- Home

- »

- Consumer F&B

- »

-

Canned Legumes Market Size, Share, Industry Report, 2020-2027GVR Report cover

![Canned Legumes Market Size, Share & Trends Report]()

Canned Legumes Market Size, Share & Trends Analysis Report By Product (Beans, Peas, Chickpeas), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-233-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global canned legumes market size was valued at USD 2.56 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2020 to 2027. Escalating demand for convenient food owing to the increasing number of working population groups, especially dual income households, is fueling the growth of the market across the globe.

Furthermore, with the rising health concerns among the consumers, demand for canned legumes has been increasing as they are a rich source of plant-based proteins. Rising importance of ethnic foods is expected to boost the demand for lentils and chickpeas in the upcoming years.

In addition, government initiatives have been boosting the consumption of canned legumes in several regions. For instance, the United Nations General Assembly declared 2016 as the International Year of Pulses. This initiative has increased the awareness of the consumers about the nutritional value of pulses, which led to augmented consumption of legume variants, including pulses and beans.

Canned legumes are considered highly nutritious as they contain protein, carbohydrate, fiber, B vitamins, copper, iron, manganese, magnesium, phosphorous, and zinc. They are low-fat, saturated fat free, and cholesterol-free products. As a result, they are gaining popularity in vegan and vegetarian diets. Furthermore, the coronavirus pandemic has significantly boosted the demand for canned products, including legumes, from March 2020 as consumers have been stocking up on long-lasting essentials. This emergence of panic shopping has been fueling the market growth for these legumes across the globe.

Over the past few years, companies have been adopting improved images of beans and pulses on cans in order to enhance the presentation of canned legumes. Numerous producers in Europe are promoting products by incorporating local heritage or local beans in their portfolio. This approach is expected to help them to enter the local food trend, and hence widen their opportunity. In addition, shifting consumer preference for BPA-free packaging is boosting the demand for canned legumes.

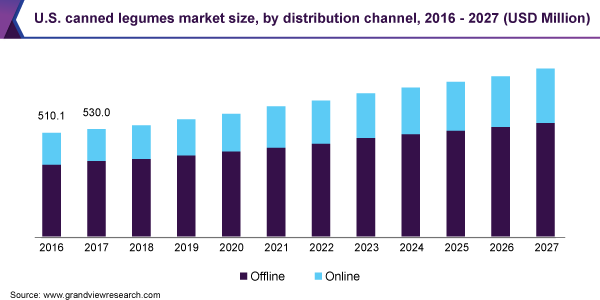

Distribution Channel Insights

Offline distribution channel held the largest share of over 70.0% in 2019. High penetration of supermarkets, hypermarkets, and grocery chains has increased the sales of canned legumes through offline distribution channel. Increasing number of grocery chains in South America, Asia Pacific, and Africa has been boosting the growth of this distribution channel across the globe. A large number of consumers prefer to buy from brick-and-mortar stores as they can see, touch, and feel products before buying and taking them home immediately.

Online distribution channel is projected to witness the fastest growth over the forecast period. Considering the growing trend of online shopping, large grocery chains such as Walmart and Target have developed online services. Furthermore, entry of Amazon, the leading e-commerce player, into the grocery and food market has been fueling the online sales of canned legumes.

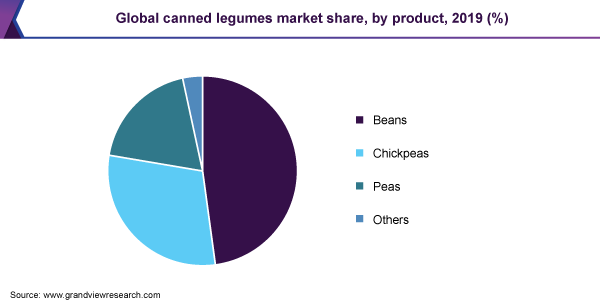

Product Insights

Beans dominated the canned legumes market with more than 45.0% share of the total revenue in 2019. These legumes are increasingly popular for their high nutritional value. The processed beans have gained significant traction among modern consumers as they do not require washing, peeling, or cooking like the raw form of the product. White beans, navy beans, kidney beans, black-eyed bean, and pinto beans are majorly used beans for processed food. Among different preparations of beans, baked beans are extremely popular as they blend well with several recipes, including pasta, meat, and vegetables, and are highly nutritive. Pork and beans and beans with tomato sauce are the majorly consumed canned legumes across the globe.

