- Home

- »

- Advanced Interior Materials

- »

-

Canada Maintenance, Repair & Overhaul Distribution Market Report, 2028GVR Report cover

![Canada Maintenance, Repair & Overhaul Distribution Market Size, Share & Trends Report]()

Canada Maintenance, Repair & Overhaul Distribution Market Size, Share & Trends Analysis Report By Product (Power Transmission, Gasket), By End Use (Food, Beverage & Tobacco, Aircraft), And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-498-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Advanced Materials

Report Overview

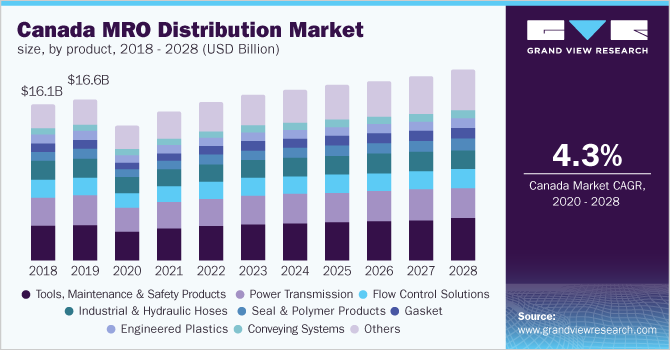

The Canada maintenance, repair & overhaul distribution market size was estimated at USD 13.60 billion in 2020 and is expected to expand at a compounded annual growth rate (CAGR) of 4.3% from 2020 to 2028. Periodic maintenance, repair, and overhaul (MRO) activities to reduce operational costs and to enhance the productivity of industrial operations are expected to drive the demand for MRO distribution. The COVID-19 outbreak in Canada has negatively impacted the manufacturing and service industries on account of the closure of production and related services. Suspension of trade across the globe and Canada has further disrupted the demand-supply of essential; components in 2020, thus negatively impacted the market for MRO distribution.

The maintenance, repair, and overhaul distribution market in Canada are expected to ascend at a compound annual growth rate of 4.3% over the forecast period. COVID-19 outbreak in Canada has restricted several industrial operations and impacted the demand for maintenance products in 2020.

The Canada maintenance, repair, and overhaul (MRO) distribution market is likely to witness a momentous growth over the forecast period owing to the increasing product demand from various end-use industries. Periodic maintenance, repair, and overhaul activities help reduce operational costs and enhance the productivity of industrial operations, which is expected to drive their demand.

Given the certainty of the rise in demand for MRO products from several end-use industries in Canada over the forecast period, the MRO distribution industry needs to be upgraded to achieve success on various crucial points such as the elimination of inventory inaccuracies within the industry.

Manufacturers have increased their allocations for maintenance expenditure to avoid miscellaneous operational costs in the long run. Apart from in-house maintenance, manufacturers in the country are also taking help from outsourced MRO services and product providers. Such initiatives by the manufacturers are the key factors for driving the demand for MRO services.

Product Insights

The tools, maintenance, and safety products segment led the Canada MRO distribution market and accounted for a revenue share of more than 22% in 2020 and is expected to expand at a CAGR of 4.6% over the projected period. Stringent regulations by several governing agencies towards the application of MRO services in different industries are expected to propel market growth.

Industrial and hydraulic hoses are utilized in several industries including mining, agriculture, oilfield, petrochemical service, and food and beverage industries. The MRO of hoses includes steps such as visual inspection, fittings, repair and replacement, and test run for proper installation. The different hoses utilized in industries include steam hoses, pressure water hoses, air & water hoses, spiral hoses, and others.

The adoption of MRO products and services in power transmission helps to lower down the risk for a power outage in the case of the electrical industry, and proper lifting of products using hydraulic equipment in construction, automobile, and metallurgy industries. The rise in the adoption of power transmission equipment in industrial operations is anticipated to ascend the demand for maintenance products.

Flow control solutions comprise valves, locks, plugs, sensors, gauges, compressors, meters, and filtration products that are used to monitor the flow of liquids and gases in machinery and pipes in power generation, air conditioning plants, oil and gas, and construction, food, beverage, dairy, pharmaceutical, biotechnology, and chemical process industries.

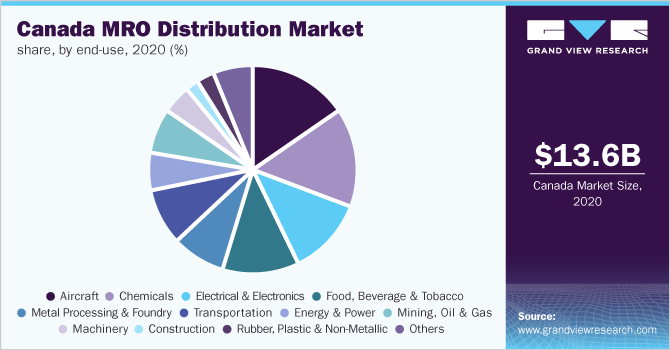

End-use Insights

MRO distribution for aircraft led the market and accounted for about 15.5% share of the revenue in 2020. The growing aircraft consumer traffic in the country for both domestic and international lines has led several foreign companies to invest in the Canadian airline industry, thus creating new growth avenues in the MRO distribution market.

