of natural ingredients. Furthermore, consumers have been increasingly replacing carbonated drinks with gluten-free and vegan options and several food service outlets are considering tapioca to be a popular substitute for wheat flour in gluten-free boba balls.

Tapioca Express is a franchise that offers a wide selection of high-quality tapioca drinks, mixed in various combinations of black or green tea, milk, juice, coffee, and small marbles of tapioca. The franchise has been expanding its presence in California, Washington, Texas, Virginia, and other states in the U.S. owing to the growing popularity of tapioca boba drinks. In April 2021, Mother Pearl Inc., a vegan boba tea shop, launched a line of new beverages with tapioca as a staple ingredient. It offers beverages crafted with plant-based ingredients, activated charcoal, and turmeric tapioca, such as Yuen Yeung 2.0, Very Berry Crush, Taro Mo-latte, and Jasmine Pearl.

However, bursting bubble products are expected to be a faster-growing market during the forecast period. Bursting boba, usually known as popping boba, is a gel-like ball with juice inside, which bursts when chewed. The availability of different flavors of popping boba, such as green apple, strawberry, mango, honey melon, green tea, pomegranate, lychee, and orange, is driving the market. This, in turn, is bolstering the market growth during the forecast period. Moreover, bursting or popping boba is used as a topping in iced milk teas, and frozen yogurt, and used as a substitute for traditional boba in bubble tea owing to its versatility. Thus, it is likely to offer immense growth opportunities for the market.

Distribution Channel Insights

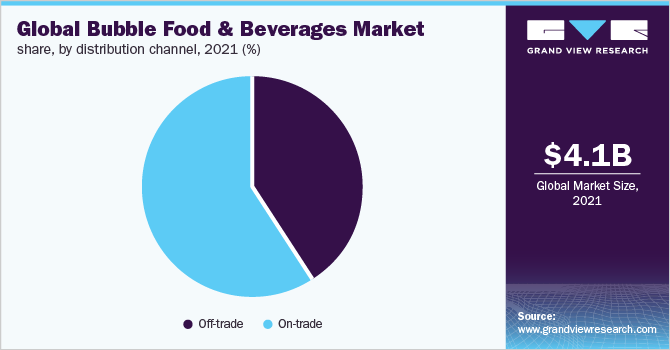

The on-trade segment accounted for the largest share of more than 59.00% of the global revenue in 2021 and is also expected to register the fastest CAGR during the forecast period. The development of on-trade channels has gained momentum owing to the changes in demographics & income, rapid urbanization, and the increasing influence of westernization, which often promote the purchase of trending and handcrafted products. Moreover, rising consumer preference for convenience, hygiene, and high-quality standards has driven the demand for handcrafted bubble food & beverages. High-end or fine dining restaurants and premium shops have become significant players in the on-trade channel as they offer unique dining experiences.

New product and menu development are key for stores to attract customers and differentiate themselves, which has been boosting the segment’s growth. Before the COVID-19 pandemic, high-end restaurants catered mainly to millennials and Gen Z and focused on unique ambiance, appealing interiors, and exquisite foods & exotic beverages. Chefs and consumers are highly concerned about where the foods & ingredients are sourced from and about the cleanliness & hygiene of eateries, which have become major selling points.

The off-trade segment includes online stores, supermarkets & hypermarkets, and others. Rising internet penetration among consumers and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment. In addition, easy accessibility and heavy discounts & offers provided by online platforms boost the sale through online channels. Furthermore, consumers are willing to purchase boba food products through websites, such as Boba Tea Direct, which is a premium seller of boba that offers a large selection of high-quality boba balls for café inventory at wholesale prices.

Regional Insights

The Asia Pacific dominated the global market and accounted for the largest revenue share of around 36.3% in 2021. This is attributed to increased awareness about bubble foods & beverages in countries like China, Thailand, Australia, and New Zealand. Furthermore, an increasing number of product launches in key markets, such as China, Thailand, and Australia, is likely to support segment growth. For instance, in January 2021, DKSH signed an agreement with FES (Vietnam) to promote and distribute the signature Hillway instant bubble tea brand in Thailand. The brand’s products are now accessible to consumers through local supermarkets and convenience stores.

