- Home

- »

- Consumer F&B

- »

-

Carbonated Soft Drink Market Share Report, 2021-2028GVR Report cover

![Carbonated Soft Drink Market Size, Share & Trends Report]()

Carbonated Soft Drink Market Size, Share & Trends Analysis Report By Flavor (Cola, Citrus), By Distribution Channel (Hypermarkets, Supermarkets & Mass Merchandisers, Online Stores & D2C), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-2-68038-144-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global carbonated soft drink market size was valued at USD 221.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2021 to 2028. Modern-day consumers can be seen focusing on convenience, and thus a large part of everyday purchase includes single grab-and-go products rather than the conventional bulk buying products. This has led to shelf-stable innovations and eco-friendly packaging, made with clean, renewable materials, and fewer preservatives and chemicals. The products are continually being improved and innovated to create something for everyone. Owing to growing consumer health awareness, companies are now more focused on including natural, low-calorie, and low-sugar ingredients in their products, like using stevia sweeteners instead of conventional or synthetic sweeteners.

The packaging is taking on a more 'natural' approach to appeal to consumers looking for convenience and healthier options. Consumer demand for on-the-go drink solutions shows no sign of slowing down. Within the ready-to-drink market, it has become evident that using creative and vibrant packaging can help sell the beverage to consumers facing a time crunch and increasingly looking for products to fit their active lifestyles. Therefore, convenience trends are fueling the demand for ready-to-drink beverages.

While carbonated soft drinks are designed to suit consumers' tastes and flavor preferences, in recent years, these products are also being developed to serve as functional beverages for health-conscious consumers. Consumers expect newly introduced soft drinks to be free from certain ingredients that damage health in the long term and actively improve physical and mental fitness through carefully selected ingredients. Consumers are likely to exhibit continued demand for low-sugar soft drinks and products with stress-relieving properties. The growing importance laid on mental health and physical well-being is anticipated to drive this trend.

Technological advancements have transformed the production process for carbonated soft drinks. Market players have been using laser technology instead of inkjet technology for labeling and packaging beverages due to their various unique benefits. This process coding is fast, the printing is permanent, and it is very easy to integrate with the production line. The entire process under laser technology does not require any ink, which reduces the cost of the finished product. Innovations in packaging also play a crucial role as it leads to longer shelf life, and as a result, it is becoming more comfortable to sell carbonated soft drinks out of small shops and vending machines.

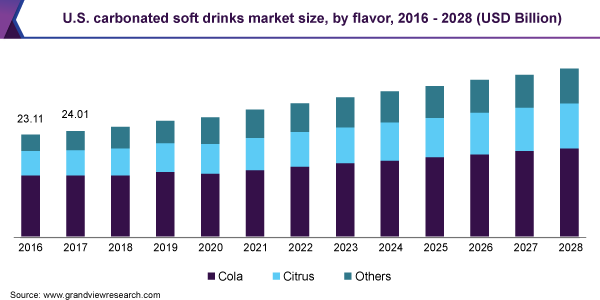

Flavor Insights

Cola flavor accounted for the largest share of more than 50.0% in 2020. Cola flavored carbonated Soft Drinks enjoy the dominance owing to the first mover’s advantage. In June 2020, HI-CHEW launched Soda Pop Mix in cola flavor. The soda has a refreshing flavor that perfectly caters to the demand for unique, innovative, and non-traditional soft drinks among consumers. In the U.S., the demand for flavor has been showing constant rapid growth. Candy lovers have been celebrating this effervescent experience that can only be matched by a thirst-quenching sip of soda. It honors the traditional soda presenting the refreshing, fizzy taste of the classic.

The citrus segment is expected to expand at the fastest CAGR of 4.9% from 2021 to 2028. Rapscallion Soda introduced S_01 Rhubarb in June 2020. The carbonated soft drink is fortified with citrus flavors. The low-calorie drink is sustainable and has a slightly sour taste that comes with a fizzy floral finish and is composed of grapefruit zest, cane sugar, Scottish rhubarb, and Sichuan pepper.

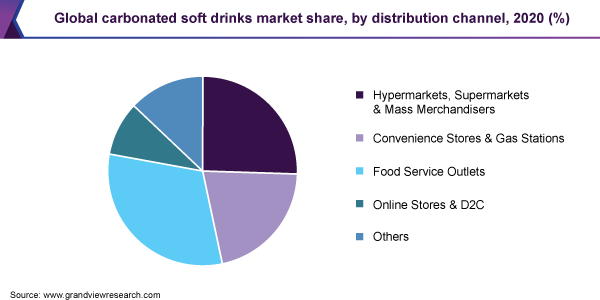

Distribution Channel Insights

Hypermarkets, supermarkets & mass merchandisers accounted for the largest share of over 20.0% in 2020. Many consumers prefer buying soft drinks from supermarkets and general merchandisers due to the shopping experience offered by these stores. With the rising income levels and increasing urbanization, modern supermarkets and hypermarkets have emerged across the globe. The emergence of these supermarkets and hypermarkets has been revolutionizing the nature of the food and beverage supply.

