- Home

- »

- Pharmaceuticals

- »

-

Burn Ointment Market Size, Size, Industry Report, 2020-2027GVR Report cover

![Burn Ointment Market Size, Share & Trends Report]()

Burn Ointment Market Size, Share & Trends Analysis Report By Product (Topical Antibiotics, Silver, Iodine), By Depth Of Burn (Minor, Partial Thickness), By End Use (Hospitals, Clinics), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-040-4

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

The global burn ointment market size was valued at USD 813.7 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2020 to 2027. Favorable reimbursement policies, technological advancements, and the rising incidence of burn cases are some of the key factors responsible for market growth. In addition, rising awareness regarding various treatment options is also anticipated to drive the market. Increasing incidences of blaze wounds are anticipated to fuel the demand for cost-effective ointments over the forecast period. According to the data published by WHO, on an average 265,000 deaths are caused by burns every year. The majority of these deaths occur in low to middle-income countries and half of them occur in South East Asia. Moreover, around 1,000,000 people in India are moderately or severely burnt and around 173,000 children in Bangladesh are burnt each year. It also reported that in the U.S., approximately 4,500 burn victims die annually and 10,000 die due to blaze wounds.

Owing to this substantial increase in the number of blaze incidences, the patient population for wound care and treatment has increased. This in turn is expected to drive demand for blaze wound ointment over the forecast period. According to the American Burn Association (ABA), blaze wounds are responsible for 43.0% of the total burn admissions to burn centers. Scalding is caused by hot liquids or gases and most commonly occurs from exposure to high-temperature tap water in baths or showers, hot cooking oil, steam, and hot drinks. Children are particularly at risk of accidental burns. The number of affected layers of skin, show the severity of the blaze wound.

Due to the rising incidences of blaze wounds, the demand for various treatment options is increasing and as a result, the overall healthcare expenditure on blaze wound care is increasing. Treatment options for blaze wound care include advanced dressings, biologics, and traditional blaze wound care products. Burn ointments are used as first aid in hospitals as well as home-care setting.

Increasing awareness level among the people regarding various treatment options related to blaze wound care is also a key factor driving the market over the forecast period. The market is also gaining pace owing to the rising willingness among the people to spend more and opt for new advanced blaze wound care products especially in the case of patients affected with burns. Various types of burn ointments available in the market are topical antibiotics, silver, and iodine-based products.

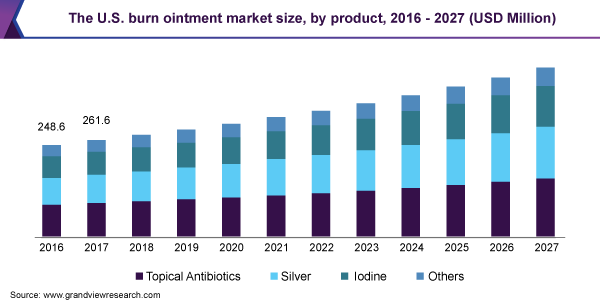

Product Insights

The topical antibiotics segment held the largest market share of 34.7% in 2019 and is anticipated to witness significant growth over the forecast period. The segment growth is majorly driven by the high usage of this product in home-care settings and the rising incidence of blaze wounds across the globe. Some of the topical antibiotics available in the market are Mafenide acetate, Bacitracin, Mupirocin, Neosporin, Polymyxin B, Nitrofurazone, and Nystatin.

The silver-based ointment segment is anticipated to witness the fastest growth over the forecast period. This ointment is used in the treatment of second and third-degree burn wound infections. It is used in killing bacteria on the wounds and prevents its growth. Some of the silver-based ointments are Silver nitrate, Silver sulfadiazine, Silver foams, Flammacerium, Acticoat 7, Aquacel-Ag, Silvercel, and Silver amniotic membrane.

End-use Insights

The hospital segment dominated the burn ointment market and accounted for the largest share of 41.8% in 2019. This is owing to the increasing incidence of blaze wounds and hospitalizations each year. According to NCBI, approximately 486,000 people are affected by blaze wounds every year. According to CDC, over 40,000 severely burned patients are hospitalized each year in the U.S. Moreover, according to a study published by NCBI, in Africa, 18.0% of the hospitalizations are due to burns (2011). The rising incidence of blaze wounds is expected to drive demand for ointments.

Furthermore, hospitals provide advanced blaze wound care ointments, which contribute to the overall growth of the segment. Hospitals also provide a large array of treatment options pertaining to blaze wound care. The hospitals follow the 504 DRG to provide quick reimbursements for burn-affected patients from the Medicare program. All the aforementioned factors are responsible for the rising demand for blaze wound ointments in hospitals.

