- Home

- »

- Animal Health

- »

-

CBD Pet Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![CBD Pet Market Size, Share & Trends Report]()

CBD Pet Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Indication (Joint Pain, Anxiety/Stress, General Health/Wellness), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-103-5

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global CBD pet market size was estimated at USD 195.98 million in 2022 and is expected to grow at a lucrative compound annual growth rate (CAGR) of 31.8% from 2023 to 2030. The market is primarily driven by factors such as rising R&D initiatives, increasing demand, pet humanization, and expenditure. The complexity and uncertainty around regulations, however, is a key restraining factor for the cannabidiol (CBD) pet market. Many CBD companies are thus pursuing certification from veterinary organizations or trusted animal-welfare groups [such as the National Animal Supplement Council (NASC)] to help differentiate their products and assure customers of product quality. In October 2019, Medterra CBD’s line of CBD pet products including tinctures and pet chews gained the NASC approval.

The COVID-19 pandemic had an overall neutral impact on the CBD pet market due to the presence of both positive and negative factors. Restraining factors included supply chain hurdles, operational challenges, complexities in regulations, and a decline in CBD prices. As per an independent survey by LeafReport, CBD prices decreased by 17% in 2020 except for pet edibles, which registered a 44% increase in prices. This was due to the entry of more hemp suppliers in the market since the implementation of the farm bill in 2018.

The positive impact included an increase in demand for CBD pet products owing to rising pet health concerns and pet expenditure. As per the chief marketing officer at cbdMD, Matt Coapman, and Paw CBD, the COVID-19 pandemic propelled CBD sales as people stayed at home and were more attuned to their pet’s health. After the COVID-19 pandemic, as pet parents started to go back to their offices, CBD products gained demand as a means to alleviate any separation issues the pets may have. Anxiety issues (separation, noise aversion, etc.), comfort support, and mobility are the most common reasons pet owners opt for CBD.

CBD or cannabidiol is a plant-based chemical that has a proven therapeutic value for animal companions. Its benefits include pain relief & seizure control. Its anti-inflammatory actions have also been studied. This non-psychoactive compound appears to be safe for use in pets such as dogs and cats. As CBD gains more attention among pet owners, CBD-derived products become more diverse in forms such as treats, foods, oils, topicals, and tinctures. Owing to rising awareness, pet owners are increasingly using CBD for their cats, dogs, and other pets. For instance, according to a survey conducted by Leafreport in 2021, 50% of the respondent pet owners in the U.S., reported using CBD for their pets. Such factors are expected to fuel market growth.

Animal Type Insights

In 2022, the dogs segment held the largest revenue share by animal type, owing to a comparatively higher pet dog population and wider usage of CBD products for dogs for treating various conditions. These conditions include osteoarthritis, hip dysplasia, or chronic diseases. According to a study published in September 2021 by the National Library of Medicine, CBD has been reported to be efficient in reducing joint inflammation and pain in dogs affected with osteoarthritis & epilepsy. On the other hand, the growing adoption rate of dogs in every region further boosts the market growth.

Cats are the second-most popular choice as pets. These also remain much easier to adapt in smaller family homes. Hence, the segment is thus projected to grow the fastest at a rate of over 30% from 2023 to 2030. The younger generation, especially millennials, display high concern for maintaining the health of their pets including cats. Moreover, cats are among the most widely adopted pets in European countries such as Germany. For instance, FEDIAF estimates that in 2021, 26% of German homes had at least one cat. This figure was substantially higher than that in 2019. In several situations, pet cats show signs of anxiety and nervousness, where CBD oils can be naturally effective in minimizing anxiety without any harmful adverse effects.

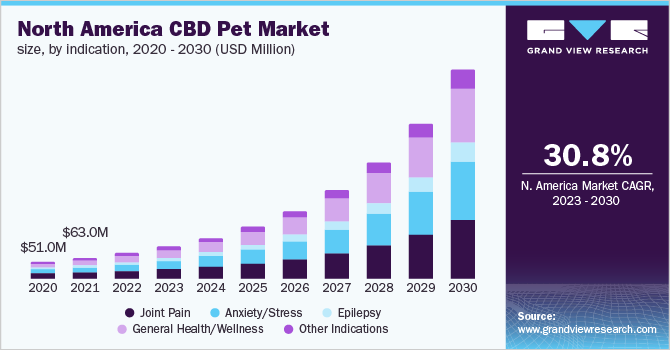

Indication Insights

By indication, joint pain accounted for the highest share of over 20% of the market in 2022. The anxiety/stress segment on the other hand is estimated to grow at the fastest CAGR of over 31%. CBD is widely used for reducing joint pain and improving the quality of a pet’s life. Joint pain can have many causes such as arthritis, overworking, trauma, and hip dysplasia, among others. CBD can be helpful in relieving pain associated with these conditions. Market players offer a variety of products for the alleviation of joint pain and anxiety/ stress in pets. These solutions include CBD oils, treats/ foods, and topicals.

