- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Buildtech Textiles Market Size & Share, Industry Report, 2019-2025GVR Report cover

![Buildtech Textiles Market Size, Share & Trends Report]()

Buildtech Textiles Market Size, Share & Trends Analysis Report By Raw Material (Natural, Synthetic), By Product (Woven, Non-woven), By Application (Residential, Non-residential), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-117-7

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Industry Insights

The global build tech textiles market size was valued at USD 12.87 billion in 2018 and is expected to register a CAGR of 5.8% over the forecast period. Rising awareness regarding sustainable construction is estimated to drive the demand. Also, increasing investments in civil engineering structures are anticipated to complement market growth.

Buildtech textiles include the composite materials and textiles used in the construction of permanent as well as temporary building structures. These products have applications in the construction industry for concrete reinforcement, interior construction, roofing materials, insulation, noise prevention, and air conditioning.

Buildtech textiles are waterproof, crack-resistant, and offer heat insulation. As a result, the demand for the product in the construction of residential buildings is expected to augment over the forecast period. Also, a rise in incidents of natural calamities, such as wildfire and hurricanes, hitting various parts of the U.S. is anticipated to drive the construction industry, thereby having a positive impact on the demand for build tech textiles over the forecast period.

Buildtech textiles are primarily made from natural or synthetic fibers. The major synthetic fibers include HDPE (high-density polyethylene), PET (polyethylene terephthalate), polypropylene, polyethylene, and nylon. Buildtech textiles have applications in residential and non-residential construction owing to their diversified characteristics such as crack resistance, heat & sound insulation, and membrane structure.

Cost-effectiveness and longer lifespan of build tech textiles as compared to other materials are projected to drive the product demand over the forecast period. Besides, initiatives by foreign regulatory bodies and promotional policies have aided in increasing the awareness related to the benefits offered by the product, thereby complementing market growth.

The construction spending by public, private, and PPP investors has witnessed significant growth in the emerging markets, whereas advanced economies have stabilized over the last few years. Furthermore, the demand for build tech textiles is rising on account of the hefty investments coupled with initiatives taken by the government in implementing the product in upcoming construction projects.

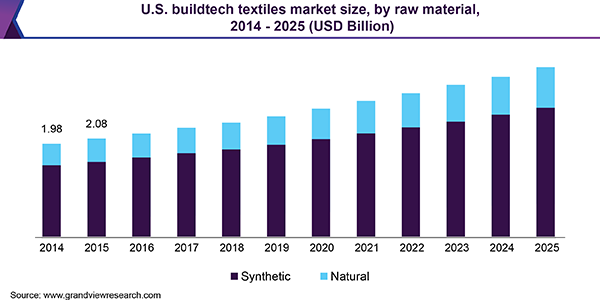

Raw Material Insights

Synthetic build tech textiles are manufactured majorly from polymers such as polyethylene, polyamide, polypropylene, and polyester. However, commercially used polymers for manufacturing the product include polypropylene and polyester on account of their superior properties as compared to their counterparts.

HDPE fibers dominated the overall market accounting for around 27.1% of the revenue share in 2018 on account of its chemical resistance during their exposure in construction. However, increasing expenditure for the development of bio-based polymers on account of the rising concerns over greenhouse gas emissions is estimated to boost the demand for bio-polyethylene as raw materials.

The demand for polypropylene as a raw material for build tech textiles is high and the trend is anticipated to continue over the forecast period on account of the superior properties including chemical inertness, high stretchability, and recyclability exhibited by the polymer as compared to its counterparts.

Nylon is anticipated to witness growth at a CAGR of 5.2% in terms of revenue, from 2019 to 2025, on account of the raw material properties including high tensile strength, high elasticity, and excellent resistance to abrasion. Also, the high durability of nylon grade fibers is likely to have a positive impact on the segment growth over the forecast period.

Product Insights

Knitted build tech textiles are estimated to reach USD 3.58 billion by 2025, on account of its increasing penetration in building construction for preventing corrosion. Also, knitted fabrics are laid easily on the construction sites owing to its easy handling ability, which enables lower labor costs, thereby augmenting its demand over the forecast period.

Nonwoven fabrics provide high vapor and moisture permeability along with high tensile strength absorbency, which enables increased product penetration in building construction, thereby complementing build tech textiles market growth. Furthermore, high tear-strength and multi-directional elongation of nonwoven fabrics aids in driving the product demand over the forecast period.

Nonwoven products dominated the building tech textile market contributing to around 40% of the revenue share in 2018, owing to their unique properties such as absorbency, liquid repellency, and mechanical strength. Also, the nonwoven textiles are manufactured without the conversion of fabric into yarn, thereby reducing the manufacturing cost and encouraging the entry of new players in the market.

