- Home

- »

- Medical Devices

- »

-

Cardiovascular And Soft Tissue Repair Patches Market Report, 2022-2030GVR Report cover

![Cardiovascular And Soft Tissue Repair Patches Market Size, Share & Trend Report]()

Cardiovascular And Soft Tissue Repair Patches Market Size, Share & Trend Analysis Report By Application (Cardiac Repair, Vascular Repair, Pericardial Repair, Dural Repair, Soft Tissue Repair), By Raw Material, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-677-6

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Report Overview

The global cardiovascular and soft tissue repair patches market size was estimated at USD 3.8 billion in 2021 and is expected to expand at a CAGR of 8.4% from 2022 to 2030. The rapidly rising incidence rate of congenital heart diseases across the globe is driving the development & growth of the market. As per data estimates on congenital heart diseases published by the Centers for Disease Control and Prevention, congenital heart diseases impact nearly 1% or 40,000 live births annually in the U.S. Atrial Septal Defect (ASD) and ventricular septal defect are the two commonest congenital heart diseases.

According to an article on trends and prevalence of atrial septal defect published by NCBI in December 2019, it stated ASD is the second most occurring type of congenital heart disease and the incidence rate is 56 per 100,000 live births across the globe, and the prevalence of the same is 1.6 per 1,000 live births. The growing awareness levels towards diagnosing & detecting congenital heart diseases early is driving key players to focus on innovation & develop technologically advanced products. These technological innovations have a multidimensional impact on product design, development, raw material fabrication, and clinical implementation. The tissue repair patches used in surgical procedures include vascular repair and reconstruction, soft tissue repairs, and dural repairs.

The growing prevalence of hernias, including inguinal hernias, ventral hernias, congenital diaphragmatic hernias, umbilical hernias, and others, is expected to drive the demand and positively impact growth. As per studies, abdominal wall hernias are the most commonly occurring hernias and have a prevalence rate of 1.7% across all ages and 4% across populations aged 45 years and above. Inguinal hernias are the most commonly diagnosed abdominal wall hernias accounting for 75% of the total caseload. Inguinal hernia repairs are common, and the U.S. recorded an incidence rate of 28 per 100,000 individuals, while the U.K. recorded 10 per 100,000 individuals.

COVID 19 cardiovascular and soft tissue repair patches market impact: a decline of 11.2% market growth between 2019 and 2020

Pandemic Impact

Post COVID Outlook

The market for cardiovascular and soft tissue repair patches declined at a rate of 11.2% from 2019 to 2020.

The market is estimated to witness a year-on-year growth of ranged from 6.0% to 8.5% in the next 5 years

The ongoing Covid-19 pandemic enforced governments to impose multiple lockdowns and travel restrictions to curb the transmission rate. These enforcements caused a sharp decline in elective surgical procedures and forced healthcare facilities to prioritize procedures.

The growing trend of minimally invasive procedures reduces hospitalization and minimizes risks arising from coronavirus is driving the adoption rate amongst healthcare providers and positively impacting the procedural volume

The Covid-19 pandemic significantly transformed healthcare infrastructure and disrupted supply and demand chains, manufacturing cycles, sales channels, product distribution chains, and operations of multiple players. These disruptions drastically declined the revenue earnings of key participants

Through the guidance of renowned healthcare organizations such as the WHO and CDC, healthcare facilities are mitigating key logistical challenges and providing high-quality care to minimize the backlog of elective surgeries

According to the University of California San Francisco Department of Surgery, in the U.S. annually a million-hernia repair surgical procedures are performed of which 800,000 are inguinal hernia repair procedures, and the rest are performed for treating other types of hernias.

The growing demand for patches in diagnosing and treating cardiac and soft tissue ailments is driving the collaborative efforts amongst several research organizations, raw material suppliers, and key manufacturers to develop innovative products. Furthermore, key participants are focusing on developing novel technologies composed of tissue engineering materials, which is expected to boost the growth of the market for cardiovascular and soft tissue repair patches.

For instance, a research team from Israel-based Tel Aviv University has developed a bionic heart patch by combining an organic living tissue with a nanoelectronic system, and this product could be used in supporting patients’ recovery from heart attacks. The growing demand is boosting public-private partnerships across several regional markets to boost development and growth. For instance, governments are undertaking initiatives to enhance affordability and accessibility to cardiac treatment options which is expected to support growth. For example, the Japanese government provided favorable support and recognition to the collaboration between Osaka Medical College and Teijin Limited, and Fukui Warp Knitting Co. Ltd. developing regenerative cardiac repair patches. Governments are beginning to provide favorable support and promote collaborations amongst medical and industrial players.

