- Home

- »

- Next Generation Technologies

- »

-

Burglar Alarm Systems Market Size & Growth Report, 2030GVR Report cover

![Burglar Alarm Systems Market Size, Share & Trends Report]()

Burglar Alarm Systems Market Size, Share & Trends Analysis Report By Type (Wireless, Wired), By Component, By Application (Commercial & Industrial, Residential), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-944-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global burglar alarm systems market size was valued at USD 4.16 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. The intruder alarm systems have significantly developed in recent years. Advanced technologies such as artificial intelligence (AI), internet of things (IoT) have disrupted the overall security systems market. Future technologies, such as the Internet of Things (IoT), enable the introduction of smart homes. Furthermore, advances in sensor data fusion technology have raised end-user demand for advanced security systems.

For instance, in November 2022, Arlo Technologies, Inc., an American company providing wireless surveillance cameras announced the release of the Arlo Home Security System. The home security system features a new, all-in-one multi-sensor with the capability of eight distinct sensing functions.

Market growth for burglar alarm systems has been rapid as technology improves every year, making the industry more effective. Burglar alarm systems are integrated into residential security systems, home security, and building management solutions to provide a secure foundation by lowering costs. Integration of intruder alarm systems with video security systems is a prevailing market trend.

Companies such as Honeywell, Assay Abloy, Johnson Controls, and others are constantly developing and optimizing intelligent sensor technologies to cater to the varying security demands of end-user. In addition, UL 634 is the standard for the connectors and switches used in alarm systems. Level 1 and level 2 refer to switches with advanced tamper protection and defeat resistance. While designing a security, access control system, or door protection system, reference to UL 634 is the standard approach for understanding the level of detection and tamper supervision.

Market players are prioritizing partnerships & collaborations with home security service providers to expand product offerings and services. For instance, in October 2021, ADT partnered with Redfin, a full-service real estate brokerage provider, to offer innovative home services and security monitoring for homes. The partnership will allow ADT to install sensors, alarms, and smart locks, by delivering insights into customer data. Further, this partnership would benefit the company to scale its business by providing home security solutions to Redfin customers and strengthening its position in the market.

COVID-19 Insights

The alarm industry across the globe witnessed a moderate demand in the year 2020. The residential segment was observed to be the potential customer of security systems. New business models, the presence of tech giants, and changing consumer preferences have increased the adoption of alarm security solutions. Amid the COVID-19 pandemic, the global burglar alarm systems market exhibited steady growth attributed to the supply chain disruptions led by lockdowns imposed by governments worldwide. As a result, the hardware segment witnessed sluggish growth during 2020.

Technological advancements such as audio analytics, voice control, and video analytics encourage market players to adopt new business strategies such as partnerships and collaboration to grab market opportunities. For instance, in January 2022, Johnson Controls announced the acquisition of FogHorn Systems, an Edge AI software solution provider for commercial and industrial Internet of Things (IoT) solutions. Through this acquisition, Johnson intends to accelerate innovation for smart autonomous buildings by merging OpenBlue technology with Foghorn. Such significant partnerships are likely to create lucrative opportunities for alarm system providers.

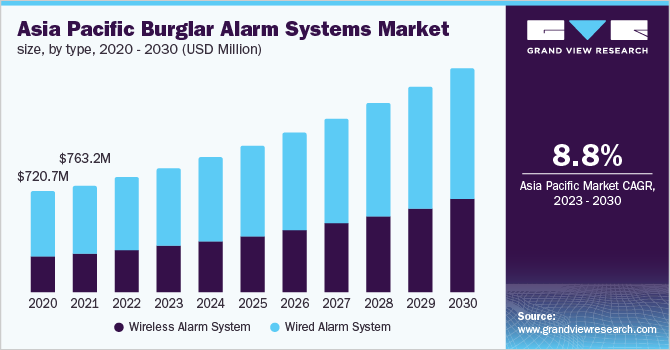

Type Insights

The wired alarm segment accounted for the largest revenue share of over 63% in 2022. Wired intruder alarms are in higher demand however, wireless intruder alarms are more convenient to install. Intruder alarms have been more popular in recent years due to technological advancements and safety concerns. Furthermore, some technologies used in intruder alarms include electrical field, vibration, audio, capacitance, and photoelectric beam sensors.

For instance, in May 2022, Hangzhou Hikvision Digital Technology Co., Ltd., announced the release of a new AX Hybrid PRO alarm system. The system provides a combination of wired protection, delivering boosted flexibility with seamless wireless integration. The alarm system is suitable in varied scenarios including factories, banks, offices, and retail stores.