Coated fabrics used as a part of build tech textiles are waterproof and provide resistance against fire as they are manufactured using polyvinyl chloride (PVC) and Polytetrafluoroethylene (PTFE). Also, rapid technological development in the construction industry has resulted in the adoption of various fabrics such as fiberglass, knitted spacer, and laminated fabrics.

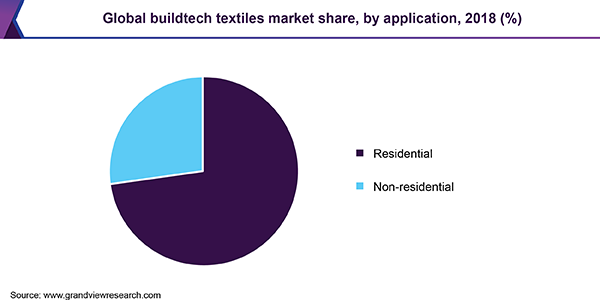

Application Insights

The demand in non-residential construction is estimated to witness a CAGR of 5.5%, in terms of revenue, from 2019 to 2025, on account of the product’s ability to provide aesthetic appeal to the buildings. Also, increasing demand for office spaces in various developing and developed economies including Canada, India, Japan, and the U.K. is anticipated to boost commercial construction, thereby positively impacting the application of build tech textiles in the non-residential segment.

The demand is driven by steady growth in construction and refurbishment activities in key sectors such as housing, offices, educational institutes, hotels and restaurants, resorts, transport buildings, and online retail warehousing. Also, the product is used in the form of architectural membranes in various buildings such as cafes, storage facilities, and outdoor entertainment areas as these products protect against heat, UV rays, wind, and rain.

Residential construction is estimated to witness significant growth on account of favorable demographic and sociological factors including high birth rate, increased life expectancy, and a growing aging population. Rapid growth in the construction of residential buildings coupled with increasing awareness regarding the advantages of build tech textiles is anticipated to complement the segment growth.

The waterproofing property of the product aids its penetration in several applications including house wraps, wall cavities, and reinforcement. The increased rate of international and domestic migration in the region is expected to boost the demand for housing, thereby propelling residential construction. This, in turn, is likely to have a positive impact on the demand to build tech textiles in residential construction.

Regional Insights

France is expected to witness a CAGR of 5.6%, in terms of revenue, from 2019 to 2025 owing to the rapid growth in residential construction, which is driven by long-standing favorable demographic and sociological factors including high birth rate, increased life expectancy, and growing aging population, thereby bolstering the product demand.

Increased construction activities in Europe due to low mortgage rates are expected to propel the demand for build tech textiles in the form of tarpaulins, awnings, and canopies in new construction as well as renovation activities. However, increased uncertainty over trade policies between China and the U.S., declining construction spending in the Netherlands, and deteriorating non-construction investments in Italy are some of the factors anticipated to result in decelerating growth in the construction industry, thereby hampering the market growth.

The implementation of China’s 13th Five-Year Plan (2016 - 2020) for social and economic development aims to optimize the energy system, promotion of energy consumption reform, as well as to build a clean, safe, decarbonized, and efficient modern energy system. This plan is expected to encourage the consumption of energy-efficient products, thereby propelling the demand for build tech textiles at a CAGR of 6.8%, in terms of revenue, from 2019 to 2025, to reduce the energy consumption of buildings by maintaining insulation.

The construction industry in Central & South America is expected to witness substantial growth on account of the increasing investments in various infrastructure projects by foreign and domestic private players in the region. Rapid developments in the construction industry coupled with increased awareness among builders regarding the product properties are anticipated to complement the market growth.

Buildtech Textiles Market Share Insights

DuPont, Ahlstrom-Munksjö, SKAPS Industries, Toray, SRF Limited, and 3M are the major market players. These companies have a widespread geographic presence with sales offices or manufacturing facilities located globally to supply the knitted, woven, and nonwoven products.

Various factors including the expansion of production facilities in the emerging markets of the Middle East and the Asia Pacific regions is likely to aid the major companies to gain a competitive edge over their competitors. Also, the formation of strategic alliances with raw material and equipment manufacturers in the value chain by the build tech textiles manufacturers helps in ensuring uninterrupted production.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in kilotons, revenue in USD million and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, France, Germany, Italy, Russia, Spain, U.K., China, India, Japan, South Korea, Australia, Brazil, South Africa

Report coverage

Volume and revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global build tech textiles market report based on raw material, product, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Natural

-

Synthetic

-

HDPE

-

PET

-

Nylon

-

Polyethylene

-

Polypropylene

-

Others

-

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Woven

-

Non-woven

-

Knitted

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Residential

-

Non-residential

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."