- Home

- »

- Biotechnology

- »

-

Cell Therapy Market Size, Share And Growth Report, 2030GVR Report cover

![Cell Therapy Market Size, Share & Trends Report]()

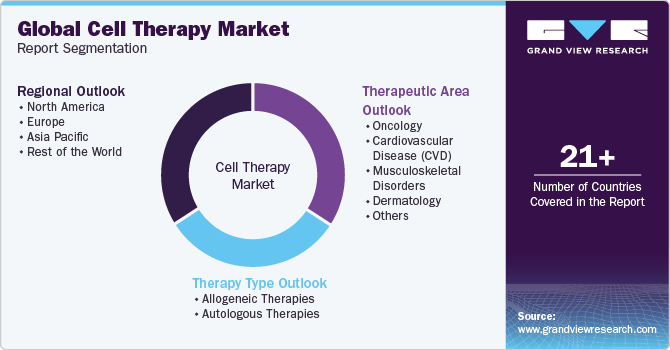

Cell Therapy Market Size, Share & Trends Analysis Report By Therapy Type (Autologous (Stem Cell Therapies, Non-stem Cell Therapies), Allogeneic), By Therapeutic Area, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-701-8

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Cell Therapy Market Size & Trends

The global cell therapy market size was estimated at USD 4.74 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.66% from 2024 to 2030. The market for cell therapy is constantly growing to include new cell types, which presents significant opportunities for companies to strengthen their market positions. As a result, during the past few years, there has been a dramatic increase in the number of companies engaged in developing cell therapies.

The rise in funding for cell therapy clinical studies, the adoption of useful guidelines for cell therapy manufacturing, and the success of products are some of the major factors influencing the growth in the number of companies in the market. The development of cell banking facilities and the ensuing growth in cell manufacturing, storage, and characterization have enhanced the market's ability to handle large volumes on a global scale. Furthermore, several companies are offering cell therapy characterization research and analysis services which is boosting the growth of cell-based therapeutics manufacturing. This has directly contributed to the market's increased revenue generation over the previous few years.

The increase in the number of clinical trials can be attributed to the presence of private and government funding agencies that are constantly providing approvals to support projects across different stages of clinical trials. The majority of late-stage projects in Europe are receiving funds through EU grants. For instance, in July 2022, Achilles Therapeutics declared that it had been awarded a USD 4.2 million Horizon Europe, the EU’s key funding initiative for research and innovation. This funding was awarded to advance personalized therapy manufacturing.

The rise of personalized medicine has led to an increase in clinical studies. Cellular therapies, especially those involving genetically modified cells, offer the potential for customized treatments that target the unique genetic makeup of individual patients. This personalized analysis enhances treatment effectiveness and minimizes adverse effects, marking a paradigm shift in the way healthcare is delivered.

Stem cell therapy is also increasingly gaining attention due to its applications in therapeutics for autoimmune and metabolic disorders. It plays an essential role in developing immunity in an individual to fight against various metabolic disorders. For instance, in May 2022, Sernova and Evotec entered into a collaboration for development of cell therapy to be used for the treatment of insulin-dependent diabetes using induced pluripotent stem cells (iPSC)-based therapeutics.

In addition, automation in adult stem cells & cord blood processing and storage are the key technologies expected to positively influence growth of the adult & cord blood cells market. Furthermore, key entities in the market are involved in collaborations to reprogram newborn stem cells from umbilical cord blood as well as tissue into induced pluripotent stem cells (IPSCs). These developments are expected to drive growth of market over the forecast period.

Market Concentration & Characteristics

The cell therapy landscape is also characterized by a high degree of innovation. Pioneering research and technological breakthroughs are enhancing the efficacy and safety of cell-based therapies. These innovations encompass several key areas, from novel cell sources and manufacturing techniques to optimized delivery methods.

Companies are pursuing mergers and acquisition strategies to strengthen their pipelines, expand geographical reach, and accelerate product development. As the cell therapy industry matures, M&A activities serve as a pivotal force in consolidating resources, optimizing manufacturing capabilities, and securing intellectual property, fostering a competitive landscape for sustainable growth.

The increasing availability of advanced cell engineering technologies and genetic editing tools, such as CRISPR-Cas9, has led to an increased focus on regulations in this industry. Regulatory measures for enhancing efficacy & reducing the risk of adverse reactions are expected to present significant challenges for market growth.

