- Home

- »

- Healthcare IT

- »

-

Global Cancer Registry Software Market Size Report, 2019-2026GVR Report cover

![Cancer Registry Software Market Size, Share, & Trends Report]()

Cancer Registry Software Market Size, Share, & Trends Analysis Report By Software (Standalone), By Deployment Model (On-Premise), By Component (Commercial), By End Use (Government & Third Party), By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-753-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Healthcare

Report Overview

The global cancer registry software market size was valued at USD 47.4 million in 2018 and is expected to grow at a compound annual growth rate (CAGR) of10.5% from 2019 to 2026. Increasing incidence of cancer and a growing number of accountable care organizations are among factors driving the market growth. According to WHO, cancer accounted for around 9.6 million deaths globally and around 17 million new cases were diagnosed in 2018.

The cancer registry software helps automate data collection for national and state registries, which further helps track the effectiveness of different treatment approaches. Moreover, the data collected by the state registries help understand and address the disease in a better way. The collected data is pivotal to target risk factors such as tobacco use, sun exposure, or some environmental factors including chemical & radiation exposure. This information is also necessary for identifying locations where screening and treatment options should be tracked and improved. Moreover, registry data is useful for research institutes to estimate the efficiency of cancer control, treatment, & prevention program.

The adoption of cancer registry software is anticipated to increase shortly owing to various advantages such as efficient workflow management, ease of use, automated case registries, updates, and effective follow up. It helps in connecting remote patients, thereby widening the scope for epidemiological research.

As per NIH, cancer is a national burden and is the second leading cause of death in the U.S. Cancer costs an estimated USD 107 billion in healthcare expenditures and lost productivity from illness & death every year. Rising adoption of EHR and patient engagement solutions is further anticipated to boost the demand for cancer registry software.

Cancer registry in hospitals can help clinicians evaluate therapy results and plan treatment accordingly. Developed and developing countries are working toward implementing the software in all hospitals to track the disease and provide a framework for assessing and controlling the impact. However, data security-related issues, privacy policies, and low awareness may restrain growth shortly.

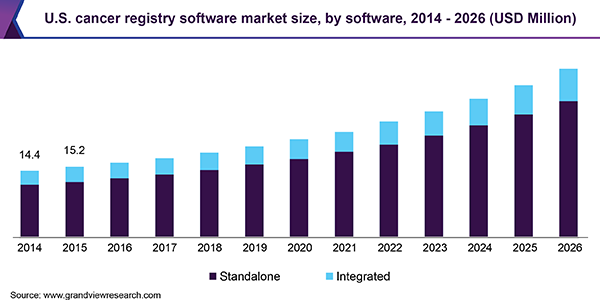

Software Insights

Based on software, the market is segmented into standalone and integrated software. The standalone segment held the largest revenue share as of 2018 owing to its advanced features and easy-to-use tools. Moreover, it allows the processing of registry data and multiple system usages, which is further boosting the market. The automatic upgrade feature of standalone software helps reduce IT overhead costs. CAN REG 5 is standalone software launched by WHO, which is open-source with features such as automated system backup and data restoration.

Integrated software is expected to exhibit significant growth over the forecast period owing to the increasing need for integrating software with a regional oncology network. This will help track affected geographic locations and evaluate the clinical intervention. It will further help gain information on disease burden and the effectiveness of treatment programs. Moreover, integration with screening archives is also necessary to identify screen-detected cancers and improve evaluation techniques. These factors are expected to propel the growth of this segment in the coming years.

Deployment Model Insights

The on-premise segment held the largest share of the deployment model market as of 2018. Increase in adoption of on-premise solutions by hospitals & research institutes due to their various benefits such as the lower risk of external attacks and high data security against breach are boosting the revenue. These solutions are also helpful for heavy data file transfers and system upgrades. Research institutes mostly use on-premise models due to the confidentiality of their data and advanced features associated with these models.

The cloud-based segment is expected to exhibit lucrative growth over the forecast period owing to reduced installment charges and IT overhead costs. Cloud-based software mostly provides a platform-as-a-service solution. Major advantages of a cloud-based system include real-time data analysis and integration by standard guidelines. Companies are working toward increasing data safety of this model, which is expected to propel market growth soon.

Component Insights

Based on components, the market is segmented into commercial and public. The commercial segment held the largest revenue share as of 2018 owing to its advantage of data safety as compared to the public database. The commercial database is mostly in compliance with government standards and coding. The data is also highly structured and easy to track. Commercial systems allow data exchange among government research organizations such as CDC and central cancer registries.

The public database market is expected to exhibit lucrative growth over the forecast period owing to increasing cancer research programs. This database is used for specific research tasks or projects. An increasing number of research institutes in developed countries due to the growing disease burden is further propelling growth. Registry Plus is a public database registry launched by CDC for collecting and processing cancer registry data for any specific project.

