- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Carbon Fiber Market Size, Share And Growth Report, 2030GVR Report cover

![Carbon Fiber Market Size, Share & Trends Report]()

Carbon Fiber Market Size, Share & Trends Analysis Report By Raw Material (PAN-Based, Pitch-Based), By Tow Size, By Application (Automotive, Aerospace & Defense), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-523-6

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Carbon Fiber Market Size & Trends

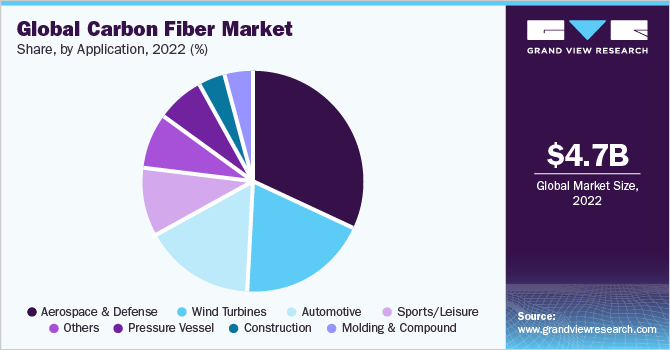

The global carbon fiber market size was valued at USD 4.66 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.9% from 2023 to 2030. This growth is attributed to the growing adoption of carbon fiber in automotive and aerospace applications. Increasing automotive demand coupled with the rising need for lightweight vehicles is expected to fuel the demand over the forecast period. The need for fuel-efficient vehicles along with government regulations limiting or restricting automotive pollution are anticipated to play a key role during the forecast period.

The growing aerospace industry in countries across the Asia Pacific and Europe is also projected to fuel the growth. Rising demand for commercial aviation on account of increased disposable income and globalization has driven growth across the aerospace industry over the last few years. This trend is likely to continue over the forecast period as well. The surge in demand for sports and leisure applications, especially in the Asia Pacific region, is also likely to increase the product scope.

Carbon fiber products play an essential role in manufacturing automotive and aircraft parts. Growing concerns regarding fuel consumption and CO2 emission levels have urged manufacturers to use carbon fiber composite materials as substitutes for metal components. Technological innovations to minimize the manufacturing cycle time are expected to propel the demand for carbon fiber in the automotive sector.

The energy crisis has forced various end-users to use carbon fiber for increasing the energy efficiency of products. A surge in product demand across aerospace and wind turbine applications is expected to boost the global market growth over the forecast period. Moreover, rising governmental support toward the installation of wind turbines is projected to positively influence the demand for carbon fiber. The growth of the commercial aviation segment is also expected to propel the demand for carbon fiber in aerospace applications over the forecast period.

Raw Material Insights

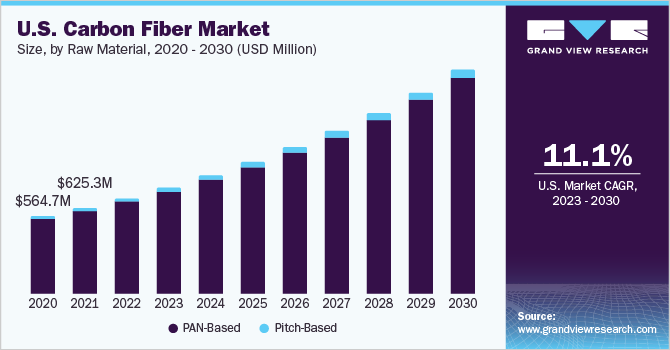

Based on raw material, the polyacrylonitrile (PAN) segment dominated the market with a revenue share of 96.2% in 2022 and the segment is further forecasted to grow at the fastest CAGR of 11.9% by 2030. The superior properties of PAN results in wider acceptance in various application industries. Moreover, increasing demand for a higher strength-to-weight ratio carbon fiber, PAN precursor is widely used on account of its superior material properties.

PAN-based carbon fibers although more expensive than pitch-based are nonetheless, used widely. The wider acceptance of PAN-based fibers in the preparation of polymer matrix composites has led to a drastic difference in the production of both precursors. Owing to the growing demand for a higher strength-to-weight ratio, PAN precursor has gained popularity and enjoys higher market penetration.

