- Home

- »

- Medical Devices

- »

-

Computed Tomography Market Size & Share Report, 2030GVR Report cover

![Computed Tomography Market Size, Share & Trends Report]()

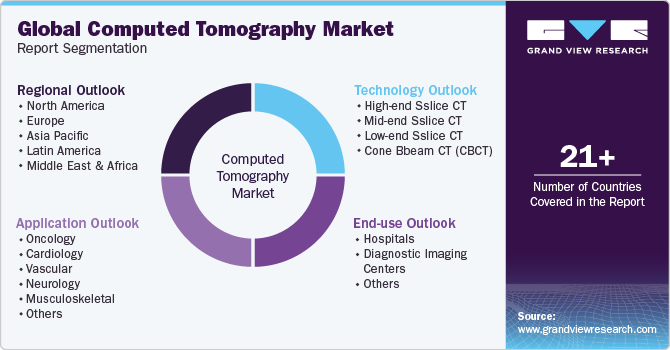

Computed Tomography Market Size, Share & Trends Analysis Report By Technology (High-end Slice, Mid-end Slice, Low-end Slice, Cone Beam), By Application (Oncology, Cardiology, Vascular, Neurology, Musculoskeletal), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-959-3

- Number of Pages: 195

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Computed Tomography Market Size & Trends

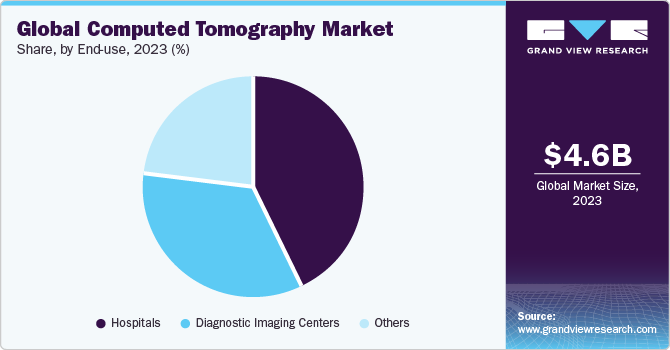

The global computed tomography market size was estimated at USD 4.61 billion in 2023 and is expected to grow at a CAGR of 7.87% from 2024 to 2030. Technological advancements in computed tomography (CT) technology, coupled with the growing prevalence of chronic disorders, such as cancer, orthopedics, and cardiovascular & neurological conditions, are expected to accelerate market growth. Furthermore, increasing awareness and focus on preventive healthcare measures have led to a surge in routine diagnostic procedures, contributing to the expanding market for computed tomography. The introduction of CT has been of great benefit to medical care. This technology improves diagnoses, prevents unnecessary medical procedures, improves treatment by providing detailed anatomical imaging, and is a cost-effective imaging technique.

It is an essential diagnostics tool, especially for scanning bone, soft tissue, and blood vessels all at the same time. Since CT imaging is quick and easy during emergency cases, internal injuries can be detected early enough to save lives. Thus, increasing demand for advanced assessment tools in the emergency department and growing number of ambulatory emergency care units are the factors expected to have a positive impact on market growth. Technological advancements, such as the integration of artificial intelligence (AI) and the development of accessories to enhance image quality obtained by conventional CT scanners are the major factors expected to fuel market growth. For instance, in May 2023, Royal Philips launched an AI-powered CT scanner, Philips CT 3500 aiming at the need of routine radiology and high-volume screening programs.

The system is being launched at China International Medical Equipment Fair (CMEF 2023) and Deutscher Röntgenkongress (ROKO 2023), Germany in May 2023. In addition, In May 2021, Siemens Healthineers launched Somatom X. need CT scanner. It is a high-speed, high-resolution CT scanner with an intelligent operation approach that makes procedures easier for medical staff and patients. Also, in September 2021, GE Healthcare introduced a new CT system, Revolution Ascend which uses AI to improve operational efficiency and patient comfort. R&D activities remain competitive & flexible in healthcare owing to gradually advancing technologies & an uncertain economic environment. Companies are focusing on basic research to late-stage manufacturing of computed tomography technologies, using R&D efforts to gain a competitive edge.

