- Home

- »

- Medical Devices

- »

-

Cleanroom Technology In Healthcare Market Report, 2030GVR Report cover

![Cleanroom Technology In Healthcare Market Size, Share & Trends Report]()

Cleanroom Technology In Healthcare Market Size, Share & Trends Analysis Report By Product (Consumables, Equipment), By End-use, By Region, And Segment Forecast, 2023 - 2030

- Report ID: GVR-2-68038-216-7

- Number of Pages: 208

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global cleanroom technology in healthcare market size was valued at USD 3.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.58% from 2023 to 2030. The growth of the market is attributed to factors such as compliance with stringent regulatory standards for product approvals coupled with the technological and economic benefits of these technologies, which are helping companies achieve superior rankings.

Furthermore, benefits such as customized solutions, reduced time and cost, and improved product flow between cleanrooms are among the key factors boosting the demand. Technological advancements associated with these technologies, from HEPA technology to the unidirectional airflow system, to the commercialization of these technologies to modular cleanroom technology, are other factors expected to boost the market for cleanroom technology over the forecast period.

The rising demand for cleanrooms in manufacturing units across various industries is an important factor anticipated to boost the market growth over the forecast period. Various sources of contamination, such as raw materials, personnel, product flow, and machinery, are likely to contaminate the overall production cycle, which may result in the contamination of the product. The growing adoption of cleanroom technology is expected to ensure the sterility of the final products and the overall manufacturing processes.

In recent years, the prevalence of hospital-acquired infections (HAIs) has increased. As per the WHO, out of every 100 patients in acute care hospitals, 15 patients in low- and middle-income countries and seven patients in high-income countries will acquire at least one HAI during hospital stays. On average, one in every 10 affected patients will die from HAI.As per a new study published by researchers working with the CDC, hospitals in the U.S. observed a significant increase in HAI in 2020.Thus, the need for the installation of cleanrooms in hospitals has increased significantly to overcome the growing prevalence of HAIs. Within hospitals, cleanrooms are integrated into burn units, surgery suits, isolation areas, and, in certain cases, corridors, which are regularly exposed to biohazardous materials.

The pandemic has positively influenced the market owing to the growing need to maintain a contamination-free environment during sample collection and testing of COVID-19 suspected cases. Rising research and development activities to develop vaccines against COVID-19 have driven pharma and biopharmaceutical companies to invest significantly in the market in order to maintain a contamination-free environment.

Moreover, the COVID-19 pandemic has significantly impacted the designing and manufacturing of medical devices, equipment, and consumables. Various medical device manufacturers have increased their production during the pandemic to meet ever-increasing customer demand. Since they are an integral part of the production process in the medical sector, the demand for these products is expected to witness growth during pandemic times.

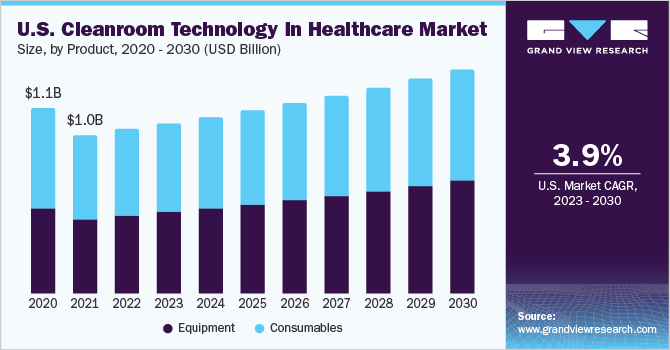

Product Insights

Based on the product, the market is bifurcated into consumables and equipment. The consumables segment dominated the market with the largest revenue share of 52.7% in 2022. The continuous use of consumables and the high sales volume of gloves, wipes, disinfectants, and other cleaning products are factors responsible for the dominant share of the segment. Cleanroom consumables could either be disposable or reusable and are required in production units in various sectors, such as biotechnology companies, pharmaceutical companies, diagnostic centers, and hospitals.

