- Home

- »

- Next Generation Technologies

- »

-

Canada Customer Relationship Management Market ReportGVR Report cover

![Canada Customer Relationship Management Market Size, Share & Trends Report]()

Canada Customer Relationship Management Market Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By End-use, By Application, By Solution, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-590-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The Canada customer relationship management market size was evaluated at USD 3.47 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% from 2023 to 2030. The adoption of customer relationship management (CRM) software across Canada is gaining traction in multiple industries such as IT & Telecom, retail, BFSI, and others owing to the changing nature of the software in terms of functionalities and features. CRM suites also enable enterprises to gauge business performance and track the sales trajectory, which is turning out to be a lucrative feature for businesses operating in the country. Salesforce.com’s rapid growth in Canada during recent years indicates that cross-sales to existing customers with an installed base for add-ons and upgrades are also contributing to the growth of the market.

CRM solutions are gaining extensive popularity in diverse sectors such as healthcare, government & education, and others. As enterprises become more customer-centric, the customer relation management market is projected to result in rapid growth over the forecast period. Ongoing trends such as the use of automation and AI, hyper-personalization of customer service, and different customer value models are the main factors boosting the growth of the segment. Further, implementing robust social media customer service can aid in increasing response times, lower costs, enhance customer satisfaction and surge the adoption of CRM platforms across industries.

The Canada CRM market has largely evolved in recent years in line with the changing customer demands. The most important development in the market is the integration of CRM solutions with social media platforms to connect with customers over social media channels. Several vendors are promoting their products as social CRMs and are offering features such as psychographic/demographic profiling and sentiment extracting as the mainstream functions of their CRM suites. As a result, activities such as online collaboration, feedback sharing, media sharing, and ideation are replacing conventional static CRM communications.

Businesses in Canada are increasingly turning to public cloud services in place of traditional infrastructure and software. Hence, opting for cloud-based services can help businesses in saving money and that money can be invested in bettering the operations such as CRM and other software. SaaS solutions can offer several advantages. SaaS solutions are easy to deploy and can also be customized according to the changing requirements. SaaS solutions can also help businesses in saving on the costs incurred on licensing fees, support, and training. Hence, SaaS solutions can typically help organizations in cutting overall IT investments while enhancing operational efficiency and focusing on core expertise.

Businesses are increasingly utilizing CRM software to gain insights into changes in customer behavior. Organizations have inculcated upgraded business models to develop their customer reach and enhance the end-user experience. Organizations are also aiming on developing their ability to adapt to both changing customer expectations and market conditions. Incumbents of several industries and industry verticals are increasing their customer reach through various e-commerce models, such as direct-to-customer (D2C), e-retail, marketplace, and social commerce.

Moreover, a paradigm shift from standalone horizontal portals catering to different parameters of experience components separately to digital experience portals integrating all the necessary parameters of experience components into a single platform is also getting evident.

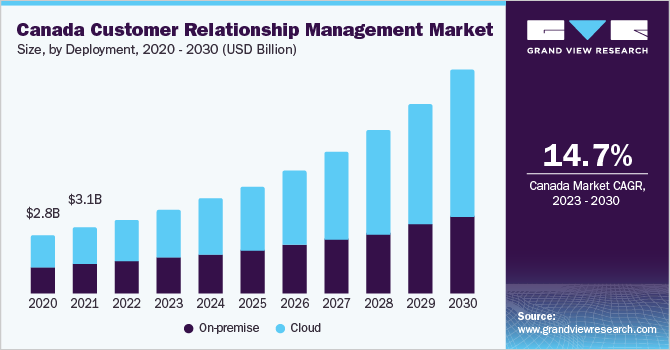

Deployment Insights

The cloud segment accounted for the largest market share of 55.4% in 2022. Organizations are increasingly opting for the cloud-based deployment of a variety of CRM solutions as they are hosted on the vendor’s server and can be remotely accessed from any location. This eliminates the need for manually upgrading business solutions and enables users to access data from any location in a hassle-free way.

The on-premise segment is anticipated to grow at a CAGR of 11.4% during the forecast period. A large number of companies are shifting from manual systems to automated systems for carrying out a variety of operations. This has led to increasing demand for on-premise solutions. As such, the on-premise segment is expected to witness steady growth over the forecast period.

Solution Insights

The customer service segment accounted for the largest market share of 23.9% in 2022. Future demand is anticipated to be fueled by the increasing use of customer care teams to monitor customer interactions, handle support requests, and effectively address problems. Agents can access customer information, history, and preferences thanks to CRM software, enabling them to offer prompt and individualized service. Customer satisfaction increases as a result of customer care employees using CRM technologies to efficiently handle questions, address complaints, and solve issues.

The social media monitoring segment is anticipated to grow at a CAGR of 17.3% during the forecast period. Strategies for customer relationship management must include social media marketing. Social media platforms can be integrated with CRM systems to improve marketing initiatives and fortify client relationships. CRM systems can work together with social media advertising tools, giving companies the ability to target particular consumer categories, follow up on leads, and enter customer data directly into the CRM database. These advantages have increased the use of social media marketing tools, which has increased market size.

End-use Insights

The large enterprises segment accounted for a market share of 63.8% in 2022. Large organizations have multiple operational departments. They widely use CRM solutions to integrate customer data with business process management features, allowing users to coordinate with their marketing, sales, and customer support processes. Moreover, various players offering scalable features in their CRM to meet the needs of large enterprises are also anticipated to surge the demand for CRM solutions in this segment.