Hence, several private and government organizations are investing heavily in R&D. For instance, in 2022, Siemens Healthineers introduced a new CT production unit in India to fulfill the growing demand for CT devices and boost its market position. Furthermore, rising number of CT scan procedures is expected to fuel market growth. According to NCBI, more than 70 million CT scans are performed in the U.S. and 7.1 million in the UK every year with an annual increasing rate of 10%, signifying the growth potential of CT in the overall medical imaging market. A steep rise in the applications of CT scans and growing trends of using CT scans for effective lung cancer screening are expected to boost the demand for CT scanners in developed as well as developing countries. Growing applications of CT also extend in dentistry to detect tooth decay and assess infection in surrounding areas.

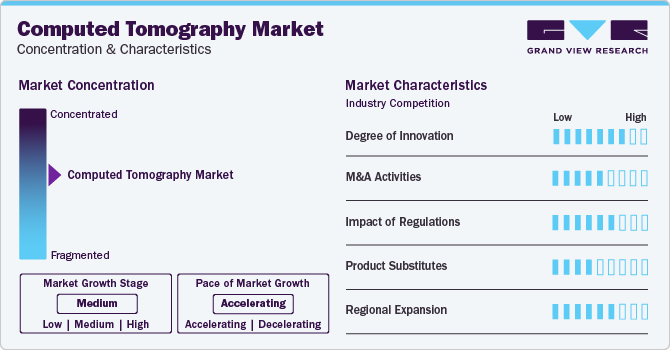

Market Concentration & Characteristics

The computed tomography industry is accelerating at a moderate to high stage and is expected to witness a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the industry has witnessed a significant rise in new product launches, posing a challenge for established players to maintain their foothold in the constantly evolving industry. Key industry players are making substantial investments in R&D activities to create innovative imaging technologies, which are anticipated to drive market expansion.

The computed tomography industry has been characterized by a high degree of innovation including new software and hardware developments enabling more accurate and detailed imaging of the body. For instance, in January 2021, Siemens Healthineers introduced the Naeotom Alpha, which is the world's first CT scanner to use photon-counting technology. This innovative system has been approved for clinical use in both the United States and Europe

Key players are engaged in a moderate level of merger and acquisition (M&A) activities. For instance, in January 2023, GE HealthCare announced an agreement to acquire IMACTIS, a French company that specializes in CT interventional guidance technology for use in a variety of healthcare settings. This acquisition is part of GE HealthCare's efforts to expand and improve their offerings in the rapidly growing field of computed tomography

The industry is highly regulated. In the U.S., the Food and Drug Administration (FDA) regulates CT scanners and requires manufacturers to obtain clearance or approval before they can be marketed. In Europe, CT scanners are regulated by the European Medicines Agency (EMA) and are subject to the European Union's Medical Device Regulation (MDR). Similarly, the Pharmaceuticals and Medical Devices Agency (PMDA), Japan; National Medical Products Administration (NMPA), China; and Central Drugs Standard Control Organization (CDSCO), India are some of the regional regulatory authorities

The product substitutes that can be used instead of CT scanners have a low to moderate impact on the CT industry growth. However, alternative imaging modalities, such as X-ray systems, magnetic resonance imaging (MRI) machines, and ultrasound machines, can be used to visualize body's internal structure

Several key players are conducting regional expansion to dominate the computed tomography industry. Asia Pacific is expected to grow considerably due to the rapidly expanding healthcare industry and increasing demand for advanced medical imaging technologies. Other regions, such as Europe and North America, are also expected to see steady growth. In February 2024, Canon Medical Systems Corporation successfully installed their Canon photon-counting CT (PCCT) system for the second time in the world at Radboud University Medical Center, which is located in Nijmegen, the Netherlands and led by Dr. Bertine Lahuis. Clinical research using the PCCT system started in late January. This new technology is the future of X-ray CT due to its advanced capabilities and features