Anxiety or stress is as common in animals as in humans. Some common symptoms include increased vigilance, panting, compulsive behavior, changed sleep patterns, unusual barking, drooling, restlessness, destructive behaviors, urination, and depression showing that an animal is anxious or stressed. According to a survey conducted in May 2022 by Green Element—a CBD-supplying company—anxiety rates in the U.S. pet dogs caused by other cats or dogs increased to 43.5% in 2022 from 16.5% in 2020. This is expected to contribute to segment growth.

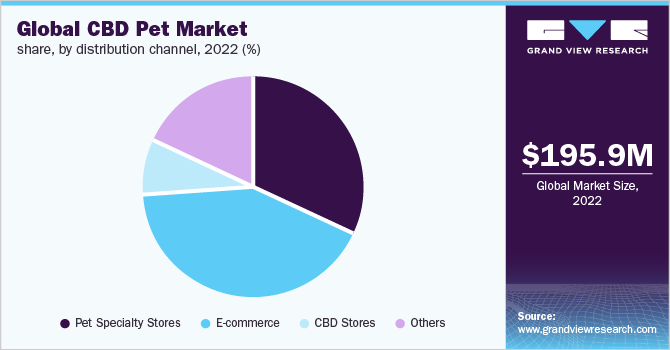

Distribution Channel Insights

The e-commerce segment dominated the market with the largest revenue share of more than 42% in 2022. These channels help pet owners avoid physically visiting the store and reduce travel, as well as associated expenses. The seasonal discount options available on e-commerce websites combined with an extensive product portfolio contribute to the high share of the segment. Hence, the growing preference for online shopping due to convenience and the booming e-commerce industry is expected to drive segment growth.

CBD stores are specialty pet product centers that sell an increasingly wide range of CBD products for companion animals. According to a PPN, LLC report published in October 2020, nearly 34% of the U.S. & Canadian pet owners purchase CBD pet products through specialty CBD store channels. CBD stores help people analyze several factors before purchasing products for their pets, such as the concentration of CBD in the product, its quality, exclusion of herbicides/pesticides, the amount of Tetrahydrocannabinol (THC), and, most importantly, whether the plant has been cultivated in the U.S. or not. Moreover, CBD pet stores are expected to grow in numbers in the near future, as CBD in pet care is considered the next big opportunity in developed markets such as the U.S.

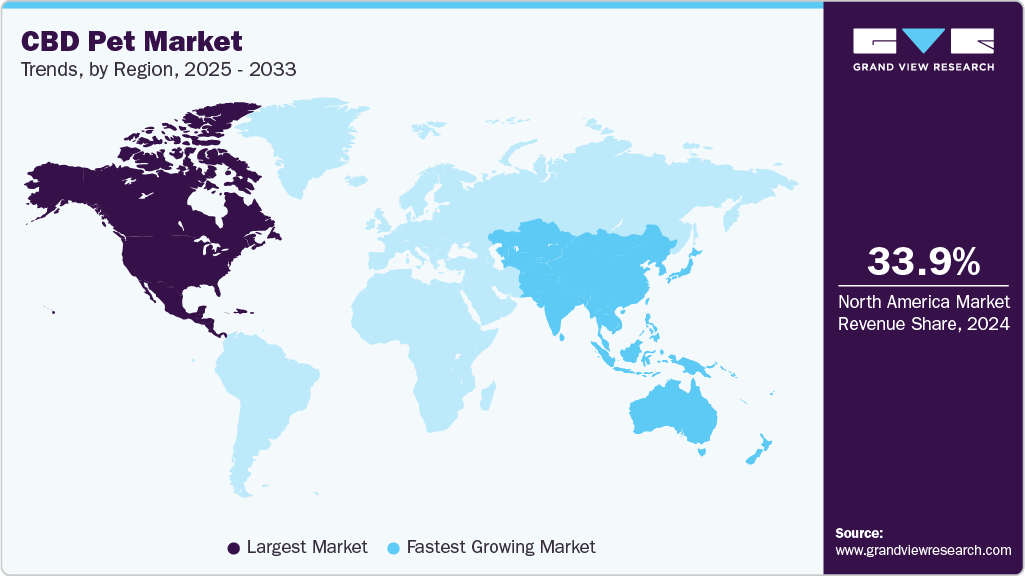

Regional Insights

The North America region dominated the CBD pet industry in 2022 with a share of over 40.53%. The increased benefits of cannabis coupled with high awareness among owners drive the market growth. Furthermore, an overall increase in the acceptance of cannabidiol for pet care, pharmaceutical, and wellness purposes is expected to fuel the market growth. The market growth can also be attributed to the increasing R&D activities conducted by major CBD pet companies. Major companies have launched several new products. Furthermore, increased strategic collaborations with other marketplayers continue to boost their market share.