Pitch-based carbon fiber is primarily used for satellite parts and sports goods due to some of its application-specific desirable properties. Pitch-based product is mainly used due to their lower manufacturing costs than PAN-based product. However, over the coming years, pitch precursor is expected to lose its market share to the PAN precursor segment on account of its lower properties than PAN-based carbon fiber.

Tow Size Insights

Based on tow size, the carbon fibers industry is categorized into small tow and large tow. The small tow market segment dominated the segment with a revenue share of 77.6% in 2022. The small tow segment is further predicted to grow significantly over the coming years. Small tow fibers are widely used in the aerospace industry owing to their high tensile strength and high modulus when used for manufacturing composites, which are used in numerous applications.

The large tow segment is forecasted to grow at a CAGR of 10.3% over the coming years. This growth is attributed to the growing adaption of carbon fiber across several application industries due to its high strength-to-weight ratio and its advantages over conventional materials including metals and their alloys.

Application Insights

Based on application, the market is segmented into automotive, aerospace & defense, wind turbines, sports/leisure, molding & compound, construction, pressure vessel, and others. The aerospace & defense segment accounted for the largest revenue share of 32.0% in 2022 and the segment is forecasted to grow at a CAGR of 11.3% over the forecast period.

A rise in fuel prices has boosted the need for fuel-efficient vehicles. A reduction in curb weight is the most effective means of improving fuel efficiency. Carbon fiber has been most widely utilized as a replacement for steel in automotive applications on account of its higher strength-to-weight ratio. Similarly, carbon fiber is also replacing metals in aerospace applications as it contributes to a reduction in the weight of the aircraft and hence, improves fuel efficiency.

The aerospace sector demands lightweight and rigid materials for usage in aircraft, rockets, satellites, and missiles as it determines performance. The U.S. and Europe are the key regions in the aerospace & defense industry, wherein the carbon fiber demand is driven by aircraft manufacturers such as Boeing and Airbus. The aerospace industry is dominated by commercial aviation and the production of large passenger and cargo jets. The primary objective of using composite materials including carbon fiber is to reduce airplane weight and introduce machines with improved performance.

The high significance associated with the use of renewable sources, owing to their environmental benefits, has triggered the growth of the wind turbine industry over the last few years. Rising government support toward the development of renewable energy resources is also expected to drive the wind turbine industry over the forecast period.

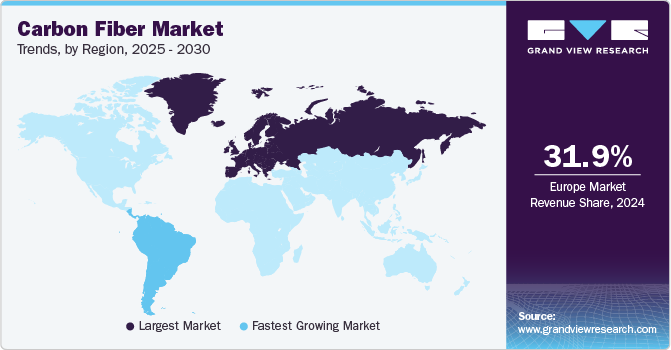

Regional Insights

The Europe region dominated the regional segment and accounted for the highest revenue share of 31.6% in 2022. The growth of the aerospace & defense industry in Europe and North America has triggered the growth of the carbon fiber industry over the past few years and this trend is expected to continue over the forecast period. The presence of aerospace giants such as Airbus and Boeing in Europe and North America has propelled the regional demand for carbon fiber.

Moreover, the growth in the commercial aviation sector across the developing countries in the Asia Pacific region including China, India, South Korea, and Vietnam is propelling the growth of the market. The presence of key aircraft manufacturers such as Airbus as well as defense equipment manufacturers such as MBDA in Europe has triggered the demand for carbon fiber across the world. The presence of automotive giants such as Volkswagen, Mercedes, and Ferrari, who emphasize low-weight high-performance cars, has further triggered the regional carbon fiber demand. Stringent regulations coupled with proactive efforts initiated by the European automotive manufacturers are anticipated to foster market growth over the forecast period.