The market is also witnessing high levels of product and regional expansion due to rising number of approvals for cell-based therapeutics granted by key regulatory authorities such as the U.S. FDA and EMA in recent years. This attribute is anticipated to fuel market growth in near future.

Therapy Type Insights

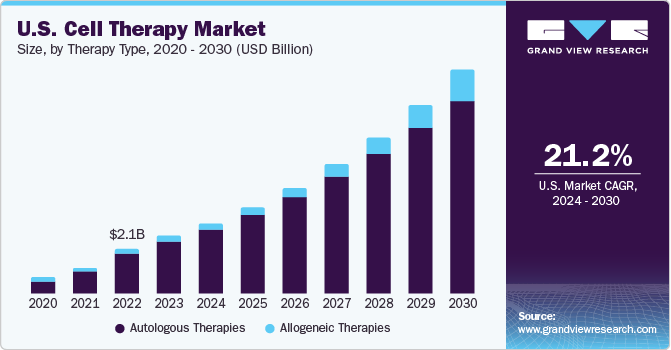

Autologous therapy segment dominated the market with a share of 91.22% in the year 2023. The growth in the segment is attributed to the high adoption of numerous CAR-T therapies owing to its favorable outcomes for treatment of various types of cancers and genetic disorders. The FDA has approved some of such therapies and their wider adoption is currently under progress. For instance, in February 2022, the U.S. FDA accorded its approval to the drug called ciltacabtagene autoleucel (Carvykti) for adult subjects with multiple myeloma that is irresponsive to the refractory therapeutics or that has relapsed after therapeutics.

Allogeneic cell therapy segment is estimated to register substantial growth in the market from 2024 to 2030. The growth can be attributed to its high adoption for designing novel therapeutic regimes. There are 542 active allogenic CAR-T agents in the global pipeline, with many of them yielding favorable outcomes. For instance, Adaptimmune Ltd. collaborates with Genentech to focus on utility of allogeneic therapies derived from iPSCs to create T-cells with higher proliferation capacity than the mature T-cells.

Therapeutic Area Insights

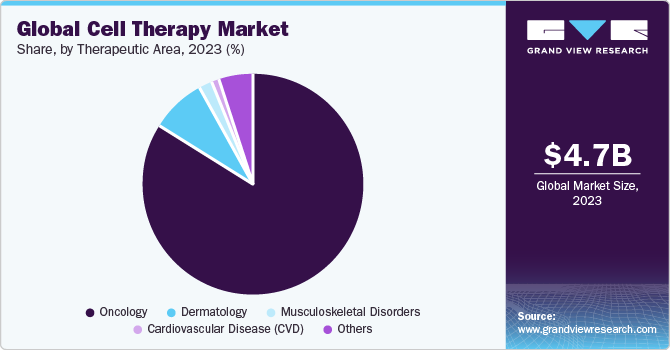

The oncology segment dominated the overall market with the largest revenue share in 2023. CAR T-cells targeting CD19 are reported to provide high rates of complete and long-lasting remissions for patients with acute lymphocytic leukemia (ALL). Furthermore, increasing FDA approval for novel therapies is expected to create growth opportunities for the market. For instance, in October 2021, the U.S. FDA approved the use of the brexucabtagene autoleucel (Tecartus), a CAR T therapy for individuals with B-cell precursor ALL who have not responded to prior treatment (refractory) or whose condition has returned after treatment. With this approval, brexucabtagene became the first CAR T treatment for adults with ALL.

The musculoskeletal disorders segment is anticipated to witness significant market expansion in the forthcoming years. Considerable research is being conducted on technologies aimed at enabling the regeneration or restoration of impaired musculoskeletal tissues. Researchers across diverse groups are analyzing clinically applicable cell types used in therapies to address musculoskeletal tissue degeneration. They are also exploring the direct application of engineered or native skeletal progenitor cells to stimulate tissue repair and revitalize musculoskeletal tissues. These factors are expected to drive the segment growth.

Regional Insights

North America accounted for the largest revenue share of 58.7% in 2023. This is attributed to the collaborative research initiatives by research institutes and the pharmaceutical giants. There are emerging advancements in the region through numerous collaborations. For instance, in June 2022, Immatics entered into a collaboration with Bristol Myers Squibb to develop Gamma Delta Allogeneic Cell Therapy Programs. The availability of funds from government organizations significantly contributes to market growth in the U.S. For instance, in January 2022, Cellino Biotech announced that it raised around USD 80 million through a Series A financing round from 8VC, Felicis Ventures, and other investors. The company plans to use these funds to expand access to stem cell-derived therapies to develop the first independent human cell foundry by 2025.

