- Home

- »

- Clinical Diagnostics

- »

-

Cancer Biopsy Market Size, Share & Growth Report, 2030GVR Report cover

![Cancer Biopsy Market Size, Share & Trends Report]()

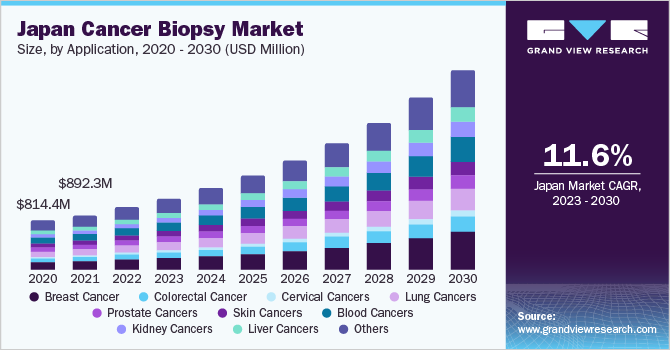

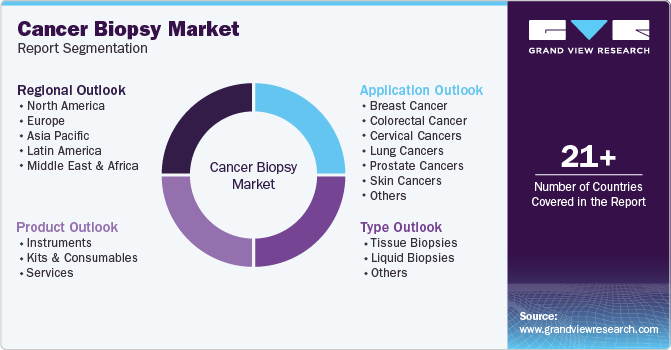

Cancer Biopsy Market Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Core Needle Biopsy), By Application (Breast Cancer, Lung Cancer), By Product (Kits & Consumables, Instruments), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-254-2

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global cancer biopsy market size was valued at USD 27.99 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.04% from 2023 to 2030. The market is projected to experience substantial growth due to several key factors. One of the primary drivers is the increasing prevalence of oncology cases, which is further fueled by the expanding geriatric population. Additionally, the introduction of liquid biopsy and continuous advancements in biopsy techniques are expected to significantly contribute to market expansion.Furthermore, within the field of oncology diagnostics, various biopsy techniques are utilized, including endoscopic, bone marrow, skin, needle, and surgical biopsies.

Among these, needle biopsies have emerged as a preferred method for early detection of patients. Specifically, fine needle aspiration (FNA) type needle biopsies offer notable advantages, such as minimal invasiveness and quicker results, leading to further growth in the market. Additionally, a series of advancements in image-guided biopsies and expanding applications of the same have been marked as a key trend in recent years. For instance, in March 2022 liquid biopsy provided the opportunity to detect cancer in various fluid bodies, and the advanced liquid biopsy enabled an attractive noninvasive procedure to get biomaterials from cancer for diagnosis.

The introduction of liquid biopsy in the fields of cancer diagnosis, screening, prognosis, and treatment monitoring has brought about a substantial increase in competition and advancements within the market. Companies actively involved in entering or conducting liquid biopsies are seen as crucial drivers of growth in clinical settings. For instance, in June 2023, LabCorp introduced a liquid biopsy aimed at identifying cancer-related biomarkers. This innovative blood test has the potential to enable cancer patients to initiate one of the most effective treatments at the earliest possible stage. Presently, liquid biopsy is primarily utilized for patients who are unable to undergo tissue biopsies, especially for the diagnosis of advanced and metastatic cancer cases.

Moreover, in June 2018, Data Driven Diagnostics Sciences, Inc., commonly referred to as D3Sciences (D3S), which is a startup, developed a cutting-edge needle biopsy instrument for minimally invasive procedures. This innovative device incorporates electrosurgery and electrocautery techniques to safely enhance the volume of tissue samples collected. The company's primary goal is to expedite cancer diagnosis and treatment by ensuring the acquisition of optimal tissue samples, enabling more effective personalized medicine approaches. This is anticipated to fuel the growth of the segment over the period.

Type Insights

Tissue biopsy generated the highest revenue and accounted for 62.02% of the total revenue in 2022. It is still considered to be a mainstay of biopsies and is largely adopted across various cancer diagnosis applications. This is attributed to robust research activities evaluating its safety and efficacy, which have contributed to this segment’s dominance in the global market throughout the forecast period.

