- Home

- »

- Medical Devices

- »

-

Clear Aligners Market Size, Share And Growth Report, 2030GVR Report cover

![Clear Aligners Market Size, Share & Trends Report]()

Clear Aligners Market Size, Share & Trends Analysis Report By Age (Adults, Teens), By Material, By End-use (Hospitals, Standalone Practices), By Distribution Channel, And Regional Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-960-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Clear Aligners Market Size & Trends

The global clear aligners market size was valued at USD 5.13 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 30.7% from 2024 to 2030. Clear aligners are a series of tight-fitting custom-made mouthpieces or orthodontic systems that are useful in correcting misaligned or crooked teeth. Clear aligners are virtually discreet and removable alternatives to braces designed around patients’ convenience and flexibility. Factors such as the growing patient population suffering from malocclusions, rising technological advancements in dental treatment, and growing demand for customized clear aligners are driving the overall market growth. The pandemic had a positive impact on the market globally and key players recovered with high revenues in 2020 as compared to previous years. For instance, according to Dental Tribune, Align Technology sold a record 1.6 million cases of clear aligners in 2020 as compared to 1.5 million cases in 2019.

The company also stated that the adoption of Invisalign aligners by adults and teenagers increased by 36.7% and 38.7%, respectively in 2020 and the adoption of aligners among teens or younger patients was highest during the pandemic. The major factor for the growth of this marker was that people were more reluctant to go to an orthodontist’s office to get traditional teeth braces which increased the adoption of clear aligners. The advent of pandemics helped the industry prosper in terms of adoption, sales, and revenue, and this trend is expected to continue in the future.

In the advent of escalating dental disorders, advancements like 3D impression systems, additive fabrication, Nickel and Copper-Titanium Wires, digital scanning technology, CAD/CAM appliances, temporary anchorage devices, and incognito lingual braces, clear aligners are among the latest advancements that are making orthodontic treatments more efficient, predictable and effective. Dental treatments have become customized and technologies like a digital impression system like iTero by Align Technology is assisting in developing accurate and customized clear aligners systems to treat mild to moderate misalignment conditions.

These invisible aligners are developed through virtual digital models, computer-aided design (CAD-CAM), and thermoformed plastic materials like copolyester or polycarbonate plastic. Inconvenience caused by the metal and ceramic braces and the long-term gum sensitivity has caused an increased adoption of clear aligners by patients and dentists. The aligner is designed for the wearer’s comfort and is flexible. According to Dental Tribune, clear aligners technology has quickly become an increasingly popular alternative to fixed appliances for tooth straightening, since it is an aesthetically appealing and comfortable choice. Invisalign is the largest producer of clear aligners, and other brands include Clear Correct, Inman Aligner, and Smart Moves. However, factors like the high cost of clear aligners, less number of dentists in emerging areas, and limited insurance coverage for orthodontic treatments are likely to hinder the market growth.

The advent of COVID-19 was eminent on the dental market as the majority of elective procedures were postponed. As dentistry is considered an elective and high-contact service, most of the dental practices were closed. However, In the U.S., 27 states allowed dental offices to open for elective care by May 2020, and by June around 48 states opened for elective dental care. The American Dental Association predicted spending projections to be more optimistic in the future due to resuming of dental practices and recovering patient volume. The ADA also predicted that dental expenditures will grow and bounce back completely to pre-pandemic levels or 80% of pre-pandemic volume by October 2020 or January 2021.

Market Concentration & Characteristics

The clear aligners market is currently in a high-growth stage with a rapidly accelerating pace of expansion. This dynamic market is marked by a notable level of innovation, largely propelled by swift technological advancements. Key factors driving this innovation include the widespread adoption of digital technologies, continuous developments in 3D printing, and an increasing demand for orthodontic solutions that blend comfort and aesthetic appeal. The surge in market growth can also be attributed to a growing awareness of dental aesthetics and a shift toward minimally invasive orthodontic treatments.

The industry is also characterized by a high level of merger and acquisition (M&A) activity undertaken by the leading players. This is due to several factors, the rising focus on increasing the company’s products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of aesthetic treatments. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in October 2022, Align Technology introduced the iTERO Exocad connector for enabling doctors with advanced visualization in the field of digital orthodontics that includes the treatment of clean aligner.

The competitive landscape of the clear aligners industry is vibrant, with companies actively differentiating themselves through ongoing research and development efforts. This includes advancements in material properties, aligner design, and treatment planning algorithms. Collaborations, partnerships, and strategic alliances between orthodontic companies and technology providers are becoming more prevalent, indicating the industry's commitment to sustained innovation.