The wireless alarm segment is expected to exhibit the highest CAGR over the forecast period. Wireless commercial security systems offer a more comprehensive range of exclusive protection features, lower installation costs, and relatively simple upgrades than wired systems.

For instance, in October 2021, Inovonics Wireless Corporation announced the availability of the Inovonics mobile duress, which is meant to offer accurate interior room and floor level location when an Inovonics pendant is activated. Developed on the Inovonics cloud platform, the solution combines dependable hardware with sophisticated API and software capabilities for data access and easy integration.

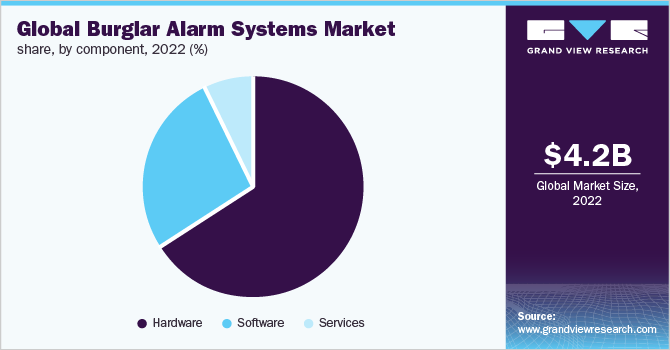

Component Insights

The hardware segment led the market in 2022, accounting for over 65% share in 2022. Alarm sensors have the most significant market share in terms of hardware. As the market evolves and moves toward cloud-based security systems, customers are anticipated to prioritize wireless security systems.

For instance, in April 2022, RISCO Group, a provider of cloud-based security systems, obtained ISO 27001 accreditation for cloud and interactive services relating to security, smart home solutions, and building management. The certification acknowledges the company's enormous efforts and significant investments to safeguard and enhance privacy and data security from cyber-attacks.

The software segment is expected to exhibit the highest CAGR over the forecast period. For instance, in May 2021, Sabec, the company that transformed the Nintendo Switch into a scientific calculator, released Spy Alarm, a new burglar alarm software for the Nintendo Switch. Spy Alarm uses the infrared sensor on the right Joy-Con to create an invisible beam. When someone or something trips the tripwire, your Switch will sound an alarm, and the incident will be recorded in the app.

Burglar alarm system providers are prioritizing spending on smart technologies. It includes artificial intelligence (AI) and the internet of things (IoT) to deliver comprehensive alarm systems to the end-users. The market players are focused on integrating wireless systems options and remote monitoring tools with burglar alarm systems, which is likely to drive the demand for security software solutions. Further, burglar alarm systems require an array of specific products, including sensors, network systems, and alarm systems supported by by-product services.

Application Insights

The residential segment led the market in 2022, accounting for over 55% share of the global revenue. Intruder alarm systems are gaining traction across the residential and commercial segments. Banking, healthcare, and education are likely to be the most susceptible industries. To offer efficient alarm systems, organizations have released several product standards.

For instance, in November 2022, Kami Vision, an AI services company announced Kami Pro Security, an industrial grade, video alarm system for application in small businesses and residences. The alarm system utilizes 24/7 professional monitoring services and vision AI to detect invaders and circulate verified video in real time through an app.

The commercial & industrial segment is expected to exhibit the highest CAGR over the forecast period. Business locations are typically high-traffic regions with higher crime rates, and burglars may find commercial properties appealing. The surrounding environment also influences its safety since other businesses have implemented security measures.

As a result, commercial intruder alarm systems are sophisticated and extensive, and these systems are often designed to protect much more significant areas. Multiple layers of security systems, such as video surveillance cameras and controlled access cards, are installed throughout the facility.

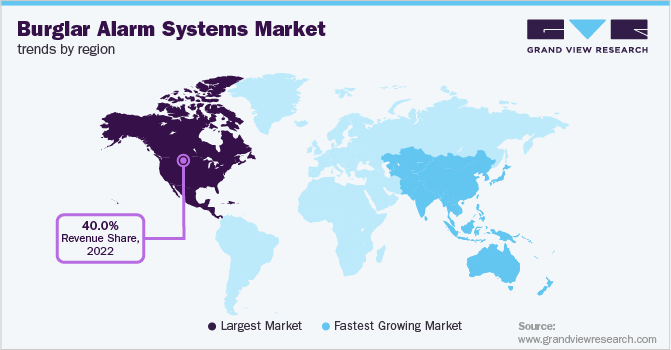

Regional Insights

North America dominated the market in 2022, accounting for over 40% share of the global revenue. North America is analyzed across three countries in the market study, including the U.S., Canada, and Mexico. Market players are expanding their footprints across the region through mergers and acquisitions.

