- Home

- »

- Advanced Interior Materials

- »

-

Calcium Carbonate Market Size & Share Report, 2030GVR Report cover

![Calcium Carbonate Market Size, Share & Trends Report]()

Calcium Carbonate Market Size, Share & Trends Analysis Report By Type (GCC), By Application (Automotive, Building & Construction, Agriculture), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-296-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Calcium Carbonate Market Size & Trends

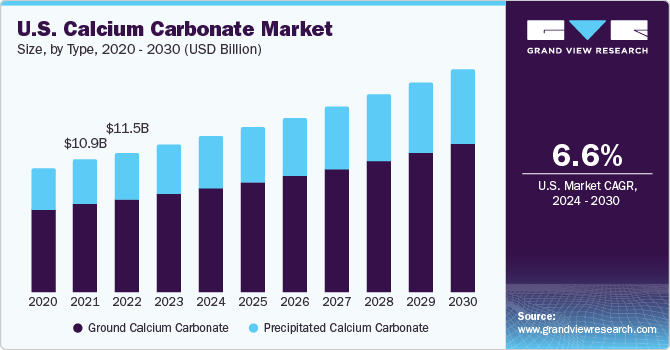

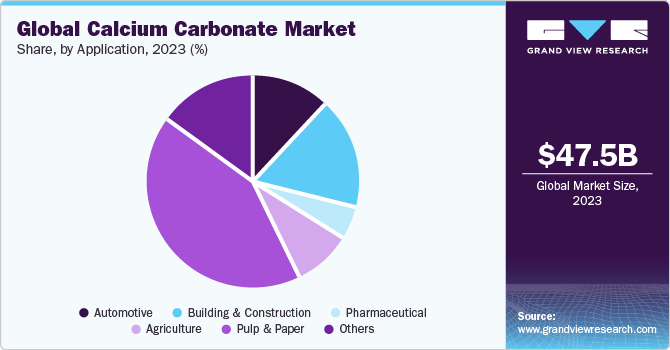

The global calcium carbonate market size was estimated at USD 47.53 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Increasing demand for paper from hygiene-related products like tissue paper and packaging applications is a major growth driver for the market. However, the product demand witnessed a decline in 2020 owing to the outbreak of the coronavirus. The pandemic caused widespread shutdowns across the globe, which significantly impacted the economy worldwide in the first half of 2020. With the ease in restrictions in the second half of the year, companies are putting in extra efforts to resume their operations, which is a positive sign for market growth.

The U.S. has been a prominent destination for the product considering high demand from industries including paints & coatings, adhesives & sealants, and paper manufacturing. Paper is the largest application segment of the market and the U.S. is amongst the world’s largest paper manufacturers. Despite the pandemic that majorly impacted the country’s economy, the demand for calcium carbonate continues to persist, especially in the paper production sector owing to a growing emphasis on cleanliness.

Calcium carbonate is used to produce calcium citrate (citric acid), which is used as a food additive, a preservative, an acidifier, or a flavoring agent. It is used in applications such as cleaning agents, cosmetics, pharmaceuticals, and dietary supplements. It is also used to adjust the pH value of water through the neutralization process. Untreated water is passed through filters, which contain calcium carbonate, the material dissolves in the water and raises its pH levels to greater than 6. The demand for treated drinking water is rising with an increase in population, which is expected to drive the use of calcium carbonate as a water-treating ingredient in the coming years.

The calcium carbonate market has been hampered by supply chain instability, a slowdown in raw material production, trade movement slowing, and a decline in construction, vehicle, and paint and coatings demand due to the COVID-19 pandemic. Calcium carbonate demand is tied directly to numerous industries that are experiencing business uncertainty, such as automotive, paper, plastics, and building & construction.

A drop-in paper consumption from corporate offices, schools & universities, and the newspaper and printing industries have hampered the paper industry's growth. However, new application categories, including hygiene paper products, food packaging, medical specialty sheets, and corrugated packaging, have provided opportunities for the business, which is driving up demand for calcium carbonate, reducing the pandemic's impact to some extent.

According to the American Forest & Paper Association, the U.S. paper and wood products industry recorded high levels of tissue production in February and March 2020. The U.S. mills produced around 700 kilotons of tissue in March. Factors like lockdown and extra hygiene concerns led to panic buying and stockpiling of tissues and other cleaning products, thereby, benefitting the market growth.

