- Home

- »

- Medical Devices

- »

-

Carbon Dioxide Incubators Market Size & Share Report 2030GVR Report cover

![Carbon Dioxide Incubators Market Size, Share & Trends Report]()

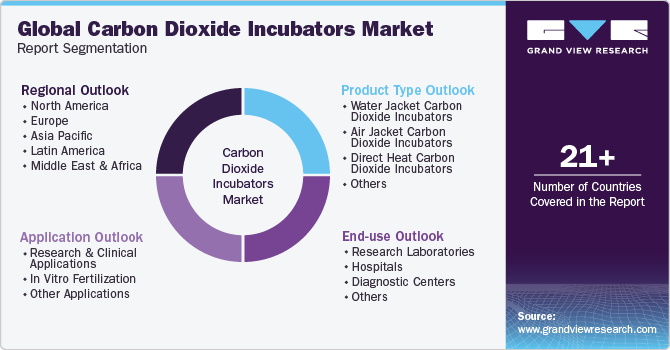

Carbon Dioxide Incubators Market Size, Share & Trends Analysis Report By Product Type (Water Jacket Carbon Dioxide Incubators, Direct Heat Carbon Dioxide Incubators), By End-use, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-128-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global carbon dioxide incubators market size was estimated at USD 685.23 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The market growth can be attributed to the increasing research and development (R&D) in the biotechnology and life science sector, growing demand for cell-based therapies, technological advancements, and increasing adoption of plastic surgery, antiaging therapies, tissue repair, and dermatological treatments. Moreover, technological advancement and innovation in the carbon dioxide incubator devices, such as password-protected settings, door opening alarms, auto decontamination cycles, self-calibration, pre-set alarms, and over-temperature alarms and thermostats are expected to drive the demand for these devices over the forecast period.

The market is experiencing strong growth due to the expanding R&D activities in the biotechnology and life sciences sectors. The increasing emphasis on innovative therapies, drug development, and personalized medicine is driving the demand for controlled and precise environments for cell culture and experimentation. Biotechnology companies are actively engaged in R&D to create groundbreaking therapies and treatments. CO2 incubators play a pivotal role in such therapies by providing optimal conditions for cell growth ensuring consistent results. Moreover, in the life science sector, research institutions are investigating new treatments for various diseases and disorders. These incubators enable the cultivation of primary cells & cell lines, crucial for understanding disease mechanisms and testing potential therapies. Research on cancer, neurodegenerative diseases, and infectious diseases greatly benefits from the controlled environment that CO2 incubators offer.

The rising demand for cell-based therapies in regenerative medicine and healthcare drives market growth. Cell-based therapies, which involve using living cells to treat a wide range of diseases and conditions, require optimal conditions for cell culture & growth–a role CO2 incubators fulfill effectively. Moreover, regenerative medicine, including stem cell therapies, tissue engineering, and cell-based transplantation, has gained substantial attention for its potential to revolutionize medical treatments for Alzheimer’s disease and spinal cord injuries. CO2 incubators provide controlled environments where cells can be cultured, expanded, and differentiated to generate functional tissues or replace damaged cells.

Furthermore, the development of personalized cell therapies is on the rise. These incubators are vital in growing patient-specific cells that can be genetically modified and readministered to treat conditions like cancer and genetic disorders. These therapies require precise control over the incubation environment to ensure the efficacy & safety of the manipulated cells.

Plastic surgery and dermatological treatments often involve grafting and transplanting tissues for reconstruction or rejuvenation. CO2 incubators facilitate the culture and expansion of cells in these procedures, ensuring graft viability and enhancing patient outcomes. According to a Plastic Surgery Statistics Report, 181,132 procedures for scar revision were performed in 2019, positioning it among the five most frequently performed reconstructive procedures. In addition, antiaging therapies, such as Platelet-rich Plasma (PRP) treatments, rely on concentrated growth factors from a patient's blood to rejuvenate the skin. CO2 incubators play a critical role in preparing PRP by maintaining optimal conditions for cell separation and enrichment, ensuring the therapeutic efficacy of the treatment.