The demand for MRO services is expected to rise with the increase in the setup of several large-scale textile manufacturing factories in recent years. The large machinery used for weaving, spinning, and printing require timely maintenance and repairs for their smooth functioning and accuracy in maintaining uniformity in threads, clothes, fittings, and prints.

Rising usage of wood, pulp, and paper-based products in several residential, commercial, and industrial applications is expected to lead to the setup of large-scale manufacturing facilities for these products. The growth in such industries is expected to increase the demand for MRO services for the accurate and smooth functioning of large-scale machines.

Growth in domestic oil production and exploration activities and shale gas transportation in the country has led to an increase in requirements for large-scale machinery. Operations of these machineries in a harsh environment require MRO services from time to time. Thus, the rise of the mining and oil & gas industry in the country is expected to drive the growth of the MRO distribution market.

Key Companies & Market Share Insights

The MRO distribution market in Canada is highly consolidated owing to the presence of well-established companies. Major companies operating in the region include The Hillman Group, Grainger Canada, Wajax Limited, Applied Industrial Technologies, Wurth Canada, MRC Global, Inc., and SBP Holdings among others.

The major players involved in the MRO products and services distribution in Canada cater to several end-use industries via third-party distributors, annual maintenance contracts, direct sales channels, and e-commerce. In addition, companies tend to collaborate with distributors and retailers companies in different regions for offering their services. Some of the prominent players operating in the Canada maintenance, repair & overhaul (MRO) distribution market are:

-

The Hillman Group, Inc.

-

Eriks North America

-

Grainger Canada

-

Wajax Limited

-

Applied Industrial Technologies

-

SBP Holdings

-

DGI Supply

-

Lawson Products, Inc.

-

AWC

-

Hisco, Inc.

-

EACO Corporation

-

BDI Canada

-

Wurth Canada

-

MRC Global, Inc.

-

MSC Industrial Direct Co., Inc.

-

Motion Industries, Inc.

-

Sun-Source

-

Gregg Distributors LP

-

GreenLine Hose &Fittings, Ltd.

-

A.R. Thomson Group

-

Flex-Pression

-

Quest Gasket

-

Norwesco Industries Ltd.

-

Belterra Corporation

-

Midland Industries

Canada Maintenance, Repair & Overhaul Distribution Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 15.02 billion

Revenue forecast in 2028

USD 19.10 billion

Growth Rate

CAGR of 4.3% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

Canada

Key companies profiled

The Hillman Group, Inc.; Eriks North America; Grainger Canada; Wajax Limited; Applied Industrial Technologies; SBP Holdings; DGI Supply; Lawson Products, Inc.; AWC; Hisco, Inc.; EACO Corporation; BDI Canada; Wurth Canada; MRC Global, Inc.; MSC Industrial Direct Co., Inc.; Motion Industries, Inc.; Sun-Source; Gregg Distributors LP; GreenLine Hose & Fittings, Ltd.; A.R. Thomson Group; Flex-Pression; Quest Gasket; Norwesco Industries Ltd.; Belterra Corporation; Midland Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the Canada maintenance, repair & overhaul distribution market report based on products and end use:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Tools, Maintenance & Safety Products

-

Conveying Systems

-

Industrial & Hydraulic Hoses

-

Gasket

-

Seal and Polymer Products

-

Flow Control Solutions

-

Engineered Plastics

-

Power Transmission

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Food, Beverage & Tobacco

-

Textile

-

Wood & Paper

-

Mining, Oil & Gas

-

Metal Processing & Foundry

-

Rubber, Plastic & Non-Metallic

-

Chemicals

-

Pharmaceuticals

-

Electrical & Electronics

-

Transportation

-

Aircraft

-

Machinery

-

Construction

-

Agriculture

-

Energy & Power

-

Others

-

Frequently Asked Questions About This Report

b. The Canada MRO distribution market size was estimated at USD 13.60 billion in 2020 and is expected to reach USD 15.02 billion in 2021.

b. The Canada MRO distribution market is expected to grow at a compound annual growth rate of 4.3% from 2020 to 2028 to reach USD 19.10 billion by 2028.

b. Tools, maintenance & safety products dominated the Canada MRO distribution market with a share of 22.0% in 2020. This is attributed to a wide demand for periodic maintenance of machinery in industrial production.

b. Some of the key players operating in the Canada MRO distribution market include The Hillman Group, Inc., Eriks North America, Grainger Canada, Wajax Limited, Applied Industrial Technologies, SBP Holdings, and others.

b. The key factors that are driving the Canada MRO distribution market include a rise in demand for periodic maintenance of industrial machinery to avoid operational mishaps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."