- Home

- »

- Next Generation Technologies

- »

-

Cold Chain Equipment Market Size And Share Report, 2030GVR Report cover

![Cold Chain Equipment Market Size, Share & Trends Report]()

Cold Chain Equipment Market Size, Share & Trends Analysis Report By Equipment Type (Storage Equipment, Transportation Equipment), By Application (Fruits & Vegetables, Dairy Products), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-787-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Cold Chain Equipment Market Size & Trends

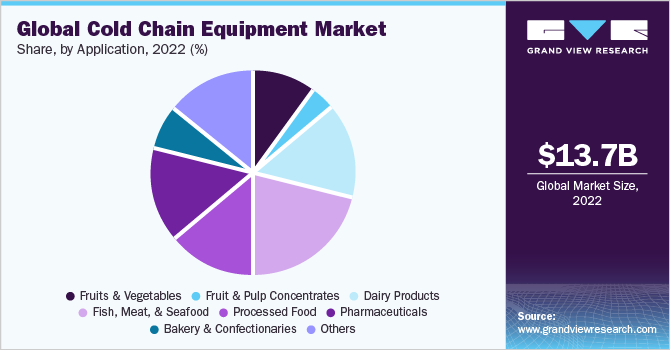

The global cold chain equipment market size was estimated at USD 13.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.3% from 2023 to 2030. It consists of a wide range of devices, including freezers, refrigerators, cold rooms, temperature sensors, data loggers, and monitoring systems. These devices are designed to maintain a constant temperature within a predetermined range and to offer real-time information regarding temperature variations, which is essential for making sure that items continue to be secure and efficient.Effective cold chain equipment is required to preserve the quality and safety of these perishable goods due to the rising demand for fresh produce, seafood, meat, and dairy products.Similar to the food and beverage industry, the pharmaceutical and healthcare industry relies significantly on cold chain equipment to store and ship temperature-sensitive medical supplies including vaccines and medications.

Companies are using IoT and cloud computing to monitor and manage temperature and humidity levels in real time, allowing them to swiftly address any issues. Data loggers and sensors are used in the pharmaceutical industry, among others, to track the temperature and humidity of goods as they are transported. Effective cold chain equipment is required due to the rising demand for perishable foods.

For instance, businesses in the seafood sector must make sure that fish and other seafood items are transported safely and in good condition. Companies are making investments in cutting-edge refrigeration and monitoring gear, including temperature sensors, data loggers, and monitoring systems, to meet this demand.

Also, there is a huge need for cold chain equipment due to the expansion of the pharmaceutical and healthcare sectors. For instance, the COVID-19 pandemic has increased the need for efficient vaccine distribution and storage, and businesses are investing in cutting-edge cold chain technology to guarantee the vaccines' continued safety and efficacy.

To address the demand for ultra-low temperature storage of the COVID-19 vaccine from Pfizer-BioNTech, businesses are investing in cutting-edge freezers and refrigeration equipment. The market for cold chain equipment is expanding as a result of the aforementioned issues, and businesses are spending money on cutting-edge machinery to fulfill the rising need for temperature-controlled storage and transportation.

COVID-19 Impact

The COVID-19 pandemic has had a significant effect on the market for cold chain equipment, with the increased need for temperature-controlled storage and transportation of vaccines and other essential medical supplies driving significant growth in the sector. The need for ultra-low temperature storage to store and transport the COVID-19 vaccine has been one of the main impacts of the pandemic on the market for cold chain equipment.

Advanced freezers and refrigeration equipment that can sustain these temperatures are in high demand because vaccines like those made by Pfizer-BioNTech must be stored at extremely low temperatures of -70°C. This increased demand for ultra-low temperature storage has created supply chain challenges as manufacturers have struggled to keep up with demand. Because makers have found it difficult to keep up with demand, the increased demand for ultra-low temperature storage has posed problems for the supply chain.

To transport the vaccine safely and effectively, companies have also had to reexamine their distribution networks, especially in regions with sparse infrastructure and storage capacity. The pandemic has raised the demand for ultra-low temperature storage, but it has also brought attention to the cold chain industry's need for sophisticated monitoring and tracking tools. It is crucial to keep an eye on the temperature and humidity levels of immunizations as they are shipped around the world to make sure they are still safe and effective.

