- Home

- »

- Organic Chemicals

- »

-

Chemical Tanker Shipping Market Analysis, Industry Report, 2018-2025GVR Report cover

![Chemical Tanker Shipping Market Size, Share & Trends Report]()

Chemical Tanker Shipping Market Size, Share & Trends Analysis Report By Product (Organic, Inorganic, Vegetable Oils & Fats) By Shipment Route (Inland, Coastal, Deep Sea) By Cargo Type, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: 978-1-68038-349-2

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Bulk Chemicals

Industry Insights

The global chemical tanker shipping market size was valued at USD 2,072.6 billion in 2016. The high concentration of chemical production and increasing demand across the globe is mostly responsible for market growth. Shale gas evolution is one of the significant factors positively influencing the market growth.

Although exports in 2015 showed a decreasing trend in light of appreciated dollar rates and global economic slowdown, the export market is expected to pick up over the coming years. In 2016, the U.S. accounted for approximately 15% of the worldwide chemical shipments. New capacity additions in the sector, which will also be used for exports, is anticipated to propel the pickup tanker demand over the coming years.

Falling crude oil prices have still not prompted the Organization of Petroleum Exporting Countries, the U.S., Canada, and Russia to decrease their oil production levels, thus crude oil prices are not expected to rise exponentially from 2016 to 2018. Low crude oil cost is projected to improve profit margins of refineries, thus promoting North American oil product trade. In 2016, low oil prices increased oil trade to countries such as China, thereby providing better profitability to vessel owners.

Organic chemicals have a broad base of applications and entice significant interest due to their potential industrial uses. Engagement of substantial trade activities coupled with low charter rates for waterborne transportation is expected to foster the market over the forecasted period. Fleet operators are coming up with innovative technological solutions to drive global chemical tanker supply. Tanker coating plays a crucial role in chemical shipping on account of its hazardous nature and different properties.

Growing consumer concerns for healthy and hygienic food is also expected to drive vegetable/ animal oil and fats trade which in turn is supposed to boost the global chemical tanker shipping market over the forecast period. However, the market is restrained by unstable political conditions. Increasing geopolitical issues among the countries are expected to hinder the market growth over the forecast period.

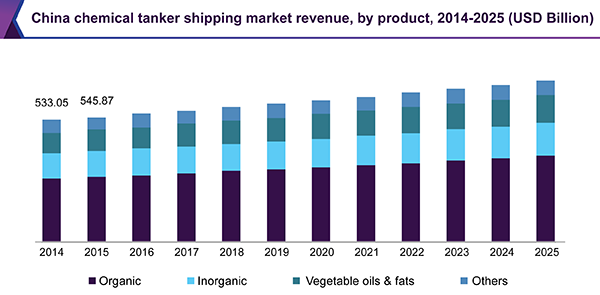

Product Insights

Organic chemicals segment is expected to be the leading segment in this industry due to its increasing demand from pharmaceuticals, food & beverages, pesticides, crop protection, fertilizers, water treatment, personal care products & cosmetics, polymers, gasoline additives, and other products. The shale gas boom in North America and China has triggered organic chemical production in the region, with ethylene being the key raw material.

Vegetable oils & fats segment is expected to emerge as the second fastest-growing segment owing to its increasing usage in culinary applications, biodiesel, pet food additives, as well as manufacturing soaps, perfumes, candles, skin products, and other personal care products. Products such as palm oil included in this segment are traded on a large scale, especially for biodiesel production.

Inorganics account for 17.7% of the global shipments. These products find demand from several applications such as pigments, catalysts, coatings, surfactants, fuels, medicines, and agricultural applications. These chemicals are used as additives, finished products, and industrial processes.

Shipment Route Insights

The deep-sea tanker volume in 2016 was recorded at 24,722.8 kilotons and estimated to derive a demand of 56.479.6 kilo tons by the end of the period 2017-2027. The growth rate predicted for this segment is 4.8% in the eyes of the uncertainty of the dollar rate value which has appreciated significantly during 2015-2016, but currently showing signs of decline.

The highest growth rate in this segment was attributed to deep-sea tankers. Chemical trade for the construction & building and automotive manufacturing industries are the factors attributing the growth of this sector.

The most significant crude oil and derivative export volume in North America remain in the Gulf of Mexico. East coast ports include Portland ME, Philadelphia, and New York. West coast ports include Long Beach, California, San Francisco, and Vancouver. Petrochemicals and crude oils are transported along the coast by either barrage or ship.

