- Home

- »

- Medical Devices

- »

-

China Vascular Grafts Market Size Report, 2021-2028GVR Report cover

![China Vascular Grafts Market Size, Share & Trends Report]()

China Vascular Grafts Market Size, Share & Trends Analysis Report By Product, By Application (Kidney Failure, Vascular Occlusion, Coronary Artery Disease), By Raw Material, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-634-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

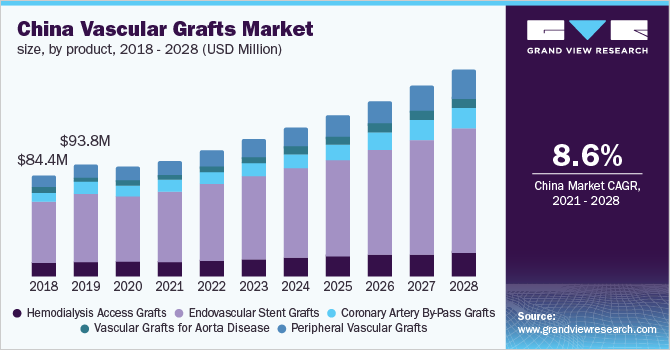

The China vascular grafts market size was valued at USD 91.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2021 to 2028. Increasing incidence of various health conditions or diseases, which can damage the aorta and pose a life-threatening risk, is a major factor aiding the adoption of cost-effective vascular grafts in China. Health conditions that were considered are hypertension, injury atherosclerosis, Marfan syndrome, and connective tissue disorders, like polychondritis, osteogenesis imperfecta, scleroderma, Ehlers -Danlos disorder, Turner syndrome, and polycystic kidney disease.

In addition, the rising need for early detection and prevention of coronary heart disease has led to an increase in the number of treatment options such as bypass grafting operations and treatment interventions. The presence of a large population is expected to increase the demand for stent-grafts in the country over the forecast period.Ongoing research activities about modification of ePTFE vascular grafts with O-carboxymethyl chitosan, which enhances hydrophilicity of ePTFE grafts, are expected to drive the demand for prosthetic grafts over the forecast period. Supportive reimbursement policies for vascular surgeries increase patient spending power, and a rise in the need for advanced products are some of the factors anticipated to create lucrative growth opportunities over the forecast period.

The rising prevalence of Peripheral Artery Diseases (PADs) is further attributing to the market growth. According to data published by the National Library of Medicine in June 2019, the prevalence of PAD until the mid-60s increased gradually. Post which, it accelerated. The prevalence of PAD in males ranged from 2.8% among the population aged between 25 and 29 to 21.9% among the population aged between 95 and 99. In females, the prevalence of PAD increased from 3.8% among the population aged between 25 and 29 years to 27.95% in those between 95 and 99 years. It also stated that around 24.2 million people with PAD reside in rural areas, accounting for about 70% of all PAD cases in China.

The COVID-19 pandemic has negatively impacted the market for vascular assist devices owing to government-imposed stay-at-home or quarantine orders and a decline in the number of elective procedures. For instance, the cardiac and vascular group of Medtronic plc registered a revenue decline of 9.0% in FY2020 compared to FY2019. The continuous strain of the COVID-19 outbreak coupled with recommended deferrals of elective medical procedures is further declining the overall growth by reducing the product demand owing to the prioritization of treatment for COVID-19.

COVID19 China Vascular Grafts market impact: 3.0% decrease in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The China vascular grafts market decreased by 3.0% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 7.0% to 9.0% in the next 5 years

Hospitals limiting the elective procedures owing to increasing prioritization of COVID-19 associated treatments have significantly affected the market growth.

An increase in the number of strategic initiatives and the growing focus of healthcare facilities for developing strategies to restart elective vascular surgeries once the pandemic stabilizes is anticipated to drive the market growth post-COVID-19.

The pandemic affected supply chains, manufacturing, operations, product distribution, and other business activities of the market players in the country. It, in turn, resulted in the decline in sales of their vascular graft products.

The rising prevalence of various diseases and increasing demand for minimally invasive procedures compared to open procedures is anticipated to drive their adoption in the coming years.

The companies are increasingly focusing on introducing newer innovative solutions and expanding their geographic reach through various strategies, including the launch of new products, partnerships, product approvals, and collaborations, to support end-users in delivering value-based care and maintain a competitive edge. For instance, in November 2019, Terumo Corporation announced the acquisition of Aortica Corporation. The acquisition is aimed at supporting the growth of the company’s vascular grafts business and contributing toward personalized aortic therapy. However, low per capita healthcare expenditure is expected to hinder the growth of the overall market. For instance, per capita, healthcare expenditure in China is less than the global healthcare expenditure. According to World Bank in 2018, per capita, healthcare expenditure in China was USD 501.06 in comparison with the global average of USD 1,111.08.

Product Insights

In 2020, the endovascular stent-grafts product segment held the largest market share of 60.8%. Increasing acceptance of endovascular stent-grafts, especially for the treatment of thoracoabdominal aortic aneurysm, is expected to boost usage of these products thereby, aiding the market growth. As open surgeries consume a long time and there is excessive blood loss associated with them, minimally invasive endovascular stent-grafts are expected to gain momentum during the forecast period. Furthermore, the reduced mortality rate associated with this treatment and technological advancements in novel product development are among factors expected to positively influence market growth in China.

However, the peripheral vascular grafts segment is anticipated to register the fastest growth during the forecast period. Technological advancements in the novel products development for the treatment of Peripheral Artery Diseases (PAD) are anticipated to drive demand for peripheral vascular grafts during the forecast period. The spiral flow peripheral vascular graft delivers improved patency in comparison to polytetrafluoroethylene grafts that are utilized for reconstructing damaged blood vessels.

