- Home

- »

- Medical Devices

- »

-

Buttock Augmentation Market Size Report, 2021-2028GVR Report cover

![Buttock Augmentation Market Size, Share & Trends Report]()

Buttock Augmentation Market Size, Share & Trends Analysis Report By Product, By End-use (Hospitals, Aesthetic Clinics), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-345-9

- Number of Pages: 107

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global buttock augmentation market size was estimated at USD 1.5 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 22.0% from 2021 to 2028. Buttock implants are cosmetic surgical procedures that are done to contour or enhance the shape and size of the butt. This can be achieved through surgical implants that include placing silicone implants under gluteal tissue, with fat grafting in which, the fat is taken from another body area through liposuction technology, such as the stomach, or thighs and re-injected into the butt for natural augmentation or through butt injections.

Factors like increasing aesthetic awareness among the population, high social media influence, rising disposable income, and technological advancement in the field of aesthetics are the factors driving the market for buttock augmentation. Moreover, procedures like fat grafting have a high success rate, high satisfaction, and low complications which are expected to boost the market further. Image/appearance consciousness is increasing along with awareness about beauty care products and procedures available across the world. Social media plays a vital role in influencing the purchasing decisions of millennials, and peer recommendations have high significance when it comes to purchasing beauty products.

According to the 2019 Hubspot data, 71.0% of people are more likely to purchase a product or service online when it is recommended by others. Moreover, a small number of influencers can be attributed to the largest share of referral branding via social media. According to Forbes, 5% of the influencers who offer product or service recommendations drive 45% of social influence. According to a survey conducted by the American Society of Plastic Surgeons, in 2015, 93% of the patients opted for cosmetic procedures because of the referrals from friends and family who experienced good results. Moreover, out of this, 75% opted for the procedure because of the increasing online availability of information about cosmetic treatments.

As stated by the International Society of Aesthetic Plastic Surgery, in 2019, around 5, 34,345 buttock augmentation and buttock lift procedures were carried out globally. Buttock augmentation procedure currently constitutes 4.7% of the total surgical procedures carried out globally and is growing at a significant rate. According to a survey conducted by NCBI it was stated that the primary factor influencing people to opt for cosmetic procedures was improving their physical attractiveness and selfâ€esteem (86%) followed by restorative and health reasons (46%).

The American Society of Plastic Surgeons reported that buttock augmentation surgery has increased by 252% between the years 2000 and 2017 and is among the fastest-growing surgical cosmetic segment. Technological advancements such as the use of silicone or hyaluronic gel injections for buttock enhancement that are currently under study, if proved to be effective can be fruitful, as it will open doors to non-invasive treatment for augmentation procedures leading to high adoption and high market growth.

However, elective procedures like buttock augmentation were one of the worst affected at the beginning of the COVID-19 pandemic. Surgical practices across the world were halted. With no patient visits and declining revenues, several aesthetic clinics had to undergo unforeseen challenges. With the ease of lockdowns in most of the countries, buttock augmentation services are also reopening, however, following strict protocols has added to the expenses for several aesthetic experts. International Society of Aesthetic Plastic Surgery has laid down strict protocols in order to resume clinics and provide infection control procedures.

However, according to BBC, the number of inquiries and appointments for cosmetic procedures has witnessed a surge during the pandemic. For instance, a June 2020 survey conducted by the American Society of Plastic Surgeons (ASPS) of more than 1,000 consumers found that 49% of those who haven’t had cosmetic surgery indicated they are open to cosmetic or reconstructive treatment in the near future. Another ASPS study published the same month found that 64% of U.S. plastic surgeons had witnessed a rise in their telemedicine consultations after COVID-19 began.

Product Insights

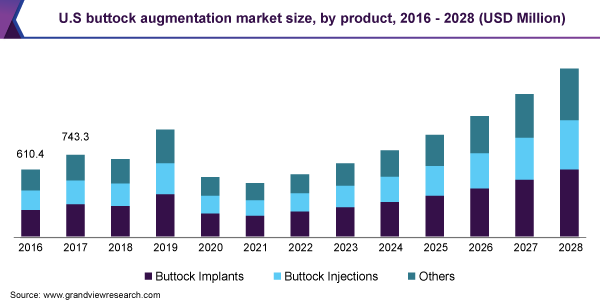

The buttock implants segment dominated the market for buttock augmentation and accounted for the largest revenue share of more than 40.0% in 2020. Based on product, the industry is segmented into silicone gel implants and fat grafting. Buttock implants are a procedure wherein artificial enhancement material mostly silicone implants is surgically placed in the buttock in order to contour or enhance its shape.

The most common buttock implant surgery include butt lifts, implants, and augmentation with fat grafting. According to the American Society of Aesthetic Plastic Surgery, augmentation surgery has increased by 252% in the last decade. Among these buttock augmentation through fat grafting is the most efficient, popular, and well-adopted method as it provides low complication risk, high patient satisfaction, and lower recovery time. According to the International Society of Aesthetic Plastic Surgery in 2019, around 37,329 buttock augmentation procedures using fat grafting technique were carried out in the U.S. This indicates the high adoption and demand for fat grafting augmentation procedures in the country.

The buttock injections segment is also subdivided into hydrogel butt injections, PMMA butt injections, PLLA, and silicone butt injections. As of now, the FDA has not approved any injections for augmentation procedures as there are limited research and studies proving its effectiveness. However Latin American and some western countries offer buttock augmentation procedures through injection and Poly-L-lactic acid or Hydrogel Butt Injections are amongst the most preferred.