Despite the demand for calcium carbonate in the paper segment, the market witnessed a dip in 2021 owing to restricted transportation, a halt in manufacturing operations for non-essential industries, and the shutdown of mines across various regions. Several market players reported negative sales and profits for the first half of 2021.

For instance, LafargeHolcim, an integrated player in the market, reported a 14% profit fall in Q1 of 2020 as the pandemic caused building sites to shut down around the world. The company mines limestone produces calcium carbonate and uses it to manufacture cement, which is further catered to the construction industry. The company had to stop its mining activities in March 2020 in Meghalaya, India due to lockdown; however, the operations resumed after a couple of months as mining activities were allowed by the state government with the enforcement of social distancing norms and proper hygiene conditions.

Market Concentration & Characteristics

Market growth is driven by rising in demand for paper from packaging applications and hygiene related products like tissue paper. Calcium carbonate is a versatile material that finds its use in various industries. It is commonly used for producing concrete and ceramic materials. Additionally, it is used as a filler and additive in manufacturing paints, coatings, adhesives, sealants, and plastic materials. Due to the increased demand for construction materials such as marble, tiles, and concrete in residential and commercial buildings, the market value for calcium carbonate is rising.

The global calcium carbonate market is fragmented. The market is characterized by many big and small vendors, making it moderately competitive. The major player's geographic presence is comparatively large with large production facilities. While small regional players operating in this market also account for notable shares. During the forecast period, the competition level in the market is expected to remain moderate. This is due to the low level of innovation and moderate R&D prospects among vendors.

Type Insights

The ground calcium carbonate segment dominated the market with a revenue share of 68.70% in 2023. This growth is attributed to the fact that when compared to other inorganic powders, GCC powder is relatively affordable and possesses superior whiteness, inertness, and incombustibility, as well as low oil- and water adsorption. It is commonly utilized in polymer composites to enhance physical properties and improve workability. Simultaneously, the cost of polymer composites can be significantly reduced by replacing expensive resins with affordable GCC fillers.

Precipitated calcium carbonate is another segment witnessing fastest growth over the period. It is a novel lime-derived substance with numerous industrial applications. It is produced by the hydration of high-calcium quicklime and reacting the resultant slurry with carbon dioxide. The finished product is bright white with homogeneous narrow particle size dispersion. PCC is available in a variety of crystal morphologies and sizes that can be adjusted to enhance performance in a particular application. Applications of PCC include food & beverages, pharmaceuticals, rubbers, PVC/plastics, paints, adhesives & sealants, and thermal & electrical insulators. It is also used as a substitute for additives and wood pulp for manufacturing high-quality paperboard and paper as it is a cost-effective mineral.

Application Insights

The paper segment emerged as the largest application segment in 2023 and accounted for a revenue share of around 41.69%. Calcium carbonate is added as a filler to the paper pulp or is applied as a coating pigment. Its addition enhances the brightness and opacity of the paper. Although the internet did impact the print media market, it did not restrict the demand for paper in other applications, such as packaging and tissue paper.

The current pandemic has compelled manufacturers to ramp up their production to cater to the rising consumer needs.For instance, in August 2020, Celulosa Argentina announced an increase in its production of paper packaging by 30%. The company’s focus was on the food industry as the demand surged in this sector. With a rise in the e-commerce sector and growing usage of tissue papers, the paper application segment is anticipated to continue its dominance over the forecast period.

Building & construction is another segment witnessing growth over the forecast period. The global construction industry is a fast-growing sector, however, the outbreak of COVID-19 and the lockdown imposed by governments hampered the expansion of the construction industry. With the opening up of markets, the sector gained momentum immediately. According to Oxford Economics, the global construction industry is expected to grow to reach ~USD 8 trillion by 2030 and will be mainly driven by, the U.S. and India. The growth is attributed to the high demand for better public infrastructure such as rail transport systems, roadways, airports, and harbors, triggering demand for calcium carbonate over the forecast period.

Regional Insights

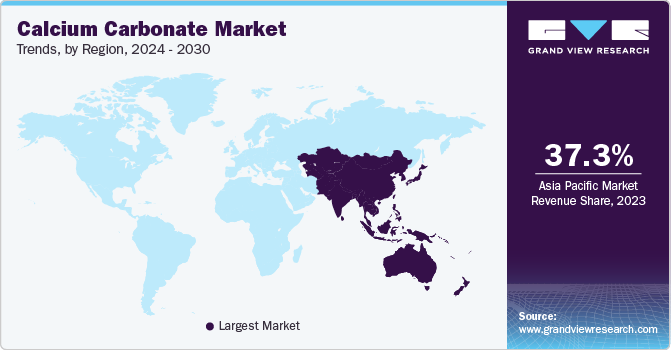

Asia Pacific dominated the global market and accounted for the largest revenue share of more than 37.34% in 2023. The region is anticipated to expand further at a steady CAGR from 2023 to 2030 due to rising investments in the infrastructure development and manufacturing sector. However, due to the pandemic, the manufacturing operations and supply chain have been immensely impacted. Apart from China, all other major Asian countries have reported negative GDP growth for the second quarter of 2020.