The online stores and D2C segment is expected to register the fastest CAGR of 6.1% from 2021 to 2028. An increasing number of online retailers, who offer competitive pricing, are boosting the growth of this sales channel. The growth can also be attributed to the increasing familiarity/dependency of generation X, millennials, and generation Z with/on the Internet and e-commerce.

Regional Insights

Central and South America accounted for the largest share of exceeding 25.0% in 2020. The strong popularity of carbonated soft drinks among the youth population in countries, including Brazil, Argentina, and Venezuela, is expected to drive the regional market in the near future.

The Middle East and Africa is expected to emerge as the fastest-growing regional market with a CAGR of 6.4% from 2021 to 2028. Growing disposable income, rapid urbanization, expansion of financial sectors, and new product launches in countries, such as Nigeria and Kenya, are expected to remain favorable factors for the industry growth.

Key Companies & Market Share Insights

New product launches are expected to remain key strategies among the industry participants over the next few years. In January 2021, PepsiCo launched two new products under its carbonated soft drinks category, namely Major Melon Zero Sugar and Mtn Dew Major Melon. The company expects to offer a nostalgic taste to its consumers through this new carbonated soft drink product. It is available in 20-ounce bottles and 12-ounce bottles in a pack of 12. Some prominent players in the global carbonated soft drink market include: -

-

ANADOLU GRUBU A.Åž.

-

COCA-COLA FEMSA

-

Danone

-

JONES SODA CO.

-

Keurig Dr Pepper Inc.

-

Monster Energy Company

-

National Beverage Corp.

-

PepsiCo

-

Refresco Group

-

SODASTREAM INTERNATIONAL LTD.

-

SUNTORY BEVERAGE & FOOD LIMITED

-

The Coca-Cola Company

Carbonated Soft Drink Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 237.0 billion

Revenue forecast in 2028

USD 320.1 billion

Growth Rate

CAGR of 4.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Brazil; U.A.E.

Key companies profiled

ANADOLU GRUBU A.Åž.; COCA-COLA FEMSA; Danone; JONES SODA CO.; Keurig Dr Pepper Inc.; Monster Energy Company; National Beverage Corp.; PepsiCo; Refresco Group; SODASTREAM INTERNATIONAL LTD.; SUNTORY BEVERAGE & FOOD LIMITED; The Coca-Cola Company

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global carbonated soft drink market report on the basis of flavor, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Billion, 2016 - 2028)

-

Cola

-

Citrus

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2016 - 2028)

-

Hypermarkets, Supermarkets & Mass Merchandisers

-

Convenience Stores & Gas Stations

-

Food Service Outlets

-

Online Stores & D2C

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The global carbonated soft drink market size was estimated at USD 221.55 billion in 2020 and is expected to reach USD 237.04 billion in 2021.

b. The global carbonated soft drink market is expected to grow at a compound annual growth rate of 4.7% from 2021 to 2028 to reach USD 320.11 billion by 2028.

b. Central & South America dominated the market with a share of 27.2% in 2019. The young population along with the availability of products from across the globe is leading to a robust consumption of carbonated soft drinks in the region.

b. Some key players operating in the carbonated soft drink market include ANADOLU GRUBU A.Åž., COCA-COLA FEMSA, Danone, JONES SODA CO., Keurig Dr Pepper Inc., Monster Energy Company, National Beverage Corp., PepsiCo, Refresco Group, SODASTREAM INTERNATIONAL LTD., SUNTORY BEVERAGE & FOOD LIMITED., The Coca-Cola Company.

b. Key factors that are driving the carbonated soft drink market growth include the demand for convenience, shelf-stable innovations, eco-friendly packaging, made with clean, renewable materials, and fewer preservatives and chemicals.

b. The Middle East & Africa is expected to emerge as the fastest-growing region in the carbonated soft drink market with a CAGR of 6.4% from 2021 to 2028, owing to the growing disposable income, rapid urbanization, and new product launches.

b. The online stores and D2C segment is expected to register the fastest CAGR of 6.1% from 2021 to 2028. An increasing number of online retailers, who offer competitive pricing, are boosting the growth of this sales channel.

b. Cola flavor accounted for the largest share of more than 50.0% in 2020. Cola flavored carbonated Soft Drinks enjoy dominance owing to the first mover’s advantage.

b. In January 2021, PepsiCo launched two new products under its carbonated soft drinks category, namely Major Melon Zero Sugar and Mtn Dew Major Melon. New product launches are some of the most notable developments of the carbonated soft drink market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."