- Home

- »

- Medical Devices

- »

-

CBD Consumer Health Market Size & Share Report, 2030GVR Report cover

![CBD Consumer Health Market Size, Share & Trends Report]()

CBD Consumer Health Market Size, Share & Trends Analysis Report By Product (Medical OTC Products, Nutraceuticals), By Distribution Channels (Retail Pharmacies, Retail Stores, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-762-9

- Number of Pages: 183

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

CBD Consumer Health Market Size & Trends

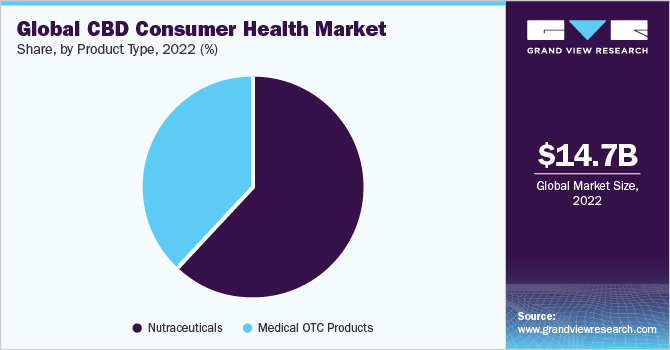

The global CBD consumer health market size was valued at USD 14.7 billion in 2022 and is anticipated to grow at a CAGR of 18.1% during the forecast period. The leading factor attributed to the growth is the positive government reforms for the legalization of cannabidiol (CBD) in various regions. CBD consumer products are gaining significant acceptance due to rising awareness of their health benefits. Furthermore, the demand for hemp-derived CBD products is increasing globally due to the legalization of hemp in various countries.

Cannabidiol has become increasingly popular in dietary supplements due to its health benefits and non-narcotic properties. Unlike Tetrahydrocannabinol (THC), it helps users obtain the health benefits of cannabis without intoxication. People believe that CBD supplements offer more natural alternatives when compared to prescription or over-the-counter drugs for relieving stiffness, pain, anxiety, stress, and other medical conditions. Hemp-derived CBD is a preferred source by manufacturers owing to the low concentration of THC. The presence of favorable regulations about hemp cultivation in various countries, such as the U.S., Canada, China, India, the UK, and several European countries, has supported the demand for hemp-derived CBD products and helped these countries boost exports.

Cannabidiol has become the latest consumer trend. An increasing number of benefits of cannabidiol in various health applications and marketing and advertising efforts taken by the market participants are some of the major factors driving the product demand. Subsequently, the increase in product options for consumers, such as topicals, analgesics, edibles, oils, tinctures, and many other products, is also driving the CBD consumer health market.

In addition, increasing awareness about the health benefits of CBD-infused products has led to an increase in the number of people willing to buy these products, irrespective of the cost. The mainstream retailers earlier engaged in the sale of non-CBD products are focusing on selling CBD-based products due to the higher profit margin and growing demand. For instance, In March 2023, CV Sciences, Inc., a U.S. based consumer wellness company specializing in selling hemp extracts and other proven, science-backed natural ingredients, announced the launch of +PlusCBD Daily Balance THC-Free Gummies and Softgels in their product portfolio, which offers wellness benefits of CBD to the consumers. In March 2019, CVS Pharmacy started selling hemp-derived CBD topicals across 800 retail stores in eight states in the U.S. In addition, after a short span, another company, Walgreens Boots Alliance, announced its decision to stock its CBD topicals in 1,500 stores across the U.S.

Product Type Insights

Nutraceuticals segment accounted for the largest revenue share of over 60% in 2022 and is also expected to witness a CAGR of 18.7% over the forecast period. The increasing adoption of CBD-infused nutraceutical products in various applications such as weight management, sports nutrition, and health and wellness are contributing to the market growth. The increasing awareness amongst consumers regarding the health benefits of cannabidiol, changing consumer preferences towards organic ingredients in dietary supplements, and favorable government reforms regarding CBD are the key factors driving the growth.