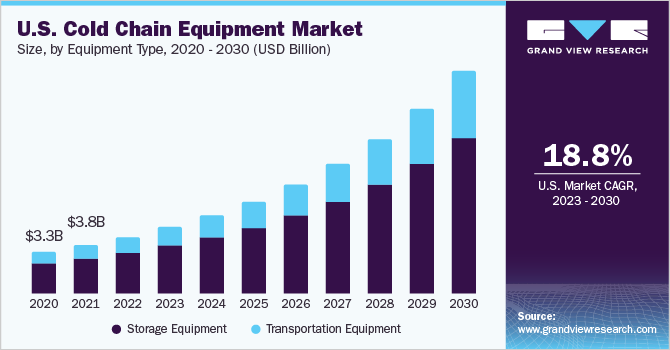

Equipment Type Insights

In terms of equipment type, the market is bifurcated into storage equipment and transportation equipment. The storage equipment segment dominated the overall market, gaining a revenue share of 74.9% in 2022 and witnessing a CAGR of 21.7% during the forecast period. The storage equipment is created to maintain a particular temperature range that is suitable for the product being stored.

For some goods, like vaccines, this temperature range can vary from below freezing to just above freezing, and above freezing for other products, like fruits and vegetables. Throughout the cold chain process, it is essential to keep the products' quality, safety, and efficacy, which calls for appropriate storage equipment and temperature control. The products could spoil, lose their efficacy, or even become dangerous to use or consume without the right storage equipment.

The transportation equipment segment is anticipated to grow at a faster CAGR of 23.9% throughout the forecast period. Depending on the method of transportation and the particular requirements of the product being carried out, different types of transportation equipment are used in the cold chain system. Refrigerated trucks, vans, and containers, as well as air cargo containers, and ships with refrigeration units, are a few instances of transportation tools used in the cold chain system.

To guarantee that the product maintains the required temperature throughout the entire journey, from loading to unloading, the transportation equipment must keep a specified temperature range. This is accomplished by utilizing specialized heating or cooling systems that can keep a constant temperature independent of the outside environment. To prevent product damage during transit, temperature control and transportation equipment are both essential. To protect against damage from factors like vibrations, shocks, and humidity fluctuations, the equipment must be built to provide adequate insulation, airflow, and humidity control.

Application Insights

In terms of application, the market is segmented intofish, meat, & seafood, fruits & vegetables, dairy products, processed food, fruit & pulp concentrates, bakery & confectionaries, pharmaceuticals, and others. Among these, the fish, meat, & seafood segment is expected to dominate in 2022, gaining a market share of 20.9%. The refrigerated storage of fish, meat, and seafood is crucial as harmful bacteria can grow on the meat when the animal is slaughtered.

Food, meat, and seafood are among the high-risk products in terms of food poisoning. Hence, refrigerated storage solutions are vital to maintaining their quality and shelf life. Bacteria can multiply rapidly in meat when stored between 5°C and 63°C. The optimal temperature to store fish, meat, and seafood products is between 0°C and 5°C.

The processed food segment is anticipated to witness the fastest CAGR of 25.3% throughout the forecast period. Processed foods are food items that have undergone various chemical or mechanical processes from their raw agricultural state, such as heating, cooking, canning, and dehydrating. They include ready-to-eat meals, frozen pizzas, and foods with added ingredients such as spices, oils, and sweeteners. According to the U.S. Department of Agriculture and Foreign Agricultural Service (FAS), the total U.S. processed food export was valued at USD 34.24 billion in 2021. Cold chain solutions help maintain the quality of processed foods and increase their shelf life.

Regional Insights

North America led the overall market in 2022, with a revenue share of 45.0%. The cold chain equipment market in North America is a mature and established industry that serves a wide range of sectors, including food, pharmaceuticals, and chemicals. Several prominent companies provide cold chain equipment solutions in the region. One example is Lineage Logistics, which is the world's largest temperature-controlled warehousing and logistics company.

Lineage Logistics operates over 300 facilities across North America and provides a wide range of services, including blast freezing, cross-docking, and import/export services. Another example is Carrier, which is a global leader in heating, air conditioning, and refrigeration solutions. Carrier offers a range of cold chain equipment solutions, including refrigerated transport vehicles, storage solutions, and refrigeration systems. In addition, Americold is a leading provider of temperature-controlled warehousing and logistics services, with a focus on sustainability and energy efficiency.