Key Companies & Market Share Insights

The key industry players focus on enhancing strategic partnerships to develop new products as well as achieve a competitive advantage over other market participants. Various other manufacturers in the U.S. and various countries in Europe have recently developed or adopted carbon fiber manufacturing technologies and have marked their presence in the global carbon fiber industry.

The major players operating in the market are integrated throughout the value chain. The companies have streamlined their operations to procure raw materials and also manufacture the product, to reduce the product price. Some prominent players in the global carbon fiber market include:

-

A&P Technology Inc.

-

Anshan Sinocarb Carbon Fibers Co. Ltd

-

DowAksa USA LLC

-

Formosa Plastics Corporation

-

Hexcel Corporation

-

Holding company Composite

-

Hyosung Advanced Materials

-

Jiangsu Hengshen Co. Ltd

-

Mitsubishi Chemical Corporation

-

Nippon Graphite Fiber Co. Ltd

-

SGL Carbon

-

Solvay

-

Teijin Limited

-

Toray Industries Inc.

-

Zhongfu Shenying Carbon Fiber Co. Ltd

Carbon Fiber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.18 billion

Revenue forecast in 2030

USD 10.68 billion

Growth rate

CAGR of 10.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Raw material, tow size, application, Region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; China; Japan; Taiwan; Brazil

Key companies profiled

A&P Technology Inc.; Anshan Sinocarb Carbon Fibers Co. Ltd; DowAksa USA LLC; Formosa Plastics Corporation; Hexcel Corporation; Holding company Composite; Hyosung Advanced Materials; Jiangsu Hengshen Co. Ltd; Mitsubishi Chemical Corporation; Nippon Graphite Fiber Co. Ltd; SGL Carbon; Solvay; Teijin Limited; Toray Industries Inc.; Zhongfu Shenying Carbon Fiber Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

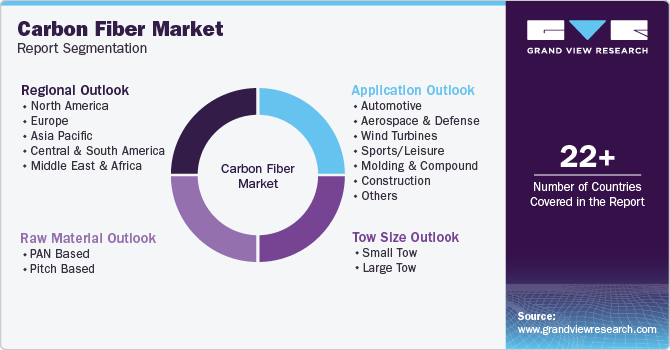

Global Carbon Fiber Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global carbon fiber market report based on raw material, tow size, application, and region:

-

Raw Material Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

PAN Based

-

Pitch Based

-

-

Tow Size Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Small Tow

-

Large Tow

-

-

Application Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Wind Turbines

-

Sports/Leisure

-

Molding & Compound

-

Construction

-

Pressure Vessel

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Taiwan

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global carbon fiber market size was estimated at USD 4.66 billion in 2022 and is expected to reach USD 5.18 billion in 2023.

b. The global carbon fiber market is expected to grow at a compound annual growth rate a CAGR of 10.9% from 2023 to 2030 to reach USD 10.68 billion by 2030.

b. The aerospace & defense market accounted for the largest revenue share in 2022 and this is attributed to the growing use of carbon fiber in the industry to cater to growing demand for commercial aircrafts across the world.

b. Some key players operating in the carbon fiber market include A&P Technology Inc., Anshan Sinocarb Carbon Fibers Co. Ltd, DowAksa USA LLC, Formosa Plastics Corporation, Hexcel Corporation, Holding company Composite, Hyosung Advanced Materials, Jiangsu Hengshen Co. Ltd, Mitsubishi Chemical Corporation, Nippon Graphite Fiber Co. Ltd, SGL Carbon, Solvay, Teijin Limited, Toray Industries Inc., Zhongfu Shenying Carbon Fiber Co. Ltd.

b. The growing automotive development and aerospace & defense sector is propelling the growth for carbon fiber in the market. This is due to the light weightiness of carbon fiber in comparison to its conventional alternatives such as metals and its alloys.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."