Application Insights

The soft tissue segment dominated the market for cardiovascular and soft tissue repair patches and accounted for the largest revenue share of 42.0% in 2021. This is owing to the rapidly growing incidence rate of hernias including ventral hernias, umbilical hernia, inguinal hernias, congenital diaphragmatic hernia, and others coupled with the growing demand for tissue repair patches in treatment procedures. A growing number of inguinal hernia repairs is driving the growth of the segment. According to the International Surgery Journal estimates in 2016, it stated that approximately 28 per 100,000 individuals underwent inguinal hernia repairs in the U.S.

On the other hand, the cardiac repair segment is anticipated to register the fastest growth rate in the market for cardiovascular and soft tissue repair patches over the forthcoming years. This is owing to the alarming rise of congenital heart diseases amongst the global pediatric population driving the demand for cardiac patches. As per studies, the atrial septal defect is the third most common congenital heart disease with a prevalence rate of 10% in pediatric congenital heart disease and 30.0% in adult congenital heart disease. To repair the atrial septal defect, two connected cardiac patches are placed permanently placed in the hole to cover both rights and left atrial sides. In a few months, the hole gets completely sealed as the lining of the heart wall grows over the patch.

Raw Material Outlook

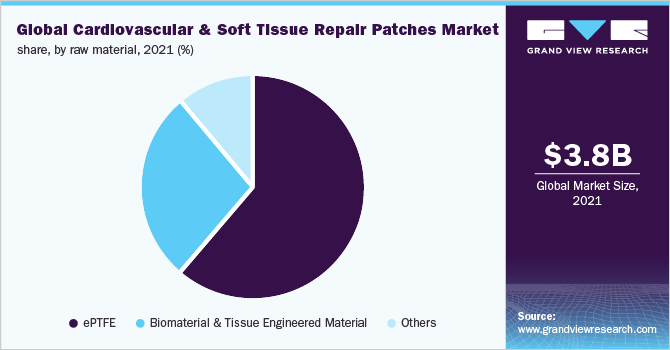

The Eptfe segment dominated the cardiovascular and soft tissue repair patches market and accounted for the largest revenue share of 61.4% in 2021. This growth of the segment is owing to the multiple benefits associated with ePTFE such as high tensile strength, high durability, and easy availability. Moreover, the widespread application of ePTFE in manufacturing medical accessories such as wound care materials, transducer protectors, ostomy bags, face masks, drainage bags, urine bags, and medical device enclosures. On the other hand, the biomaterial and tissue-engineered material segment is anticipated to register the fastest growth rate in the market for cardiovascular and soft tissue repair patches over the forthcoming years.

The most commonly used raw material in manufacturing cardiovascular and soft tissue repair patches is bovine pericardium which is gaining popularity. Bovine pericardium offers several physical and chemical properties which are boosting its adoption of the same. Furthermore, advantages associated with bovine pericardium such as easy acceptability in the human body and minimized risk of post-operative complications are driving the growth. Bovine pericardium is composed of a high content of structural protein providing enhanced elasticity and conformity suiting multiple anatomical situations. These patches are easily customizable as per required configurations and sizes. Lastly, these patches provide enhanced convenience, reliability, and improved biocompatibility.

Regional Insights

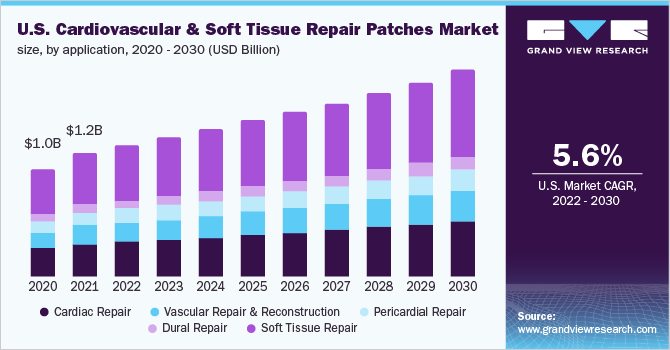

North America dominated the market for cardiovascular and soft tissue repair patches and accounted for the largest revenue share of 37.6% in 2021. This is owing to rapidly changing lifestyles, growing prevalence of cardiac diseases, rising number of hernia disorders, increasing alcohol consumption and smoking, growing obesity levels, and rising substance abuse. According to estimates published Annals of Laparoscopic and Endoscopic Surgery in 2019, it was stated that the U.S. performs 350,000 abdominal wall hernia repairs annually. Increasing disposable income, advancing healthcare infrastructure, easy availability of novel products and technologies, and the presence of several key players in North America are driving the market for cardiovascular and soft tissue repair patches. Furthermore, increasing collaborative efforts by raw material suppliers, pharmaceutical manufacturers, and government agencies are driving the market in North America.