Age Insights

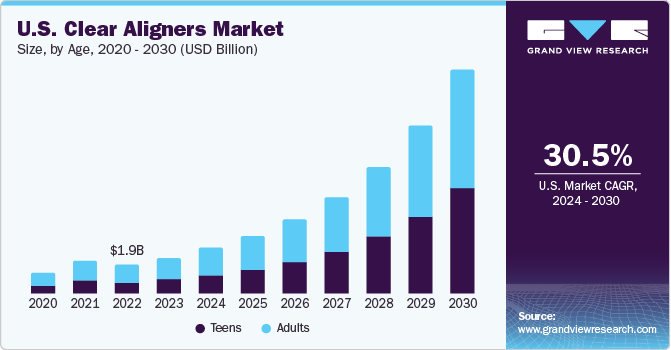

The adults segment held the largest share of 60.2% in 2023 and is expected to grow at a significant CAGR over the forecast period. Dental conditions like malocclusion are widely prevalent amongst the population and apart from affecting the quality of life, it can also lead to problems such as impaired dentofacial aesthetics, disturbances of oral function, such as mastication, swallowing, and speech, and greater susceptibility to trauma and periodontal disease. Nowadays, acceptable aesthetic appearance including dental appearance plays a vital role in society. An increasing concern for dental appearance is seen more among the adolescent population. Aligner therapy is one of the fastest-growing areas in orthodontics, driven significantly by patients who regard it as a more comfortable, convenient, and discreet alternative to fixed appliances.

The teens segment is expected to reciprocate high growth over the forecast period. The FDA approved, Invisalign clear aligners developed by Align Technology, have been used in the treatment of 5 million people as of 2018 and worldwide Invisalign shipments to teenagers were about 87.1 thousand cases as of 2018. As per NCBI, the prevalence of Class I and Class II malocclusions are highest among the population, and the adoption of clear aligners that is effective in treating these conditions has gradually increased. This is because many teenagers prefer avoiding discomfort caused by the metal braces and also look aesthetically appealing. For these reasons, teenagers are highly opting for clear aligners to get treated for their dental conditions. To date, over 1 million teenagers have started orthodontic treatment with Invisalign clear aligners.

Material Type Insights

The polyurethane segment held the largest share of 76.5% in 2023 owing to the presence of invisalign clear aligners that are made of polyurethane material type. When employed as a component of an aligner, polyurethane offers a number of advantages. It can be used for both hard and soft parts because of its wide range of characteristics. This substance can be used to make products that are so powerful that teeth can be pushed into alignment. While still being soft enough to be worn for extended durations.

For aligners to work, it’s essential that patients keep them in and don’t remove them. These aligners also won’t get damaged from common processes such as grinding and biting. Furthermore, polyurethane (PU) PU foils are considered to offer more benefits than PETG when used for aligners production.

End-use Insights

The standalone practitioners segment held the highest share of 52.8% in 2023 and is also reciprocating significant CAGR over the forecast period. As standalone practitioners are readily adopting clear aligners systems and are equipped with advanced digital technologies.

According to Today's RDH, a digital media company for Registered Dental Professionals, there are many benefits of choosing a private/standalone dental services and some of the benefits include a wider range of dental treatments, shorter wait times, specialist and quality service as well as high adoption of latest equipment and quality materials for both diagnostics and treatment.

The dentistry news reported that almost half (46%) of NHS dentists are planning to move to private dentistry. In 2019, Dentistry Confidence Monitor surveyed more than 400 dentists working in NHS and in private settings and reported that 84% of private dentists were happy as they can provide the level of care they want, compared to 17% of NHS dentists. Moreover, 79% of private dentists said they could carry out their work without feeling overly stressed, compared to 8% of NHS dentists. Factors like flexibility, lesser administrative work, patient-centric customized service, and control over the practice is expected to boost the demand for standalone dental practices.

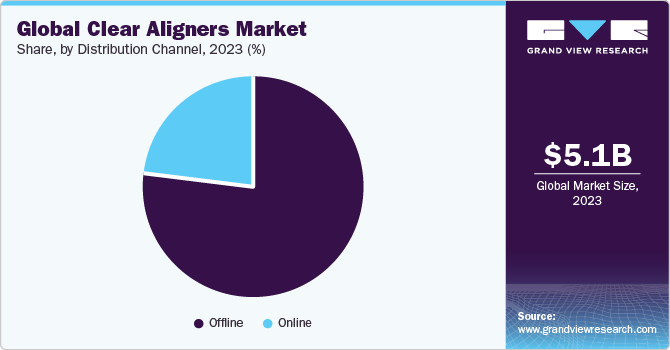

Distribution Channel Insights

The offline segment held the highest share of 74.6% in 2023, since, Align Technology is the most dominant player in the global market, and the company carries out its sales operations solely through offline channels. Invisalign can offer discounts as high as 35%, encouraging dentists and orthodontists to actively sell as many teeth-straightening aligners as possible, which increases their per-patient profits.

However, due to the rise in the number of Direct-to-Consumer (DTC), clear aligner companies globally have resulted in high adoption of the online sales channel. SmileDirectClub, a D2C brand that operates through online channels, reported, based on one of its internal research in 2021, that its product and customer experience are competitive with Invisalign, and its products are 60% less expensive. Business-to-customer sale is the current trend in the market; however, the new trend that is gaining momentum is DTC sales. This is when the company directly sells its products to patients without a dental professional being involved. Clear aligners have become a more popular choice among consumers and expand access to treatment.

Regional Insights

North America dominated the market capturing 57.01% share in 2023 and is expected to showcase a significant CAGR in the forecast period. This is attributed to increasing R&D investments and the local presence of global players & their efforts to obtain new patents. A survey conducted by the American Dental Association stated that 85% of individuals in the U.S. truly value dental health and consider oral health an essential aspect of overall care. There are four million people in the U.S. wearing braces out of which 25% are adults and the advent of clear tray-style aligners has attracted the attention of many patients wanting to improve their smile but would prefer to avoid the metal-mouth look of braces. Factors like increasing awareness regarding the recent development in dental hygiene, various convenient options available for treating teeth misalignment, and a surge in beauty standards have propelled people to opt for aligners, in turn, increasing the U.S. clear aligners market growth.