Application Insights

In 2020, the cardiac aneurysm segment held the largest market share of 49.2%. It can be attributed to an increase in the prevalence of cardiovascular diseases and improvements in the development of advanced tissue-engineered grafts for pediatric congenital heart surgeries. Furthermore, key factors such as the development of novel prosthetic grafts with improved porosity and efficiency coupled with the growing acceptance of these products are boosting their adoption for this application. Moreover, the increasing geriatric population and growing adoption of unhealthy lifestyles, such as alcohol consumption and smoking, is anticipated to drive the demand for minimally invasive vascular grafting procedures.

The vascular occlusion segment is anticipated to register the fastest growth during the forecast period. The increasing prevalence of vascular occlusive diseases and easy availability of graft procedures, especially the saphenous vein graft, are expected to drive the demand for vascular grafts during the forecast period. Furthermore, an increasing number of synthetic graft implantations, especially Polytetrafluoroethylene (PTFE), for vascular occlusive diseases is anticipated to propel market growth over the forecast period.

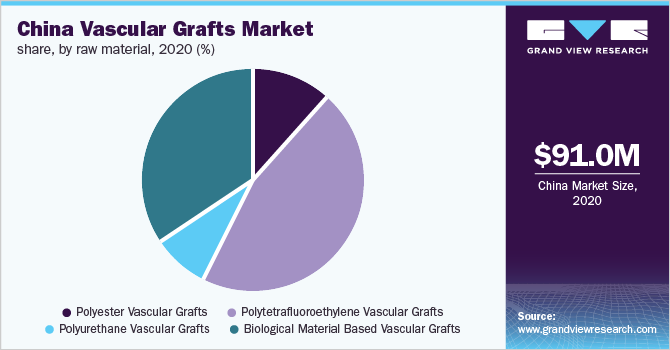

Raw Material Insights

Polytetrafluoroethylene vascular graft segment held the largest market share of 46.0% in 2020, and it is anticipated to register the fastest growth during the forecast period. Key factors responsible for the largest share include rising demand for novel engineered prosthetics and technologically advanced products. Furthermore, a low risk of degradation and infection due to polytetrafluoroethylene grafts is a crucial factor contributing to the largest share of this segment. For instance, polytetrafluoroethylene grafts held a large revenue share of approximately 20% for LeMaitre, a manufacturer of vascular products, in 2020.

The polyester vascular grafts segment is also expected to witness significant growth during the forecast period. Technological advancements in novel polyesters, such as sirolimus-eluting poly and low porosity artificial vascular grafts, which are created with ultrafine polyester fibers, are among the key factors, are expected to drive demand for polyester grafts over the forecast period. In addition, easy availability of raw material, high tensile strength, and durability are further bolstering their adoption in the forthcoming years.

Key Companies & Market Share Insights

Partnerships, collaborations, mergers and acquisitions, and the development of new products are among key strategies adopted by these players to gain a competitive edge in the market. For instance, in April 2017, Lombard Medical announced a strategic partnership with MicroPort Scientific Corporation. The partnership allowed Lombard Medical to accelerate the commercialization of its product portfolio for abdominal aortic aneurysms in China and other global markets. Some of the prominent players in the China vascular grafts market include:

-

Medtronic plc

-

Terumo Corporation

-

LeMaitre Vascular, Inc.

-

C.R. Bard; W.L. Gore and Associates, Inc.

-

Cook

-

Shanghai Suokang Medical Implants Co. Ltd.

-

Getinge AB

China Vascular Grafts Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 96.9 million

Revenue forecast in 2028

USD 172.8 million

Growth Rate

CAGR of 8.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, raw material

Country scope

China

Key companies profiled

Medtronic plc; Terumo Corporation; LeMaitre Vascular, Inc.; Getinge AB; Cook; C.R. Bard; W.L. Gore and Associates, Inc.; and Shanghai Suokang Medical Implants Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research, Inc. has segmented the China vascular grafts market report based on product, application, and raw material:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Hemodialysis Access Grafts

-

Endovascular Stent Grafts

-

Coronary Artery By-Pass Grafts

-

Vascular Grafts for Aorta Disease

-

Peripheral Vascular Grafts

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Cardiac Aneurysm

-

Endovascular Stent Graft

-

Vascular Graft

-

Kidney Failure

-

Vascular Occlusion

-

Coronary Artery Disease

-

-

Raw Material Outlook (Revenue, USD Million, 2016 - 2028)

-

Polyester Vascular Grafts

-

Polytetrafluoroethylene Vascular Grafts

-

Polyurethane Vascular Grafts

-

Biological Material Based Vascular Grafts

-

Human Saphenous and Umbilical Veins

-

Tissue Engineered Materials

-

Frequently Asked Questions About This Report

b. The China vascular grafts market size was estimated at USD 91.0 million in 2020.

b. The China vascular grafts market is expected to reach USD 172.8 million by 2028 with a compound annual growth rate of 8.6% from 2021 to 2028.

b. The endovascular stent-grafts product segment held the largest market share of 60.8% in 2020

b. Key players in the China vascular grafts market include Medtronic plc; Terumo Corporation; LeMaitre Vascular, Inc.; Getinge AB; Cook; C.R. Bard; W.L. Gore and Associates, Inc.; and Shanghai Suokang Medical Implants Co. Ltd.

b. Key factors driving the China vascular grafts market include increasing prevalence of Peripheral Artery Diseases (PADs), cardiovascular diseases, and end-stage renal disease.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."