Moreover, the increasing number of companies entering the CBD nutraceuticals space, lucrative investment opportunities, and increasing consumer base are likely to drive the demand for these products at a substantial pace over the forecast period. In January 2023, Medical Marijuana, Inc., the first publicly traded cannabis company in the U.S., launched two new full-spectrum products in Brazil under its subsidiary HempMeds Brasil. These competitively priced products are available in 30 and 60 mL jars, offering 3,000 to 6,000mg of CBD with significant cost savings for the rapidly growing Brazilian market. The subsidiary's competitive pricing model aims to capitalize on the growing market.

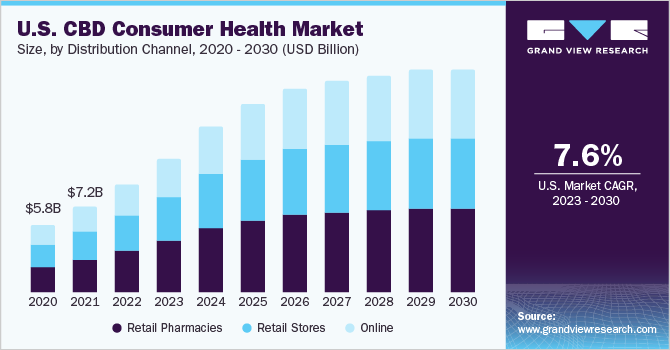

Distribution Channel Insights

In 2022, the retail pharmacies segment dominated the overall market with a revenue share of around 40% and is anticipated to grow at a lucrative pace over the forecast period. After the legalization of CBD products in various geographies, the avenues for supplying those products to consumers broadened. This is mainly due to the higher consumption of cannabidiol-infused OTC medicines or products through retail pharmacies.

In addition, the online stores segment is estimated to register the fastest CAGR of 9.0% during the forecast period owing to the ease of availability of products through online portals. Furthermore, many companies have introduced their online portals to purchase CBD-based products. This has increased the visibility of cannabidiol products to consumers, even in remote locations. In addition, companies have tied up with specialty stores, such as Sephora or GNC, for online and offline sales. In Oct 2022, Charlotte's Web Holdings, Inc. partnered with Gopuff, a national distribution platform, to offer its leading CBD products, including gummy lines, oil tinctures, topical creams, balms, and pet products, on the Gopuff platform.

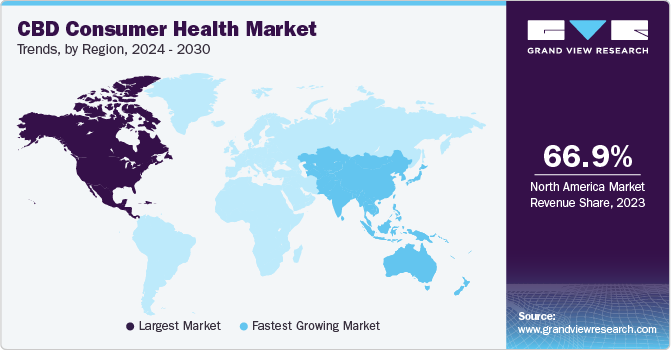

Regional Insights

North America dominated the CBD consumer health market for cannabidiol consumer health products, with a revenue share of around 70% in 2022. This is attributed to the higher concentration of CBD companies and relaxed laws regarding the utilization of the products. In addition, an increase in consumption, rise in awareness about their health benefits, growing popularity for CBD-based food and health products, and the introduction of the Farm Bill 2018, legalizing hemp cultivation and manufacturing of hemp-derived products in the U.S. are some major factors driving the demand in North America. Recently, in January 2023, FDA concluded that existing regulatory frameworks for foods and supplements are not appropriate for cannabidiol, and the agency will plan to work with Congress to develop a strategy.

Asia Pacific segment is estimated to register the fastest CAGR of 40% during the forecast period. This is attributed to the increasing awareness and acceptance of the health benefits of CBD, especially for chronic pain, anxiety, insomnia, epilepsy, and skin condition, and the acceptance of CBD products in some Asian countries, such as Thailand, South Korea, Japan, and India, which creates a favorable environment for the industry and consumers are some factors propelling the growth in this region.