Economies are putting in extra efforts for the proper functioning of operations in different sectors by maintaining essential protocols required during the pandemic. As the operations resume, certain industries have reported positive news; for instance, automotive sales in India went up in the past two months. Also, the demand for paints & coatings, and vehicles is anticipated to increase, which, in turn, will augment the demand for calcium carbonate.

India has created a suitable platform for maximum investments from foreign investors. Moreover, the country has a strong demographic dividend associated with an increasing working-age population (about two-thirds of the total population). The calcium carbonate market in India is witnessing a significant growth due to the rising demand from several end-use industries including paper, plastics, and paints & coatings among others.

North America was the second-largest regional market. Though the region has been severely impacted by the pandemic, the end-use industries of the market have begun their operations at minimal capacity considering the rise in consumer demand. Industries including medical, packaging and DIY are boosting the demand for products such as adhesives and paper, which is a positive sign for the calcium carbonate market. For instance, In January 2021, Gabriel Performance Products (Gabriel) was acquired by Huntsman Corporation from Audax Private Equity. Gabriel is a North American specialty chemical producer of specialized epoxy curing agents and additives for the sealants, coatings, composites, and adhesives end markets.

The U.S. held the largest share in the North American regional market and is expected to maintain its dominance over the forecast period. Considering the product demand in the country, companies are engaged in boosting their production capacities and expanding their presence in the country.

For instance, in March 2020, Anglo Pacific Group PLC announced entering into a financing agreement with Incoa Performance Minerals LLC for funding the construction of a calcium carbonate-associated infrastructure in the Dominican Republic.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In August 2022, Cimbar Resources Inc. announced the acquisition of U.S.-based Imerys Carbonate Inc. calcium carbonate manufacturing assets located in Arizona, U.S. This acquisition helped Cimbar Resources expand its product portfolio and facilitate its goal of providing customers with a wide range of products from multiple locations.

-

In April 2023, Omya India, a prominent producer of calcium carbonate, announced its plan to invest USD 25 million in its advanced calcium carbonate plant in Gujarat. This significant investment strives to expand the plant's capacity and improve its overall efficiency, reinforcing Omya India's dedication to delivering high-quality products to meet the growing demand.

Key Calcium Carbonate Companies:

The following are the leading companies in the calcium carbonate market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these calcium carbonate companies are analyzed to map the supply network.

- AGSCO Corp.

- Carmeuse

- Blue Mountain Minerals

- GCCP Resources

- GLC Minerals, LLC

- Greer Limestone Company

- Gulshan Polyols Ltd.

- ILC Resources

- Imerys

- Mineral Technologies

- Mississippi Lime

- Omya

- Parchem Fine & Specialty Chemicals

- The National Lime & Minerals, Inc.

Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 50.6 billion

Revenue forecast in 2030

USD 74.6 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Italy; Spain, Finland Sweden; Valencia; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; Iran; UAE; South Africa.

Key companies profiled

AGSCO Corp., Carmeuse, Blue Mountain Minerals, Carmeuse Lime & Stone Company, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, J.M. Huber Corp., LafargeHolcim, Midwest Calcium Carbonates, Mineral Technologies, Mississippi Lime, Mountain Materials, Inc., NALC, LLC, Omya, Parchem Fine & Specialty Chemicals, The National Lime & Stone Company, United States Lime & Minerals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium Carbonate Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcium carbonate market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Ground Calcium Carbonate

-

Precipitated Calcium Carbonate

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Pharmaceutical

-

Agriculture

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Finland

-

Sweden

-

Valencia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

- Indonesia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global calcium carbonate market size was estimated at USD 44.7 billion in 2022 and is expected to reach USD 47.53 billion in 2023.

b. The global calcium carbonate market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 74.64 billion by 2030.

b. The paper segment emerged as the largest application segment in 2022 and accounted for a revenue share of around 41.8%. Calcium carbonate is added as a filler to the paper pulp or is applied as a coating pigment. Its addition enhances the brightness and opacity of the paper.