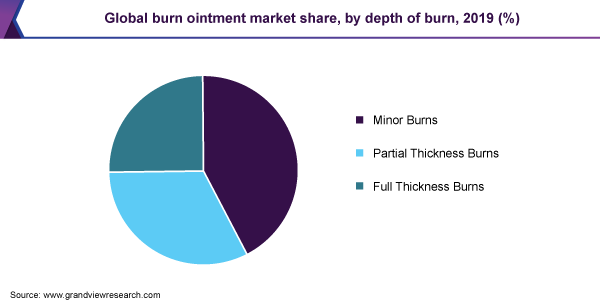

Depth Of Burn Insights

The minor burn segment dominated the market and held the largest market share of 42.0% in 2019. Minor burns are superficial and affect only the outermost layer of the skin. Any burn less than 10.0% of the Total Body Surface Area (TBSA) is termed as a minor burn. According to the National Center for Injury Prevention and Control, 1.2 million people in the U.S. are affected by blaze wounds annually. This, in turn, is anticipated to drive demand for ointments to treat minor blaze wounds over the forecast period.

The partial thickness burn segment is anticipated to witness the fastest growth over the forecast period. Partial thickness burns are those that are greater than 10.0% and less than 30.0% of Total Body Surface Area (TBSA). Partial burns affect the dermis and epidermis layers of the skin. These burns are serious and have a high risk of infections due to which they should be properly treated in consultation with a healthcare professional. According to the U.S. FDA, approximately 40,000 people are hospitalized each year due to partial burns.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 42.0% in 2019. The region is expected to witness a CAGR of 6.0% over the forecast period. Increasing incidence of burns and rising awareness regarding various treatment options of burn wounds are expected to drive demand for blaze wound ointments in the region. Moreover, the presence of key market players in this region, focusing on strategic initiatives such as the launch of new products and mergers and acquisitions, is expected to create lucrative growth opportunities in the region.

In Asia Pacific, the market is anticipated to witness the fastest growth over the forecast period. According to WHO, the incidence of blaze wounds that require immediate medical attention is approximately 20 times higher in the Western Pacific region in comparison with the Americas. The increase in the incidence of blaze wounds is a major factor boosting the market in this region. The presence of supportive government initiatives such as the Asia Pacific Burn Congress and high untapped opportunities are among the key factors expected to propel the growth of the market in the region over the forecast period.

Key Companies & Market Share Insights

Key companies are stressing on research and development to develop technologically advanced products to gain a competitive edge. Companies are engaging in partnerships, mergers, and acquisitions, aiming to strengthen their product portfolio, manufacturing capacities, and provide competitive differentiation. Moreover, the key competitors are launching various initiatives to spread awareness regarding various blaze wound care treatment. For instance, in December 2016, Smith and Nephew successfully completed its wound care Academy in the Kingdom of Saudi Arabia to enhance wound care knowledge of healthcare professionals. Some of the prominent players in the burn ointment market include:

-

Johnson & Johnson

-

Sun Pharmaceutical Industries Ltd.

-

Dr.Morepen

-

Smith & Nephew

-

ConvaTec Inc.

Burn Ointment Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 860.1 million

Revenue forecast in 2027

USD 1.3 billion

Growth Rate

CAGR of 6.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, depth of burn, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; The Middle East & Africa (MEA)

Country scope

The U.S.; Canada; The U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Johnson & Johnson; 3M; Integra LifeSciences Corporation; Smith and Nephew; ConvaTec Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global burn ointment market report on the basis of product, depth of burn, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Topical Antibiotics

-

Silver

-

Iodine

-

Others

-

-

Depth of Burn Outlook (Revenue, USD Million, 2016 - 2027)

-

Minor Burns

-

Partial Thickness Burns

-

Full Thickness Burns

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospital

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global burn ointment market size was estimated at USD 813.74 million in 2019 and is expected to reach USD 860.13 million in 2020.

b. The global burn ointment market is expected to grow at a compound annual growth rate of 6.1% from 2020 to 2027 to reach USD 1.30 billion by 2027.

b. North America dominated the burn ointment market with a share of 42.00% in 2019. This is attributable to the increasing incidence of burns and rising awareness regarding various treatment options for burn wounds.

b. Some key players operating in the burn ointment market include Johnson & Johnson, 3M, Integra LifeSciences Corporation, Smith & Nephew, and ConvaTec Inc.

b. Key factors that are driving the market growth include a rising number of burn cases, technological advancements, and increasing awareness regarding various treatment options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."