APAC region is expected to witness the highest CAGR over the forecast period due to increasing demand for clear aligners in developing economies, namely India and China. The surge is also due to the aesthetic appeal of the aligner systems. Moreover, dental tourism in India is flourishing, and according to Indian Dental Association (IDA) estimates, dental tourism constitutes more cost-effectiveness for foreign patients, shorter patient waiting time, a large pool of experienced practitioners, availability of quality accommodations, and visa-on-arrival at 14% of the total medical tourism industry. Factors such as cost-effectiveness for foreign patients, shorter patient waiting times, a large pool of experienced practitioners, availability of quality accommodations, and visa-on-arrival facilities make India a go-to destination for dental treatments. According to Journal of Dental Health, Oral Disorders & Therapy, the prevalence of Class I malocclusion is high in India, followed by Class II malocclusion. A large patient pool, the presence of skilled professionals, and high aesthetic awareness are expected to boost the clear aligners market.

Europe is the second largest contributor to clear aligners market. Key countries in the European region are Germany, the UK, Spain, France, Italy, and others. The growing importance of aesthetics and improved self-confidence post-treatment are factors boosting the market growth. Companies such as Dentsply Sirona have a long-established presence in the European market, especially in Germany, Sweden, France, and the UK. The region reports the highest net sales for the company in dental products, contributing around 40% to total sales. Countries in the European region are well-developed and provide modern technologies for aesthetic surgeries & patient care.

Key Companies and Market Share Insights

One of the key factors driving competitiveness among clear aligners companies is the rapid adoption of advanced digital technology like intraoral scans, digital tooth set-ups, 3D printers, and CAD/CAM appliances. Moreover, a prominent number of these players are rapidly opting for strategic expansions and collaborations for increasing their geographical presence, and increasing sales volume in emerging and economically favorable regions and product launches. For instance, in April 2023, Henry Schein Inc. entered into a partnership with Biotech Dental Group for making expansion in its digital workflow, provide clear aligner solutions to customers, and improve clinical results for dental professionals.

Key Clear Aligners Companies:

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

Recent Developments

-

In May 2023, SmileDirect Club declared the US launch of patented SmileMaker platform that will expand the technology for teeth straightening. This platform uses AI for capturing 3D scan of teeth, thus making it easier for consumers to undertake the clear aligner treatment.

-

In May 2022, Straumann Group acquired PlusDental for expanding its position in the field of consumer orthodontics, and providing clear aligner treatments to potential patients.

-

In December 2021, Henry Schein Inc. launched Studio Pro 4.0 which is a treatment planning software for clear aligners. This software allows dental practitioners to customize, visualize, and communicate plans for the treatment of clear aligner.

Clear Aligners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.49 billion

Revenue forecast in 2030

USD 32.35 billion

Growth Rate

CAGR 30.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age, material type, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Brazil; Mexico; Argentina; China; India; Japan; Australia; South Korea; Thailand; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Align Technology; Dentsply Sirona; Institute Straumann; Envista Corporation; 3M ESPE, Argen Corporation; Henry Schein Inc; TP Orthodontics Inc; SmileDirect Club; Angel Aligner

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clear Aligners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the clear aligners market report based on age, material type, end-use, distribution channel, and region:

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Teens

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Plastic Polyethylene Terephthalate Glycol

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Stand Alone Practices

-

Group Practices

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clear aligners market size was estimated at USD 4.1 billion in 2022 and is expected to reach USD 5.1 billion in 2023.

b. The global clear aligners market is expected to grow at a compound annual growth rate of 30.08% from 2023 to 2030 to reach USD 32.3 billion by 2030.

b. North America accounted for a leading 57.1% share of the clear aligners market in 2022. Increasing R&D investments, and the presence of global players operating from the region were some of the driving factors.

b. Some key players operating in the clear aligners market include Align Technology; Dentsply Sirona; Patterson Companies Inc.; Institute Straumann; Danaher Corporation; 3M EPSE; Argen Corporation; Henry Schein Inc.; TP Orthodontics Inc.

b. Key factors that are driving the clear aligners market growth include the increasing number of patients suffering from malocclusions, the advent of technologically advanced dental treatment procedures and devices, and the growing demand for personalized clear aligners.