b. Some of the key players operating in the calcium carbonate market are AGSCO Corp., Carmeuse, Blue Mountain Minerals, Carmeuse Lime & Stone Company, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, J.M. Huber Corp., LafargeHolcim, Midwest Calcium Carbonates, Mineral Technologies, Mississippi Lime, Mountain Materials, Inc., NALC, LLC, Omya, Parchem Fine & Specialty Chemicals, The National Lime & Stone Company, United States Lime & Minerals, Inc.

b. One of the key factors is rising concerns pertaining to health awareness that is boosting the demand for hygiene-related products such as tissue paper, which is anticipated to propel calcium carbonate market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Calcium Carbonate Market Variables, Trends & Scope

3.1. Global Calcium Carbonate Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.2.2. Manufacturing/Technology Trends

3.3. Regulatory Framework

3.4. Price Trend Analysis, 2018-2030

3.4.1. Factors Influencing Price

3.5. Trade Balance Analysis, 2018-2023 (HS Code: 28365000)

3.5.1. List of importers, By Key Countries (Tons)

3.5.2. List of Importers, By Key Countries (Thousand USD)

3.5.3. List of Exporters, By Key Countries (Tons)

3.5.4. List of Exporters, By Key Countries (Thousand USD)

3.6. Market Dynamics

3.6.1. Market Driver Analysis

3.6.2. Market Restraint Analysis

3.6.3. Industry Challenges

3.7. Porter’s Five Forces Analysis

3.7.1. Supplier Power

3.7.2. Buyer Power

3.7.3. Substitution Threat

3.7.4. Threat from New Entrant

3.7.5. Competitive Rivalry

3.8. PESTEL Analysis

3.8.1. Political Landscape

3.8.2. Economic Landscape

3.8.3. Social Landscape

3.8.4. Technological Landscape

3.8.5. Environmental Landscape

3.8.6. Legal Landscape

Chapter 4. Calcium Carbonate Market: Type Outlook Estimates & Forecasts

4.1. Calcium Carbonate Market: Type Movement Analysis, 2023 & 2030

4.2. Ground Calcium Carbonate (GCC)

4.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3. Precipitated Calcium Carbonate (PCC)

4.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Calcium Carbonate Market: Application Outlook Estimates & Forecasts

5.1. Calcium Carbonate Market: Application Movement Analysis, 2023 & 2030

5.2. Automotive

5.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.3. Building & Construction

5.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.4. Pharmaceutical

5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.5. Agriculture

5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.6. Pulp & Paper

5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.7. Others

5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Calcium Carbonate Market Regional Outlook Estimates & Forecasts

6.1. Regional Snapshot

6.2. Calcium Carbonate Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.3.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.4. U.S.

6.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.3.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.5. Canada

6.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.3.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.3.6. Mexico

6.3.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.3.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4. Europe

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.2.1. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.2.2. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.3. Germany

6.4.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.3.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.3.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.4. France

6.4.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.5. UK

6.4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.6. Russia

6.4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.7. Italy

6.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.8. Spain

6.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.8.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.9. Finland

6.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.9.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.10. Sweden

6.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.10.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.4.11. Valencia

6.4.11.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4.11.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.4.11.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5. Asia Pacific

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.4. China

6.5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.5. South Korea

6.5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.6. Japan

6.5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.7. India

6.5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.5.8. Indonesia

6.5.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5.8.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.5.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6. Central & South America

6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6.4. Brazil

6.6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.6.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.6.5. Argentina

6.6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7. Middle East & Africa

6.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.4. Saudi Arabia

6.7.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.7.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.5. South Africa

6.7.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.7.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.6. Iran

6.7.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.7.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

6.7.7. UAE

6.7.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.7.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

6.7.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share Analysis, 2023

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.6. Company Profiles/Listing

