- Home

- »

- Plastics, Polymers & Resins

- »

-

Canada Multilayer Flexible Packaging Market Report, 2030GVR Report cover

![Canada Multilayer Flexible Packaging Market Size, Share & Trends Report]()

Canada Multilayer Flexible Packaging Market Size, Share & Trends Analysis Report By Material (Plastics, Paper, Aluminum Foil), By Product, By Layer Structure, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-980-8

- Number of Pages: 132

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Market Size & Trends

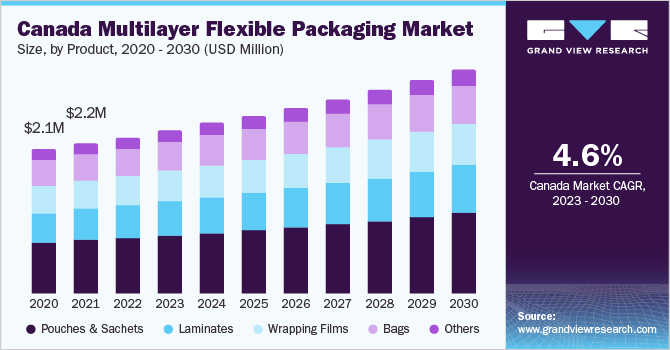

The Canada multilayer flexible packaging market size was estimated at USD 2.31 billion in 2022 and is anticipated to grow a CAGR of 4.6% over the forecast period 2023-2030. The rising packed food consumption trend and growing demand for recycled and sustainable packaging are driving the demand for the multilayer flexible packaging market in Canada.

The outbreak of the COVID-19 pandemic in 2020 led to an immediate lockdown and restrictions on movements both globally and in Canada. The restrictions on mobility increased online purchasing and the demand for packaged foods and groceries. The uncertainty toward normalization of operations led to panic buying of packaged consumer goods, such as home care, personal care products, pet food, baby food, and snacks, which resulted in considerable demand for multilayer flexible packaging.

Multilayer flexible packaging is widely used for the packaging of cheese, cream, yogurt, chocolates, pet food, processed meat, cereals, etc. It consists of multiple layers of materials such as plastic films, aluminum, and/or paper, which act as a barrier to protect the packaged food products against vapor and oxygen and help retain their nutritional value. The growing demand for packaged food products in Canada positively impacts the demand for multilayer flexible packaging in the country.

The conventional plastic-based flexible packaging used in various end-use industries such as food & beverages, pharmaceuticals, personal care & cosmetics, home care, textiles, and electrical & electronics generates humongous plastic waste. Earlier, the Government of Canada used to ship plastic scraps to Asian countries such as China, Indonesia, and Malaysia. However, the stringent regulations related to plastic waste imports imposed by governments of different countries in Asia have led the Government of Canada to take initiatives to recycle its plastic scrap and promote the adoption of sustainable packaging products. As multilayer flexible packaging comprises sustainable materials, the initiative by the government of the country to develop sustainable packaging products is expected to positively impact the demand for the multilayer flexible packaging market in Canada in the coming years.

Material Insights

Based on materials, the Canada multilayer flexible packaging industry is segmented into plastics, paper, and aluminum foil. The plastics segment accounted for the largest market share of 49.6% in 2022 in terms of revenue and is anticipated to grow at a CAGR of 4.7% during the forecast period. This is owing to its application in the form of films as layers adhered to other sheet materials and in the form of adhesive to glue the packaging layers together. In plastic films, polyethylene film is a widely used material for food packaging applications.

The paper segment is expected to grow at the fastest CAGR of 5.3% during the forecast period 2023-2030. The growing demand for sustainable packaging materials has driven the demand for paper in flexible packaging applications. Kraft paper is one of the layers in multilayer flexible packaging. It is manufactured from wood pulp and is known for its lightweight characteristics, high tear resistance, thickness, and strength.

Product Insights

Based on product, the Canada multilayer flexible packaging industry is segmented into bags, pouches & sachets, wrapping films, laminates, and others. The pouches & sachets recorded the largest market share of 35.7% in 2022. These pouches are lightweight, flexible, and easy to transport, making them a cost-effective option for both manufacturers and retailers and have a lower environmental impact than other packaging types, as they require less material to produce and generate less waste.

The laminates segment is anticipated to grow at the fastest CAGR of 5.1% during the forecast period 2023-2030. Laminates in multilayer flexible packaging differ from multilayer wrapping films in terms of material composition. It includes the lamination of any two materials like aluminum foil, plastic polymer, and paper to form a laminate helping to achieve functions that the mono materials are limited to, which drives the demand for this segment in the market.

Layer Structure Insights

Based on layer structure the market is segmented into 3 layers, 5 layers, 7 layers, and more than 7 layers. The 3 layers segment accounted for the largest market share of 40.3% in 2022. 3-layer structure-based pouches, film laminates, and bags are used in applications that require high-temperature processes, strong barrier protection, and high sealing strength which makes them suitable for application in retort packing and microwaveable bags.