The SMBs segment is anticipated to grow at a CAGR of 16.4% during the forecast period. Over the projection period, the segment is anticipated to develop as more governments around the world implement efforts using digital Small and Medium Enterprise (SME) campaigns such as video marketing, social media, and search engine marketing. Additionally, it is anticipated that investments in SMEs will raise the demand for digital services and make it easier to adopt project management solutions, both of which will contribute to the expansion of the SME segment in the local market.

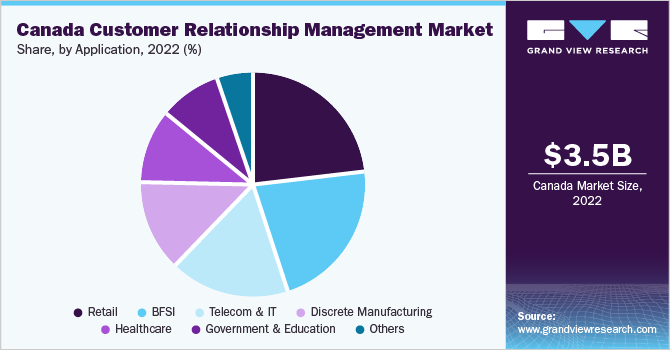

Application Insights

The retail segment accounted for the largest market share of 23.58% in 2022. The increasing competition in the retail industry has led to a growing demand for advanced CRM software and online systems to enable enterprises to provide their customers with efficient services. Moreover, new CRM offerings that support multiple channels for sale, offer analysis, and provide a complete overview of customers and their purchasing habits are also on the rise.

Such developments are expected to increase the demand for CRM solutions in the retail segment over the forecast period. The Canadian retail industry is widely adopting business solutions as they provide competitive benefits, such as graphical user interface support, optimum utilization of resources, and reduction in overhead & excessive inventory costs. This has largely contributed to the growth of the retail segment.

The telecom & IT segment is anticipated to grow at a CAGR of 16.5% during the forecast period. Factors such as the availability of high-speed wireless internet infrastructure and services and the booming IT industry are expected to further fuel the growth of the segment. For instance, software-as-a-service (SAAS) for CRM deployment enables companies to own multiple datasets from discrete systems to enhance decision-making and customer service delivery. This approach facilitates various organizations with a vertical-specific CRM to serve a dedicated purpose.

Key Companies & Market Share Insights

The key players operating in the market include Adobe Systems Inc.; Creatio; Genesys; HubSpot Inc.; IBM; Insightly, Inc.; International Business Machines Corporation; Microsoft; Oracle Corporation; Pegasystems Inc.; Sage Group PLC; Salesforce.com, Inc.; SAP SE; and Verint Systems, Inc. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In June 2021, Salesforce.com, Inc. unveiled new digital 360 capabilities to help businesses improve their digital operations and provide the newest in digital marketing, commerce, and experiences. Some prominent players in the Canada customer relationship management market include:

-

Adobe Systems Inc.

-

Creatio

-

Genesys

-

HubSpot Inc.

-

IBM

-

Insightly, Inc.

-

International Business Machines Corporation

-

Microsoft

-

Oracle Corporation

-

Pegasystems Inc.

-

Sage Group PLC

-

Salesforce.com, Inc.

-

SAP SE

-

Verint Systems, Inc.

Canada Customer Relationship Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.90 billion

Revenue forecast in 2030

USD 10.17 billion

Growth Rate

CAGR of 14.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, application, end-use

Key companies profiled

Adobe Systems Inc.; Creatio, Genesys; HubSpot Inc.; IBM; Insightly, Inc.; International Business Machines Corporation; Microsoft; Oracle Corporation; Pegasystems Inc.; Sage Group PLC; Salesforce.com, Inc.; SAP SE; Verint Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Customer Relationship Management Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada customer relationship management market report based on solution, deployment, application, and end-use:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Service

-

Customer Experience Management

-

Analytics

-

Marketing Automation

-

Salesforce Automation

-

Social Media Monitoring

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

Telecom & IT

-

Discrete Manufacturing

-

Government & Education

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMBs

-

Frequently Asked Questions About This Report

b. The global Canada Customer Relationship Management Market size was estimated at USD 3.47 billion in 2022 and is expected to reach USD 3.90 billion in 2023.

b. The global Canada CRM market is expected to grow at a compound annual growth rate of 14.7% from 2023 to 2030 to reach USD 10.17 billion by 2030.

b. Large enterprises dominated the Canada CRM market with a share of over 63.8% in 2020. Large organizations have multiple operational departments, due to which they widely use CRM solutions to integrate customer data with business process management features, enabling users to coordinate with their sales, marketing, and customer support processes.

b. Some key players operating in the Canada Customer Relationship Management Market include Adobe Systems Inc., Creatio, Genesys, HubSpot Inc., IBM, Insightly, Inc., International Business Machines Corporation, Microsoft, Oracle Corporation, Pegasystems Inc., Sage Group PLC, Salesforce.com, Inc., SAP SE, and Verint Systems, Inc.

b. Key factors that are driving the Canada Customer Relationship Management Market growth include the adoption of CRM software in various industries owing to the changing nature of the software in terms of functionalities and features. CRM suites also enable enterprises to gauge business performance and track the sales trajectory, which is turning out to be a lucrative feature for businesses.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."