- Home

- »

- Advanced Interior Materials

- »

-

Composites Market Size And Share Analysis Report, 2030GVR Report cover

![Composites Market Size, Share & Trends Report]()

Composites Market Size, Share & Trends Analysis Report By Product Type (Carbon Fiber, Glass Fiber), By Manufacturing Process (Layup, Filament, Injection Molding, Pultrusion), By End-use, By Region And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-917-3

- Number of Pages: 167

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Composites Market Size & Trends

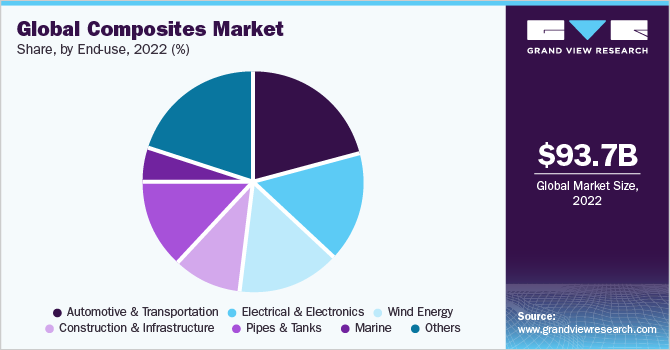

The global composites market size was estimated at USD 93.69 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. This growth is attributed to the rising demand for lightweight components in the automotive and transportation industry. Furthermore, increasing utilization of advanced lightweight components across the manufacturing industries is anticipated to support the market growth during the forecasted years.

Composites find application in the aerospace & defense sector owing to their ability to reduce the body weight of military aircraft and helicopters to a large extent. A reduction in weight is considered important in order to increase fuel efficiency and overall performance and is expected to emerge as the key driver propelling the industry’s growth.

The COVID-19 outburst across the globe has significantly impacted the supply chains as major economies suspended trade operations. Moreover, demand for the product across various end-use industries such as aerospace, automotive, and construction has been reduced in 2020. However, with the ease of trade restrictions, the situation is expected to recover in 2021, which is expected to restore the growth trajectory of the market.

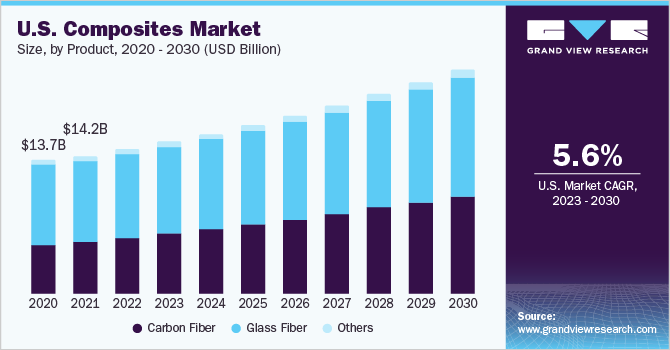

The U.S. composites market is expected to grow in aerospace & defense on account of the increasing penetration of the product coupled with the presence of the leading aircraft manufacturer in the country i.e. The Boeing Company. The rapid growth of the aerospace industry in the country and expected growth in the defense sector is likely to drive the demand over the forecast period.

The growing environmental concerns and stringent regulations regarding pollution control have forced automotive manufacturers to enhance their technologies and develop vehicles having low pollution. Moreover, the implication of environmental regulations primarily in Europe and the U.S. has forced automotive manufacturers to include composites in automotive production. This is expected to accelerate market growth progressively.

The high cost of raw materials for composites is likely to challenge procurement operations by the component manufacturers. Moreover, the growing demand for these raw materials by other manufacturing industries is likely to pose a challenge for composites manufacturers. However, key players are conducting extensive R&D activities to develop low-cost composite grades with similar mechanical properties as that of the high-cost variants. This is expected to spur the demand for composites during the forecast period.

Product Insights

Glass fiber led the market and accounted for the largest revenue share of 60.0% in 2022. Glass fibers are largely used as a raw material for composites owing to their high tensile strength, rigidity, and lightweight. Additionally, it has excellent impact resistance due to which glass fiber is mainly used in composite manufacturing.