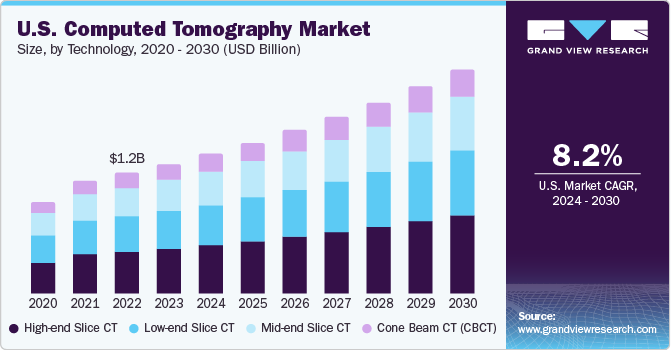

Technology Insights

The high-end slice CT segment dominated the market and accounted for the largest revenue share of 35.0% in 2023. High-end slice technology has 80% less radiation exposure than mid-end slice technology (64 slices) with a 16 cm imaging area helping in accurate technique. High-end slice scanners are used in patients with arrhythmia, pediatric patients who tend to move more during scans, and obese people. They cover a larger imaging area and take less time. Some of the available scanners can scan the whole body in 0.3 sec/per rotation (Siemens 700 Slice), which can enable healthcare providers to offer customized solutions and even produce real-time images. A 320-slice scan can offer an imaging area of 16 cm in 1 rotation. In addition, patients do not need to hold their breath during the process, improving patient comfort, especially for children. Examples of high-end slice CT scanners include SOMATOM Force by Siemens Healthineers and GE Revolution CT by GE Healthcare.

The cone-beam segment is expected to witness the fastest CAGR over the forecast period due to an increase in the use of cone-beam CTs in areas, such as dental, orthopedic, ENT, oral surgery, and interventional radiology. Compact size, low radiation exposure, and low cost compared to conventional CT are some of the advantages associated with the technique. The ability of CBCT for 3D evaluation of the maxillofacial region has led to their increasing demand in dentistry. Growing applications of CBCT are expected to propel the overall CT market during the forecast period. In addition, recent improvements in software have broadened the diagnostic capacity of this segment. The majority of CBCT equipment typically includes user-friendly software that contains basic 3D imaging tools. Cone beam CT technology can facilitate the diagnosis of a disease with more clarity and accuracy, which is anticipated to drive the demand for this segment over the forecast period.

End-use Insights

The hospital segment dominated the market and accounted for the largest revenue share of 43.28% in 2023. The increased number of emergency admissions in hospitals and high number of surgeries performed each year have contributed to the segment’s share. Moreover, CT scans serve as an effective tool for accurate diagnosis pre-operative and post-operative to determine the effectiveness of the treatment. In addition, hospitals are frequently installing or upgrading medical imaging devices. The availability of medical imaging systems, such as CT, MRI, ultrasound, and others, within hospitals can positively affect various factors, such as duration of hospital stay, total healthcare cost, quality of care, and availability of emergency care. Furthermore, the difficulty and risk associated with transportation of critical-ill patients from hospital to a third-party diagnostics center for CT scans, has forced hospitals to establish their CT scan machines, which contributes to the segment growth.

The diagnostic imaging centers segment is expected to witness a significant growth rate from 2024 to 2030. These centers are essential for providing accurate and timely diagnoses. CT scans are a critical tool used to diagnose a wide range of medical conditions. Diagnostic imaging centers are preferred over hospitals as they specialize in imaging services, allowing them to focus solely on providing the best possible care for their patients. This specialization results in higher expertise and experience among their staff and better overall patient experience. Also, diagnostic imaging centers typically have more advanced and up-to-date equipment, allowing for faster, more accurate diagnoses. This is because they invest heavily in state-of-the-art equipment and technology, which is not always the case in hospitals.

Application Insights

The oncology segment dominated the market and accounted for the largest revenue share of 27.24% in 2023 and is expected to expand at the fastest CAGR over the forecast period. CT scans are commonly used to detect and monitor tumors, to evaluate the effectiveness of cancer treatment, and to plan radiation therapy. CT scans can help oncologists determine the size, shape, and location of tumors and whether they have spread to other parts of the body. The increasing prevalence of cancer and growing applications of CT scans in the diagnosis of various types of cancers including lumps and tumors are expected to drive segment growth. For instance, according to the Global Cancer Observatory, the International Agency for Research on Cancer (IARC), 19,976,499 new cases of cancer were estimated in 2022, among which 9,743,832 patients died. The number of prevalent cases for the last five years is 53,504,187. The introduction of innovative technologies including computer-aided detection and computer-aided diagnosis of suspicious cancer nodules and assessing the risk of malignancy, especially in lung cancer is expected to boost the computed tomography (CT) market growth. The software can additionally calibrate the captured image with biopsy outcome helping in accurate diagnosis.

The neurology & musculoskeletal segment is expected to witness a significant growth rate over the forecast period. This can be attributed to the increasing geriatric population, as they are more susceptible to developing neurological disorders. Neurological disorders are currently one of the leading causes of death and disability globally. According to a recent Global Burden of Disease (GBD) study, the number of people suffering from brain diseases is predicted to double by 2050. This study further highlights that over 40% of the world's population currently struggles with neurological disorders, and this number is expected to almost double by 2050. In addition, aged people are more prone to falls due to their compromised mobility, which leads to several types of fractures, especially hip fractures. Moreover, with the increasing participation of people in sports activities worldwide, ligament tears have become one of the most common types of injuries. In such cases, a CT scan is a highly effective tool. All these factors are expected to drive the growth of this market.