7.6.1. AGSCO Corp.

7.6.1.1. Company Overview

7.6.1.2. Financial Performance

7.6.1.3. Product Benchmarking

7.6.2. Carmeuse

7.6.2.1. Company Overview

7.6.2.2. Financial Performance

7.6.2.3. Product Benchmarking

7.6.3. Blue Mountain Minerals

7.6.3.1. Company Overview

7.6.3.2. Financial Performance

7.6.3.3. Product Benchmarking

7.6.4. GCCP Resources

7.6.4.1. Company Overview

7.6.4.2. Financial Performance

7.6.4.3. Product Benchmarking

7.6.5. GLC Minerals, LLC

7.6.5.1. Company Overview

7.6.5.2. Financial Performance

7.6.5.3. Product Benchmarking

7.6.6. Greer Limestone Company

7.6.6.1. Company Overview

7.6.6.2. Financial Performance

7.6.6.3. Product Benchmarking

7.6.7. Gulshan Polyols Ltd.

7.6.7.1. Company Overview

7.6.7.2. Financial Performance

7.6.7.3. Product Benchmarking

7.6.8. ILC Resources

7.6.8.1. Company Overview

7.6.8.2. Financial Performance

7.6.8.3. Product Benchmarking

7.6.9. Imerys

7.6.9.1. Company Overview

7.6.9.2. Financial Performance

7.6.9.3. Product Benchmarking

7.6.10. Mineral Technologies

7.6.10.1. Company Overview

7.6.10.2. Financial Performance

7.6.10.3. Product Benchmarking

7.6.11. Mississippi Lime

7.6.11.1. Company Overview

7.6.11.2. Financial Performance

7.6.11.3. Product Benchmarking

7.6.12. Omya

7.6.12.1. Company Overview

7.6.12.2. Financial Performance

7.6.12.3. Product Benchmarking

7.6.13. Parchem Fine & Specialty Chemicals

7.6.13.1. Company Overview

7.6.13.2. Financial Performance

7.6.13.3. Product Benchmarking

7.6.14. The National Lime & Stone Company

7.6.14.1. Company Overview

7.6.14.2. Financial Performance

7.6.14.3. Product Benchmarking

7.6.15. United States Lime & Minerals, Inc.

7.6.15.1. Company Overview

7.6.15.2. Financial Performance

7.6.15.3. Product Benchmarking

List of Tables

Table 1 Calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 2 Calcium carbonate market estimates and forecasts, by ground calcium carbonate (GCC), 2018 - 2030 (USD Million) (Kilotons)

Table 3 Calcium carbonate market estimates and forecasts, by precipitated calcium carbonate (PCC), 2018 - 2030 (USD Million) (Kilotons)

Table 4 Calcium carbonate market estimates and forecasts, by automotive 2018 - 2030 (USD Million) (Kilotons)

Table 5 Calcium carbonate market estimates and forecasts, by building & construction, 2018 - 2030 (USD Million) (Kilotons)

Table 6 Calcium carbonate market estimates and forecasts, by pharmaceutical, 2018 - 2030 (USD Million) (Kilotons)

Table 7 Calcium carbonate market estimates and forecasts, by agriculture, 2018 - 2030 (USD Million) (Kilotons)

Table 8 Calcium carbonate market estimates and forecasts, in pulp & paper, 2018 - 2030 (USD Million) (Kilotons)

Table 9 Calcium carbonate market estimates and forecasts, in others, 2018 - 2030 (USD Million) (Kilotons)

Table 10 North America calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 11 North America calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 12 North America calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 13 North America calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 14 North America calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 15 U.S. calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 16 U.S. calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 17 U.S. calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 18 U.S. calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 19 U.S. calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 20 Canada calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 21 Canada calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 22 Canada calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 23 Canada calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 24 Canada calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 25 Mexico calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 26 Mexico calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 27 Mexico calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 28 Mexico calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 29 Mexico calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 30 Europe calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 31 Europe calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 32 Europe calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 33 Europe calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 34 Europe calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 35 Germany calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 36 Germany calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 37 Germany calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 38 Germany calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 39 Germany calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 40 France calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 41 France calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 42 France calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 43 France calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 44 France calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 45 U.K. calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 46 U.K. calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 47 U.K. calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 48 U.K. calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 49 U.K. calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 50 Russia calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 51 Russia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 52 Russia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 53 Russia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 54 Russia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 55 Italy calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 56 Italy calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 57 Italy calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 58 Italy calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 59 Spain calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 60 Spain calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 61 Spain calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 62 Spain calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 63 Spain calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 64 Finland calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 65 Finland calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 66 Finland calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 67 Finland calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 68 Finland calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 69 Sweden calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 70 Sweden calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 71 Sweden calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 72 Sweden calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 73 Sweden calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 74 Asia Pacific calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 75 Asia Pacific calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 76 Asia Pacific calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 77 Asia Pacific calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 78 Asia Pacific calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 79 China calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 80 China calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 81 China calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 82 China calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 83 China calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 84 Japan calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 85 Japan calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 86 Japan calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 87 Japan calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 88 Japan calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 89 South Korea calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 90 South Korea calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 91 South Korea calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 92 South Korea calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 93 South Korea calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 94 India calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 95 India calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 96 India calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 97 India calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 98 India calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Kilotons)