Table of Contents

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.1.1 Age

1.1.2 Material Type

1.1.3 End-Use

1.1.4 Distribution Channel

1.1.5 Regional Scope

1.1.6 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Gvr’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.2 Volume Price Analysis (Model 2)

1.7 List Of Secondary Sources

1.8 List Of Primary Sources

1.9 List Of Abbreviations

1.10 Objectives

Chapter 2 Executive Summary

2.1 Market Outlook

Chapter 3 Clear Aligners Market: Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Related/Ancillary Market Outlook

3.1.2.1 Dental 3d Printing Market

3.1.2.2 Dental Implant Market

3.2 Market Segmentation And Scope

3.3 Market Driver Analysis

3.3.1 Rapidly Growing Patient Population With Malocclusion

3.3.2 Rapid Technological Advancements In Dental Health

3.3.3 Growing Demand For Customized Aligners

3.4 Market Restraint Analysis

3.4.1 High Cost Of Clear Aligners

3.5 Porter’s Five Forces Analysis

3.6 PESTEL Analysis

Chapter 4 Impact of COVID-19

4.1 Impact Of COVID-19 Dental Industry

4.2 Impact of COVID-19 on Clear Aligners

4.3 After effects of COVID-19 Pandemic on Clear Aligners Market

4.4 Gap Analysis

4.5 Analysis on Distribution channel (Online Vs Direct Sales)

4.5.1 ALIGN TECHNOLOGY, INC.

4.5.2 ENVISTA HOLDINGS CORPORATION

4.5.3 HENRY SCHEIN, INC.

4.5.4 ARGEN CORPORATION

4.5.5 TP ORTHODONTICS, INC.

4.5.6 3M

4.5.7 STRAUMANN

4.5.8 DENTSPLY SIRONA

4.5.9 SMILEDIRECT CLUB

4.5.10 ANGEL ALIGNER

4.6 Sales Analysis

Chapter 5 Clear Aligners Market: Age Segment Analysis

5.1 Clear Aligners: Market Share Analysis, 2023 & 2030

5.2 Adults

5.2.1 Adults Market, 2018 - 2030 (USD Million)

5.3 Teens

5.3.1.1 Teens Market, 2018 - 2030 (USD Million)

Chapter 6 Clear Aligners Market: Material Type Segment Analysis

6.1 Clear Aligners: Market Share Analysis, 2023 & 2030

6.2 Polyurethane

6.2.1 Polyurethane Market, 2018 - 2030 (USD Million)

6.3 Plastic Polyethylene Terephthalate Glycol

6.3.1 Plastic Polyethylene Terephthalate Glycol Market , 2018 - 2030 (USD Million)

6.4 Others

6.4.1 Others Market, 2018 - 2030 (USD Million)

Chapter 7 Clear Aligners Market: End Use Segment Analysis

7.1 Clear Aligners: Market Share Analysis, 2023 & 2030

7.2 Hospitals

7.2.1 Hospitals Market, 2018 - 2030 (USD Million)

7.3 Stand Alone Practices

7.3.1 Stand Alone Practices Market, 2018 - 2030 (USD Million)

7.4 Group Practices

7.4.1 Group Practices Market, 2018 - 2030 (USD Million)

7.5 Others

7.5.1 Others Market, 2018 - 2030 (USD Million)

Chapter 8 Clear Aligners Market: Distribution Channel Segment Analysis

8.1 Clear Aligners: Market Share Analysis, 2023 & 2030

8.2 Online

8.2.1 Online Market, 2018 - 2030 (USD Million)

8.3 Offline

8.3.1 Offline Market, 2018 - 2030 (USD Million)

Chapter 8 Clear Aligners Market: Regional Analysis

8.1 Clear Aligners: Market Share Analysis, 2023 & 2030

8.2 North America

8.2.1 North America Clear Aligners Market, 2018 - 2030 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.1 Competitive Scenario