End-use Insights

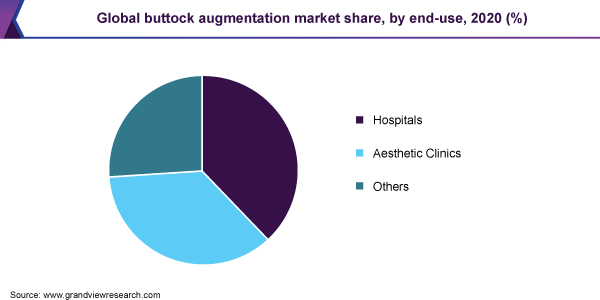

The hospital segment dominated the market for buttock augmentation and accounted for the largest revenue share of 38.0% in 2020. According to the American Society of Plastic Surgeons, almost 18 million people underwent minimally invasive aesthetic procedures in the U.S. in 2018 and has been on the rise ever since. As the hospital facilities in many developed and developing countries are robust they are well equipped with high-end devices with the latest innovative technology. A high percentage of the skilled practitioners in the field of aesthetic procedures are affiliated with hospitals as they provide all the necessary facilities to carry out such treatments. Moreover, customer preference also comes into the picture as patients feel safe from gaining treatments from the recognized hospital as they avail insurance coverage for such treatments. Various specialty hospitals have tie-ups with the trusted manufacturers and have tendered for buying advanced aesthetic devices, thereby impelling segmental growth in the coming years.

However, aesthetic clinics are expected to witness significant CAGR over the forecast period. Aesthetic clinics are gaining popularity due to their increased quality of services, personalized attention provided to the clients and comparatively low cost of treatment than other settings. Aesthetic clinics also provide comprehensive treatment to cosmetic problems relate to skin, hair, body, and face but also cater to mainstream spa and beauty treatment like waxing and manicures, dentistry, removal of skin tags, warts, freckles, birthmarks, etc. this is the major factor propelling the market growth.

Regional Insights

North America dominated the buttock augmentation market and accounted for the largest revenue share of 43.0% in 2020, owing to the technological advancement and increase in the number of individuals opting for procedures involved in the market. The region has aesthetic high awareness regarding and the people opting for cosmetic procedures have also seen a surge. Moreover, the region also has the largest pool of cosmetic professionals in the country and according to the statistics of the International Society of Aesthetic Plastic Surgery; the region has one of the highest procedure volumes for buttock augmentation procedures.

In Asia Pacific, the market for buttock augmentation is expected to witness the highest growth rate in the forecast period. This is mainly due to the increasing urbanization in the region. With huge populations in this region, many individuals are inclined towards aesthetical improvement. Moreover, there is high social media influence in the region coupled with low treatment cost and high-quality procedure service that are propelling the market growth. In 2019, around 11,184 surgical buttock augmentation procedures were carried out in India.

Key Companies & Market Share Insights

The competitive landscape is strengthened by service quality and expertise in carrying out complicated cosmetic procedures. For instance, In March 2020, Polytech Health and Aesthetics announced to plan a significant investment and expansion plan, to relocate its entire headquarters to a state-of-the-art facility near its current location in Dieburg, Germany. This will assist in the company’s strategy of increasing the manufacturing capacity of implants. Some of the prominent players in the buttock augmentation market include:

-

Sientra, Inc

-

POLYTECH Health & Aesthetics,

-

Allergan

-

Sebbin

-

Merz North America, Inc

-

Silimed

-

Spectrum Designs Medical

-

Implantech

Buttock Augmentation Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.7 billion

Revenue forecast in 2028

USD 6.6 billion

Growth rate

CAGR of 22.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2021 to 2028

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Sientra, Inc.; POLYTECH Health & Aesthetics; Allergan; Sebbin; Merz North America, Inc.; Silimed; Spectrum Designs Medical; Implantech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global buttock augmentation market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Buttock Implants

-

Silicone Gel implants

-

Fat grafting

-

-

Buttock Injections

-

Hydrogel Butt Injections

-

PMMA Butt Injections

-

Poly-L-lactic acid

-

Silicone Butt Injections

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Aesthetic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global buttock augmentation market size was estimated at USD 1.53 billion in 2020 and is expected to reach USD 1.66 billion in 2021.

b. The global buttock augmentation market is expected to grow at a compound annual growth rate of 22.0% from 2020 to 2028 to reach USD 6.68 billion by 2028.

b. The buttock implants segment dominated the global buttock augmentation market and accounted for the largest revenue share of more than 40.0% in 2020.

b. The hospital segment led the global buttock augmentation market and accounted for the largest revenue share of 38.0% in 2020.

b. North America dominated the buttock augmentation market with a share of 43% in 2020. This is attributable to the presence of a large number of skilled professionals and significant awareness among people in the region regarding the advancement in buttock augmentation procedures.

b. Some key players operating in the buttock augmentation market include Sientra Inc; POLYTECH Health & Aesthetics; Allergan; Sebbin; Merz North America, Inc; Silimed; Spectrum Designs Medical and Implantech.

b. Key factors that are driving the market growth include growing consumer awareness regarding the influence of appearance on a person’s social life and self-esteem is the major factor fueling the buttock augmentation market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."