Asia Pacific is estimated to register a significant CAGR during the forecast period due to increased demand for cell therapy in the region. Certain factors, such as increasing awareness about novel therapies, growing investments, and expected favorable policies by governments, are estimated to accelerate market growth during the forecast period. For instance, in June 2022, Tessa Therapeutics Ltd. raised USD 126 million through rounds of series funding to catalyze the development of next-generation cancer therapy. Similarly, the South Korean market is expected to exhibit lucrative growth due to various strategic initiatives undertaken by local players and international companies. For instance, in August 2022, Panacell Biotech announced that it would be using Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes for treating COVID-19 infection.

Key Companies & Market Share Insights

Cell therapy market is currently experiencing increased efforts of key companies to develop and launch novel cell therapies for multiple indications. Companies with strong pipeline and resources are pushing for product approvals to gain first mover advantage in the specific applications. Companies are also engaging in collaborations and licensing agreements to sustain their foothold in the highly competitive market environment.

Some of the key players operating in the market include Bristol-Myers Squibb Company, Novartis AG, Gilead Sciences, Inc.

-

Bristol-Myers Squibb Company is involved in the development and marketing of CAR-T cell therapies. In May 2023, the company received European Commission (EC) approval for Breyanzi for treatment of refractory or relapsed large B-cell lymphoma in adult patients.

-

Novartis AG is also involved in the development of various cell therapies to strengthen its market position. In January 2020, the company announced that Kymriah would be publicly funded to treat eligible adult patients with relapsed or refractory DLBCL in Australia.

-

Aurion Biotech, Holostem Terapie Avanzate S.r.l., Nkarta, Inc. are some of the emerging market participants in the market.

-

In October 2023, Aurion Biotech began a phase 1/2 clinical trial of cell therapy for corneal edema in the U.S.

-

In October 2023, Nkarta, Inc. announced the FDA's approval of an IND application to investigate NKX019, its allogeneic, CD19-directed CAR NK cell therapy candidate, to cure lupus nephritis.

Recent Developments

-

In October 2023, Aurion Biotech began a phase 1/2 clinical trial of cell therapy for corneal edema in the U.S.

-

In October 2023, Nkarta, Inc. announced the FDA's approval of an IND application to investigate NKX019, its allogeneic, CD19-directed CAR NK cell therapy candidate, to cure lupus nephritis.

-

In June 2023, Vertex Pharmaceuticals Incorporated and Lonza revealed a joint venture to facilitate the manufacturing of Vertex's portfolios of investigational stem cell therapies. These therapies are designed to aid individuals with Type 1 Diabetes (T1D), with a specific focus on the VX-880 and VX-264 programs currently undergoing clinical trials.

-

In May 2023, Johnson & Johnson signed a global collaboration & licensing agreement with Cellular Biomedicine Group to develop next-generation CAR-T therapies.

-

In March 2023, Adaptimmune Therapeutics plc. and TCR2 Therapeutics announced a strategic alliance to form a world-class cell therapy organization for solid tumors.

-

In May 2023, the Bristol-Myers Squibb Company received European Commission (EC) approval for Breyanzi for treatment of refractory or relapsed large B-cell lymphoma in adult patients. This approval would improve company’s position in European market

-

In January 2020, the Novartis AG announced that Kymriah would be publicly funded to treat eligible adult patients with relapsed or refractory DLBCL in Australia.

Key Cell Therapy Companies:

- Novartis AG

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Johnson & Johnson Services, Inc

- JCR Pharmaceuticals Co., Ltd.

- JW Therapeutics

- Atara Biotherapeutics

- Anterogen Co., Ltd.

- MEDIPOST

- S. BIOMEDICS

- Aurion Biotech

- Holostem Terapie Avanzate S.r.l

- Nkarta, Inc.

Cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.89 billion

Revenue forecast in 2030

USD 20.07 billion

Growth rate

CAGR of 22.66% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Therapy type, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; UK; Germany; Switzerland; Japan; China; India; South Korea

Key companies profiled

Novartis AG; Gilead Sciences, Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Services, Inc; JCR Pharmaceuticals Co., Ltd.; JW Therapeutics; Atara Biotherapeutics; Anterogen Co., Ltd.; MEDIPOST; S. BIOMEDICS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell therapy market based on therapy type, therapeutic area, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allogeneic Therapies

-

Stem Cell Therapies

-

Hematopoietic Stem Cell Therapies

-

Mesenchymal Stem Cell Therapies

-

-

Non-Stem Cell Therapies

-

Keratinocytes & Fibroblast-based Therapies

-

Others

-

-

-

Autologous Therapies

-

Stem Cell Therapies

-

BM, Blood, & Umbilical Cord-derived Stem Cells

-

Adipose Derived Cells

-

Others

-

-

Non-Stem Cell Therapies

-

T-Cell Therapies

-

CAR T Cell Therapy

-

T Cell Receptor (TCR)-based

-

-

Others

-

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease (CVD)

-

Musculoskeletal Disorders

-

Dermatology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global cell therapy market size was estimated at USD 4.74 billion in 2023 and is expected to reach USD 5.89 billion in 2024.

b. The global cell therapy market is expected to witness a compound annual growth rate of 22.66% from 2024 to 2030 to reach USD 20.07 billion by 2030.

b. The autologous therapies segment dominated the 2023 market with a revenue share of 91.2% owing to the presence of a substantial number of approved products for clinical use.

b. Some key players in the cell therapy market are Novartis AG, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc, JCR Pharmaceuticals Co., Ltd., JW Therapeutics, Atara Biotherapeutics, Anterogen Co., Ltd., MEDIPOST, S. BIOMEDICS

b. Key drivers of the cell therapy market are increasing clinical studies pertaining to the development of cellular therapies, growing adoption of regenerative medicine, and introduction of novel platforms and technologies.

Table of Contents

Chapter 1. Cell Therapy Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Therapy Type Segment

1.1.2. Therapeutic Area Segment

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources

1.3.4. Primary Research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List Of Secondary Sources

1.8. List Of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Cell Therapy Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Landscape Insights

Chapter 3 Cell Therapy Market: Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market Outlook

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.1.1 Rise In The Number Of Clinical Studies Pertaining To The Development Of Cellular Therapies

3.2.1.2 Rising Adoption Of Regenerative Medicine

3.2.1.3 Introduction Of Novel Platforms And Technologies

3.2.2 Market Restraint Analysis

3.2.2.1 Ethical Concerns Related To Stem Cell Research

3.2.2.2 Clinical Issues Pertaining To Development & Implementation Of Cell Therapy

3.3 Industry Analysis Tools

3.3.1 Porter’s Five Forces Analysis

3.3.2 PESTEL Analysis

3.3.3 COVID-19 Impact Analysis

Chapter 4 Cell Therapy Market Categorization: Therapy Type Estimates & Trend Analysis

4.1 Allogeneic Cell Therapy

4.1.1 Global Allogeneic Cell Therapy Market, 2018 - 2030 (USD Billion)

4.1.2 Stem Cell Therapies

4.1.2.1 Global Allogeneic Cell Therapy Market For Stem Cell Therapies, 2018 - 2030 (USD Billion)

4.1.2.2 Hematopoeitic Stem Cell Therapies

4.1.2.2.1 Global Allogeneic Cell Therapy Market For Hematopoeitic Stem Cell Therapies, 2018 - 2030 (USD Billion)

4.1.2.3 Mesenchymal Stem Cell Therapies

4.1.2.3.1 Global Allogeneic Cell Therapy Market For Mesenchymal Stem Cell Therapies, 2018 - 2030 (USD Billion)

4.1.3 Non-Stem Cell Therapies

4.1.3.1 Global Allogeneic Cell Therapy Market For Non-Stem Cell Therapies, 2018 - 2030 (USD Billion)

4.1.3.2 Keratinocytes & Fibroblast-Based Therapies

4.1.3.2.1 Global Allogeneic Cell Therapy Market For Keratinocytes & Fibroblast-Based Therapies, 2018 - 2030 (USD Billion)

4.1.3.3 Others

4.1.3.3.1 Global Allogeneic Cell Therapy Market For Other Non-Stem Cell Therapies, 2018 - 2030 (USD Billion)

4.2 Autologous Cell Therapy

4.2.1 Global Autologous Cell Therapy Market, 2018 - 2030 (USD Billion)

4.2.2 Stem Cell Therapy

4.2.2.1 Global Autologous Cell Therapy Market For Stem Cell Therapy, 2018 - 2030 (USD Billion)

4.2.2.2 BM, Blood, & Umbilical Cord-Derived Stem Cells

4.1.2.2.1 Global Autologous Cell Therapy Market For BM, Blood, & Umbilical Cord-Derived Stem Cells, 2018 - 2030 (USD Billion)