Advancements targeted towards enhancing tissue biopsy procedures are expected to maintain its dominance in the global market for the next few years. For instance, Cernostics is developing an assay suitable for diagnosing cancer patients suffering from Barrett's Esophagus. This one-of-a-kind diagnostic test makes use of biopsy images that are digitally scanned, which aids in the analysis and quantification of alterations occurring at cellular or molecular levels within a tissue.

Liquid biopsies are anticipated to expand at the fastest CAGR over the forecast period. A rising preference toward liquid biopsy among physicians has been observed in recent years, supplemented by its ability to offer disease snapshots from the primary and distant tumor sites. This approach is put to use in personalized medicine treatment wherein tumor markers are sampled repeatedly to alter the therapy based on the patient’s response to the treatment. Furthermore, the companies are combining liquid biopsy along with advanced AI technology for better analysis of mutations in DNA. For instance, GC Genome Corporation, a South Korean based-company, in April 2023, announced its collaboration with the Korea Advanced Institute of Science and Technology (KAIST), thus highlighting the company’s new AI-based liquid biopsy technology for better DNA mutation analysis.

Application Insights

Breast biopsy emerged as the dominant segment with a market share of 15.31% in 2022, and the same is anticipated to grow at the fastest CAGR over the forecast period. Breast cancer has the highest prevalence rate. Around 1 in 8 U.S. women develop invasive breast cancer as per the U.S. breast cancer statistics. For instance, in 2022,In the US, women will be diagnosed with 287,850 new cases of invasive breast cancer, 51,400 cases of DCIS, and 43,250 will pass away from breast cancer.

Rising number of patients suspected of having breast cancer are subjected to microscopic analysis of breast tissue which is mandatory to obtain a definitive diagnosis along with detecting the stage and characterization of type. This has propelled the demand for a needle biopsy or surgical biopsy to obtain tissue for microscopic analysis, in turn contributing to the segment dominance.

Circulating tumor cells (CTC)-based liquid biopsies can track the minimal residual disease (MRD) in nonmetastatic prostate cancer patients along with the follow-up evaluations performed to offer independent prognostic insights. A novel European project initiated, Transcan—PROLIPSY is designed to assess the potential of combined use of CTCs, exosomes, and ctDNA as a noninvasive liquid biopsy modality to diagnose prostate cancer followed by its routine evaluation.

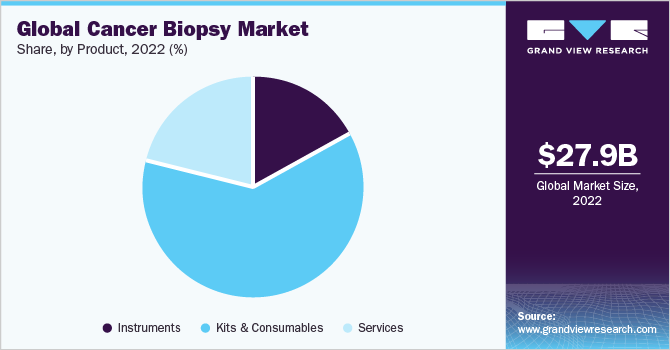

Product Insights

Kits and consumables accounted for a revenue share of 61.52% in 2022 as these are integral across various stages of biopsies and robust investments by key players operating in this industry have made significant contributions. This is also supplemented by a considerable increase in the number of patients across the globe who demand instruments and kits to be efficient accurate, and rapid. Cancer biopsy has witnessed several developments in terms of instruments, kits, and consumables. For instance, in December 2022, Summit Medical LLC. announced the launch of a single-use instrument to its product line for cervical rotating biopsy punch, which supports immediately required processes such as cancer diagnosis.

Instruments are anticipated to grow at the fastest CAGR over the forecast period. Several developing manufacturers are concentrating on launching instruments that can enhance endoscopy-based biopsies. For instance, in May 2022, Limaca Medical, an Israel-based company, announced the launch of Precision-GI, which is designed to provide a conclusive diagnosis through histologic and genetic testing of endoscopic biopsy tissues.

Regional Insights

North America market generated the highest revenue in 2022 and accounted for 40.53% of the total revenue generated. North America is anticipated to maintain a dominant share throughout the forecast, with the U.S. making significant contributions to the regional revenue. In addition, distributors and manufacturers operating in this region aim to distribute as well as develop novel kits that are well-suited for rapid diagnostic applications.

