- Home

- »

- Biotechnology

- »

-

Cell Culture Market Size, Share And Growth Report, 2030GVR Report cover

![Cell Culture Market Size, Share & Trends Report]()

Cell Culture Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Application (Biopharmaceutical Production, Diagnostics, Cell & Gene Therapy), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-536-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

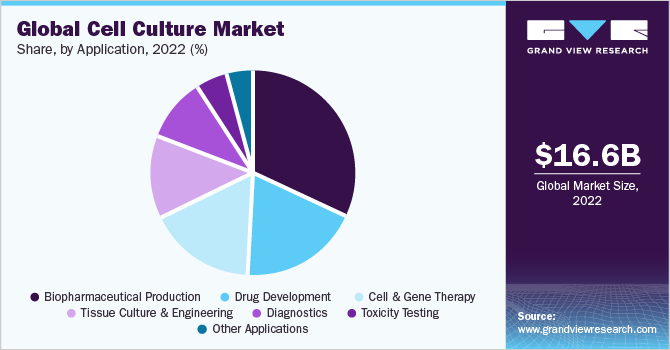

The global cell culture market size was estimated at USD 16.59 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.32% from 2023 to 2030. Its growth can be attributed to the rapid adoption of cell culture techniques to develop substrates for the safe production of viral vaccines, and the rising global demand for advanced therapy medicinal products. Furthermore, novel three-dimensional cell culture techniques and the growing need for them in biopharmaceutical development & vaccine production are expected to drive the market growth over the forecast period. The COVID-19 pandemic has presented researchers with the opportunity to investigate the novel contagious virus for the creation of therapeutic and diagnostic tools.

Numerous prominent pharmaceutical and biotechnology companies have been engaging in extensive R&D efforts to produce innovative vaccines, therapies, and testing kits. As a result, there has been a substantial increase in the need for cell culture tools in research applications. Furthermore, the pandemic has increased the demand for new cell-based models, organoids, and high-throughput screening platforms for research & drug discovery efforts. The urgency to combat the pandemic increased the demand for bioreactors and culture systems for applications in vaccine production and drug testing during the pandemic. In addition, several emerging and established players undertook various initiatives to capitalize on the increased demand for cell culture products due to the COVID-19 pandemic.

For instance, in January 2021, Captivate Bio, based in Massachusetts, U.S., launched its portfolio of cell culture tools for accelerating research applications for COVID-19 and other emerging diseases. Furthermore, in August 2022, Thermo Fisher Scientific expanded its New York-based dry powder media manufacturing facility to support the global demand for media products required for manufacturing COVID-19 vaccines and other biologics. Such initiatives are likely to positively impact the market growth over the forecast period. Furthermore, cell culture technology has applications in the development of functional tissues and organs as it enables researchers to create artificial organs that can replace damaged or malfunctioning organs in patients.

The potential impact of artificial organs in improving the quality of life for patients with organ failure is substantial and can drive the demand for cell culture techniques. In addition, cell culture-based vaccine production has gained prominence in recent years due to several advantages, including improved safety and faster production timelines offered by such vaccines. As a result, cell culture technology is being widely used for the production of several U.S.-licensed vaccines, including those for polio, rotavirus, smallpox, rubella, hepatitis, and chickenpox. Similarly, cell-based flu vaccines have been approved for use in several European countries. Hence, with the growing healthcare awareness and rising demand for vaccines, the market is anticipated to witness rapid expansion in the near future.

Product Insights

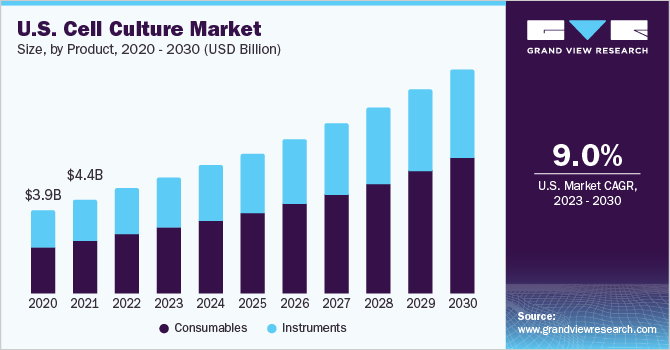

The consumables segment accounted for the largest market share of 57.44% in 2022 and is expected to witness significant growth during the forecast period primarily due to recurring demand and purchase of consumables. Another factor propelling the segment growth is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines. Consumables are expected to continue to havea high demand during the forecast period. The consumables segment is further categorized into reagents, media, and sera.