4.2.2.3 Adipose Derived Cells

4.1.2.3.1 Global Autologous Cell Therapy Market For Adipose Derived Cells, 2018 - 2030 (USD Billion)

4.2.2.4 Others

4.2.2.4.1 Global Autologous Cell Therapy Market For Other Therapies, 2018 - 2030 (USD Billion)

4.2.3 Non-Stem Cell Therapy

4.2.3.1 Global Autologous Cell Therapy Market For Non-Stem Cell Therapy, 2018 - 2030 (USD Billion)

4.2.3.2 T-Cell Therapies

4.2.3.2.1 Global Autologous Cell Therapies Market For T-Cell Therapy, 2018 - 2030 (USD Billion)

4.2.4.2.2 CAR-T Cell Therapy

4.2.4.2.2.1 Global Autologous Cell Therapy Market For CAR-T Cell Therapy, 2018 - 2030 (USD Billion)

4.2.4.2.3 T-Cell Receptor (TCR)

4.2.4.2.3.1 Global Autologous Cell Therapy Market For T-Cell Receptor (TCR), 2018 - 2030 (USD Billion)

4.2.3.3 Others

4.2.3.3.1 Global Autologous Cell Therapies Market For Other Autologous Non-Stem Cell Therapies, 2018 - 2030 (USD Billion)

Chapter 5 Cell Therapy Market Categorization: Therapeutic Area Estimates & Trend Analysis

5.1 Cell Therapy Market: Therapeutic Area Movement Analysis

5.2 Oncology

5.2.1 Global Cell Therapy Market For Oncology Therapies, 2018 - 2030 (USD Million)

5.3 Cardiovascular Disease (CVD)

5.3.1 Global Cell Therapy Market For Cardiovascular Disease (CVD) Therapies, 2018 - 2030 (USD Million)

5.4 Musculoskeletal Disorders

5.4.1 Global Cell Therapy Market For Musculoskeletal Disorders Therapies, 2018 - 2030 (USD Million)

5.5 Dermatology

5.5.1 Global Cell Therapy Market For Dermatology Therapies, 2018 - 2030 (USD Million)

5.6 Others

5.6.1 Global Cell Therapy Market For Other Therapies, 2018 - 2030 (USD Million)

Chapter 6 Cell Therapy Market Categorization: Regional Estimates & Trend Analysis