The equipment segment is projected to witness significant growth during the forecast period.Cleanroom equipment ensures cleanliness levels and helps comply with regulatory standards. This equipment is designed to minimize air contamination. Equipment used in cleanrooms is Heating Ventilation and Air Conditioning System (HVAC) systems, laminar air flow units, air showers, air diffusers, fume hoods, desiccating cabinets, pass-through systems, and air filter systems.

The demand for cleanroom equipment is expected to increase due to the rising number of medical devices and pharmaceutical companies. Increasing spending on research and new drug development, strong government support, and strict regulatory guidelines are key factors driving the segment growth.

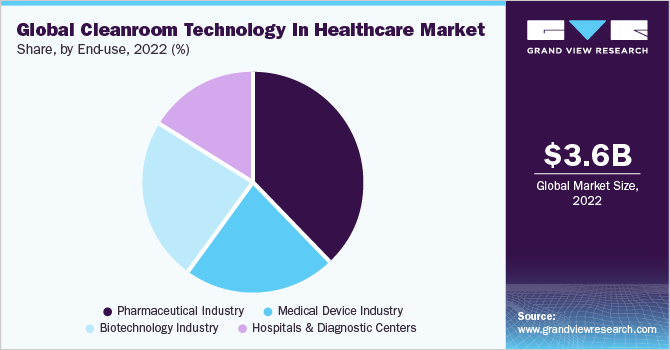

End Use Insights

Based on the end use, the market is segmented into the pharmaceutical industry, medical device industry, biotechnology industry, and hospitals and diagnostic centers. The pharmaceutical industry captured the highest market share of 38.4% in 2022. Proper regulations regarding the approvals of pharmaceutical products have led to an increase in demand for cleanroom technology. Proper design, installation, operation, and maintenance of the cleanroom is essential to ensure that the manufacturing process produces safe and effective pharmaceutical products. Cleanroom technology equipment installation, such as air showers, air diffusers, and HVAC confirms the highest product quality with less wastage, maximized yield, and optimized production process.

Cleanroom technology is extremely critical in biotechnology as it includes sensitive processes, such as R&D, biocontamination control, pilot studies, and production. It is extremely essential for the involved personnel to adhere to cleanroom protocols and use consumables & apparel. The installation of cleanroom equipment is based on regulatory standards that are designed as per the application. This, coupled with increasing research on biologics, is expected to boost segment growth over the forecast period.

Demand for hygiene and infection control is high in hospitals & diagnostic facilities. Hospital laboratories process biological samples, such as urine, serum, plasma, and tissue sections. It is important to keep these instruments contamination-free to execute accurate processing of a sample. In addition, the adoption of cleanrooms is growing in the U.S. hospitals to overcome increasing incidence of hospital-associated infections. These factors have contributed to the segment growth.

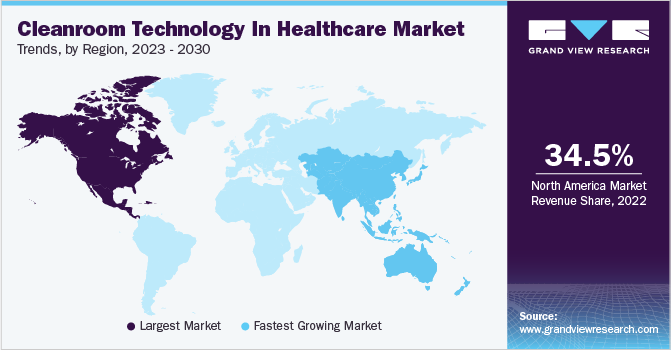

Regional Insights

North America dominated the market with a share of 34.5% in 2022. Major factors contributing to the growth of this region include developed healthcare infrastructure, presence of the local key medical device and pharmaceutical companies, and significant increase in awareness about nutraceuticals and cosmeceuticals. Moreover, stringent regulations regarding the authorization of healthcare products, such as those in the U.S., have resulted in significant demand for cleanroom technology.