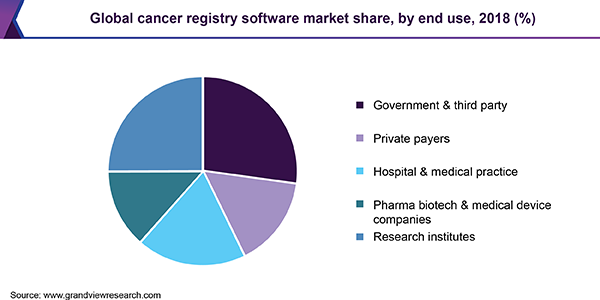

End-use Insights

The government & third party held the largest revenue share of the end-user segment as of 2018. Increasing the implementation of this software by governments of both developed and developing countries to reduce the cancer burden is fueling the growth of the market. Governments can easily track the most affected areas using this registry and can take preventive measures. Moreover, increasing government funding in hospitals for the implementation of software is boosting segment revenue.

Research institutes segment is expected to grow at a lucrative rate over the forecast period due to increasing research initiatives being undertaken by government & private organizations to address the increasing incidence of cancer. These institutes use software to track patients for clinical trials and check the efficacy of treatment programs. Pharmaceutical, biotechnology, & medical devices companies segment is also expected to exhibit significant growth over the forecast period owing to increasing R&D by these companies for better treatment outcomes.

Regional Insights

North America accounted for the largest revenue share in the cancer registry software market in 2018 owing to the presence of developed infrastructure. Increasing incidence of cancer in this region due to tobacco smoking and lack of physical activity, among others, is propelling the market growth. According to the National Cancer Institute (NCI), there were 1,735,350 new cases of cancer reported in the U.S. as of 2018. Moreover, the presence of key industry players, increasing investments in healthcare IT, and high adoption of this software are among factors further fueling growth.

The Asia Pacific is expected to witness lucrative growth over the forecast period owing to increasing government initiatives being undertaken in this region. The Ministry of Health Labour and Welfare in Japan has undertaken initiatives to improve the existing healthcare infrastructure. China has also launched its 12th Five-year Plan to upgrade Regional Healthcare Information Networks (RHINs) for rural citizens of the country. Moreover, the shift of pharmaceutical companies to low-cost manufacturing countries such as China and India is further propelling the growth of the Asia Pacific market. However, weak infrastructure, low quality, and insufficient coverage are some of the major factors, which may limit growth soon.

Key Companies & Market Share Insights

The market is consolidated in nature with the presence of a limited number of players. These players adopt strategies, such as the launch of new products, technological advancements, and M&A, to gain a higher share of the market. For instance, in November 2018, Onco, Inc. upgraded Oncology Version 4.4.0., with new AJCC 8th, NAACCR 18, SEER, CoC, and STORE requirements to increase its revenue. In April 2018, Elekta invested in PalabraApps LLC.in order to improve its MOSAIQ Oncology Information System software. Some of the prominent players in the cancer registry software market include:

-

Elekta

-

C/NET Solutions

-

Electronic Registry Systems Inc.

-

Onco Inc.

-

McKesson Corporation

-

Rocky Mountain

Cancer Registry Software Market Report Scope

Report Attribute

Details

The market size value in 2020

USD 56.1 million

The revenue forecast in 2026

USD 103.5 million

Growth Rate

CAGR of 10.5% from 2019 to 2026

The base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Russia; Japan; China; India; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Elekta; C/NET Solutions; Electronic Registry Systems; Inc.; Onco, Inc.; McKesson Corporation; Rocky Mountain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2026. For this study, Grand View Research has segmented the global cancer registry software market report based on product, delivery mode, component, end-use, and region:

-

Software Outlook (Revenue, USD Million, 2014 - 2026)

-

Standalone

-

Integrated

-

-

Deployment Model Outlook (Revenue, USD Million, 2014 - 2026)

-

On-premise

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2014 - 2026)

-

Commercial

-

Public

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2026)

-

Government & third party

-

Private payers

-

Hospital & medical practice

-

Pharma biotech & medical device companies

-

Research institutes

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cancer registry software market size was estimated at USD 51.5 million in 2019 and is expected to reach USD 56.1 million in 2020.

b. The global cancer registry software market is expected to grow at a compound annual growth rate of 10.5% from 2019 to 2026 to reach USD 103.5 million by 2026.

b. North America dominated the cancer registry software market with a share of 45.43% in 2019. This is attributable to presence of developed infrastructure and increasing incidence of cancer due to tobacco smoking and lack of physical activity.

b. Some key players operating in the cancer registry software market include Elekta, C/NET Solutions, Electronic Registry Systems, Inc., Onco, Inc., McKesson Corporation, and Rocky Mountain.

b. Key factors that are driving the cancer registry software market growth include increasing incidence of cancer and growing number of accountable care organizations coupled with efficient workflow management, ease of use, automated case registries, eUpdates, and effective follow up.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."