8.2.2.1 Regulatory Framework

8.2.2.1 U.S. Clear Aligners Market, 2018 - 2030 (USD Million)

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.1 Competitive Scenario

8.2.3.1 Regulatory Framework

8.2.3.1 Canada Clear Aligners Market, 2018 - 2030 (USD Million)

8.3 Europe

8.3.1 Europe Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.2 U.K.

8.3.2.1 Key Country Dynamics

8.3.2.1 Competitive Scenario

8.3.2.1 Regulatory Framework

8.3.2.1 U.K. Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.1 Competitive Scenario

8.3.3.1regulatory Framework

8.3.3.1 Germany Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.1 Competitive Scenario

8.3.4.1 Regulatory Framework

8.3.4.1 France Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.1 Competitive Scenario

8.3.5.1 Regulatory Framework

8.3.5.1 Italy Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.1 Competitive Scenario

8.3.6.1 Regulatory Framework

8.3.6.1 Spain Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.7 Norway

8.3.7.1 Key Country Dynamics

8.3.7.1 Competitive Scenario

8.3.7.1 Regulatory Framework

8.3.7.1 Norway Clear Aligners Market, 2018 - 2030 (USD Million)

8.3.8 Denmark

8.3.8.1 Key Country Dynamics

8.3.8.1 Competitive Scenario

8.3.8.1 Regulatory Framework

8.3.8.1 Denmark Aligners Market, 2018 - 2030 (USD Million)

8.3.9 Sweden

8.3.9.1 Key Country Dynamics

8.3.9.1 Competitive Scenario

8.3.9.1 Regulatory Framework

8.3.9.1 Sweden Clear Aligners Market, 2018 - 2030 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.2 Japan

8.4.2.1key Country Dynamics

8.4.2.1 Competitive Scenario

8.4.2.1regulatory Framework

8.4.2.1 Japan Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.1 Competitive Scenario

8.4.3.1regulatory Framework

8.4.3.1 China Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.4 India

8.4.4.1 Key Country Dynamics

8.4.4.1 Competitive Scenario

8.4.4.1regulatory Framework

8.4.4.1 India Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.5 Australia

8.4.5.1 Key Country Dynamics

8.4.5.1 Competitive Scenario

8.4.5.1regulatory Framework

8.4.5.1 Australia Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.6 South Korea

8.4.6.1 Key Country Dynamics

8.4.6.1competitive Scenario

8.4.6.1 Regulatory Framework

8.4.6.1 South Korea Clear Aligners Market, 2018 - 2030 (USD Million)

8.4.7 Thailand

8.4.7.1key Country Dynamics

8.4.7.1 Competitive Scenario

8.4.7.1regulatory Framework

8.4.7.1 Thailand Clear Aligners Market, 2018 - 2030 (USD Million)

8.5 Latin America

8.5.1 Latin America Clear Aligners Market, 2018 - 2030 (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.1 Competitive Scenario

8.5.2.1regulatory Framework

8.5.2.1 Brazil Clear Aligners Market, 2018 - 2030 (USD Million)

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.1 Competitive Scenario

8.5.3.1 Regulatory Framework

8.5.3.1 Mexico Clear Aligners Market, 2018 - 2030 (USD Million)

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.1 Competitive Scenario

8.5.4.1regulatory Framework

8.5.4.1 Argentina Clear Aligners Market, 2018 - 2030 (USD Million)

8.6 Mea

8.6.1 MEA Clear Aligners Market, 2018 - 2030 (USD Million)

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.1 Competitive Scenario

8.6.2.1regulatory Framework

8.6.2.1 South Africa Clear Aligners Market, 2018 - 2030 (USD Million)

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.1 Competitive Scenario

8.6.3.1 Regulatory Framework

8.6.3.1 Saudi Arabia Clear Aligners Market, 2018 - 2030 (USD Million)

8.6.4 UAE

8.6.4.1 Key Country Dynamics

8.6.4.1 Competitive Scenario

8.6.4.1regulatory Framework

8.6.4.1 Uae Clear Aligners Market, 2018 - 2030 (USD Million)

8.6.5 Kuwait

8.6.5.1 Key Country Dynamics

8.6.5.1 Competitive Scenario

8.6.5.1 Regulatory Framework

8.6.5.1 Kuwait Clear Aligners market, 2018 - 2030 (USD Million)

Chapter 9 Competitive Analysis

9.1 Company Profiles

8.1.1 ALIGN TECHNOLOGY, INC.

9.1.1.1 Company Overview

9.1.1.2 Financial Performance

9.1.1.3 Product Benchmarking

9.1.1.4 Strategic Initiatives

9.1.2 ENVISTA HOLDING CORPORATION

9.1.2.1 Company Overview

9.1.2.2 Financial Performance

9.1.2.3 Product Benchmarking

9.1.2.4 Strategic Initiatives

9.1.3 INSTITUT STRAUMANN AG

9.1.3.1 Company Overview

9.1.3.2 Financial Performance

9.1.3.3 Product Benchmarking

9.1.3.4 Strategic Initiatives

9.1.4 DENTSPLY SIRONA

9.1.4.1 Company Overview

9.1.4.2 Financial Performance

9.1.4.3 Product Benchmarking

9.1.4.4 Strategic Initiatives:

9.1.5 3M

9.1.5.1 Company Overview

9.1.5.2 Financial Performance

9.1.5.3 Product Benchmarking

9.1.5.4 Strategic Initiatives

9.1.6 ARGEN CORPORATION

9.1.6.1 Company Overview

9.1.6.2 Financial Performance

9.1.6.3 Product Benchmarking

9.1.6.4 Strategic Initiatives

9.1.7 HENRY SCHEIN, INC.

9.1.7.1 Company Overview

9.1.7.2 Financial Performance

9.1.7.3 Product Benchmarking

9.1.7.4 Strategic Initiatives

9.1.8 TP ORTHODONTICS, INC.

9.1.8.1 Company Overview

9.1.8.2 Financial Performance

9.1.8.3 Product Benchmarking

9.1.8.4 Strategic Initiatives

9.1.9 ANGEL ALIGNER

9.1.9.1 Company Overview

9.1.9.2 Financial Performance

9.1.9.3 Product Benchmarking

9.1.9.4 Strategic Initiatives

9.1.10 SMILEDIRECT CLUB

9.1.10.1 Company Overview

9.1.10.2 Financial Performance

9.1.10.3 Product Benchmarking

9.1.10.4 Strategic Initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 List of secondary sources

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Commodity flow analysis

Fig. 8 Volume Price Analysis

Fig. 9 Clear aligners market snapshot (2023)

Fig. 10 Clear aligners market segmentation

Fig. 11 Market driver relevance analysis (Current & future impact)

Fig. 12 Market restraint relevance analysis (Current & future impact)

Fig. 13 Penetration & growth prospect mapping

Fig. 14 Porter’s five forces analysis

Fig. 15 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 16 Clear aligners market age outlook: Segment dashboard

Fig. 17 Clear aligners market: Age movement analysis

Fig. 18 Adults market, 2018 - 2030 (USD Million)

Fig. 19 Teens market, 2018 - 2030 (USD Million)

