- Home

- »

- Medical Devices

- »

-

Cannula Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Cannula Market Size, Share & Trends Report]()

Cannula Market Size, Share & Trends Analysis Report By Product (Cardiac, Dermatology, Nasal), By Type (Neonatal Cannulae, Straight Cannulae, Winged Cannulae), By Material, By Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-568-7

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Cannula Market Size & Trends

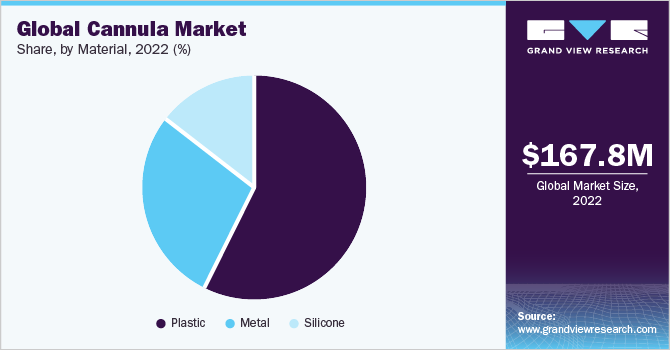

The global cannula market size was valued at USD 167.8 million in 2022 and is anticipated to grow a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The increase in demand for minimally invasive surgeries, the rise in the number of surgeries among the geriatric population, and the significant increase in the prevalence of chronic lifestyle-related diseases such as diabetes and cardiovascular diseases are the primary factors that are driving the growth of the cannula market. In addition, factors such as government initiatives to provide primary healthcare services at affordable rates and increase awareness regarding chronic diseases are also anticipated to further help the market grow significantly during the forecast period. The cannula market experienced a mixed impact during the pandemic.

While there was a significant surge in demand for nasal cannula for the treatment of COVID-19 patients, the dermatology segment experienced a temporary drop in sales due to the restriction of elective surgeries. However, the dermatology segment recovered during the second half of the pandemic.

With a large population being infected with the COVID-19 virus, it can be projected that there could be a rise in respiratory diseases in the future since the virus poses a great threat to the respiratory system. Moreover, with the opening of economies and the world moving towards normalcy, the market is projected to experience lucrative growth during the forecast period.

Minimally invasive surgeries are gaining popularity in the healthcare industry. There has been a rapid increase in the preference for minimally invasive surgeries for the treatment of cardiovascular diseases. This is since minimally invasive surgeries cause less surgical trauma and result in a better aesthetic appearance. It offers advantages such as smaller incisions, minimized infection risks, smaller scars, a lesser amount of bleeding, and lesser pain & trauma. Thus, this is leading to an increased preference for minimally invasive surgeries which in turn is expected to boost the growth of the cannula market.

Product Insights

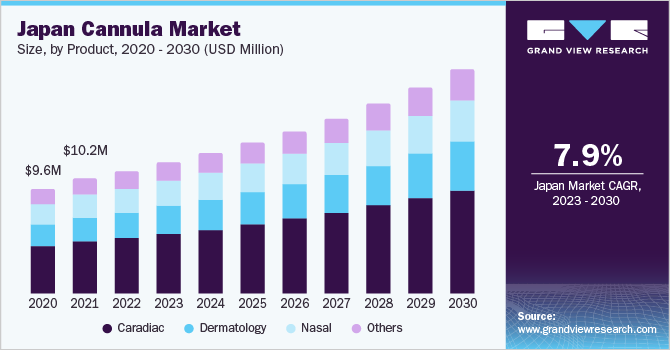

Based on product, the cannula market is segmented into cardiac (arterial, venous, cardioplegia and others) dermatology, nasal and others. The cardiac segment held the largest market with 46.3% share in 2022. This is attributed to the high prevalence of cardiovascular diseases. Increasing shift towards sedentary lifestyle, consumption of processed foods and reduced amounts of physical activities is leading to a rise in prevalence of cardiovascular disease. In addition, the increase in geriatric population that is higher risk of developing these diseases is also contributing to a significant rise in cardiovascular diseases. Thus, the rise in the prevalence of cardiovascular diseases is a major factor responsible for the dominance of cardiac segment in the cannula market.

The dermatology segment is expected to administer significant growth over the forecast period. This is due to the increasing use of microcannula to avoid complications during and after procedures. Moreover, there is a significant rise in the number of cosmetic surgeries being carried out which is anticipated to further boost the demand for dermatology segment. According to a research paper published in 2021, every year providers carry out more than 15 million cosmetic surgery procedures in the U.S. Thus, increase in penetration MIS is expected to gain segment growth over the forecast period.

Type Insights

Based on type, the market is fragmented into neonatal, straight, winged, a wing with port, and winged with stop cork cannulae. The straight cannulae segment dominated the market with the highest market share in 2022 and is anticipated to grow at a CAGR of 7.5% over the forecast period. This is due to its design which makes it simpler to use. The product’s extra sharp needle makes it easier to insert as well. Therefore, these types of cannulae are used in cardiac surgeries to avoid any mishaps and cut down any unnecessary delay that may lead to stretching the entire process.

On the other hand, neonatal cannulae are expected to register maximum growth with the highest CAGR during the forecast period. The primary factor contributing to the growth of this segment is the increase in the prevalence of respiratory problems among neonates. The soft and flexible nature of neonatal cannulae makes them highly suitable for use in high flow oxygen therapy for newborns. According to a research paper published by the National Library of Medicine, in 2016, 33.3% of all neonatal admissions at >28 weeks’ gestation, excluding infants with syndromes and those with congenital or surgical conditions, had respiratory conditions as their primary reason for admission.