For instance, in September 2021, ASSA ABLOY acquired Spectrum Brands, Inc., segment hardware and home improvement. Spectrum Brands, Inc. is a U.S.-based company and a provider of residential security solutions. The acquisition is likely to expand ASSA ABLOY’s product portfolio and reinforce its position in the residential sector in the North America region.

Substantial expansion of real-estate and IT sectors across Asia Pacific is anticipated to drive the demand for smart alarm systems. In recent years, home security solutions and services are witnessing an increasing demand from countries including India, Japan, Singapore, and others, which is likely to contribute to the market growth across the region. Furthermore, several security rules and standards released by the government would support the market across Asia Pacific. Technological innovations are expected to contribute to China's significant market share.

The Europe market is expected to showcase significant growth over the forecast period. In Europe, there is a strong influence of burglar alarm systems manufacturers focused on producing technically advanced alarm systems to attract a variety of commercial office spaces and residential townships.

Implementing a high-quality security entry system to prevent intruders and potential robberies is among the crucial drivers driving the burglar alarm systems industry in the region. As a result of the Covid-19 pandemic, demand for alarm monitoring-based digital applications in the residential sector is expected to gain traction. With increased demand from commercial and retail sectors, the MEA region's burglar alarm systems market is expected to rise.

Key Company & Market Share Insights

The global burglar alarm systems market comprises several multinational and regional service providers who constantly improve their market position. The activities of market players are inclined toward strategic partnerships, collaborations, mergers & acquisitions.

For instance, in July 2021, Securitas AB announced the acquisition of Tepe Security, a well-known electronic security firm in Turkey. Securitas gains the number two position in Turkey's monitoring market due to this acquisition, which aligns with the Group's aim of expanding its electronic security and security solutions sales by 2023. Some prominent players in the global burglar alarm systems market include:

-

ADT

-

ASSA ABLOY

-

Banham

-

Hangzhou Hikvision Digital Technology Co., Ltd.

-

Honeywell International, Inc

-

Inovonics Wireless Corporation

-

Johnson Controls

-

Securitas AB

-

Siemens

-

Risco Group

-

Napco Security Technologies, Inc.

Burglar Alarm Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.39 billion

Revenue forecast in 2030

USD 6.72 billion

Growth Rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil

Key companies profiled

ADT; ASSA ABLOY; Banham; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International, Inc; Inovonics Wireless Corporation; Johnson Controls; Securitas AB; Siemens; Risco Group; Napco Security Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burglar Alarm Systems Market Segmentation

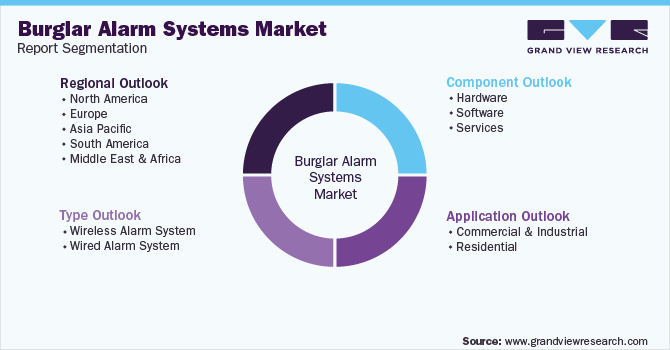

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global burglar alarm systems market report based on type, component, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Wireless Alarm System

-

Wired Alarm System

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Central Monitoring Receiver

-

Remote Terminal Unit

-

Alarm Sensors

-

Motion Detection Sensors

-

Door/Windows Sensors

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial & Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global burglar alarm systems market was valued at USD 4.16 billion in 2022 and is expected to reach USD 4.39 billion in 2023.

b. The global burglar alarm systems market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030 and is anticipated to reach USD 6.72 billion by 2030.

b. North America dominated the burglar alarm systems market with a share of 40.1% in 2022. North America is analyzed across three countries in the market study, including the U.S., Canada, and Mexico. Market players are expanding their footprints across the region through mergers and acquisitions.

b. Some key players operating in the burglar alarm system market include ADT, ASSA ABLOY, Banham, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc, Inovonics Wireless Corporation, Johnson Controls, Securitas AB, Siemens, Risco Group, Napco Security Technologies, Inc.

b. Key factors that are driving the burglar alarm system market increasing adoption in developed countries, automated & electrified surveillance systems, and a rise in security concerns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."