6.1 North America

6.1.1 North America Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.1.2 U.S.

6.1.2.1 Key Country Dynamics

6.1.2.2 Target Disease Prevalence

6.1.2.3 Competitive Scenario

6.1.2.4 Regulatory Framework

6.1.2.6 U.S. Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.1.3 Canada

6.1.3.1 Key Country Dynamics

6.1.3.2 Target Disease Prevalence

6.1.3.3 Competitive Scenario

6.1.3.4 Regulatory Framework

6.1.3.6 Canada Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2 Europe

6.2.1 Europe Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.2 Germany

6.2.2.1 Key Country Dynamics

6.2.2.2 Target Disease Prevalence

6.2.2.3 Competitive Scenario

6.2.2.4 Regulatory Framework

6.2.2.6 Germany Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.3 UK

6.2.3.1 Key Country Dynamics

6.2.3.2 Target Disease Prevalence

6.2.3.3 Competitive Scenario

6.2.3.4 Regulatory Framework

6.2.3.6 UK Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.4 Switzerland

6.2.4.1 Key Country Dynamics

6.2.4.2 Target Disease Prevalence

6.2.4.3 Competitive Scenario

6.2.4.4 Regulatory Framework

6.2.4.6 Switzerland Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3 Asia Pacific

6.3.1 Asia Pacific Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.2 Japan

6.3.2.1 Target Disease Prevalence

6.3.2.2 Competitive Scenario

6.3.2.3 Regulatory Framework

6.3.2.5 Japan Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.3 China

6.3.3.1 Target Disease Prevalence

6.3.3.2 Competitive Scenario

6.3.3.3 Regulatory Framework

6.3.3.5 China Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.4 India

6.3.4.1 Target Disease Prevalence

6.3.4.2 Competitive Scenario

6.3.4.3 Regulatory Framework

6.3.4.5 India Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3.5 South Korea

6.3.5.1 Target Disease Prevalence

6.3.5.2 Competitive Scenario

6.3.5.3 Regulatory Framework

6.3.5.5 South Korea Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4 Rest Of The World

6.4.1 Rest Of The World Cell Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 7 Competitive Landscape

7.1 Company Categorization

7.2 Strategy Mapping

7.3 Company Market Position Analysis, 2023

7.4 Company Profiles/Listing

7.4.1 Novartis AG

7.4.1.1 Company Overview

7.4.1.4 Financial Performance

7.4.1.3 Product Benchmarking

7.4.1.4 Strategic Initiatives

7.4.2 Gilead Sciences, Inc.

7.4.2.1 Company Overview

7.4.2.2 Financial Performance

7.4.2.3 Product Benchmarking

7.4.2.4 Strategic Initiatives

7.4.3 Bristol-Myers Squibb Company

7.4.3.1 Company Overview

7.4.3.2 Financial Performance

7.4.3.3 Product Benchmarking

7.4.3.4 Strategic Initiatives

7.4.4 Johnson & Johnson Services, Inc

7.4.4.1 Company Overview

7.4.4.2 Financial Performance

7.4.4.3 Product Benchmarking

7.4.4.4 Strategic Initiatives

7.4.5 JCR Pharmaceuticals Co., Ltd.

7.4.5.1 Company Overview

7.4.5.2 Financial Performance

7.4.5.3 Product Benchmarking

7.4.5.4 Strategic Initiatives

7.4.6 JW Therapeutics

7.4.6.1 Company Overview

7.4.6.2 Financial Performance

7.4.6.3 Product Benchmarking

7.4.6.4 Strategic Initiatives

7.4.7 Atara Biotherapeutics

7.4.7.1 Company Overview

7.4.7.2 Financial Performance

7.4.7.3 Product Benchmarking

7.4.7.4 Strategic Initiatives

7.4.8 MEDIPOST

7.4.8.1 Company Overview

7.4.8.2 Financial Performance

7.4.8.3 Product Benchmarking

7.4.8.4 Strategic Initiatives

7.4.9 Anterogen Co., Ltd.

7.4.9.1 Company Overview

7.4.9.2 Financial Performance

7.4.9.3 Product Benchmarking

7.4.9.4 Strategic Initiatives

7.4.10 S. BIOMEDICS

7.4.10.1 Company Overview

7.4.10.2 Financial Performance

7.4.10.3 Product Benchmarking

7.4.10.4 Strategic Initiatives

List of Tables

Table 1 List Of Secondary Sources

Table 2 Global Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 3 Global Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 4 Global Cell Therapy Market By Region, 2018 - 2030 (USD Million)

Table 5 North America Cell Therapy Market By Country, 2018 - 2030 (USD Million)

Table 6 North America Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 7 North America Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 8 U.S. Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 9 U.S. Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 10 Canada Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 11 Canada Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 12 Europe Cell Therapy Market By Country, 2018 - 2030 (USD Million)

Table 13 Europe Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 14 Europe Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 15 Germany Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 16 Germany Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 17 UK Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 18 UK Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 19 Switzerland Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 20 Switzerland Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 21 Asia Pacific Cell Therapy Market By Country, 2018 - 2030 (USD Million)

Table 22 Asia Pacific Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 23 Asia Pacific Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 24 China Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 25 China Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 26 Japan Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 27 Japan Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 28 India Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 29 India Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 30 South Korea Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 31 South Korea Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

Table 32 Rest Of The World Cell Therapy Market By Therapy Type, 2018 - 2030 (USD Million)

Table 33 Rest Of The World Cell Therapy Market By Therapeutic Area, 2018 - 2030 (USD Million)

List Of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Cell Therapy Market, Market Segmentation

Fig. 7 Market Driver Analysis (Current & Future Impact)

Fig. 8 Market Restraint Analysis (Current & Future Impact)

Fig. 9 PESTEL Analysis

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Global Cell Therapy Market: Therapy Type Key Takeaways

Fig. 12 Global Cell Therapy Market: Therapy Type Movement Analysis

Fig. 13 Global Cell Therapy Market For Allogeneic Therapies, 2018 - 2030 (USD Million)

Fig. 14 Global Cell Therapy Market For Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 15 Global Cell Therapy Market For Hematopoetic Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 16 Global Cell Therapy Market For Mesenchymal Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 17 Global Cell Therapy Market For Non-Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 18 Global Cell Therapy Market For Keratinocyte & Fibroblast-Based Therapies, 2018 - 2030 (USD Million)

Fig. 19 Global Cell Therapy Market For Other Non-Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 20 Global Cell Therapy Market For Autologous Cell Therapies, 2018 - 2030 (USD Million)

Fig. 21 Global Cell Therapy Market For Autologous Stem-Cell Therapies, 2018 - 2030 (USD Million)