Material Insights

Based on material, the market is segmented into plastic, metal, and silicone. The plastic segment held the highest market share with 56.9% in 2022 due to its increased adoption rate in both in-patient and out-patient procedures. Most plastic cannulas are translucent and allow surgeons to visualize instrumentation & sutures passing through the cannula in shoulder arthroscopy. Thus, making it suitable for using it in maximum procedures which are leading to its dominance throughout the forecast period.

However, the silicone segment is anticipated to experience maximum growth during the forecast period. This is attributed to the increasing usage of silicone cannulas in oxygen therapies, to ensure the continuous supply of oxygen to patients during surgery and for people suffering from respiratory disorders. Moreover, silicone cannulas are soft and flexible which makes them a preferred choice for application among healthcare professionals and patients.

Size Insights

Based on size, the market is segmented into 14G,16G,18G, 20G, 22G, 24G, and 26G. Different sized cannulas are represented by different colors. The 18G size accounted for the highest market share in 2022 and this trend is expected to continue throughout the forecast period. This is because the 18G size cannula is most widely used in hospitals for adults as well as adolescents. 18G cannulas are used to infuse blood products and deliver medications. These cannulas aim for quick blood transfusion. Moreover, these are also used for computed tomography/pulmonary embolism protocols or other testing that needs large IV sizes.

The 22G size cannulas are expected to experience the highest growth of 7.8% CAGR during the forecast period. This can be attributed to its small gauge size which allows a faster flow of fluid in patients with complicated veins. According to a research study published in the Journal of Vascular Access in 2018, the majority of patients are treated successfully with one long peripheral cannula for the duration of their treatment without the need for further cannulation.

End-use Insights

Based on end-use, the market is classified into hospitals, ambulatory surgical centers, and others. The others segment includes blood banks, research centers, and pathology labs. The hospitals segment held the maximum market share in 2022 with 53.2%. This is due to the rise in hospitalization rate for a variety of causes and treatments. Cannulas are used in a wide variety of specialty departments in the hospitals including orthopedic surgery, cardiovascular surgery, neurology, gynecology, general surgery, oxygen therapy, dermatology, and many more.

Ambulatory surgical centers are projected to witness the fastest growth throughout the forecast period. Ambulatory surgical centers are modern healthcare facilities that offer same-day surgical care, along with preventive and diagnosis procedures. Thus, there is a rise in the shift towards ambulatory surgical centers to undergo treatment and avoid hospitalization. This in turn is leading to a rise in the number of ambulatory surgical centers. Currently, there are more than 9,280 active ambulatory surgical centers in the U.S.

Regional Insights

North America dominated the market with the highest revenue share of 40.92% in 2022and is expected to witness a CAGR of 7.8% over the forecast period. This is due to the availability of advanced healthcare facilities in the region and the presence of dominant market players. In addition, the increasing prevalence of lifestyle diseases in the region is also a major factor in its dominance. Other factors such as greater awareness about minimally invasive surgeries and the increasing adoption rate of cosmetic surgeries in this region are further driving the growth of the market in this region. According to the American Society of Plastic Surgeons, about 16.7 billion USD was spent on cosmetic procedures in 2020 in the U.S.

Asia Pacific is expected to experience lucrative growth during the forecast period owing to a drastic rise in the geriatric population in the region which creates a massive patient pool with individuals suffering from chronic diseases such as cardiovascular diseases and diabetes. Moreover, the increasing efforts by the government to introduce favorable policies to transform the healthcare sector, especially in the rural areas, is further expected to boost the growth of the market in this region.

Key Companies & Market Share Insights

Key manufacturers in the cannula market are focusing on launching new products in the market that will enable them to have a strong portfolio which will strengthen their position in the market. For instance, in January 2023, Inspira Technologies announced that the convertible dual lumen cannula has been granted a patent by the U.S. Patent and Trademark Office (USPTO).

Also, in January 2023, Sterimedix presented the development of aesthetic and ophthalmic cannulas at Arab Health as part of its constant expansion into international markets. some of the major players operating in the global cannula market include:

-

Medtronic

-

Becton Dickinson (BD)

-

Edward Lifesciences

-

LivaNovaca

-

Smiths Medical

-

Boston Scientific Corporation

Cannula Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 178.3 million

Revenue forecast in 2030

USD 294.5 million

Growth Rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, material, size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Becton Dickinson (BD); Edward Lifesciences; LivaNova; Smiths Medical; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannula Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global cannula market report on the basis of product, type, material, size, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Cardiac

-

Arterial

-

Venous

-

Cardioplegia

-

Femmoral

-

-

Dermatology

-

Nasal

-

Others

-

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Neonatal Cannulae

-

Straight Cannulae

-

Winged Cannulae

-

Wing With Port

-

Winged With Stop Cork

-

-

Material Outlook (Revenue, USD Million; 2017 - 2030)

-

Plastic

-

Metal

-

Silicone

-

-

Size Outlook (Revenue, USD Million; 2017 - 2030)

-

14G

-

16G

-

18G

-

20G

-

22G

-

24G

-

26G

-

-

End-use Outlook (Revenue, USD Million; 2017 - 2030)

-

Hospital

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cannula market size was estimated at USD 167.8 million in 2022 and is expected to reach USD 178.3 million in 2023.

b. The global cannula market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 294.6 million by 2030.

b. North America dominated the cannula market with a share of 40.9% in 2022. This is attributable to the availability of advanced healthcare infrastructure and greater awareness about minimally invasive surgeries among patients and physicians.

b. Some key players operating in the cannula market include Medtronic, Becton Dickinson (BD), Edward Lifesciences, LivaNova, Smiths Medical, and Boston Scientific Corporation.

b. Key factors that are driving the cannula market growth include a surge in awareness about minimally invasive surgeries, increasing infant mortality rate, improving healthcare infrastructure in emerging economies, and a rising number of hospitals and clinics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."