- Home

- »

- Advanced Interior Materials

- »

-

Calcined Anthracite Market Size, Industry Report, 2018-2025GVR Report cover

![Calcined Anthracite Market Size, Share & Trends Report]()

Calcined Anthracite Market Size, Share & Trends Analysis Report By Technology (Gas, Electrical), By End Use (Pulverized Coal Injection, Basic Oxygen Steelmaking, Electric Arc Furnaces), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-178-8

- Number of Pages: 73

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Industry Insights

The global calcined anthracite market size was estimated at USD 3.16 billion in 2016. The market is anticipated to be driven by rising demand for carbon-rich charging materials in steel manufacturing. Low environmental impact and low product cost compared to calcined petcoke are expected to offer it a competitive edge over the next few years.

Availability of anthracite is a crucial variable influencing market dynamics, as it is the key raw material used to manufacture the product. Anthracite accounts for only about 2.0% of the overall coal production and finds high demand for steel and power generation. This has left the industry facing raw material shortage, resulting in the high bargaining power of raw material suppliers.

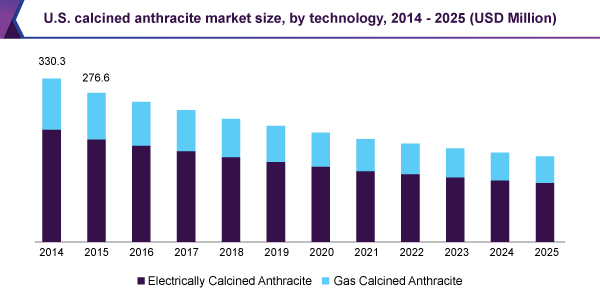

In the U.S., Pennsylvania is the only state involved in the mining of anthracite. High-volume steel production in the country has resulted in the dominance of the U.S. in the North America market. However, steel production in the country declined by around 0.4% from 2015 to 2016, resulting in lower product demand.

The product offers higher carbon percentage and low ash, moisture, and volatile matter content compared to traditional coal products. As a result, it has gained a high demand in the manufacturing of steel and other metals, a process that requires coal with very low moisture and impurity content.

Global coal production has been declining over the past few years and stood at 231 million tons in 2016. Production fell by 6.2% from 2015 to 2016, which was the highest decline in the history of coal mining. These factors have impacted the availability of raw material for anthracite manufacturing, impacting the growth of the industry.

Petcoke, which is used as a key alternative for anthracite, especially in steel manufacturing, is likely to be banned in emerging economies such as India. The country already banned petcoke in the national capital and neighboring states in 2017 owing to severe problems associated with pollution in the region. These factors are expected to hamper the industry in the coming years.

Technology Insights

Demand for gas calcined anthracite (GCA) accounted for over 25.0% of the overall market volume in 2016. GCA is manufactured by heating high-grade anthracite in gas-fired furnaces instead of using electricity. Properties offered by GCA are nearly similar to those offered by electrically calcined anthracite (ECA), which makes it suitable for steel or foundry applications.

Asbury Carbons and Rheinfelden Carbon are major manufacturers involved in the production of GCA. Rheinfelden Carbon offers two grades of GCA: standard and premium. The premium-grade product has higher carbon content as compared to standard grade, which makes it ideal for steel manufacturing applications.

Calcined coke is heated to temperatures as high as 2000°C, which converts conventional anthracite into a modified graphite structure with high carbon content. ECA products contain low moisture, sulfur, and ash, which makes them ideal for processes that require high-purity coal.

Product demand as a carbon source is expected to increase over the forecast period owing to cost reduction and consistent quality it offers as compared to other conventional products. In 2016, Elkem was the largest manufacturer of ECA in the world and primarily caters to the steel manufacturing industry.

End-use Insights

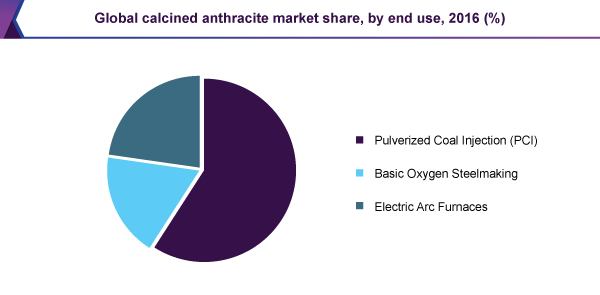

The product is mainly used as a source of carbon in the steel industry. Its rising demand in the basic steelmaking process and in electric furnaces is expected to have a positive impact on the growth of the calcined anthracite market. Product application in steel manufacturing reduces the consumption of high-cost metallurgical coke, thus reducing overall production cost.

The electric arc furnaces segment was valued at USD 695.5 million in 2016. Calcined anthracite is added in electric arc furnaces along with other charging materials, such as petcoke, to remove metal oxides. Rising demand for highly pure and thermally- and electrically-stable coal products in the manufacturing of steel and other metals is expected to drive growth.

When fed into the blast furnace during the basic oxygen steelmaking process, the product plays an important role in eliminating impurities in the steel. During this process, flux, iron, and steel in the oven are removed, which results in formation of liquid steel. Increasing inclination of steel manufacturers toward the use of high-quality coke, which produces higher quality steel, is expected to have a positive impact on market growth over the forecast period.

Regional Insights

Asia Pacific is expected to be the largest and fastest-growing market owing to the high steel production volumes offered by Asian manufacturers. China, Japan, and India collectively dominated the global steel production in 2016 and are expected to continue as market leaders over the forecast period, thus benefiting the regional market.

The market in Europe was valued at USD 429.1 million in 2016. Countries in this region are expected to register lower CAGRs as compared to those in Asia Pacific owing to declining steel production Europe, coupled with the widening demand-supply gap in the regional industry.

Russia is one of the major producers of anthracite in the world and a key exporter for major end users such as China, the U.S., and Germany. Russian raw material prices are relatively lower as compared to other major manufacturing regions such as Australia, which makes the country one of the major raw material suppliers in the market.

In 2016, the market in Japan was valued at USD 229.8 million. The country imports anthracite primarily from Russia and Australia. It imported over 6.3 million tons of anthracite in 2015, out of which 30.0% was imported from Australia and over 40.0% from Russia. With the rising demand in several end-use applications, anthracite imports into Japan are expected to increase over the forecast period.

Calcined Anthracite Market Share Insights

Reduction in mining activities owing to growing environmental awareness among governments of various countries has resulted in declining coal production in the past few years. In addition, the decline in anthracite reservoirs is expected to increase competitive rivalry for raw material procurement, thus increasing the bargaining power of suppliers.

The industry has been witnessing a persistent demand-supply gap caused by the low availability of the raw material. Small-scale companies have survived in the industry owing to inadequate production volumes of major players. Many industry players are seeking to establish partnerships with anthracite mining companies to ensure constant raw material supply.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, U.K., Russia, China, India, Japan, Brazil, and Saudi Arabia

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue and volume growth at a global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global calcined anthracite market size on the basis of technology, end use, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Gas Calcined Anthracite

-

Electrically Calcined Anthracite

-

-

End-use Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Pulverized Coal Injection (PCI)

-

Basic Oxygen Steelmaking

-

Electric Arc Furnaces

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."