- Home

- »

- Consumer F&B

- »

-

Complete Nutrition Products Market Size Report, 2028GVR Report cover

![Complete Nutrition Products Market Size, Share & Trends Report]()

Complete Nutrition Products Market Size, Share & Trends Analysis Report By Product (Powder, RTD Shakes, Bars), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-342-3

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global complete nutrition products market size was valued at USD 3.9 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.0% from 2021 to 2028. Complete nutrition products are gaining popularity among consumers owing to the increasing focus on health, natural ingredients, clean labels, and organic food alternatives. Moreover, consumer demand for convenient and easy-to-cook food products is anticipated to increase the demand for complete nutrition products in the upcoming years.

The COVID-19 outbreak has impacted the market for complete nutrition products in both positive and negative ways. During the initial phase of the outbreak, key players such as Huel Inc. started witnessing a sudden increase in demand as more and more consumers started stocking up on convenient and nutritional food products. Lockdown measures in most countries forced people to stay at home, which prompted consumers to buy products that require no cooking at all which has increased the demand for complete nutrition products during the forecast period.

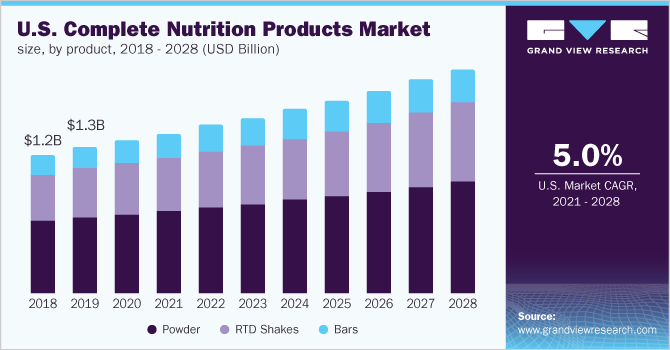

In the U.S., the market is expected to expand at a CAGR of 5.0% during the forecast period. The demand for powders has increased significantly owing to the prevalence of deficiency of proper nutrients such as vitamins, minerals, and calcium in regular diets. As a result, numerous health experts can be seen recommending complete nutrition products. Along with providing complete nutrition, these are also cost-efficient and more convenient than conventional products.

Most of these powders contain vitamins D and B12, minerals such as calcium and iron, herbs such as echinacea and garlic, and products like glucosamine, probiotics, and fish oils. Along with these, they also contain fillers, binders, and flavorings. Most manufacturers suggest that these should be consumed either with milk or lukewarm water and also specify the serving size.

The growth of e-commerce as a result of rising internet penetration across the globe is expected to improve the visibility of complete nutrition products in the upcoming years. The continuous advancements in e-retailing have also provided opportunities to players such as YFood Labs GmbH, and Huel Inc. to sell and market their products to consumers across the globe.

Key players in the market for complete nutrition products are increasingly launching specialized e-commerce websites owing to the rising internet penetration and increasing propensity of mobile shopping among consumers, which is expected to offer significant growth opportunities for complete nutrition products in the upcoming years

The continuously evolving consumer preferences for high-quality ingredients and convenient products have led to an increase in willingness to spend a higher amount on nutritional and health-oriented products which is expected to boost the demand for RTD shakes during the forecast period. These shakes are available in compact packaging in the form of bottles, cans, and cartons which makes it convenient and portable to carry them at workplaces, outings, and gyms.

Product Insights

The powder segment dominated the market for complete nutrition products and accounted for the largest revenue share of 54.3% in 2020 and is expected to maintain dominance over the forecast period. Key concerns such as a healthier lifestyle, an increased inclination for natural and organic products are driving the demand for powders. Complete nutrition products in the form of powder are considerably more economical than most of their counterparts, which is driving its demand among consumers.

However, the RTD shakes segment is projected to register the fastest CAGR of 6.8% from 2021 to 2028. The rapidly increasing demand for convenient and cost-efficient nutrition products is driving the adoption of RTD shakes among most consumers. Market players such as Soylent, and Huel Inc. are offering a range of RTD shakes in differentiated flavors owing to the robust demand from the consumers, which is expected to create a positive impact on the segment growth in the upcoming years.

The bars segment accounted for a revenue share of more than 10.0% in 2020 and is expected to register a CAGR of 6.2% from 2021 to 2028. Bars are considered a potential on-the-go snacking option and help in boosting energy. These bars are a healthy blend of carbohydrates and minerals. Most of these claims to be sugar-free. Bars with high fiber content and all-natural sources are preferred. Bars dedicated toward instant energy, weight loss, and meal replacement are gaining popularity.

Distribution Channel Insights

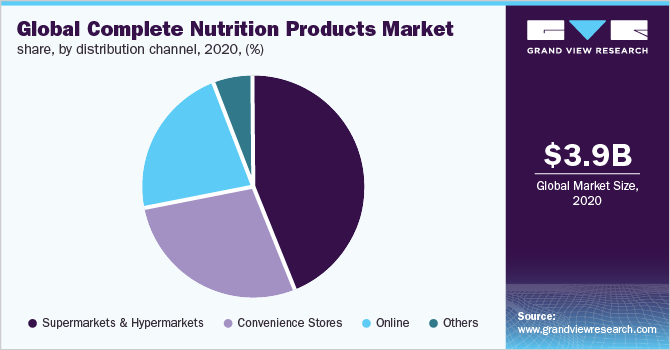

The supermarkets and hypermarkets dominated the market for complete nutrition products and accounted for the largest revenue share of over 43.6% in 2020. The increasing penetration of independent retail stores such as Walmart, Costco, GNC Holdings, LLC, and The Vitamin Shoppe is boosting product visibility and attracting a larger consumer base. Consumers prefer to shop for specialized nutrition products from these stores due to the wide availability of wellness brands. Furthermore, these stores have designated significant shelf space for vitamins and nutritional products, which increases the product visibility and makes it convenient for the consumers to buy them.

