- Home

- »

- IT Services & Applications

- »

-

Business Software And Services Market Size Report, 2030GVR Report cover

![Business Software And Services Market Size, Share & Trends Report]()

Business Software And Services Market Size, Share & Trends Analysis Report By Software, By Service, By Deployment (Cloud, On-premise), By End Use, By Enterprise Size, By Region, And Segment Forecasts 2023 - 2030

- Report ID: GVR-3-68038-149-8

- Number of Pages: 161

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global business software and services market size was valued at USD 474.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.9% from 2023 to 2030. The demand for business software and services is expected to be driven by the rapid increase in the volume of enterprise data and the increased automation of business processes across end-use industries such as retail, manufacturing, healthcare, and transportation. The increased deployment of enterprise software and services across IT infrastructure, to facilitate better decision-making, inventory cost reduction, improved profitability, and improved market position for businesses, is also expected to benefit the market.

Business expansion initiatives of several organizations across the world are also fueling the demand for the market. The rapidly rising use of cloud platforms, thanks to benefits such as flexibility, cost-effectiveness, and mobility, has sparked demand for cloud-based software solutions and services among small and medium-sized businesses. Furthermore, the market is predicted to benefit from the rising usage of innovative technologies such as blockchain, hybrid architecture, artificial intelligence, and machine learning over the forecast period.

Enterprise software and services are widely utilized in end-use industries such as BFSI, government, healthcare, manufacturing, and retail as they facilitate the simplification of corporate operations. To accomplish data privacy and security goals, business software and services provide easy and quick access to unstructured data obtained through data analytics. Furthermore, the implementation of enterprise solutions leads to a significant reduction in raw material and inventory costs, allowing businesses to boost their profitability. Many businesses are implementing business solutions to improve their operational efficiency by combining administrative systems into a single software. Departmental data is linked with real-time updates in business solution modules, resulting in improved data transparency. Businesses select the software and solutions best suited to their requirements.

The COVID-19 pandemic had a favorable impact on the commercial software and services market. According to an NTT Ltd. report commissioned by International Data Group, Inc. (IDG), the institutionalization of the work-from-home model amid local and worldwide quarantines has boosted the demand for value-added services for mitigating security concerns. Organizations globally have turned to business software and service providers for a variety of services and solutions for help with the transition, and the trend is expected to continue in the near future as well. For instance, in January 2022, Microsoft Corporation announced new frontline worker-focused features for Microsoft Teams and Microsoft Viva. Microsoft collaborated with Zebra Reflexis, Inc. to time off requests and streamline shift scheduling to run the business. Several industries, such as healthcare and retail, would benefit from the additional feature.

The market's expansion could be hampered by higher authorization prices and the need for quick assistance. The cost of licensing a solution does not include the cost of software development. The cost of solution maintenance and support is included in the normal software price, and additional integration and personalization often result in higher maintenance and support costs. Additional costs are incurred by businesses for timely maintenance and frequent updates.

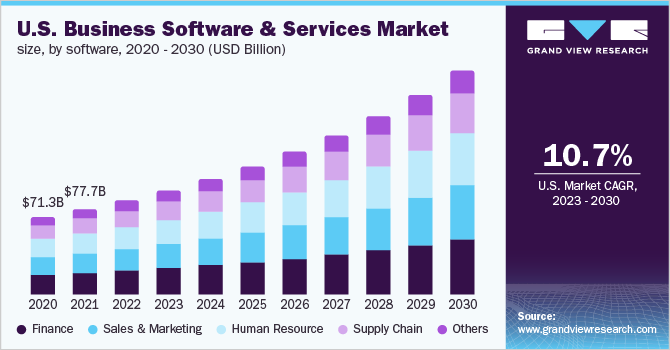

Software Insights

The finance segment dominated the market and held the largest revenue share of over 25.0% in 2022. The market is anticipated to gain from the increasing need for financial management tools in businesses and enterprises for tasks like planning, budgeting, analyzing, and reporting. Financial management software is frequently utilized in North America's BFSI sector to reduce risk, increase productivity, and enhance corporate operations. Additionally, the market will have significant growth potential throughout the forecast period due to the rising number of mobile applications that facilitate financial data management and offer a variety of additional use cases connected to financing.

