- Home

- »

- Medical Devices

- »

-

Cellulite Treatment Market Size And Share Report, 2030GVR Report cover

![Cellulite Treatment Market Size, Share & Trends Report]()

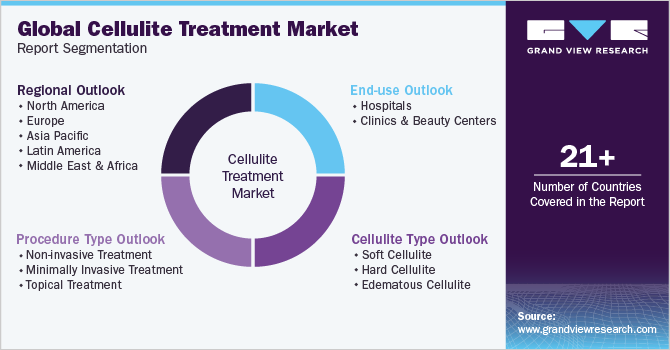

Cellulite Treatment Market Size, Share & Trends Analysis Report By Procedure Type (Non-invasive, Minimally Invasive, Topical), By Cellulite Type (Soft, Hard, Edematous), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-985-2

- Number of Pages: 101

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global cellulite treatment market size was estimated at USD 1.4 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.1% from 2023 to 2030. The rise in the obese population coupled with the growing demand for cosmetic and aesthetic procedures is expected to fuel the market growth during the forecast period. According to the World Health Organization's 2021 report, the number of overweight or obese children and adolescents was more than 340 million in 2016. Additionally, over 1.9 billion adults aged 18 and above were overweight, with over 650 million obese. The report also focused that in 2019, the number of obese or overweight children under the age of five was 38.2 million.

Furthermore, cellulite affects an individual’s behavioral, psychological, and psychiatric characteristics, which is expected to affect the demand in the market over the forecast period.As per the report published by Surgical and Cosmetic Dermatology on the psychological aspects of patients with cellulite, around 50% population expressed dissatisfaction with their appearance and around 78.3% reported their requirement to seek treatment.

The COVID-19 pandemic negatively impacted the aesthetic industry, including the cellulite treatment market. Government regulations and lockdowns in all countries negatively affected the global economy. According to the Plastic Surgery Statistics report for 2020, around 86,350 cellulite treatment procedures were performed in the U.S. The report also showed a decline of 24% in cellulite procedures from 2019 to 2020. The COVID-19 pandemic has increased the use of social media, online conferences, and digital technology during the pandemic and post-pandemic period, which emphasizes idealized and personal facial aesthetics.

The market growth is further expected to be fueled by the introduction of innovative products in the industry. For instance, in October 2019, Merz a pharmaceutical company announced that the benefits of Cellfina a minimally-invasive treatment for cellulite lasts for 5 years which is more than the previous 3 years. Cellfina exhibited a 5-year improvement in the outlook of cellulite on the thighs and buttocks of adult females. Around 78% of women in the U.S. can be treated with this system while above 93% of treated patients were satisfied with the treatment outcomes. Hence, the introduction of innovative products is expected to boost market growth.

There is a significant shift in preference for minimally invasive surgeries over invasive surgeries. According to the American Society of Plastic Surgeons' report, a significant number of 15.6 million cosmetic procedures were performed in 2020. Among these procedures, 2.3 million were identified as cosmetic surgical procedures, while 13.2 million were categorized as minimally invasive procedures.

Moreover, the growing presence of superstars and social media influencers displaying their toned physiques on various social media platforms has encouraged a desire among individuals, particularly women, to achieve similar body standards. This social pressure to achieve the perfect body shape, associated with the negative body image, is expected to contribute to an increased number of people seeking treatments, thereby driving the market growth.

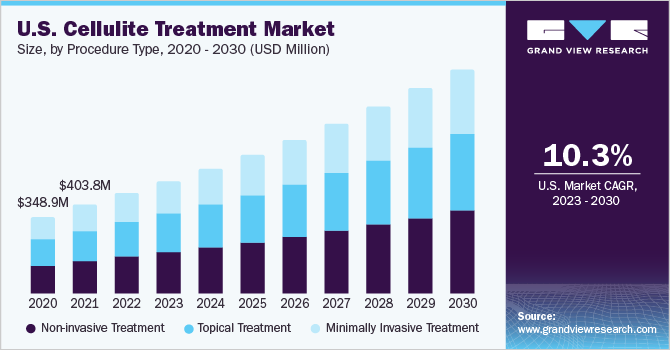

Procedure Type Insights

The non-invasive treatment segment accounted for the largest revenue share of 36.7% in 2022 and is expected to grow at the fastest CAGR of 11.3% during the forecast period. The increased accessibility of this procedure and ongoing research and development activities are key factors contributing to the growing popularity of this treatment. Among the other segments, the topical treatment segment followed the non-invasive treatment segment.

Topical treatment segment products are user-friendly, can be applied at home without any need for a medical specialist, and are contributing to the market expansion. However, the side effects associated with topical agents are expected to restrict the market growth of this particular segment.

Noninvasive procedures such as the use of radiofrequency waves are the preferred treatment option as such procedures do not damage the skin and exhibit effective results. The easy availability of over-the-counter creams for cellulite treatment is also driving the segment’s growth.

Cellulite Type Insights

The soft cellulite segment accounted for the largest revenue share of around 46.4% in 2022 and is estimated to register the fastest CAGR of 11.2% over the forecast period. Soft cellulite occurs in areas such as the abdomen, thighs, arms, and buttocks. The different treatment options for soft cellulite are the development of muscle tone through exercise, weight loss, enough protein intake, topical treatments, and radiofrequency. In comparison with other forms of cellulite, the treatment of soft cellulite is easy.