On the other hand, Asia Pacific is anticipated to register the fastest growth rate over the forthcoming years owing to the rapid advancements in healthcare infrastructure, growing trends of minimally invasive surgical procedures, rising incidence of cardiac disease, growing medical tourism, rapid economic development in several countries such as China and India, growing geriatric population, and rising burden of chronic disorders. Growing awareness towards early diagnosis and detection of congenital heart diseases and adopting a timely treatment plan such as cardiac patch implantation is driving the growth. As per World Health Organization estimates, the annual incidence rate of cardiovascular diseases is expected to rise by 50% between 2010 and 2030, driving growth opportunities for the market for cardiovascular and soft tissue repair patches in Asia Pacific.

Key Companies & Market Share Insights

The key players are constantly focusing on devising innovative product development strategies to expand their product portfolio and gain a competitive edge. Moreover, these key players are devising their mergers and acquisitions and partnership strategies to expand their business footprint. For instance, in February 2020, Terumo Cardiovascular launched its latest surgical sealant, AQUABRID used in aorta surgical procedures. Similarly, in December 2019, CryoLife and Misonix entered a strategic alliance wherein CryoLife’s NeoPatch would receive special commercialization rights in the U.S market. Some of the prominent players in the cardiovascular and soft tissue repair patches market include:

-

Baxter

-

Admedus

-

Abbott

-

LeMaitre Vascular Inc.

-

Edwards Life Sciences Corporation

-

Glycar SA Pty Ltd.

-

LabCor

-

Cryolife, Inc.

-

CorMatrix

-

Terumo Medical Corporation

-

Bard Peripheral Vascular Inc.

-

Neovasc

-

W.L. Gore & Associates, Inc.

-

B.Braun

-

Novomedics

-

TEI Biosciences Inc.

-

Perouse Medical

-

Gunze Limited

-

Atriummed

-

Maverick Bioscience

-

Southern Lights Biomaterials

- Integra LifeSciences Corporation

Cardiovascular And Soft Tissue Repair Patches Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.1 billion

Revenue forecast in 2030

USD 7.8 billion

Growth Rate

CAGR of 8.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2016 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, raw material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Baxter; Admedus; Abbott; LeMaitre Vascular Inc.; Edwards Life Sciences Corporation; Glycar SA Pty Ltd.; LabCor; Cryolife, Inc.; CorMatrix; Terumo Medical Corporation; Bard Peripheral Vascular Inc.; Neovasc; W.L. Gore & Associates, Inc.; B.Braun; Novomedics; TEI Biosciences Inc.; Perouse Medical; Gunze Limited; Atriummed; Maverick Bioscience; Southern Lights Biomaterials; Integra LifeSciences Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global cardiovascular and soft tissue repair patches market report on the basis of application, raw material, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Cardiac repair

-

Atrial septal defect

-

Common atrium

-

Defects of the endocardial cushion

-

Ventricular septal defect

-

Tetralogy of Fallot

-

Right ventricular outflow tract reconstruction

-

Suture bleeding

-

-

Vascular repair & reconstruction

-

Carotid endarterectomy

-

Anomalous connection of the pulmonary veins

-

Transposition of the great vessels

-

Reconstruction of portal and superior mesenteric veins

-

Other Vascular repair and reconstruction

-

-

Pericardial repair

-

Dural repair

-

Soft Tissue repair

-

Defects of the abdominal wall

-

Defects of the thoracic wall

-

Gastric binding

-

Hernias

-

-

-

Raw Materials Outlook (Revenue, USD Million, 2016 - 2030)

-

ePTFE

-

Biomaterial and tissue engineered material

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular and soft tissue repair patches market size was estimated at USD 3.8 billion in 2021 and is expected to reach USD 4.1 billion in 2022.

b. The global cardiovascular and soft tissue repair patches market is expected to grow at a compound annual growth rate of 8.4% from 2022 to 2030 to reach USD 7.8 billion by 2030.

b. Soft tissue repair dominated the cardiovascular and soft tissue repair patches market with a share of 42.0% in 2021. This is attributable to the rising prevalence of various types of hernias such as inguinal hernia, umbilical hernia, ventral hernias, and others.

b. Some key players operating in the cardiovascular and soft tissue repair patches market include Medtronic, Bard Peripheral Vascular Inc., Terumo Cardiovascular, W.L. Gore & Associates, GETINGE Group, CryoLife, Edwards Life Sciences, Baxter, Admedus, Integra LifeSciences Corporation.

b. Key factors that are driving the cardiovascular and soft tissue repair patches market growth include the increasing prevalence of congenital heart diseases such as atrial septal defect and ventricular septal defect and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."