In April 2019, Co-op Food introduced its canned vegan-friendly sausages and beans. This canned product contains baked beans blended with tomato sauce, herbs, and spices. Furthermore, chickpeas and lentils are expected to gain traction in the upcoming years owing to their shorter cooking time. Both the dried form and pre-cooked or ready-to-eat forms are gaining popularity among the consumers. In April 2020, NAPOLINA, an Italy-based cooking brand, launched a new series of four ready-to-eat pulses and grains. These products include chickpeas, quinoa, cannellini beans, and red kidney beans. The company claims that canned legumes are rich in protein and low in fat and they go well with the growing vegetarian flexitarian trends.

Regional Insights

Europe dominated the market for canned legumes in 2019 with more than 50.0% share of the global revenue. U.K., Germany, and France are the key markets of the region. In addition, nations such as the Netherlands, Denmark, and Romania offer a wide opportunity for canned legumes. Increasing consumer preference for plant-based alternatives to meat protein has been driving the market in Europe. Lately, processed kidney beans have gained significant popularity across the region.

North America is projected to witness the fastest growth in the upcoming years. Over the past few years, consumers in the U.S. have been increasingly consuming processed beans and pulses owing to their convenience. Consumers in the U.S. and Canada are including these products in their meals due to their nutritional value, convenience to serve, and affordability. Pinto, great northern, navy, black beans, and red kidney are the majorly consumed beans in the region.

Key Companies & Market Share Insights

Innovation in different types of packaging, including pouches and cartons, has been creating new competition for the manufacturers who offer only canned products. Companies in this industry have been introducing new canned legumes in order to gain a competitive advantage over other players. For instance, in April 2019, Teasdale Latin Foods introduced a new range of canned beans under its Teasdale Simply Especial brand, which is available in five different flavors. Some of the key players in the canned legumes market include:

-

The Kraft Heinz Company

-

Goya Foods, Inc.

-

Bush Brothers & Company

-

Faribault Foods, Inc.

-

Conagra Brands

-

KYKNOS

-

fujian chenggong Fruits & Vegetables Food co.,ltd

-

SATKO, Del Monte Food, Inc.

-

Co-op Food

-

Teasdale Latin Foods

-

NAPOLINA

Canned Legumes Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.69 billion

Revenue forecast in 2027

USD 3.50 billion

Growth Rate

CAGR of 4.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 – 2018

Forecast period

2020 – 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and MEA

Country scope

U.S.; Germany; U.K.; France; China; Japan; Brazil

Key companies profiled

The Kraft Heinz Company; Goya Foods, Inc.; Bush Brothers & Company; Faribault Foods, Inc.; Conagra Brands; KYKNOS; fujian chenggong Fruits & Vegetables Food co.,ltd; SATKO, Del Monte Food, Inc.; Co-op Food; Teasdale Latin Foods; and NAPOLINA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global canned legumes market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Beans

-

Peas

-

Chickpeas

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global canned legumes market size was estimated at USD 2.56 billion in 2019 and is expected to reach USD 2.69 billion in 2020.

b. The global canned legumes market is expected to grow at a compound annual growth rate of 4.0% from 2019 to 2027 to reach USD 3.50 billion by 2027.

b. Europe dominated the canned legumes market with a share of more than 50% in 2019. The emerging consumer preference towards plant-based alternatives for meat protein has been driving the growth of the market in Europe.

b. Some key players operating in the canned legumes market include The Kraft Heinz Company, Goya Foods, Inc., Bush Brothers & Company, Faribault Foods, Inc., Conagra Brands, KYKNOS, fujian chenggong Fruits & Vegetables Food co.,ltd, SATKO, Del Monte Food, Inc., Co-op Food, Teasdale Latin Foods, and NAPOLINA..

b. Key factors driving the canned legumes market growth include escalating demand for convenient food, and rising importance of ethnic foods among millenials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."