Hard cellulite is a compact structure, often causing pain when touched. Hard cellulite is commonly found on the outer areas of the hips and thighs. One recommended treatment option for hard cellulite is mesotherapy, which involves the injection of a customized mixture of natural extracts, vitamins, and medications into the mesoderm layer.

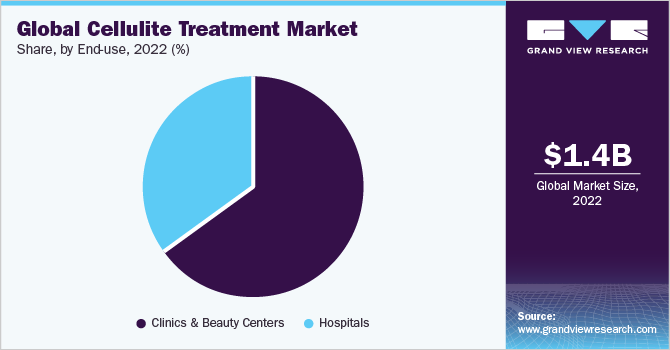

End-use Insights

The clinics and beauty centers segment held the largest revenue share of 65.1% in 2022 and is expected to grow at the fastest CAGR of 11.3% over the forecast period. Cellulite formation is a problem noticed in women aged 20 and above. As it is considered a cosmetic problem patients look for aesthetic centers for the treatment. Both beauty clinics and hospitals provide effective treatment options for patients looking for cellulite treatment. The demand for beauty centers and clinics is rising due to the increasing occurrence of cellular formation and other aesthetic-related conditions. Generally, cases from hospitals are referred to beauty centers and clinics, which further contributes to the growth in the demand for these centers.

Furthermore, some individuals prefer home-based remedies such as OTC creams for cellulite treatment. However, many patients choose to visit clinics and beauty spas for cellulite treatment due to the presence of skilled staff and certified professionals, which helps in reducing the risk of complications. Additionally, the expansion of clinics and medical spa around the world is driven by the low regulatory requirements for nonsurgical cosmetic procedures, and are contributing to the market growth.

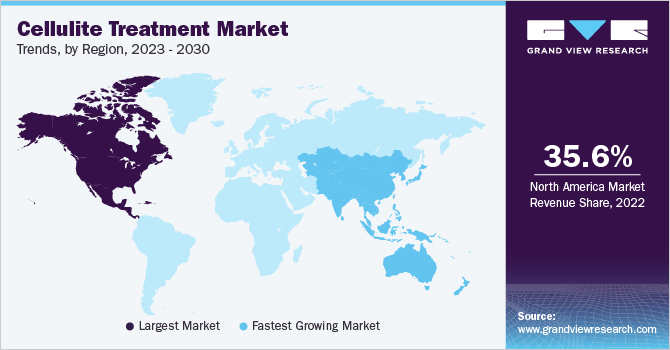

Regional Insights

North America dominated the cellulite treatment market and accounted for the largest revenue share of 35.6% in 2022 due to advanced techniques and the availability of skilled professionals in the region. The growth is also driven by the increased availability and adoption of advanced treatment options, such as laser treatments. Moreover, the growing awareness regarding aesthetic appeal and outward appearance is driving the expansion of the industry in North America. In March 2023, Sentient.io an artificial intelligence technology company launched the Sentient Sculpt in the U.S. It is a non-invasive cellulite reduction treatment utilizing electromagnetic waves and microwaves, suitable for all skin types.

Asia Pacific is expected to grow at the fastest CAGR of 12.1% during the forecast period due to lower treatment costs, rising disposable income, and an increasing prevalence of obesity. Many countries within the region are developing nations and are quickly adopting technologically advanced equipment. Medical tourism is also expected to further drive the growth of the industry. Additionally, there has been an increase in the number of both men and women over the years, who are concerned about their aesthetic appeal and outward appearance, contributing to the expansion of the regional market.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in January 2021, Candela Candela Corporation, a medical aesthetic device company, and Merz Aesthetics, a medical aesthetics company, announced the collaboration to offer a broad medical aesthetics portfolio. The collaboration is expected to start in North America and would lead to the expansion of skincare and injection portfolios globally. Some prominent players in the global cellulite treatment market include:

-

Merz Pharma

-

Hologic, Inc. (Cynosure)

-

Syneron Medical

-

Zimmer Aesthetics

-

Alma Lasers

-

Cymedics

-

Nubway

Cellulite Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.61 billion

Revenue forecast in 2030

USD 3.37 billion

Growth rate

CAGR of 11.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, cellulite type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Merz Pharma; Hologic, Inc. (Cynosure); Syneron Medical; Zimmer Aesthetics; Alma Lasers; Cymedics; Nubway

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellulite Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellulite treatmentmarket report based on procedure type, cellulite type, end-use, and region:

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-invasive Treatment

-

Minimally Invasive Treatment

-

Topical Treatment

-

-

Cellulite Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Soft Cellulite

-

Hard Cellulite

-

Edematous Cellulite

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics and Beauty Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cellulite treatment market size was estimated at USD 1.4 billion in 2022 and is expected to reach USD 1.61 billion in 2023.

b. The global cellulite treatment market is expected to grow at a compound annual growth rate of 11.1% from 2023 to 2030 to reach USD 3.37 billion by 2030.

b. North America dominated the cellulite treatment market with a share of 35.3% in 2022. This is attributable to the availability of skilled professionals, advanced techniques, and supportive government initiatives in the region.

b. Some key players operating in the cellulite treatment market include Cymedics; Nubway; Syneron Medical, Inc.; Zimmer Aesthetics; and Tanceuticals, LLC.

b. Key factors that are driving the cellulite treatment market growth include increasing demand for cosmetics and aesthetic procedures along with rising cases of obesity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."