The human resource segment is anticipated to experience considerable growth over the forecast period due to the widespread use of this software across numerous end-use industries. The integration and computerization of corporate solutions help human resource tasks, including training, payroll, and recruitment. Due to the organizational advantages, many payroll associations employ HRM systems, including ADP Canada, ASL Consulting, Apex Time Solutions, and CADJPRO Payroll Solutions. Additionally, as businesses seek to increase productivity, they increasingly choose business software to handle HR-related tasks because it offers insights into the workforce and enhances the employee experience.

Service Insights

The support and maintenance segment dominated the market and held the largest revenue share of over 40% in 2022. This is due to both the rise in popularity of business management systems and the introduction of software-based business models for identifying and addressing problems with product quality. The market is anticipated to grow due to the rising demand for third-party support & maintenance services due to its affordability and availability of skilled professionals. Additionally, significant smartphone application advancements would be expected to boost software support and maintenance services demand.

The managed services segment is anticipated to be the fastest over the projection period. The managed services market is expected to gain from businesses' growing reliance on IT infrastructure and resources to increase the effectiveness of their operations. The consulting services segment is anticipated to experience significant growth during the forecast period. There has been a surge in demand from companies seeking assistance with risk management and identifying potential growth opportunities for the segment to expand.

Deployment Insights

The on-premise segment dominated the market and held the largest revenue share of over 60% in 2022. The rising need for business software and services that allow for software customization by client requirements is anticipated to be the primary driver of on-premise deployment demand in the projection year. Additionally, companies from developing countries choose the on-premise deployment model for its improved data protection. As a result, demand for on-premise software solutions has increased over the past few years.

Since manual software upgrades are no longer necessary and customers can readily access data from faraway locations, cloud services are widely used on the global market. Utilizing and paying for only the resources they use, cloud-based services let organizations operate more efficiently and with less energy consumption. Additionally, the government's carbon emission reduction regulations encourage businesses to employ cloud-based services, which is expected to boost growth prospects for the segment. Moreover, the popularity of hybrid cloud deployment is predicted to increase during the projection period due to the affordability of cloud-based subscriptions.

Enterprise Size Insights

The large enterprise segment dominated the market and held the largest revenue share of over 60% in 2022. Large businesses use business software and services to improve internal and external company processes. Moreover, large enterprises use business solutions and services for analytical engines, real-time data compilation tools, and process blueprints. The segment's growth is further aided by large companies' increased focus on improving departmental productivity on an individual level and the ensuing installation of various business software.

The growing demand among organizations for efficient networking solutions and automation capabilities is anticipated to fuel the need for enterprise software and services in large enterprises. The rising significance of strategic decisions and allocating resources is another factor expected to fuel the segment's expansion. Due to an increase in government initiatives, including digital campaigns like social media marketing, video marketing, and search engine marketing, the SME category is anticipated to expand.

For instance, in September 2021, the Infocomm Media Development Authority and the Personal Data Protection Commission, Singapore (PDPC) collaborated to develop the Better Data-Driven Business program (BDDB) to help SMEs acquire deeper consumer insights and scale up their businesses. The user-friendly business intelligence tool under the BDDB program incorporates basic data protection practices to help organizations generate insights from existing business data.

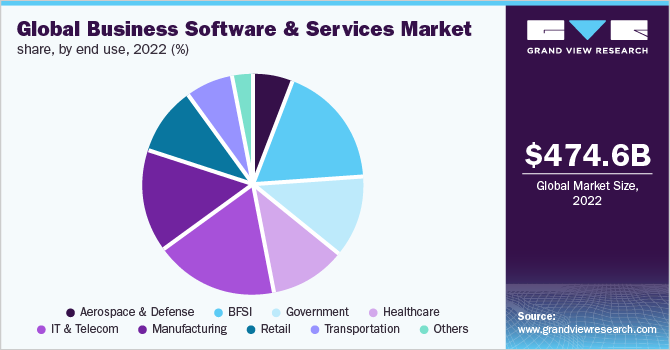

End-use Insights

The BFSI segment dominated the market and held the largest revenue share of over 15% in 2022. The growth is attributed to the growing use of corporate software, which offers advantages, including secure transactions and continuous access to client databases while enhancing the customer experience. Additionally, the category growth is anticipated to be fueled by a rise in the automation and digitization of banking institutions to streamline complicated and crucial procedures and offer a better customer experience.