Table 99 Indonesia calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 100 Indonesia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 101 Indonesia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 102 Indonesia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 103 Indonesia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 104 Central & South America calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 105 Central & South America calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 106 Central & South America calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 107 Central & South America calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 108 Central & South America calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 109 Brazil calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 110 Brazil calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 111 Brazil calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 112 Brazil calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 113 Argentina calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 114 Argentina calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 115 Argentina calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 116 Argentina calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 117 Middle East & Africa calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 118 Middle East & Africa calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 119 Middle East & Africa calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 120 Middle East & Africa calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 121 Middle East & Africa calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 122 Saudi Arabia calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 123 Saudi Arabia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 124 Saudi Arabia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 125 Saudi Arabia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 126 Saudi Arabia calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 127 South Africa calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 128 South Africa calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 129 South Africa calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 130 South Africa calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 131 South Africa calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 132 Saudi Arabia calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 133 Saudi Arabia calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 134 Iran calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 135 Iran calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 136 Iran calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 137 UAE calcium carbonate market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 138 UAE calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 139 UAE calcium carbonate market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 140 UAE calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 141 UAE calcium carbonate market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot

Fig. 6 Segmental outlook- Type, product, and application

Fig. 7 Competitive outlook

Fig. 8 Calcium carbonate market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Calcium carbonate market, by type: Key takeaways

Fig. 14 Calcium carbonate market, by type: Market share, 2023 & 2030

Fig. 15 Calcium carbonate market, by application: Key takeaways

Fig. 16 Calcium carbonate market, by application: Market share, 2023 & 2030

Fig. 17 Calcium carbonate market, by region: Key takeaways

Fig. 18 Calcium carbonate market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Calcium Carbonate Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Calcium Carbonate Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Calcium Carbonate Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

- North America

- North America Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- North America Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- U.S.

- U.S. Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- U.S. Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- U.S. Calcium Carbonate Market, By Type

- Canada

- Canada Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Canada Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Canada Calcium Carbonate Market, By Type

- Mexico

- Mexico Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Mexico Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Mexico Calcium Carbonate Market, By Type

- Europe

- Europe Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Europe Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Germany

- Germany Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Germany Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Germany Calcium Carbonate Market, By Type

- U.K.

- U.K. Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- U.K. Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- U.K. Calcium Carbonate Market, By Type

- France

- France Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- France Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- France Calcium Carbonate Market, By Type

- Italy

- Italy Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Italy Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Italy Calcium Carbonate Market, By Type

- Spain

- Spain Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Spain Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Spain Calcium Carbonate Market, By Type

- Valencia

- Valencia Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Valencia Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Valencia Calcium Carbonate Market, By Type

- Finland

- Finland Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC) (GCC)

- Precipitated Calcium Carbonate (PCC) (PCC)

- Finland Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Finland Calcium Carbonate Market, By Type

- Sweden

- Sweden Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC) (GCC)

- Precipitated Calcium Carbonate (PCC) (PCC)

- Sweden Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Sweden Calcium Carbonate Market, By Type

- Europe Calcium Carbonate Market, By Type

- North America Calcium Carbonate Market, By Type

- Asia Pacific

- Asia Pacific Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Asia Pacific Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- China

- China Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- China Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- China Calcium Carbonate Market, By Type

- India

- India Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- India Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- India Calcium Carbonate Market, By Type

- Japan

- Japan Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Japan Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Japan Calcium Carbonate Market, By Type

- South Korea

- South Korea Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- South Korea Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Indonesia

- Indonesia Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC) (GCC)

- Precipitated Calcium Carbonate (PCC) (PCC)

- Indonesia Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Indonesia Calcium Carbonate Market, By Type

- South Korea Calcium Carbonate Market, By Type

- Asia Pacific Calcium Carbonate Market, By Type

- Central & South America

- Central & South America Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Central & South America Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Argentina

- Argentina Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Argentina Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Argentina Calcium Carbonate Market, By Type

- Brazil

- Brazil Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Brazil Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Brazil Calcium Carbonate Market, By Type

- Central & South America Calcium Carbonate Market, By Type

- Middle East & Africa

- Middle East & Africa Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Middle East & Africa Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Saudi Arabia