Fig. 20 Clear aligners market material type outlook: Segment dashboard

Fig. 21 Clear aligners market: Material type movement analysis

Fig. 22 Polyurethane market, 2018 - 2030 (USD Million)

Fig. 23 Plastic polyethylene terephthalate glycol market, 2018 - 2030 (USD Million)

Fig. 24 Others market, 2018 - 2030 (USD Million)

Fig. 25 Clear aligners market end-use outlook: Segment dashboard

Fig. 26 Clear aligners market: End-use movement analysis

Fig. 27 Hospitals market, 2018 - 2030 (USD Million)

Fig. 28 Standalone Practitioners market, 2018 - 2030 (USD Million)

Fig. 29 Group Practitioners market, 2018 - 2030 (USD Million)

Fig. 30 Others market, 2018 - 2030 (USD Million)

Fig. 31 Clear aligners market distribution channel outlook: Segment dashboard

Fig. 32 Clear aligners market: Distribution channel movement analysis

Fig. 33 Online market, 2018 - 2030 (USD Million)

Fig. 34 Offline market, 2018 - 2030 (USD Million)

Fig. 35 Regional market: Key takeaways

Fig. 36 Regional outlook, 2023 & 2030

Fig. 37 North America market, 2018 - 2030 (USD Million)

Fig. 38 U.S. market, 2018 - 2030 (USD Million)

Fig. 39 Canada market, 2018 - 2030 (USD Million)

Fig. 40 Europe market, 2018 - 2030 (USD Million)

Fig. 41 U.K. market, 2018 - 2030 (USD Million)

Fig. 42 Germany market, 2018 - 2030 (USD Million)

Fig. 43 France market, 2018 - 2030 (USD Million)

Fig. 44 Italy market, 2018 - 2030 (USD Million)

Fig. 45 Spain market, 2018 - 2030 (USD Million)

Fig. 46 Norway market, 2018 - 2030 (USD Million)

Fig. 47 Denmark market, 2018 - 2030 (USD Million)

Fig. 48 Sweden market, 2018 - 2030 (USD Million)

Fig. 49 Asia Pacific market, 2018 - 2030 (USD Million)

Fig. 50 China market, 2018 - 2030 (USD Million)

Fig. 51 India market, 2018 - 2030 (USD Million)

Fig. 52 Japan market, 2018 - 2030 (USD Million)

Fig. 53 Australia market, 2018 - 2030 (USD Million)

Fig. 54 South Korea market, 2018 - 2030 (USD Million)

Fig. 55 Thailand market, 2018 - 2030 (USD Million)

Fig. 56 Latin America market, 2018 - 2030 (USD Million)

Fig. 57 Brazil market, 2018 - 2030 (USD Million)

Fig. 58 Mexico market, 2018 - 2030 (USD Million)

Fig. 59 Argentina market, 2018 - 2030 (USD Million)

Fig. 60 MEA market, 2018 - 2030 (USD Million)

Fig. 61 South Africa market, 2018 - 2030 (USD Million)

Fig. 62 Saudi Arabia market, 2018 - 2030 (USD Million)

Fig. 63 UAE market, 2018 - 2030 (USD Million)

Fig. 64 Kuwait market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Clear Aligners Age Outlook (Revenue, USD Million, 2018 - 2030)

- Adults

- Teens

- Clear Aligners Material Type Outlook (Revenue, USD Million, 2018 - 2030)

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Clear Aligners End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Clear Aligners Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

- Clear Aligners Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Clear Aligners Market, by Age

- Adults

- Teens

- North America Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- North America Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- North America Clear Aligners Market, by Distribution Channel

- Online

- Offline

- U.S.

- U.S. Clear Aligners Market, by Age

- Adults

- Teens

- U.S. Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- U.S. Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- U.S. Clear Aligners Market, by Distribution Channel

- Online

- Offline

- U.S. Clear Aligners Market, by Age

- Canada

- Canada Clear Aligners Market, by Age

- Adults

- Teens

- Canada Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Canada Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Canada Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Canada Clear Aligners Market, by Age

- North America Clear Aligners Market, by Age

- Europe

- Europe Clear Aligners Market, by Age

- Adults

- Teens

- Europe Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Europe Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Europe Clear Aligners Market, by Distribution Channel

- Online

- Offline

- U.K.

- U.K. Clear Aligners Market, by Age

- Adults

- Teens

- U.K. Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- U.K. Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- U.K. Clear Aligners Market, by Distribution Channel

- Online

- Offline

- U.K. Clear Aligners Market, by Age

- Germany

- Germany Clear Aligners Market, by Age

- Adults

- Teens

- Germany Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Germany Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Germany Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Germany Clear Aligners Market, by Age

- France

- France Clear Aligners Market, by Age

- Adults

- Teens

- France Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- France Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- France Clear Aligners Market, by Distribution Channel

- Online

- Offline

- France Clear Aligners Market, by Age

- Italy

- Italy Clear Aligners Market, by Age

- Adults

- Teens

- Italy Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Italy Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Italy Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Italy Clear Aligners Market, by Age

- Spain

- Spain Clear Aligners Market, by Age

- Adults

- Teens

- Spain Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Spain Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Spain Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Spain Clear Aligners Market, by Age

- Norway

- Norway Clear Aligners Market, by Age

- Adults

- Teens

- Norway Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Norway Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Norway Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Norway Clear Aligners Market, by Age