Carbon fiber reinforced polymer is formed when carbon fiber is molded with plastic resin. In both interior and exterior applications, sandwich structures made of carbon fiber-reinforced polymer composite materials are widely used in the aircraft sector. The CFRP composites are lightweight and have high tensile strength, they are more fuel-efficient, require less upkeep, and help OEMs adhere to the strict environmental laws in Europe and North America

Technological developments for enhancements in the strength and durability of these composites have increased penetration in pipe manufacturing applications. Moreover, the rise in demand for high-strength materials in the automotive and aerospace industries is expected to support the market in the estimated time.

Other composite products mainly include silicon carbide fiber, aromatic polyamide fiber, and hybrid fiber. Silicon carbide fiber is a compound of carbon and silicon. It occurs in nature as an exceptionally rare mineral moissanite and possesses properties such as high-temperature resistance, high modulus, high tensile strength, and good heat resistance.

Manufacturing Process Insights

The layup process led the market and accounted for the largest revenue share of 34.9% in 2022. The increasing production of boats, wind turbine blades, and architectural moldings are expected to fuel the growth of the layup process segment in the global composites market over the forecast period.

Wet layup processes help in producing a variety of shapes and sizes of composite products that are used in different end-uses such as marine prototypes and storage tanks, at a lower cost of production. Dry layup processes use pre-impregnated fibers, also known as prepregs, which have resins absorbed in the fibers that are then molded in a cavity under high temperature and pressure.

The filament winding technique results in hollow, circular parts which are used in the production of devices such as pipes and tanks. Fibers that are drawn or pushed through a resin bath are continuously wound over a mandrel. The products manufactured by this process find use in industries such as energy and consumer products.

The pultrusion process is an efficient method for manufacturing fiber-reinforced composite products. It allows the manufacturers to produce a continuous length of the fiber-reinforced polymer. This process involves drawing fiberglass through a liquid resin that saturates the glass reinforcement. The pultrusion process of manufacturing fiber composites with polymer matrix is an efficient and resource-saving technique.

Resin transfer molding is a vacuum-assisted process, wherein a reinforcement mat is placed in the mold, which is then clamped. A catalyzed resin of low viscosity is pumped under pressure, displacing the air, and expelling it at the edges until the mold is filled. This process is suitable for the production of larger components of medium volume. RTM is an ideal process for obtaining a high strength-to-weight ratio and mid-volume production ranging from 200 to 10,000 parts per year.

End-Use Insights

The automotive & transportation segment led the market and accounted for the largest revenue share of 21.0% in 2022. Composites find applications in automobiles, trucks, trailers, buses, trains, subways, and motorcycles. These industries utilize composites for the manufacturing of strong and lightweight components replacing the usage of metal. The material has the stiffness and strength of metals but is comparatively lighter which aids in manufacturing lightweight parts.

The primary intent for using composites in the wind energy sector is to keep the blade weight under control and to harness their ability to impart superior properties such as fire retardancy, excellent corrosion resistance, design flexibility, and durability to the blades. Wind energy is projected to emerge as the fastest-growing application segment in the composites market over the forecast period on account of the increasing penetration of composites coupled with the rising installation of wind energy farms.

The growing demand for advanced electronics in households, as well as industrial applications, is expected to increase the demand for composites. The most common applications for composites in the electrical and electronics category are terminal boxes, lamp housings, electrical enclosures, plugs, sockets, and components for the distribution of energy.

The use of composites in the construction & infrastructure sector is growing rapidly due to their increasing usage in refabrication and retrofit applications. Composites are used in the construction of windows, doors, non-structural gratings, bridge components, long-span roof structures, paneling, complete bridge systems, and furniture & other interiors.

Regional Insights

Asia Pacific region dominated the market and accounted for a revenue share of 45.4% in the global composites demand in 2022. The Asia Pacific composite market is projected to grow significantly during the forecast period. The region is one of the most lucrative destinations for automotive, construction, aerospace, and electronics manufacturers owing to the presence of key manufacturers in the major economies including China, India, and Japan.

In the U.S., the demand for composites is primarily driven by the increasing demand for lightweight materials in the automotive industry. Rising electrical & electronics capacity additions and steady growth in the automotive and aerospace sectors are the factors that are expected to augment the industry growth over the forecast period.