- Saudi Arabia Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Saudi Arabia Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Saudi Arabia Calcium Carbonate Market, By Type

- South Africa

- South Africa Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- South Africa Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- South Africa Calcium Carbonate Market, By Type

- Iran

- Iran Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC) (GCC)

- Precipitated Calcium Carbonate (PCC) (PCC)

- Iran Arabia Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- Iran Calcium Carbonate Market, By Type

- .UAE

- UAE Calcium Carbonate Market, By Type

- Ground Calcium Carbonate (GCC) (GCC)

- Precipitated Calcium Carbonate (PCC) (PCC)

- UAE Calcium Carbonate Market, By Application

- Automotive

- Building & Construction

- Pharmaceutical

- Agriculture

- Pulp & Paper

- Others

- UAE Calcium Carbonate Market, By Type

- Middle East & Africa Calcium Carbonate Market, By Type

- North America

Calcium Carbonate Market Dynamics

Drivers: Growth Of Paper Industry In Asia Pacific Region

The Asia Pacific region, with its large population and high income levels, significantly influences the global paper industry due to a demand-supply imbalance. Market vendors are expected to focus on China and India due to the extensive use of calcium carbonate in their paper industries. The increasing distribution of newspapers and magazines in India is another factor that could boost market growth. Despite the pandemic-induced decline in the print media industry, the Audit Bureau of Circulation in India reported an average of 1,590,784 qualifying copies of English daily newspapers for 10 editions from January to June 2022. This can be attributed to the growing demand for regional print media in languages such as Hindi, Telugu, and Kannada. From 2006 to 2016, the demand for print media in these languages saw a Compound Annual Growth Rate (CAGR) of 8.7%, 8.2%, and 6.4% respectively. According to the Audit Bureau of Circulation, advertising revenue from print media is also expected to grow at a robust rate of 8% from 2016 to 2021. The revenue of Indian print media is projected to reach USD 4,039.3 million by 2021, as depicted in the graph below.

Growth Of The Construction Sector

Calcium carbonate, a key component in the production of adhesives, sealants, paints, coatings, and cement, is primarily used in the construction industry. The growing demand from this industry is expected to stimulate the production of these materials, thereby positively impacting the calcium carbonate market in the forecast period. The need for infrastructure upgrades is anticipated to boost the demand for calcium carbonate due to its use in paints, coatings, adhesives, and sealants. The above graph illustrates the total investments in residential and non-residential construction in Europe, expressed in USD Million. The rising demand from the expanding construction sector for various building materials is predicted to propel the growth of the calcium carbonate market. Infrastructure elements such as bridges and buildings generate significant demand for various construction materials, with calcium carbonate being a crucial raw material. Calcium carbonate also plays a vital role in cement production. Therefore, the growth of the construction sector is projected to impact cement production, subsequently affecting the demand for calcium carbonate.

Restrains: Issues Pertaining To Mining Industry

Marine limestone deposits in various parts of the U.S. are over 300 years old and contain about 95% chemical-grade calcium carbonate. However, not all areas have suitable limestone deposits, and the transportation distance increases the cost of the limestone. Truck shipping is more cost-effective than train or water shipping. Establishing new quarries and plants in the U.S. is a lengthy process. It takes approximately 2 years to set up a cement plant, and the permission process can take 8 to 10 years. These challenges limit the establishment of quarries, but many companies are still striving to expand and improve their plants. Most of the mined limestone is used for aggregate or crushed applications, with the majority of crushed stone in North America coming from limestone. Despite the increase in limestone production in the U.S., the country still imports several limestone products from countries like China, Mexico, and Canada. Rising transportation costs affect the prices of the final products. Apart from transportation issues, limestone contributes to the creation of many sinkholes and caves. Limestone dissolves on the surface due to rainwater or near-surface groundwater, especially in humid conditions where a large volume of limestone dissolves in water. These issues related to limestone mining are hindering market growth.

What Does This Report Include?