- Denmark

- Denmark Clear Aligners Market, by Age

- Adults

- Teens

- Denmark Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Denmark Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Denmark Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Denmark Clear Aligners Market, by Age

- Sweden

- Sweden Clear Aligners Market, by Age

- Adults

- Teens

- Sweden Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Sweden Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Sweden Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Sweden Clear Aligners Market, by Age

- Europe Clear Aligners Market, by Age

- Asia Pacific

- Asia Pacific Clear Aligners Market, by Age

- Adults

- Teens

- Asia Pacific Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Asia Pacific Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Asia Pacific Clear Aligners Market, by Distribution Channel

- Online

- Offline

- India

- India Clear Aligners Market, by Age

- Adults

- Teens

- India Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- India Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- India Clear Aligners Market, by Distribution Channel

- Online

- Offline

- India Clear Aligners Market, by Age

- Japan

- Japan Clear Aligners Market, by Age

- Adults

- Teens

- Japan Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Japan Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Japan Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Japan Clear Aligners Market, by Age

- China

- China Clear Aligners Market, by Age

- Adults

- Teens

- China Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- China Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- China Clear Aligners Market, by Distribution Channel

- Online

- Offline

- China Clear Aligners Market, by Age

- Australia

- Australia Clear Aligners Market, by Age

- Adults

- Teens

- Australia Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Australia Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Australia Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Australia Clear Aligners Market, by Age

- South Korea

- South Korea Clear Aligners Market, by Age

- Adults

- Teens

- South Korea Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- South Korea Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- South Korea Clear Aligners Market, by Distribution Channel

- Online

- Offline

- South Korea Clear Aligners Market, by Age

- Thailand

- Thailand Clear Aligners Market, by Age

- Adults

- Teens

- Thailand Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Thailand Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Thailand Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Thailand Clear Aligners Market, by Age

- Asia Pacific Clear Aligners Market, by Age

- Latin America

- Latin America Clear Aligners Market, by Age

- Adults

- Teens

- Latin America Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Latin America Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Latin America Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Brazil

- Brazil Clear Aligners Market, by Age

- Adults

- Teens

- Brazil Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Brazil Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Brazil Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Brazil Clear Aligners Market, by Age

- Mexico

- Mexico Clear Aligners Market, by Age

- Adults

- Teens

- Mexico Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Mexico Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Mexico Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Mexico Clear Aligners Market, by Age

- Argentina

- Argentina Clear Aligners Market, by Age

- Adults

- Teens

- Argentina Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Argentina Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Argentina Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Argentina Clear Aligners Market, by Age

- Latin America Clear Aligners Market, by Age

- Middle East & Africa

- Middle East & Africa Clear Aligners Market, by Age

- Adults

- Teens

- Middle East & Africa Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Middle East & Africa Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Middle East & Africa Clear Aligners Market, by Distribution Channel

- Online

- Offline

- South Africa

- South Africa Clear Aligners Market, by Age

- Adults

- Teens

- South Africa Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- South Africa Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- South Africa Clear Aligners Market, by Distribution Channel

- Online

- Offline

- South Africa Clear Aligners Market, by Age

- Saudi Arabia

- Saudi Arabia Clear Aligners Market, by Age

- Adults

- Teens

- Saudi Arabia Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Saudi Arabia Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Saudi Arabia Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Saudi Arabia Clear Aligners Market, by Age

- UAE

- UAE Clear Aligners Market, by Age

- Adults

- Teens

- UAE Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- UAE Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- UAE Clear Aligners Market, by Distribution Channel

- Online

- Offline

- UAE Clear Aligners Market, by Age

- Kuwait

- Kuwait Clear Aligners Market, by Age

- Adults

- Teens

- Kuwait Clear Aligners Market, by Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

- Kuwait Clear Aligners Market, by End Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

- Kuwait Clear Aligners Market, by Distribution Channel

- Online

- Offline

- Kuwait Clear Aligners Market, by Age

- Middle East & Africa Clear Aligners Market, by Age

- North America

Clear Aligners Market Dynamics

Driver: Rapidly Growing Patient Population with Malocclusion

According to WHO, malocclusion is the third most prevalent dental disease globally, after dental caries and periodontal disease. Currently, the distribution and severity of oral diseases, such as malocclusions, vary in different parts of the world and within the same country or region. Malocclusion of the teeth causes misalignment that may later lead to severe oral health problems. This condition is hereditary, which means that it can be passed down from one generation to another and often causes tooth overcrowding and abnormal bite patterns. Malocclusions are divided into Class I, Class II, and Class III. Class I malocclusions are the most common, wherein the upper teeth slightly overlap the lower teeth, however, the bite is normal. Class II malocclusions, also known as retrognathism, is a condition wherein the upper jaw severely overlaps the lower jaw, causing an overbite. In addition to its effect on appearance, overbite can also lead to hard and soft tissue trauma in the long run.