Furthermore, Europe is also anticipated to witness the fastest CAGR during the forecast period, attributed to rising consumer awareness and positive attitudes regarding CBD and its products and strategic investments of major companies operating in Europe. Moreover, there is growing adoption of cannabidiol oil in countries such as Switzerland, Germany, and the UK, which is expected to drive the regional market. According to a study by Frontier Financial Group, Inc., European cannabis consumers are embracing CBD edibles and topicals. In September 2022, Medical Marijuana, Inc., the first publicly traded cannabis company in the US, announced that its subsidiary, Kannaway, has signed a distribution agreement with Complete Hemp Technologies (CHT) to expand its European market capabilities. The agreement adds warehousing and daily operations to CHT's services, resulting in cost-savings and improved gross margins in one of the Company's largest international markets.

Key Companies & Market Share Insights

Key players are focused on increasing their geographical presence and acquiring other minor players, which will help them gain a strong foothold in the market. In June 2023, Pineapple, Inc. acquired Pineapple Wellness, Inc. and its e-commerce platform. The acquisition will allow educational seminars on CBD usage and promote Pineapple Wellness products at pop-up wellness events and conferences worldwide. The strategy will also allow Pineapple to expand its reach to legal cannabis markets. In April 2023, GABY Inc. entered into a Share Purchase Agreement with HempFusion Wellness Inc. to acquire all issued and outstanding shares in the capital of HF's subsidiary Hempfusion, Inc., the parent company of Sagely Enterprises Inc. and APCNA Holdings, LLC. HempFusion is a unique topical and ingestible brand, listed with the U.S. FDA as an over-the-counter pain relief topical which includes hemp-derived CBD.

In April 2023, UK-based Naturecan acquired IAH Oregon's cannabidiol production facility in the U.S. for USD 10 million. IAH Oregon produces CBD for Naturecan's popular products, using certified organic hemp from Oregon farms. In September 2022, Real Brands acquired Boulder Botanical & Bioscience Laboratories Inc. from Frankens Investment Fund. The acquisition will increase R&D capabilities and production capacity by 300% in the human and pet supplement and CBD markets. Such initiatives by the key participants are fueling the market competition. Some of the prominent players operating in the global CBD consumer health market are:

-

Elixinol Global Limited

-

ENDOCA

-

NuLeaf Naturals LLC

-

Kazmira

-

Charlotte's Web

-

Joy Organics

-

Lord Jones

-

Medical Marijuana Inc.

-

CV Sciences Inc.

-

Isodiol International Inc.

CBD Consumer Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.5 billion

Revenue Forecast in 2030

USD 61.17 billion

Growth Rate

CAGR of 18.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China,; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Elixinol Global Limited; ENDOCA; NuLeaf Naturals LLC; Kazmira; Charlotte's Web; Joy Organics; Lord Jones; Medical Marijuana Inc; CV Sciences Inc; Isodiol International Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Consumer Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global CBD consumer health market report on the basis of product type, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical OTC Products

-

CBD Analgesic Products

-

CBD Dermatology Products

-

CBD Mental Health Products

-

CBD Sleeping Aids Products

-

Other OTC Products

-

-

Nutraceuticals

-

CBD Vitamins and Dietary Supplements (VDS)

-

CBD Sports Nutrition

-

CBD Weight Management and Wellbeing

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Stores

-

Retail Stores

-

Retail Pharmacies

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CBD consumer health market size was estimated at USD 14.7 billion in 2022 and is expected to reach USD 19.5 billion in 2023.

b. The global CBD consumer health market is expected to grow at a compound annual growth rate of 18.1% from 2023 to 2030 to reach USD 61.17 billion by 2030.

b. North America dominated the CBD consumer health market with a share of 68.8% in 2022. This is attributable to the introduction of the 2018 Farm Bill that legalized hemp cultivation and processing of hemp-derived products.

b. Some key players operating in the CBD consumer health market include CV Sciences, Inc.; Medical Marijuana Inc.; Elixinol; CV Sciences, Inc.; CHARLOTTE’S WEB; ENDOCA; Isodiol; NuLeaf Naturals, LLC; Joy Organics; Kazmira LLC; and Lord Jones.

b. Key factors driving the Cannabidiol (CBD) consumer health market growth include growing consumer preference for plant-based supplements, awareness regarding medical benefits of cannabidiol including its remedial properties, and legalization of hemp-derived CBD (cannabidiol) products in various countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."