Europe is expected to witness a steady CAGR from 2022 to 2030. Consumer preference for healthy beverages, such as black tea, green tea, oolong tea, and white tea, is expected to fuel the growth of bubble tea, especially in countries like the U.K., France, and Germany. According to an article published by Renolon in January 2022, health-conscious customers account for 25 to 30% of all grocery customers in Europe and the U.S. Moreover, increasing consumer inclination towards vegan products in countries like the U.K. and Germany is anticipated to offer lucrative opportunities for the growth of vegan bubble-based beverages.

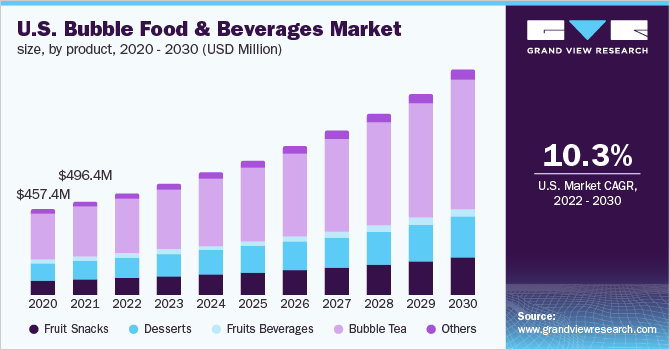

North America is expected to be the second-largest regional market and is expected to witness a significant CAGR from 2022 to 2030. Consumers in the countries, such as the U.S. and Canada, are willing to pay a high price for healthy foods & beverages, which is driving the demand for bubble food & beverages. In addition, the growing number of product launches by key players in the region will complement the overall growth. For instance, in August 2020, Del Monte Foods, Inc. expanded its existing product line of popping boba snacks with a new flavor- Tropical Mixed Fruit Bubble Fruit.

Key Companies & Market Share Insights

The market includes both international and domestic participants.Key market players focus on strategies, such as innovation and new product launches, to enhance their portfolio offering in the market.Some of the prominent players in the global bubble food & beverages market include:

-

Del Monte Foods Inc.

-

Modoo Food Ltd.

-

Bubble Tea Club

-

Bubble Tea House Company

-

Fokus Inc.

-

Gong Cha

-

Chatime

-

Lollicup USA, Inc.

-

Bubble Tea Supply Inc.

-

Ten Ren’s Tea Time

-

Troika JC

-

Boba Box

Bubble Food & Beverages Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.39 billion

Revenue forecast in 2030

USD 8.94 billion

Growth rate

CAGR of 9.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; Australia; New Zealand; Brazil

Key companies profiled

Del Monte Foods, Inc.; Modoo Food Ltd.; Bubble Tea Club; Bubble Tea House Company; Fokus Inc.; Gong Cha; Chatime; Lollicup USA, Inc.; Bubble Tea Supply Inc.; Ten Ren's Tea Time; Troika J C; and Boba Box.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global bubble food & beverages market report based on product, source, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruit Snacks

-

Desserts

-

Fruits Beverages

-

Bubble Tea

-

Others

-

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Tapioca-based

-

Bursting Bubble

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Off-trade

-

Hypermarkets & Supermarkets

-

Online

-

Others

-

-

On-trade

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bubble food & beverages market size was estimated at USD 4.05 billion in 2021 and is expected to reach USD 4.39 billion in 2022

b. The global bubble food & beverages market is expected to grow at a compound annual growth rate of 9.2% from 2022 to 2030 to reach USD 8.94 billion by 2030

b. Asia Pacific dominated the bubble food & beverages market with a share of 36.3% in 2021. This is attributable to consumers, most notably in China and Japan, who are increasingly inclining toward bubble food & beverages, which in turn is fueling the market's growth.

b. Some of the key players in the market are Del Monte Foods, Inc.; Modoo Food Ltd.; Bubble Tea Club; Bubble Tea House Company; Fokus Inc.; Gong Cha; Chatime; Lollicup USA, Inc.; Bubble Tea Supply Inc.; Ten Ren's Tea Time; Troika J C; and Boba Box

b. Key factors that are driving the bubble food & beverages market growth include rising health-consciousness among consumers, along with increasing awareness about the numerous health benefits associated with boba consumption, which has been driving the growth of the global market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."