Fig. 22 Global Cell Therapy Market For BM, Blood, & Umbilical Cord-Derived Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 23 Global Cell Therapy Market For Adipose Derived Cells, 2018 - 2030 (USD Million)

Fig. 24 Global Cell Therapy Market For Others, 2018 - 2030 (USD Million)

Fig. 25 Global Cell Therapy Market For Autologous Non-Stem Cell Therapies, 2018 - 2030 (USD Million)

Fig. 26 Global Cell Therapy Market For T-Cell Therapies, 2018 - 2030 (USD Million)

Fig. 27 Global Cell Therapy Market For CAR T Cell Therapy, 2018 - 2030 (USD Million)

Fig. 28 Global Cell Therapy Market For T Cell Receptor (TCR)-Based, 2018 - 2030 (USD Million)

Fig. 29 Global Cell Therapy Market For Other Autologous Non Stem-Cell Therapies, 2018 - 2030 (USD Million)

Fig. 30 Global Cell Therapy Market: Therapeutic Area Key Takeaways

Fig. 31 Global Cell Therapy Market: Therapeutic Area Movement Analysis

Fig. 32 Global Cell Therapy Market For Oncology, 2018 - 2030 (USD Million)

Fig. 33 Global Cell Therapy Market For Cardiovascular Disease (CVD), 2018 - 2030 (USD Million)

Fig. 34 Global Cell Therapy Market For Musculoskeletal Disorders, 2018 - 2030 (USD Million)

Fig. 35 Global Cell Therapy Market For Dermatology, 2018 - 2030 (USD Million)

Fig. 36 Global Cell Therapy Market For Others, 2018 - 2030 (USD Million)

Fig. 37 Regional Outlook, 2023 & 2030

Fig. 38 North America Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 39 U.S. Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 40 Canada Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 41 Europe Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 42 Germany Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 43 UK Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 44 Switzerland Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 45 Asia Pacific Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 46 Japan Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 47 China Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 48 India Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 49 South Korea Cell Therapy Market, 2018 - 2030 (USD Million)

Fig. 50 Rest Of The World Cell Therapy Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Cell Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Cell Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Cell Therapy Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- North America Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- U.S.

- U.S. Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- U.S. Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- U.S. Cell Therapy Market, By Therapy Type

- Canada

- Canada Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Canada Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Canada Cell Therapy Market, By Therapy Type

- North America Cell Therapy Market, By Therapy Type

- Europe

- Europe Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Europe Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- UK

- UK Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- UK Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- UK Cell Therapy Market, By Therapy Type

- Germany

- Germany Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Germany Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Germany Cell Therapy Market, By Therapy Type

- Switzerland

- Switzerland Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- SwitzerlandCell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Switzerland Cell Therapy Market, By Therapy Type

- Europe Cell Therapy Market, By Therapy Type

- Asia Pacific

- Asia Pacific Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Asia Pacific Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Japan

- Japan Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Japan Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Japan Cell Therapy Market, By Therapy Type

- China

- China Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- China Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- China Cell Therapy Market, By Therapy Type

- India

- India Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- India Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- India Cell Therapy Market, By Therapy Type

- South Korea

- South Korea Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- South Korea Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- South Korea Cell Therapy Market, By Therapy Type

- Asia Pacific Cell Therapy Market, By Therapy Type

- Rest of the World

- Rest of the World Cell Therapy Market, By Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- Stem Cell Therapies

- BM, Blood, & Umbilical Cord-derived Stem Cells

- Adipose Derived Cells

- Others

- Non-Stem Cell Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Stem Cell Therapies

- Allogeneic Therapies

- Rest of the World Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

- Rest of the World Cell Therapy Market, By Therapy Type

- North America

Cell Therapy Market Dynamics

Driver: Rise in the number of clinical studies pertaining to the development of cellular therapies

The rising number of clinical studies focusing on the development of cellular therapies reflects a growing recognition of the potential of cellular therapies across a spectrum of medical conditions and highlights the increasing focus of pharmaceutical companies to explore & harness the therapeutic potential of cells. For instance, as of January 2023, over 2,000 clinical trials were ongoing in the cell and gene therapy space. One significant factor fueling the high number of clinical studies is the promising outcomes observed in early-phase trials. Positive results from initial studies have instilled confidence in the efficacy and safety of cellular therapies, encouraging further exploration and investment. Conditions such as cancer, autoimmune disorders, and degenerative diseases are being targeted, with researchers aiming to unlock the full therapeutic potential of various cell types, including stem cells & immune cells.