Driver: Rapid Technological Advancements in Dental Health

The prevalence of oral diseases & disorders is increasing. Thus, the need for advancements in orthodontics is also increasing. Digital computer imaging and 3D technology to create an accurate fit are being increasingly used in orthodontic practices. 3D impression scanners, Nickel and Copper-Titanium Wires, digital scanning technology additive fabrication, CAD/CAM appliances, incognito lingual braces, temporary anchorage devices, and clear aligners are among the latest advancements leading to the delivery of more efficient, customized, predictable, and effective orthodontic treatments. According to Pennsylvania Dental Association, approximately 4 million people in the U.S. are wearing braces, out of which 25% of people are adults. According to the American Journal of Orthodontics and Dentofacial Orthopedics, dental treatments nowadays are inclining toward digital workflow equipped with systems such as intraoral scanners, digital tooth set-ups, 3-D printers, and CAD/CAM systems. These advancements assist in reducing treatment/chair time, offer patient-centric customized treatment, and enhance patient experience with improved outcomes.

Restraint: High Cost of Clear Aligners

A major disadvantage of clear aligner systems is their high cost. According to Healthline, the average cost of aligners such as Invisalign is anywhere from USD 3,000 to USD 8,000, exceeding the cost of metallic and ceramic braces. Clear aligners are not covered under insurance and the expense is therefore out of the patient’s pocket. Treatment time may be longer than with braces, and the cost-typically-can exceed the average USD 5,000 price of braces. Moreover, clear aligners are effective in treating mild or moderate bite issues, not more complex orthodontic issues. Clear aligners are not effective for achieving significant tooth movement, and they often take much longer to work compared to regular braces. However, some patents owned by Align Technology for clear aligners expired in 2018, which can prove to be an opportunity for competitor companies to manufacture more clear aligners and bring down the prices of these systems.

What Does This Report Include?

This section will provide insights into the contents included in this clear aligners market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Clear aligners market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Clear aligners market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the clear aligners market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for clear aligners market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of clear aligners market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Clear Aligners Market Categorization:

The clear aligners market was categorized into seven segments, namely age (Adults, Teens), material type (Polyurethane, Plastic Polyethylene Terephthalate Glycol), end-use (Hospitals, Stand Alone Practices, Group Practices), dentist type (General Dentists, Orthodontists), duration (Comprehensive malfunction, Medium treatments, Small little beauty Alignments), distribution channel (Online, Offline), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The clear aligners market was segmented into age, material type, end-use, dentist type, duration, distribution channel, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The clear aligners market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK.; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Brazil; Mexico; Argentina; China; India; Japan; Australia; South Korea; Thailand; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Clear aligners market companies & financials:

The clear aligners market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Angel Aligner, Angelalign Technology, Inc., also known as Angel Aligner, is a global service provider of clear aligner technology, production, and sales. The company is headquartered in China and has over 150 patents in processing, clear aligners, manufacturing, and 3D printing technology.

-

SmarTee, SmarTee provides digital invisible orthodontic solutions for global consumers. It is headquartered in Shanghai, China, with an overseas headquarters established in the UK in 2021.

-

Dentsply Sirona, Dentsply Sirona is a manufacturer and marketer of various oral & dental health products, along with other consumables for dental procedures. It specializes in preventive & restorative medicine, orthodontics, prosthetics, endodontics, implants, healthcare imaging instruments, and CAD/CAM. It operates in consumables, technologies, and equipment segments.

-

Institut Straumann AG, Institut Straumann AG is a provider of implant dentistry products. It operates its business through three segments: replacement, digital, and regenerative solutions. Furthermore, the company develops and manufactures prosthetics & dental implants essential for tooth replacement in collaboration with various leading dental clinics, research institutes, & universities.

-

SCHEU DENTAL GmbH, SCHEU DENTAL GmbH supplies dental practices and laboratories with advanced dental technologies, digital orthodontics, and dental sleep medicine. In 2020, SCHEU GROUP bundled SCHEU-DENTAL with two subsidiaries, CA DIGITAL, and Smile Dental, to combine their expertise in Germany.

-

Ormco Corporation (Envista), Ormco Corporation is a manufacturer of orthodontic products and solutions with a presence in over 140 countries. Its product portfolio includes twin brackets, aligners, archwires, digital dental software, lab products, and prevention products.

-

Henry Schein, Inc., Henry Schein, Inc. is a U.S. distributor of healthcare products and services. It offers solutions in the fields of business, clinical, technology, & supply chain management. Its product offerings include implants, orthodontic devices, and bone regeneration materials, as well as innovative practice management software & CAD/CAM equipment.

-

SmileDirectClub, SmileDirectClub is a direct-to-patient clear aligner company that operates multiple SmileShops and more than 1,000 SmileDirectClub Partner Network dental office locations. It works with a network of hundreds of affiliated, certified dentists & orthodontists, and thousands of team members across the globe.

-

Align Technology, Inc., Align Technology, Inc. is a medical device company with orthodontics, computer-aided designing & computer-aided manufacturing digital services; intra-oral scanners; and dental records storage as primary business segments.

-

Argen Corporation, Argen Corporation manufactures precious dental gold alloys. It is a leader in zirconia manufacturing and a leading innovator of digital dentistry solutions & scrap refining services. The company distributes its dental products and services to more than 100 countries with subsidiaries in Canada, China, Germany, and the UK.

-

TP Orthodontics, Inc., TP Orthodontics, Inc. is a provider of orthodontic services and products. The company specializes in esthetic braces, orthodontic supplies, custom orthodontic appliances, dental/orthodontics, orthodontic finishing appliances, clear aligner trays, orthodontic education, and medical device manufacturing.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Clear Aligners Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Clear Aligners Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."