The IT & telecom segment is expected to grow rapidly over the forecast period. This can be attributed to the increasing demand for re-evaluating strategies and sophisticated technology from businesses across a range of industries. Various companies are growing their business operations to serve wider markets, creating the demand for business solutions and services that allow organizations to efficiently provide solutions to their consumers. The growing government support for the digital transformation of businesses in developing economies is encouraging IT & telecom companies to develop newer software solutions, driving the segment growth.

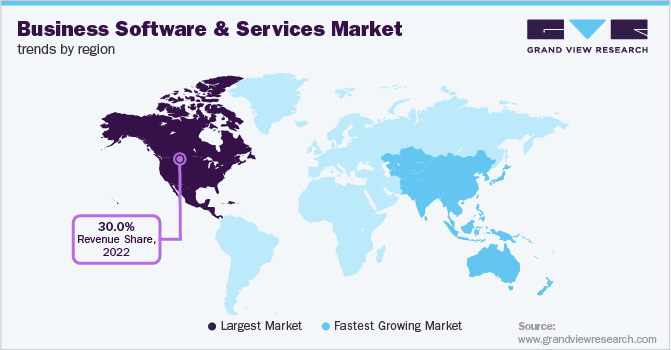

Regional Insights

North America dominated the global market with a share of over 30.0% in 2022. Increasing high-speed data network demand and several software vendors are attributed to the region's market growth. In North America, companies are also heavily investing in software and analytics projects. Additionally, the area contains a sizable population of software engineers, data analysts, and computer scientists who specialize in enterprise solutions and services.

Europe had the second-largest proportion of the worldwide market in 2021. Major investments in software and services by large companies, along with the adoption of new technologies across industries, have contributed to the positive growth of the regional market. Due to the region's growing emphasis on cloud-based services and efforts to create business intelligence solutions, the need for enterprise solutions is also predicted to rise. For instance, in December 2021, European Commission collaborated with European computing tech companies. The European Commission launched its new alliance for industrial Data, edge, and cloud. Energy-efficient, highly secure, and interoperable EU solutions enable businesses and public administrations to process data and strengthen the EU industry's position in the market.

Key Companies & Market Share Insights

The need for many rising country businesses to adhere to extremely strict regulatory laws has led to the introduction of business software and services. They facilitate the expansion of operations and increase output levels of companies while simplifying their internal processes. Increasing company policies, professional standards, and data portability drives the market growth.

Growing demand for mobility and data portability drives the need for data-centric solutions and business software. Market participants are pursuing several growth strategies to remain competitive in the industry, such as alliances, strategic contracts and collaborations, mergers and acquisitions, and developing new products. For instance, in October 2022, Epicor launched many new features in "Epicor Kinetic" software for the manufacturing industry, a cloud-based industry ERP software. Manufacturers can better compete with deep industry-specific functionality and connected services by integrating and optimizing workflows and delivering a smoother user experience journey. Some of the prominent players in the business software and services market include:

-

Acumatica, Inc.

-

Deltek, Inc.

-

Epicor Software Corporation

-

International Business Machines Corporation

-

Infor.

-

NetSuite Inc.

-

Microsoft Corporation

-

SAP SE

-

Oracle Corporation

-

TOTVS S.A.

-

Unit4

-

SYSPRO

Business Software And Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 525.77 billion

Revenue forecast in 2030

USD 1,153.75 billion

Growth rate

CAGR of 11.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software, service, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Acumatica, Inc.; Deltek, Inc.; Epicor Software Corporation; International Business Machines Corporation; Infor.; NetSuite Inc.; Microsoft Corporation; SAP SE; Oracle Corporation; TOTVS S.A.; Unit4; SYSPRO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Software And Services Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business software and services market based on software, service, deployment, enterprise size, end use, and region:

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance

-

Sales & Marketing

-

Human Resource

-

Supply Chain

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Managed Services

-

Support & Maintenance

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global business software and services market size was estimated at USD 474.61 billion in 2022 and is expected to reach USD 525.77 billion in 2023.

b. The business software and services market is expected to witness a compound annual growth rate of 11.9% from 2023 to 2030 to reach USD 1,153.75 billion by 2030.

b. The finance segment dominated the global business software and services market and accounted for the highest market share of over 25% in 2022.

b. The support & maintenance segment dominated the business software and services market with a share of 40% in 2022.

b. The on-premise segment led the global business software and services market and accounted for the highest market share of over 60% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."