The demand for composites is largely dominated by Western European countries owing to the presence of large-scale manufacturing industries. The well-established automotive, aerospace & defense, construction, and electrical & electronics industries are expected to drive industry growth in Europe. The advent of new aircraft manufacturers such as Commercial Aircraft Corporation of China, Ltd. in Europe is expected to boost the production of aircraft as well as competition among aircraft manufacturers in the region.

Central & South America is one of the most lucrative markets for composites. Moreover, in recent years, the regional market exhibited relatively solid growth in construction, especially in Brazil is expected to augment demand for composites. The regional and local players are finding the market attractive on account of robust growth in end-use industries.

Key Companies & Market Share Insights

The global composites market is characterized by the presence of a large number of players, with established players leading the market trends. The majority of these companies focus on forward integration by providing their products directly to end-users across different industry verticals. Some of these companies also use an established distribution and sales network to connect with their customers across regions easily.

The competitive rivalry among manufacturers of composites is high as the market is characterized by the presence of several global and regional players. High processing and manufacturing costs of composites are challenging the growth and profitability of composite manufacturers across the globe. Other than the high production cost, initial capital investment is anticipated to pose a challenge in the forecast period. Some prominent players in the composites market include:

-

Teijin Ltd.

-

Toray Industries, Inc.

-

Owens Corning

-

PPG Industries, Inc.

-

Huntsman Corporation LLC

-

SGL Group

-

Hexcel Corporation

-

DuPont

-

Compagnie de Saint-Gobain S.A.

-

Weyerhaeuser Company

-

Momentive Performance Materials, Inc.

-

Cytec Industries (Solvay, S.A.)

-

China Jushi Co., Ltd.

-

Kineco Limited

-

Veplas Group

Composites Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 99.10 billion

Revenue forecast in 2030

USD 163.97 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, manufacturing process, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Teijin Ltd.; Toray Industries, Inc.; Owens Corning; PPG Industries, Inc.; Huntsman Corporation LLC; SGL Group; Hexcel Corporation; DuPont; Compagnie de Saint-Gobain S.A.; Weyerhaeuser Company; Momentive Performance Materials, Inc.; Cytec Industries (Solvay, S.A.); China Jushi Co., Ltd.; Kineco Limited; Veplas Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composites Market Report Segmentation

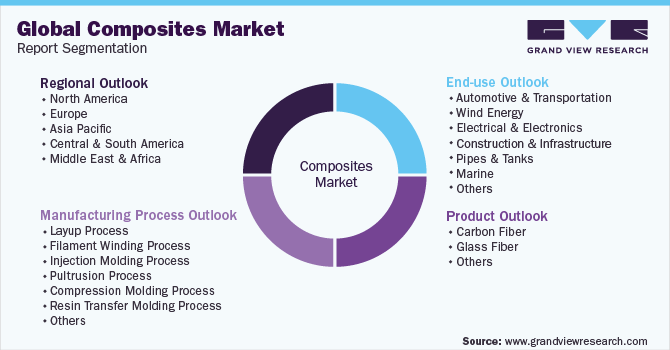

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the composites market on the basis of product, manufacturing process, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2023 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Others

-

-

Manufacturing Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2023 - 2030)

-

Layup Process

-

Filament Winding Process

-

Injection Molding Process

-

Pultrusion Process

-

Compression Molding Process

-

Resin Transfer Molding Process

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2023 - 2030)

-

Automotive & Transportation

-

Wind Energy

-

Electrical & Electronics

-

Construction and Infrastructure

-

Pipes & Tanks

-

Marine

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2023 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global composites market size was estimated at USD 93.69 billion in 2022 and is expected to reach USD 99.10 billion in 2023.

b. The global composites market is expected to grow at a compound annual growth rate a CAGR of 7.2 % from 2023 to 2030 to reach USD 163.97 billion by 2030.

b. The glass fiber composites accounted for the largest revenue share of 60% in 2022. Wide application demand from construction, wind energy, electrical & electronics and automotive & transportation industries is expected to ascend the demand for glass fibers.

b. Some key players operating in the composites market include Teijin Ltd., Toray Industries, Inc., Owens Corning, PPG Industries, Inc., Huntsman Corporation LLC, SGL Group, Hexcel Corporation, DuPont, Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials.

b. Key factors that are driving the market growth include the increasing utilization of advanced lightweight components across the manufacturing industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."