The cell culture media segment accounted for the largest share of 42.76% of the consumables market in 2022. An increase in R&D investments and an upsurge in life sciences industries, particularly biopharmaceutical products, and the expansion of the biotechnology industry all contribute considerably to the growth of the media market. Furthermore, increased interest in stem cells and their progressive applications in research in biotechnology are likely to drive market expansion.

Application Insights

The biopharmaceutical production application segmentdominated the market in 2022 with a revenue share of 32.15%. Biopharmaceutical applications of cell culture techniques are anticipated to expand due to the use of mammalian cell lines, such as the Chinese hamster ovary, in the production of biopharmaceuticals and the increasing demand for alternative medicines. Furthermore, the recent innovations in grafting procedures and new alternatives in personalized therapy have broadened the biopharmaceutical domain's potential.

The diagnostics segment is expected to grow at the fastest CAGR of 14.29% from 2023 to 2030. Cell cultures can be used in metabolomics for the identification of biomarkers of pathologically relevant conditions. Similarly, metabolites also play a crucial role in the diagnosis of cancer and its recurrence, which increases the scope of applications for cell culture media products in disease diagnosis.

Regional Insights

North America held the largest market share of 35.90% in 2022. The large share is attributed to the region’s well-established pharmaceutical & biotech sectors and widely used, technologically advanced solutions in the U.S. In addition, there is a large market for cell culture technologies due to the extensive cell therapy research efforts undertaken by several universities. The need for cell culturing technologies in research & clinical applications is further augmented by the growing prevalence of chronic & infectious diseases in this region.

The Asia Pacific region is projected to expand at the fastest CAGR of 13.79% over the forecast period due to the growing healthcare expenditure, rising awareness regarding cell and gene therapies, and a large potential for clinical research applications. Furthermore, the rapid adoption of scientific technologies and emerging therapeutics, such as regenerative medicines and cancer immunotherapies, is likely to strengthen the region’s growth in the near future.

Key Companies & Market Share Insights

Key market players are undertaking strategic initiatives, such as mergers & acquisitions, expansions, and new product developments, to extend their product portfolio and strengthen their market presence. For instance, in July 2023, Merck invested around USD 25.85 million (€23 million), in Kansas, the U.S., to increase the production of cell culture media. Some of the prominent players in the global cell culture market include:

-

Sartorius AG

-

Danaher

-

Merck KGaA

-

Thermo Fisher Scientific, Inc.

-

Corning Inc.

-

Avantor, Inc.

-

BD

-

Eppendorf SE

-

Bio-Techne

-

PromoCell GmbH

Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.45 billion

Revenue forecast in 2030

USD 39.09 billion

Growth rate

CAGR of 11.32% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor Inc.; BD; Eppendorf SE; Bio-Techne; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cell culture marketreport on the basis of product, application, and region:

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Sera

-

Fetal Bovine Serum

-

Other

-

-

Reagents

-

Albumin

-

Others

-

-

Media

-

Serum-free Media

-

CHO Media

-

HEK 293 Media

-

BHK Medium

-

Vero Medium

-

Other Serum-free Media

-

-

-

Classical Media

-

Stem Cell Culture Media

-

Chemically Defined Media

-

Specialty Media

-

Other Cell Culture Media

-

-

Instruments

-

Culture Systems

-

Incubators

-

Centrifuges

-

Cryostorage Equipment

-

Biosafety Equipment

-

Pipetting Instruments

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Drug Development

-

Diagnostics

-

Tissue Culture & Engineering

-

Cell & Gene Therapy

-

Toxicity Testing

-

Other Applications

-

-

RegionalOutlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture market size was estimated at USD 16.59 billion in 2022 and is expected to reach USD 18.45 billion in 2023.

b. The global cell culture market is expected to grow at a compound annual growth rate of 11.32% from 2023 to 2030 to reach USD 39.09 billion by 2030.

b. North America dominated the cell culture market with a share of 35.90% in 2022. This is attributed to a high extent of research and development investments, the presence of a well-established scientific infrastructure, significant demand for animal component-free media, and other factors.

b. Some key players operating in the cell culture market include Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Becton, Dickinson and Company; Merck KGaA; Sartorius AG; VWR International, LLC; Eppendorf SE; PromoCell GmbH; Bio-Techne Corporation; BioSpherix, Ltd.

b. Key factors that are driving the cell culture market growth include advancements in 3D cell culture technologies and their increasing adoption for biopharmaceutical production, drug discovery, and tissue engineering applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."