This section will provide insights into the contents included in this calcium carbonate market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Calcium carbonate market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Calcium carbonate market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the calcium carbonate market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for calcium carbonate market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of calcium carbonate market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Calcium Carbonate Market Categorization:

The calcium carbonate market was categorized into three segments, namely type (Ground Calcium Carbonate, Precipitated Calcium Carbonate), application (Automotive, Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The calcium carbonate market was segmented into type, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The calcium carbonate market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into seventeen countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Italy; Spain; Valencia; China; India; Japan; South Korea; Argentina; Brazil; Saudi Arabia; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Calcium carbonate market companies & financials:

The calcium carbonate market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

AGSCO Corp - AGSCO Corp manufactures different kinds of minerals, color chips, aggregates, ceramic colors, and custom mineral product blends. The company’s product line includes industrial minerals, a variety of flooring & pool aggregates, blasting equipment, mass finishing compounds, and aqueous parts washers. It offers calcium carbonate in the form of white fine powder in grit sizes ranging from 4 mesh to 200 mesh. The company has facilities in New Jersey, New York, Chicago, and Illinois.

-

Blue Mountain Minerals - Blue Mountain Minerals operates its business segments through building & construction, agriculture, and energy and environment. The company produces a wide range of calcium carbonate and calcium magnesium carbonate products for several industrial applications. It utilizes naturally occurring limestone rocks for manufacturing a variety of ingredients for several end-use industries.

-

Carmeuse Group - Carmeuse is a performance material and service company with core competencies in equipment, mining, and engineering solutions. The company offers calcium & dolomite, crushed limestone aggregate, chemical-grade limestone products, and integrated services that impact everyday life. Its products are used in steel manufacturing, construction, energy, and environmental services. The company has a presence across North America, Europe, Asia, South America, and the Middle East & Africa and has 28 production facilities.

-

GCCP Resources Limited - GCCP Resources Limited is mainly engaged in the business of quarrying and processing calcium carbonate by crushing quarried calcium carbonate into varying particle sizes. It has two product segments, namely GCCP Gridland Quarry/PCC and Hyper Act Quarry Operational/GCC. GCCP Gridland quarry has a production capacity of 480,000 tons of crushed limestone annually.

-

Imerys - Imerys is a calcium carbonate & mineral solutions provider, with its mining, production, and R&D operations spread globally. Its energy solutions & specialties segment includes carbonate division, which produces precipitated calcium carbonate (PCC) and ground calcium carbonate (GCC). The company manufactures and offers mineral-based value-added solutions to different industries from process manufacturing to consumer goods. It also produces limestone for local paper & packaging industries and performance mineral applications such as rubber, polymers, healthcare, personal care, beauty, and construction. It operates through 230 industrial sites located across 50 countries.

-

GLC Minerals - GLC Minerals is engaged in the processing of calcium carbonate bulk and calcium carbonate filler products along with numerous other minerals for numerous end-user markets such as glass, coatings, plastic fillers, adhesives & sealants, wastewater treatments, rubber, & fuel burning boilers. GLC Minerals mainly serves agriculture, environmental, glass, industrial fillers, and agronomy industries.

-

Greer Limestone Co. - The Greer Lime Co. provides a wide range of lime and limestone products. The product segment comprises agricultural lime, granular lime, ground lime, hydrated lime, kiln dust, large pebble lime, limestone sand, Lincolnshire seam, low carbon pebble, lower new market seam, mid-size pebble, and rock dust.

-

Gulshan Polyols Ltd. - Gulshan Polyols Limited operates through seven business segments, namely starch sugars, organic sweeteners, native starch, onsite/satellite PCC plant, calcium carbonate, IMFL, and animal nutrition. The company has a global presence in 35 countries, across 3 continents. It has been recorded in the Limca Book of Record for setting up its first On-site Plant for a Paper manufacturing company. The company’s production sites are located in Madhya Pradesh, Rajasthan, West Bengal, Punjab, Himachal Pradesh, and Gujarat in India.

-

US Aggregates - US Aggregates is a U.S.-based industrial chemical manufacturing company The company was formed with the acquisition of S&S Materials and Meshberger Stone. Later in 2019, the company acquired North American Limestone Company (NALC) and Mid Calcium Carbonates. The company offers high-calcium limestone for industrial applications. Products manufactured by the company are used in sealant products, plastics, caulk, coatings, building & construction products, polymers, rubber goods, paint formulations, paper, adhesives, and household items.

-

ILC Resources - ILC Resources is engaged in the manufacturing of feed-grade calcium carbonate. The company offers products for livestock, animal food, soil amendments, lawn & garden, and industrial applications. The company offers a wide range of limestone products including calcitic aglime, ball diamond dry, dairy-white barnlime, lawn & garden limestone, industrial lime pelletized calcitic, and precision-screened granular calcium carbonate products. It operates through its plants located in Alden, Iowa; Jasper, Missouri; and Weeping Water, Nebraska.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Calcium Carbonate Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Calcium Carbonate Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research