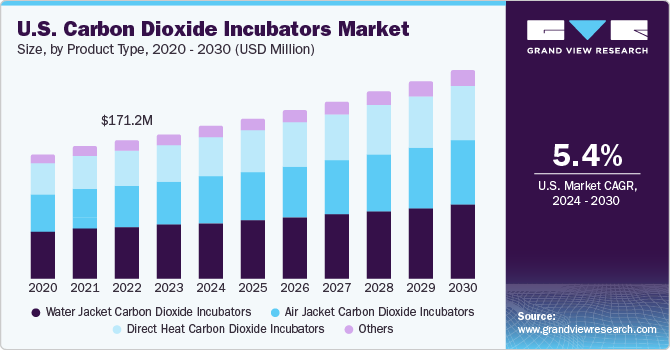

Product Type Insights

In terms of product type, the water jacket carbon dioxide incubators segment held the largest market share of 37.21 % in 2022 owing to improved performance and reliability, making them a preferred choice in research and biotechnology sectors for maintaining precise & consistent incubation environments. Water-jacketed CO2 incubators utilize a heated water system within the chamber walls for consistent temperature control. This makes them a reliable choice even during disruptions like frequent door openings or power fluctuations. In addition, recent technological developments collectively contribute to enhanced performance, reliability, and user convenience in CO2 incubators, ultimately improving the quality and reproducibility of cell culture & research outcomes. In addition, enhanced features like dual sterilization systems, precise humidity control, and remote monitoring further contribute to their appeal.

The air jacket carbon dioxide incubators segment is anticipated to witness the fastest CAGR of 6.8% over the forecast period. Air-jacketed incubators emerged as a viable substitute for water jackets, offering distinct advantages. As these are lighter and quicker to install, they maintain comparable temperature uniformity while demanding reduced upkeep. Furthermore, air-jacketed incubators accommodate high-temperature sterilization, reaching levels exceeding 180°C. These attributes position air-jacketed variants as efficient and versatile solutions for various incubation needs. Moreover, air-jacketed incubators have efficient decontamination options, including traditional high heat, ultraviolet light, and H2O2 vapor, ensuring swift cleansing if contamination occurs. Furthermore, these incubators often incorporate front door heating, optimizing uniform heating, minimizing condensation, and elevating performance.

Application Insights

In terms of application, the in vitro fertilization segment held the largest market share of 40.15% in 2022 and is anticipated to grow at the fastest rate of 6.5% over the forecast period. This growth can be attributed to the rising number of infertility cases and advancements in assisted reproductive technologies. Carbon dioxide incubators provide the conditions for optimal embryo culture, contributing to higher success rates.

Using CO2 incubators in IVF ensures embryos' viability and allows researchers and clinicians to monitor their growth and development closely. The controlled conditions the incubator provides minimize fluctuations that could adversely affect embryo health. As a result, CO2 incubators have become a cornerstone of IVF clinics and laboratories, enabling them to achieve higher success rates in fertility treatments consistently. In addition, recently, the latest IVF incubators are smaller and can hold a few samples or have separate chambers for each sample. This differs from the big incubators with one door for many samples. Moreover, companies operating in the market are launching technologically advanced incubators of IVF treatments to maintain a competitive edge in the market. Thereby, driving the segment growth. For instance, in May 2022, Cook Medical introduced the MINC+ Benchtop Incubator exclusively for IVF clinics in the U.S. and Canada. It is the advanced generation of the MINC, a mini incubator that has been a basic component in IVF facilities for over 20 years.

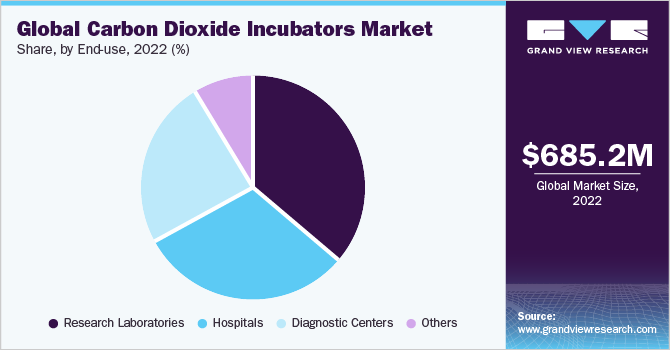

End-Use Insights

In terms of end-use, the research laboratories segment held the largest market share of 36.45% in 2022. The demand for reliable and precise incubation systems is rising, with expanding research activities in cell biology, microbiology, and drug development. Research laboratories require precise conditions to ensure accurate and reproducible results, making CO2 incubators indispensable. Their versatility, accommodating different cell types and experiments, positions them as essential equipment for various scientific investigations. As research drives advancements in medicine, biotechnology, and various disciplines, the demand for CO2 incubators in laboratories remains consistently high. Carbon dioxide incubators offer advanced features such as temperature control, humidity regulation, and sterile conditions, catering to the diverse needs of researchers.

The hospitals segment is expected to grow at the fastest rate of 6.5% over the forecast period. Hospitals hold a significant market share due to their crucial role in clinical applications and patient care. CO2 incubators are essential for maintaining cell cultures and specimens in controlled environments vital for diagnostic tests, research, and medical treatments. In hospitals, CO2 incubators are used for activities such as cell therapies, tissue culturing, microbial testing, and IVF. These controlled conditions ensure accurate and reliable results, directly impacting patient diagnosis and treatment outcomes.