The online distribution channel segment is projected to register the fastest CAGR of 6.7% from 2021 to 2028. Online distribution channels are gaining popularity due to the high levels of convenience offered. An increasing number of health-conscious consumers and a considerable shift in lifestyles is further boosting the consumption of complete nutrition products through online channels. Several market players are selling their products through online portals owing to an increasing popularity of e-commerce.

The convenience stores segment is projected to register a CAGR of 6.3% from 2021 to 2028. The widespread presence of such stores makes them one of the most convenient stops for purchasing complete nutrition products along with other daily necessities. Additionally, as the profit margins of players relying on this channel are lower than those selling via supermarkets, the price of the final product is much lower. This has encouraged the players to reach out to more customers via this sales channel.

The others channel is projected to register a CAGR of 5.0% from 2021 to 2028. The other category includes products sold through stores in transit, gyms, and various other health-specific specialty stores. The growing presence of such channels across several economies across the globe is boosting the product demand through this channel.

Regional Insights

North America dominated the complete nutrition products market and accounted for the largest revenue share of over 42.0% in 2020. This growth is owing to the rising health-related concerns such as obesity and diabetes among young consumers are propelling the demand across North America. The economies in the U.S. have been witnessing a relatively high growth rate in recent years, owing to the growing adoption of a healthy lifestyle among consumers.

In the U.S., the growing prevalence of health issues such as obesity, cardiovascular diseases, and cancer is opening new scope for the market. For instance, according to the statistics provided by the Centers for Disease Control and Prevention (CDC), in 2017-2018, the obesity prevalence in the U.S. was estimated at 42.4%. About 40.3% of people in the age group of 20 to 39 years were obese.

In Asia Pacific, the market for complete nutrition products is expected to witness a CAGR of 7.4% from 2021 to 2028. The major factor driving the market in Asia Pacific is the strong demand for complete nutrition products primarily from economies such as China, Japan, Taiwan, Australia, and India. Global players are expanding their reach by investing in lucrative markets across Asia which is expected to fuel the regional market growth. Furthermore, the prevalence of improper and unhealthy diets in most consumers including children and women is observed which is driving the demand for the market in the region.

In Europe, the market is expected to witness a CAGR of 5.8% from 2021 to 2028. According to the World Health Organization (WHO), European countries such as the U.K., Hungary, and Lithuania recorded levels of obesity at 27.8%, 26.4%, and 26.3% respectively. These countries also witness the prevalence of obesity among the young population. This health-related trend is estimated to drive the demand for the market over the forecast period.

Key Companies & Market Share Insights

The market for complete nutrition products is characterized by the presence of a few well-established players and several small and medium players. Product launches are one of the key strategic initiatives in the industry. For instance, in May 2020, RSP Nutrition launched a ready-to-drink product line- ‘Immunity and Hydration Shot’ and ‘TrueFit’. The product is a wellness-enhancing shot that boosts both immunity and hydration formulated with electrolytes, botanicals, and minerals. TrueFit is a meal replacement alternative and protein shake. Both products are available on the company’s website.

Similarly, in January 2020, SlimFast launched 21 new complete nutrition products, including RTD meal replacement shakes, snacks, meal replacement bars, and shake mixes for consumers following a Keto diet. Hazely Lopez, the company’s Keto Ambassador, promoted the products on ABC's GMA3. SlimFast’s new Keto products are available at popular retailer chains such as Walmart, Kroger, Publix, Ahold, HyVee, Meijer, and Wakefern, and online at Amazon. Some of the prominent players in the complete nutrition products market include:

-

Huel Inc.

-

Soylent

-

IdealShape

-

SlimFast

-

LadyBoss

-

RSP Nutrition

-

Numix

-

MuscleBlaze

-

Jimmy Joy

-

YFood Labs GmbH

Complete Nutrition Products Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.1 billion

Revenue forecast in 2028

USD 6.3 billion

Growth Rate

CAGR of 6.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; Japan; India; Brazil; South Africa

Key companies profiled

Huel Inc.; Soylent; IdealShape; SlimFast; LadyBoss; RSP Nutrition; Numix; MuscleBlaze; Jimmy Joy; YFood Labs GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global complete nutrition products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Powder

-

RTD Shakes

-

Bars

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global complete nutrition products market size was estimated at USD 3.9 billion in 2020 and is expected to reach USD 4.1 billion in 2021.

b. The global complete nutrition products market is expected to grow at a compound annual growth rate of 6.0% from 2021 to 2028 to reach USD 6.3 billion by 2028.

b. North America dominated the complete nutrition products market with a share of over 42% in 2020. This is attributable to rising health-related concerns such as obesity and diabetes among young consumers across North America.

b. Some key players operating in the complete nutrition products market include Huel Inc., Soylent, IdealShape, SlimFast, and LadyBoss.

b. Complete nutrition products are gaining popularity among consumers owing to the increasing focus on health, natural ingredients, clean label, and organic food alternatives. Moreover, consumer demand for convenient and easy-to-cook food products is anticipated to increase the demand for complete nutrition products in the upcoming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."