The 5-layer segment is anticipated to grow at the fastest CAGR of 5.1% during the forecast period 2023-2030. 5 layered packaging provides excellent barrier properties, which helps to protect the contents from moisture, oxygen, and other external factors that affect the quality of the product which further drives the demand for this segment in the Canada multilayer flexible packaging industry.

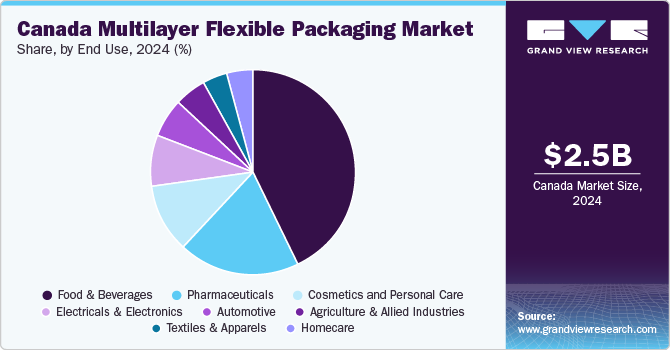

End-Use Insights

Based on end-use the market is segmented into food & beverages, automotive, pharmaceuticals, cosmetics & personal care, electrical & electronics, homecare, textiles & apparel, and agriculture & allied industries. The food & beverages segment recorded the largest market share of 43.1% in 2022. Canada possesses a multicultural population, which is continuously increasing owing to favorable working opportunities in the country. The continuously growing population in Canada is expected to drive the demand for food products and beverages, thereby directly influencing the growth of the food & beverages processing industry in the country.

The cosmetics & personal care segment is expected to grow at the fastest CAGR of 5.1% during the forecast period 2023-2030. Quebec and Ontario are home to the largest manufacturers of skincare products. The increasing awareness among consumers in Canada related to no animal tested and natural or organic cosmetic products is expected to fuel the demand for organic cosmetic products in the country which can positively impact the demand for multilayer flexible packaging products used for personal care products and cosmetics in Canada.

Key Companies & Market Share Insights

The key players operating in the Canada multilayer flexible packaging market are continuously working on developing polymers for the packaging owing to the rising demand for multilayer flexible packaging from several applications including food & beverages, cosmetic & personal care, pharmaceutical, and others.

A majority of global companies are spending extensively on research & development activities to develop advanced products and integrate new technologies and characteristics to conserve energy and improve efficiency. For instance, On February 24, 2023, ProAmpac, a North American global flexible packaging company, launched ProActive Recyclable, a new recyclable packaging product range. This new product range helps brands to meet the consumer demand for sustainable packaging. Some of the prominent players operating in the Canada multilayer flexible packaging market are:

-

Amcor plc

-

Glenroy Inc.

-

Mondi Group

-

Berry Global, Inc.

-

Constantia Flexibles

-

Transcontinental, Inc.

-

Huhtamaki

-

Uflex Limited

-

WINPAK LTD.

-

Sonoco Products Company

-

Sealed Air

-

WestRock Company

Canada Multilayer Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.41 billion

Revenue forecast in 2030

USD 3.32 billion

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, layer structure, end-use

Region scope

Canada

Key companies profiled

Amcor plc; Mondi Group; Berry Global, Inc.; Constantia Flexibles; Transcontinental, Inc.; Huhtamaki; Sealed Air; WINPAK LTD; Sonoco Products Company; Sealed Air; WestRock Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Multilayer Flexible Packaging Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada multilayer flexible packaging market report based on material, product, layer structure, and end use:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Aluminum Foil

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bags

-

Pouches and Sachets

-

Wrapping Films

-

Laminates

-

Others

-

-

Layer Structure Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

3 Layers

-

5 Layers

-

7 Layers

-

More than 7 Layers

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceuticals

-

Automotive

-

Cosmetics and Personal Care

-

Homecare

-

Electricals and Electronics

-

Agriculture and Allied Industries

-

Textiles and Apparels

-

Frequently Asked Questions About This Report

b. The Canada multilayer flexible packaging market was estimated at USD 2.31 billion in the year 2022 and is expected to reach USD 2.41 billion in 2023.

b. The Canada multilayer flexible packaging market is expected to grow at a CAGR of 4.6% from 2022 to 2030 to reach USD 3.32 billion by 2030

b. The pouches & sachets segments dominated the multilayer flexible packaging in Canada with a share of 35.70% owing to the increasing applications in the food and beverage industry.

b. The key market player in the Canada multilayer flexible packaging market includes Amcor plc, Glenroy Inc., Berry Global Inc, Mondi Group, Transcontinental, Inc, Sonoco Products Company, WINPAK LTD., Sealed Air, WestRock Company, Huhtamaki Flexible Packaging, UFlex Limited, Constantia Flexibles.

b. Growing demand for packed food and its packaging coupled with demand for sustainable packaging products is attributed to be the key driver for the multilayer flexible packaging market in Canada.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."