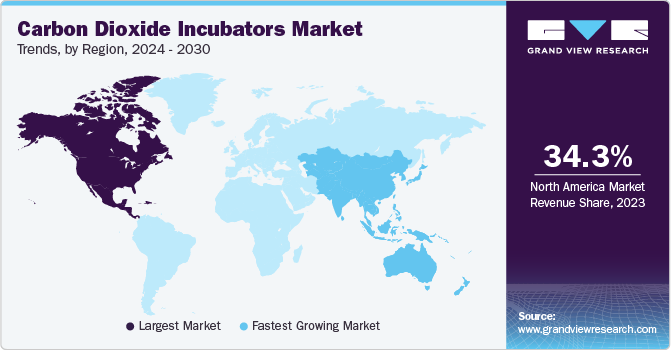

Regional Insights

Based on region, North America dominated the market in 2022 with a revenue share of 34.60% in 2022. Increasing spending on healthcare research and well-established research institutes, pharmaceutical companies, and healthcare facilities in North America have created a strong demand for CO2 incubators. Moreover, technological advancements in the region have led to the introduction of innovative carbon dioxide (CO2) incubators equipped with features such as improved temperature stability, advanced contamination control, and user-friendly interfaces. North America’s emphasis on advanced research and the adoption of state-of-the-art laboratory equipment has significantly contributed to its dominance in the market.

Asia Pacific is expected to witness the fastest growth at a CAGR of 7.6%, owing to the expanding biotechnology and healthcare sectors. Asia Pacific is home to emerging economies, such as China and India, where governments increasingly allocate funds to strengthen R&D in various fields. For instance, in October 2022, Recharge Capital, a prominent thematic-first private investment firm, announced a ~USD 3 million incubation investment in Generation Prime, a digital healthcare platform. This platform emerged as the pioneer in offering comprehensive IVF and related health services across Southeast Asia, catering to a population of over 600 million. Such strategic investments, focusing on expanding healthcare services, can potentially boost the adoption of advanced medical equipment, including CO2 incubators, contributing to market growth.

Key Companies & Market Share Insights

The carbon dioxide incubator market exhibits a moderate-to-high level of competitiveness due to the diverse range of competitive players, from midsize to small enterprises and large multinational corporations. Market penetration and product launches are among the strategies of global market players adopting to evolving customer demands while upholding their brand reputation. For instance, in July 2021, Thermo Fisher Scientific Inc. announced the launch of the Heracell Vios CR CO2 Incubator. The incubator is ideal for applications in GMP environments. Some prominent players in the global carbon dioxide incubators market include:

-

PHC Corporation

-

Thermo Fisher Scientific, Inc.

-

Eppendorf SE

-

Memmert GmbH + Co, KG

-

Binder GmbH

-

Bellco Glass

-

NuAire, Inc.

-

Sheldon Manufacturing Inc.

-

LEEC Limited.

Carbon Dioxide Incubators Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 724.89 million

Revenue forecast in 2030

USD 1.11 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PHC Corporation; Thermo Fisher Scientific, Inc.; Eppendorf SE; Memmert GmbH + Co, KG; Binder GmbH; Bellco Glass; NuAire, Inc.; Sheldon Manufacturing, Inc.; and LEEC Limited.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Dioxide Incubators Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global carbon dioxide incubators market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Jacket Carbon Dioxide Incubators

-

Air Jacket Carbon Dioxide Incubators

-

Direct Heat Carbon Dioxide Incubators

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Clinical Applications

-

In Vitro Fertilization

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Laboratories

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global carbon dioxide incubators market size was estimated at USD 685.23 million in 2022 and is expected to reach USD 724.89 million in 2023.

b. The global carbon dioxide incubators market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 1.11 billion by 2030.

b. North America dominated the market with a share of 34.60% in 2022. Advanced healthcare infrastructure, significant R&D investments, and the strong presence of pharmaceutical & biotechnology companies drive demand for precise cell culture environments. Moreover, rising focus on drug discovery, personalized medicine, and regenerative therapies accelerates market expansion.

b. Some key players operating in the carbon dioxide incubators market include PHC Holdings Corporation; Thermo Fisher Scientific, Inc.; Eppendorf SE; Memmert GmbH + Co, KG; Binder GmbH; Bellco Glass; NuAire, Inc.; Sheldon Manufacturing, Inc.; and LEEC Limited.

b. Key factors that are driving the market growth include increasing R&D in the biotechnology and life science sectors, 3.1.1.2 growing demand for cell-based therapies, increasing adoption of plastic surgery, antiaging therapies, tissue repair, and dermatological treatments, and technological advancements in CO2 incubators.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."