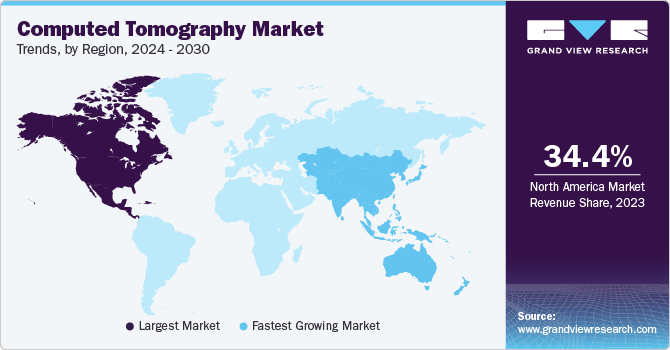

Regional Insights

North America computed tomography market accounted for the largest share of 34.39% in 2023 and is expected to maintain its dominance during the forecast period. Some key factors contributing to the region’s growth include rising geriatric population, high prevalence of obesity, and chronic diseases, including breast cancer, cardiovascular disorders, and neurological diseases, which have created a high demand for imaging analysis. In addition, technological innovations are anticipated to further propel the market growth.

U.S. Computed Tomography Market Trends

The computed tomography market in the U.S. accounted for a significant revenue share in 2023 due to continuous product launches and development of advanced products. Companies operating in the U.S. market are innovating their offerings and constantly providing better products.

Europe Computed Tomography Market Trends

The Europe computed tomography market has been growing steadily in recent years due to the high incidence of chronic diseases, such as cancer, cardiovascular diseases, and neurological disorders, which has led to a rise in the demand for advanced diagnostic tools. In addition, growing geriatric population has also contributed to the region’s growth, as older adults are more susceptible to chronic diseases. According to the Global Cancer Observatory, 4,471,422 new cancer cases were reported in 2022 in Europe, out of which 1,986,093 deaths were marked. Thus, the aforementioned statistics suggest that the Europemarket is anticipated to grow rapidly over the forecast period.

The computed tomography market in the UK is driven by factors, such as technological advancements, healthcare infrastructure investments, and a growing aging population. The adoption of advanced CT scanner technologies, including multi-detector row CT (MDCT) and cone-beam CT (CBCT), has been a notable trend. These advancements enhance imaging capabilities and contribute to faster scan times.

The Germany computed tomography market growth is attributed to the rapidly aging population, growing prevalence of chronic diseases, the presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. The rising geriatric population is a major factor driving the market growth. As per a report by NIH, in September 2023, about 18.6 million people in Germany were aged 65 years and older in 2022. With the increasing aging population, the incidence of chronic diseases is also expected to increase, thereby fueling market growth.

The computed tomography market in France has been characterized by a combination of technological advancements, healthcare infrastructure development, and evolving clinical applications. France, with its well-established healthcare system, has witnessed a consistent demand for advanced medical imaging technologies, including CT scanners.

APAC Computed Tomography Market Trends

The Asia Pacific computed tomography market is led by China & Japan and is anticipated to exhibit the fastest CAGR of 8.77% from 2024 to 2030. This can be attributed to the rapid growth of the population and increased R&D activity in this region. In addition, there is a high need for advanced devices in Asia Pacific.

The computed tomography market in China led the APAC regional market in 2023 due to high prevalence of chronic diseases. For instance, according to the Global Cancer Observatory, 4,824,703 new cancer cases were reported in 2022 in China, out of which 2,574,176 deaths were marked. CT scans are widely used to diagnose and monitor these conditions, and as the incidence of these diseases continues to rise, the demand for CT scans is also increasing.

The Japan computed tomography market is likely to grow at the fastest CAGR during the forecast period as most healthcare facilities in Japan are well-equipped with advanced and latest computed tomography technologies. In recent times, there has been growth in the adoption of computed tomography in primary care centers and clinics. This can be attributed to the launch of novel computed tomography, which is available at affordable prices, coupled with a growing interest shown by physicians in early clinical interventions.