Coastal tankers demand coming in from China and India is expected to have positive growth in the near future owing to its restructuring of policy and infrastructure. The Indian workforce is highly competitive in terms of skills and wages. India and China are also strategic gateways to import products in the Asia Pacific making it a valuable destination as well as a suitable market for chemical tankers.

Rotterdam is the central hub followed by Antwerp as the second port of deep-sea shipping in Europe. Aided by tax enabled investment schemes the Netherlands is projected to witness rapid growth for deep-sea shipping. Great lakes seaway system in the North American region is anticipated to observe cargo movements on a large scale owing to substantial existing capacity and reduce overland congestion for transportation.

Cargo Type Insights

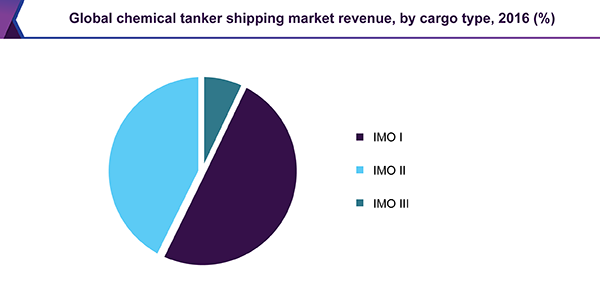

IMO I tankers are mainly specialized for carrying sophisticated products. With the advancement in technology, IMO I demand is expected to increase on account of new innovative solutions for the carriage of such products. IMO II carriers are mainly used for carrying bulk chemicals including vegetable/animal oils & fats. Increasing demand for bio-based lubricants is expected to grow IMO II carrier market volume.

IMO III dominated the global market in 2016 with over 50% of the demand in 2016 and is expected to retain its dominance over the forecast period as well. IMO III tankers are used to carry chemical products with high safety and environmental hazards. IMO III has a significant demand on account of extensive applications of natural or organic compounds in multiple industries. As these tankers do not have any restriction on the cargo quantity, it is the most preferred tanker type among all the three.

Regional Insights

North American chemical production has started growing, and the manufacturers are planning for capacity expansion because of the huge natural gas production coupled with low prices. The U.S. distributes a significant portion of its total chemical production to Mexico and Canada followed by China and Belgium. The majority of the North American producers are finding their way to Asian and European market, thereby increasing lengthy route freight movement in the region.

The European market is expected to experience a very sluggish growth on account of the decreased chemical production. The lower production can be attributed to higher raw material and energy costs. Asia Pacific is anticipated to grow at the highest CAGR and occupied 42.9% of the global revenue in 2016. Emergent economies such as India and China are expected to spectate strong economic growth over the coming years.

Increasing demand for various harmful liquefied substances from these regions is attributed to market growth. Asia Pacific production is expected to grow at a substantial rate owing to factors such as lower raw material costs, less stringent environmental policies, etc. The shale gas revolution in China is also expected to be the major factor for the growth in the region on account of low-cost feedstock production.

Chemical Tanker Shipping Market Share Insight

The global market is fragmented with a large number of regional players in the market. Key players include Odfjell, Stolt- Nielsen Ltd., IINO KAIUN KAISHA Ltd., Tokyo Marine Asia Pte Ltd, MISC, Navig8 chemicals, and Nordic tankers. Industry participants have adopted innovative strategies related to environmental protection owing to stringent regulations. They are also focusing on quality management and safe transportation techniques.

Other players are JO Tankers, Eitzen Chemical, Berlian Laju Tanker, Seatrans chemical tankers, and Lomar. North America is expected to attract new players in the market on account of the shale gas boom in the region positively impacting ethylene production in the region which in turn is expected to boost organic chemicals shipment supply globally.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Kiloton, revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

The U.S., Canada, Mexico, Germany, The U.K., Italy, France, China, Japan, India

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the chemical tanker shipping market on the basis of product, shipment route, cargo type, and region:

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2014 - 2025)

-

Organic chemicals

-

Inorganic chemicals

-

Vegetable oils & fats

-

Others

-

-

Shipment Route Outlook (Volume, Kiloton; Revenue, USD Million, 2014 - 2025)

-

Inland

-

Coastal

-

Deep sea

-

-

Cargo Type Outlook (Volume, Kiloton; Revenue, USD Million, 2014 - 2025)

-

IMO I

-

IMO II

-

IMO III

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

The U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."