Asia Pacific market is anticipated to witness the fastest growth, growing at a CAGR of 26.0% throughout the forecast period. The cold chain equipment market in the Asia Pacific region is rapidly expanding due to the increasing demand for fresh and frozen food, pharmaceuticals, and other perishable products. The region is home to some of the world's largest population centers, and there is a growing awareness of the importance of maintaining product quality and safety during transport and storage.

Many companies in the Asia Pacific region provide cold chain equipment solutions. One example is Haier, a Chinese company that offers a range of refrigerators and freezers, including medical refrigerators and vaccine freezers. Another example is Daikin Industries, a Japanese company that provides air conditioning and refrigeration equipment, including refrigerated transport trucks and trailers. In addition, Nichirei Logistics, a Japanese company, specializes in temperature-controlled warehousing and transportation solutions for food and pharmaceutical products.

Key Companies & Market Share Insights

The competitive landscape of the cold chain equipment market is highly diverse, with many global and regional players competing for market share. The market is characterized by a high level of fragmentation, with numerous small and medium-sized companies offering specialized products and services. Some of the key players offer a wide range of cold chain equipment solutions, including refrigerated transport vehicles, cold storage facilities, refrigeration systems, and temperature monitoring devices.

In July 2020, LINEAGE LOGISTICS HOLDING, LLC announced the acquisition of Ontario Refrigerated Services, Inc., a family-operated company providing refrigerated storage services. The acquisition was aimed at marking the presence of Lineage Logistics, LLC in Canada. Some prominent players in the global cold chain equipment market include:

-

Thermo King

-

Carrier Transicold

-

Zanotti SpA

-

Viessmann

-

Schmitz Cargobull

-

Fermod

-

Intertecnica

-

ebm-papst Group

-

CAREL

-

Bitzer

-

Kelvion

-

Incold S.p.A.

-

Rivacold srl

-

Kason Industries, Inc.

-

CHG Europe BV

Cold Chain Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.45 billion

Revenue forecast in 2030

USD 67.26 billion

Growth Rate

CAGR of 22.3% from 2023 to 2030

Historical year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Poland; Sweden; Finland; Norway; Croatia; Greece; Turkey; India; Brazil

Key companies profiled

Thermo King; Carrier Transicold; Zanotti SpA; Viessmann; Schmitz Cargobull; Fermod; Intertecnica; ebm-papst Group; CAREL; Bitzer; Kelvion; Incold S.p.A.; Rivacold srl; Kason Industries, Inc.; CHG Europe BV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Equipment Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold chain equipment market report based on equipment type, application, and region:

-

Equipment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Storage Equipment

-

On-grid

-

Walk-in Coolers

-

Walk-in Freezers

-

Ice-lined Refrigerators

-

Deep Freezers

-

-

Off-grid

-

Solar Chillers

-

Milk Coolers

-

Solar Powered Cold Boxes

-

Others

-

-

Others

-

-

Transportation Equipment

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fruits & Vegetables

-

Fruit & Pulp Concentrates

-

Dairy Products

-

Fish, Meat, & Seafood

-

Processed Food

-

Pharmaceuticals

-

Bakery & Confectionaries

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Poland

-

Sweden

-

Finland

-

Norway

-

Croatia

-

Greece

-

Turkey

-

-

Asia-Pacific

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cold chain equipment market size was estimated at USD 13.67 billion in 2022 and is expected to reach USD 16.45 billion in 2023.

b. The global cold chain equipment market is expected to grow at a compound annual growth rate of 22.3% from 2023 to 2030 to reach USD 67.27 billion by 2030.

b. North America dominated the cold chain equipment market with a share of 45.0% in 2022. This is attributable to the significant fragmentation of cold storage and cold chain equipment companies in the region. Also, factors such as rising disposable income, increasing population, and regulatory initiatives towards food safety during storage and transportation are expected to drive the regional market.

b. Some key players operating in the cold chain equipment market include Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., and CHG Europe BV.

b. Key factors that are driving the market growth include growing demand for frozen food across the globe, increasing demand for processed food in developing economies, coupled with the focus on reducing wastage of food in African countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."