The CBD pet landscape in Asia Pacific is expected to expand the fastest at a rate of over 33% during the forecast period. The region's CBD pet industry is expanding as a result of factors such as the increased authorization of CBD in various countries and supportive government initiatives by Thailand, South Korea, & Australia for the use of CBD. In 2016, medical cannabis became legal in Australia. Moreover, to promote the cannabis market, the federal government authorized the export of medical cannabis in 2018. Such supportive factors propel the Asia Pacific CBD pet industry.

Key Companies & Market Share Insights

The market is fragmented and competitive in nature. Market players are involved in offering the right balance of quality and affordability to customers to increase sales. Companies undertake various strategic initiatives such as collaborations, product launches, and R&D to increase their market presence and share. For example, in March 2022, HealthyTOKYO launched its first CBD pet line of products comprising CBD-infused treats and supplements for cats and dogs in Japan. In August 2022, Pet Releaf another key market player launched a line of CBD grooming products for dogs, which include skin and coat relief shampoos. Some prominent players in the CBD pet market include:

-

Honest Paws

-

Canna-Pet

-

FOMO Bones

-

Pet Releaf

-

HolistaPet

-

Joy Organics

-

Wet Noses Natural Dog Treat Co.

-

CBD Living

-

PETstock

-

Petco Animal Supplies, Inc.

-

Charlotte’s Web

-

Green Roads

-

HempMy Pet

CBD Pet Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 248.39 million

The revenue forecast in 2030

USD 1.71 billion

Growth rate

CAGR of 31.8% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, indication, distribution channel, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Honest Paws; Canna-Pet; FOMO Bones; Pet Releaf; HolistaPet; Joy Organics; Wet Noses Natural Dog Treat Co.; CBD Living; PETstock; Petco Animal Supplies, Inc.; Charlotte’s Web; Green Roads; HempMy Pet

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

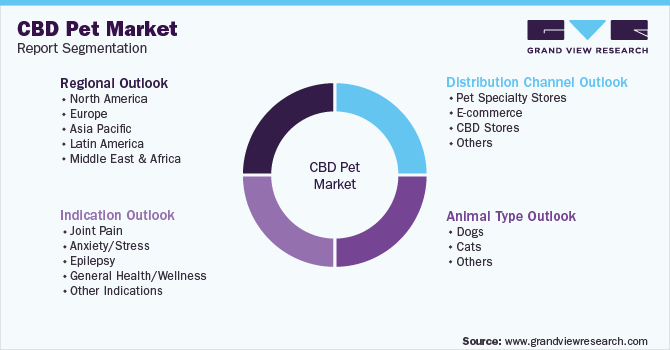

Global CBD Pet Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global CBD pet market report based on animal type, indication, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Foods/Treats

-

Vitamins & Supplements

-

-

Cats

-

Foods/Treats

-

Vitamins & Supplements

-

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Joint Pain

-

Anxiety/Stress

-

Epilepsy

-

General Health/Wellness

-

Other Indications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pet Specialty Stores

-

E-commerce

-

CBD Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global CBD pet market size was estimated at USD 195.98 million in 2022 and is expected to reach USD 248.39 million in 2023.

b. The global CBD pet market is expected to grow at a compound annual growth rate of 31.83% from 2023 to 2030 to reach USD 1.71 billion by 2030.

b. The North America region dominated the CBD pet market in 2022 with a share of over 30%. The increased benefits of cannabis coupled with high awareness among owners are driving the market growth. Furthermore, an overall increase in the acceptance of cannabidiol for pet care, pharmaceutical, and wellness purposes is expected to fuel the market growth. The market growth can also be attributed to the increasing R&D activities conducted by major CBD pet companies.

b. Some key players operating in the CBD pet market include Honest Paws; Canna-Pet; FOMO Bones; Pet Releaf; HolistaPet; Joy Organics; Wet Noses Natural Dog Treat Co.; CBD Living; PETstock; Petco Animal Supplies, Inc.; Charlotte’s Web; Green Roads; and HempMy Pet.

b. The market is primarily driven by rising R&D initiatives, increasing demand, pet humanization, and expenditure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."