Asia Pacific, on the other hand, is expected to grow at a significant CAGR over the forecast period. The cleanroom technology industry is driven by the increased regulatory issues regarding packaging, manufacturing, and distribution of quality goods. Technological advancements and product portfolio expansion by many of the key players are expected to boost the market in Asia Pacific.

Europe market is majorly driven by the expansion of the healthcare & pharmaceutical industries, an increase in the geriatric population, rise in the prevalence of chronic conditions, and high healthcare expenditure. Favorable government initiatives and rising disposable income in Europe are also among the factors responsible for the increase in demand for pharmaceuticals or nutraceuticals. Rise in awareness about pure & quality products and increase in access to cleanroom technology equipment & consumables are positively impacting the market growth.

Key Companies & Market Share Insights

The cleanroom technology in healthcare market is highly fragmented owing to the presence of several key players. New product launches, mergers, acquisitions, and R&D pertaining to advancements in cleanroom technology are some of the major strategies undertaken by key players to increase their market share. For instance, in May 2021, Labconco announced the launch of the Purifier Axiom Biosafety Cabinet. The cabinet is made of tools that support the needs for microbiological applications. Some of the prominent players in the global cleanroom technology in healthcare market include:

-

Clean Air Products

-

Kimberley-Clark Corporation

-

DuPont

-

Terra Universal, Inc.

-

Labconco

-

Clean Room Depot

-

ICLEAN Technologies

-

Abtech

-

ExyteGmbH

Cleanroom Technology In Healthcare Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 3.8 billion

The revenue forecast in 2030

USD 5.6 billion

Growth rate

CAGR of 5.58% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia and Kuwait

Key companies profiled

Clean Air Products; Kimberley-Clark Corporation; DuPont; Terra Universal Inc.; Labconco; Clean Room Depot; ICLEAN Technologies; Abtech; Exyte GmbH

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

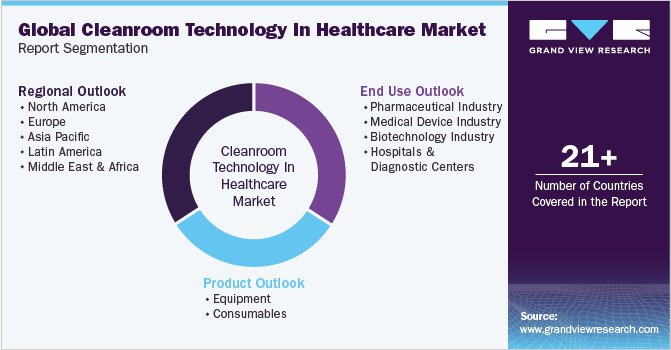

Global Cleanroom Technology In Healthcare Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cleanroom technology in healthcare market based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Heating Ventilation and Air Conditioning System (HVAC)

-

Cleanroom Air Filters

-

Air Shower And Diffuser

-

Laminar Air Flow Unit

-

Others

-

-

Consumables

-

Gloves

-

Wipes

-

Disinfectants

-

Apparels

-

Cleaning Products

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Industry

-

Medical Device Industry

-

Biotechnology Industry

-

Hospitals And Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cleanroom technology in healthcare market size was estimated at USD 3.6 billion in 2022 and is expected to reach USD 3.8 billion in 2023.

b. The global cleanroom technology in healthcare market is expected to grow at a compound annual growth rate of 5.58% from 2023 to 2030 to reach USD 5.6 billion by 2030.

b. North America dominated the market for cleanroom technology in healthcare and accounted for the largest revenue share of 34.5% in 2022. High R&D spending and high prevalence of HAIs are propelling the market in North America.

b. Some key players operating in the cleanroom technology in healthcare market include Clean Air Products; Kimberley-Clark Corporation; DuPont; Terra Universal Inc.; Labconco; Clean Room Depot; ICLEAN Technologies; Abtech; Exyte GmbH.

b. Key factors that are driving the cleanroom technology in healthcare market growth include the increasing need for a controlled environment in various end-use industries and stringent regulatory guidelines in terms of environmental conditions.

b. In 2022, the consumables segment dominated the market for cleanroom technology and accounted for the largest revenue share of 52.7%.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."