Driver: Rising adoption of regenerative medicine

The convergence of scientific advancements, increased understanding of cellular processes, and a growing emphasis on personalized medicine have propelled regenerative medicine to the forefront of medical innovation, significantly impacting the market’s growth. Cell therapies form an important component of regenerative medicine and hold immense potential in treating various medical conditions, including degenerative disorders, autoimmune diseases, and various types of cancer. The versatility of cell therapies allows for targeted interventions that stimulate tissue repair, modulate immune responses, or replace damaged cells, offering novel and effective treatment options where conventional approaches may fall short. This has led to an increasing usage of cell therapies as a part of regenerative medicine treatment regimes.

Restraint: Ethical concerns related to stem cell research

Ethical concerns related to stem cell research pose a significant restraint for the cell therapy market, creating challenges in R&D and public acceptance. For instance, concerns over the use of embryonic stem cells have been a prominent issue in this field. The extraction of these cells requires the destruction of embryos, which raises moral objections. This has led to stringent regulations and limitations on the use of embryonic stem cells in certain regions, hindering the progress of R&D in those areas. The controversy surrounding the ethical implications has also resulted in limited funding for embryonic stem cell projects. In addition, concerns about the ownership of stem cells, informed consent, and the potential exploitation of vulnerable populations raise important ethical dilemmas. The lack of a universally accepted ethical framework for stem cell research hinders research in the market.

What Does This Report Include?

This section will provide insights into the contents included in this cell therapy market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Cell therapy market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Cell therapy market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the cell therapy market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for cell therapy market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of cell therapy market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Cell Therapy Market Categorization:

The cell therapy market was categorized into three segments, namely therapy type (Allogeneic Therapies, Autologous Therapies), therapeutic area (Oncology, Cardiovascular Disease, Musculoskeletal Disorders, Dermatology), and regions (North America, Europe, Asia Pacific, Rest of the World).

Segment Market Methodology:

The cell therapy market was segmented into therapy type, therapeutic area, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The cell therapy market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Rest of the World, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-five countries, namely, the U.S.; Canada; the UK; Germany; Switzerland; Japan; China; India; and South Korea.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Cell therapy market companies & financials:

The cell therapy market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

LG Electronics, Inc. - LG Electronics, Inc. serves different verticals, such as consumer electronics, cell therapys, HVAC, robots, and commercial displays, among others.

-

Siemens AG - Siemens AG caters to seven segments, namely Digital Factory (DF); Power & Gas (PG); Wind Power & Renewables (WP); Building Technologies (BT); Mobility (MO); Energy Management (EM); and Process industries & Drives (PD).

-

Amazon.com, Inc. - Amazon.com, Inc. operates in the e-commerce, delivery & logistics, devices & services, web services, and entertainment verticals.

-

Google Nest (Google LLC) - Google Nest is involved majorly in internet related services and products that include advertisement, mobile phones, tablets, AI, among other verticals.

-

Samsung Electronics Co., Ltd. - Samsung Electronics Co., Ltd. is involved in multiple verticals such as consumer electronics, IT & mobile communications, device solutions, and research & development.

-

Schneider Electric SE - Schneider Electric SE has segregated its products under four business segments-building, infrastructure, industry, and IT .

-

Legrand SA - Legrand SA specializes in electrical and digital infrastructure building and provides solutions for home automation, cable management solutions, protection, wiring devices, power, distribution, lighting management solutions, and digital infrastructure.

-

Robert Bosch GmbH - Robert Bosch’s key product verticals include deadbolts, knobs, levers, handle sets, keypads, connected devices, touchscreens, Bluetooth-enabled locks, and other accessories.

-

Assa Abloy AB - Assa Abloy AB is involved in hospitality, healthcare, and electronic product for consumer and commercial application verticals.

-

Sony Group Corporation - Sony Group Corporation caters to different verticals, such as games & network services, entertainment technology & services, financial services, electronic products for consumers and commercials, cell therapy, among others.

-

ABB Ltd. - ABB Ltd. operates into business segments like electrification products for consumer and commercial applications, robotics and motion, industrial automation, and power grids.

-

Koninklijke Philips N.V. - Koninklijke Philips N.V. operates in multiple verticals such as healthcare, consumer electronics, cell therapy solutions, automotive, among others.

-

Honeywell International, Inc. - Honeywell International, Inc. operates through four business segments including aerospace; performance materials and technologies; building technologies; and safety and productivity solutions.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Cell Therapy Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Cell Therapy Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."