Moreover, the increasing adoption of liquid biopsies across the U.S. is largely favored by the profitable strategies laid out by the respective government authorities. Regulatory strategies for liquid biopsy-based oncology diagnostics rely on the framework, which has been developed in recent years by the US Food and Drug Administration (FDA).

This framework is comprised of the guidelines associated with enrichment biomarkers as well as companion diagnostics, and approval precedents. The ultimate success of liquid biopsy regulatory pathways has been supplemented by the increased value of Clinical Laboratory Improvement Amendment (CLIA) ‐developed tests, which the FDA has approved.

Key Companies & Market Share Insights

Companies are focusing on the expansions, development of innovative medical devices, and technological advances. In January 2023, Qiagen announced its acquisition of Verogen a forensic science NGS firm, which would help the organization strengthen its product portfolio, thus enhancing its global presence. For instance, in July 2022, BillionToOne introduced the liquid biopsy product which provides the exact tumor burden quantification without needing the tumor tissue. Thus, these collaborations among companies and new product launch are anticipated to fuel the growth of market over the forecast period. Some of the key players operating in the global cancer biopsy market include:

-

Qiagen N.V.

-

Illumina, Inc.

-

ANGLE Plc

-

BD (Becton, Dickinson and Company)

-

Myriad Genetics

-

Hologic, Inc.

-

Biocept, Inc.

-

Thermo Fisher Scientific, Inc.

-

Danaher

-

F. Hoffmann-La Roche Ltd.

-

Lucence Diagnostics Pte. Ltd.

-

GRAIL, Inc.

-

Guardant Health

-

Exact Sciences Corporation

-

Freenome Holdings, Inc.

-

Biodesix (Integrated Diagnostics)

-

Oncimmune

-

Epigenomics AG

-

HelioHealth (Laboratory for Advanced Medicine)

-

Genesystems, Inc. (Genesys Biolabs)

-

Chronix Biomedical, Inc.

-

Personal Genome Diagnostics Inc.

-

Natera, Inc.

-

Personalis Inc.

Cancer Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.05 billion

Revenue forecast in 2030

USD 51.61 billion

Growth rate

CAGR of 8.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Companies profiled

QIAGEN; Illumina Inc.; ANGLE plc.; BD; Myriad Genetics; Hologic, Inc.; BIOCEPT, INC.; Thermo Fisher Scientific, Inc.; Danaher Corporation; F. Hoffmann-La Roche Ltd.; Epigenomics AG; HelioHealth (Laboratory for Advanced Medicine); 20/20 Genesystems, Inc. (Genesys Biolabs); Personal Genome Diagnostics, Inc.; Natera, Inc.; Chronix Biomedical, Inc.; Personalis, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Grail, INC.; Guardant Health; Exact Sciences Corporation; Biodesix (Integrated Diagnostics); Oncimmune.

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cancer Biopsy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the global cancer biopsy market report based on product, type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Kits And Consumables

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Biopsies

-

Needle Biopsies

-

Fine Needle Aspiration (FNA)

-

Core Needle Biopsy (CNB)

-

-

Surgical Biopsies

-

-

Liquid Biopsies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancers

-

Lung Cancers

-

Prostate Cancers

-

Skin Cancers

-

Blood Cancers

-

Kidney Cancers

-

Liver Cancers

-

Pancreatic Cancers

-

Ovarian Cancers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer biopsy market size was estimated at USD 27.99 billion in 2022 and is expected to reach USD 30.05 billion in 2023.

b. The global cancer biopsy market is expected to grow at a compound annual growth rate of 8.04% from 2023 to 2030 to reach USD 51.61 billion by 2030.

b. The tissue biopsy segment dominated the cancer biopsy market with a share of 62.02% in 2022. Tissue biopsy is the only test that confirms the onset of lung cancer in patients and is a preferred biopsy technique across the diagnosis of different cancer types.

b. Some key players operating in the cancer biopsy market include Illumina, Inc., ANGLE Plc, BD (Becton, Dickinson, And Company), Myriad Genetics, Hologic, Inc., Biocept, Inc., Thermo Fisher Scientific, Inc. (Qiagen N.V.), Danaher, and F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the cancer biopsy market growth include the emerging significance of cancer biopsy and tissue sectioning in providing important information with respect to oncology-based molecular profiling coupled with the advent of non-invasive liquid biopsies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."