Latin America Computed Tomography Market Trends

The computed tomography market in Latin America is growing at a steady pace owing to an increasing number of chronic diseases, such as cancer and heart disease, which require CT scans for diagnosis and treatment. Other factors include the rising demand for advanced medical imaging technologies, improvements in healthcare infrastructure, and the increasing availability of healthcare insurance. In addition, the integration of AI-powered CT scans with other imaging modalities is expected to drive market growth by providing more accurate and efficient diagnoses of diseases.

The Brazil computed tomography market is estimated to grow significantly during the forecast period owing to a rise in the number of healthcare reforms and overall expenditure. In addition, country's large population and increasing demand for healthcare services are fueling market growth.

The computed tomography market in Mexico is one of the largest markets in Latin America, with a significant number of private and public hospitals offering CT services. The country's growing healthcare infrastructure and increasing investments in medical technology are expected to further drive the market in the forecast years.

The Argentina computed tomography market is driven by similar factors, such as an aging population and increasing prevalence of chronic diseases. In addition, the growing economy and increasing healthcare expenditure are expected to contribute to market growth.

Middle East & Africa Computed Tomography Market Trends

The computed tomography market in Middle East & Africa has witnessed a surge in the demand for CT technology, driven by factors including the increasing prevalence of chronic diseases, such as cardiovascular disorders and cancer, which has led to a growing need for advanced diagnostic tools such as CT scanners for early disease diagnosis. Moreover, the region's growing population and improving healthcare infrastructure contribute to its growth. The awareness and adoption of cutting-edge medical technologies among healthcare professionals propel the growth further.

The South Africa computed tomography market is driven by factors, such as increasing demand for advanced diagnostic imaging techniques, rising prevalence of chronic diseases, and rising healthcare expenditure. For instance, according to a report by the National Treasury Republic of South Africa, in 2024, the healthcare expenditure is estimated to be USD 395.03 in South Africa. In addition, the burden of infectious diseases and non-communicable ailments has heightened the demand for advanced diagnostic imaging solutions.

The computed tomography market in Saudi Arabia is driven by factors, such as the increasing prevalence of cancer, a growing geriatric population, and rising healthcare expenditure in the country. In addition, there is a high demand for advanced diagnostic imaging techniques and an increasing number of private hospitals and clinics that are investing in CT scanning equipment to cater to the needs of their patients. In addition, The Saudi Arabian government has been actively supporting R&D in the medical device sector. Funding initiatives and grants encourage the adoption of advanced imaging technologies and foster scientific advancements in the country.

Key Computed Tomography Company Insights

Key players operating in the computed tomography market include GE HealthCare, Koninklijke Philips N.V., Siemens Healthineers AG, Canon Medical Systems, NeuroLogica Corp., Shanghai United Imaging Healthcare Co., Ltd., Fujifilm Holdings Corporation, Shenzhen Anke High-tech Co., Ltd, Koning Health, Carestream Dental LLC., and others.

These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, and merger & acquisition activities.

Key Computed Tomography Companies:

The following are the leading companies in the computed tomography market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Canon Medical Systems

- NeuroLogica Corp.

- Shanghai United Imaging Healthcare Co., Ltd.

- Fujifilm Holdings Corporation

- Shenzhen Anke High-tech Co., Ltd.

- Koning Health

- Carestream Dental LLC.

Recent Developments

-

In February 2024, Koning Health obtained regulatory clearance from the Federal Authority for Nuclear Regulation (FANR) in the United Arab Emirates (UAE), marking a significant milestone in the company's expansion and its dedication to global health innovation. This regulatory approval establishes Koning as the pioneering provider of breast CT technology in the UAE, thereby setting a new standard in breast imaging and care within the region

-

In January 2024, GE HealthCare has recently announced its acquisition of MIM Software, a leading provider of AI-based solutions for medical imaging analysis. MIM Software offers innovative radiation oncology, molecular radiotherapy, diagnostic imaging, and urology solutions across various healthcare settings. GE HealthCare aims to use MIM Software's advanced imaging analytics and digital workflow capabilities to drive innovation and enhance patient care in different care areas across the globe

-

In January 2023, GE HealthCare entered into an agreement to acquire a France-based company, IMACTIS, an innovator in the quickly expanding area of Computed Tomography (CT) interventional guide across the variety of healthcare settings

-

In November 2023, Canon Medical Systems Corp. unveiled significant updates to its CT portfolio, introducing two new scanners at the Radiological Society of North America Congress (RSNA). Among them are the new flagship system, Aquilion ONE / INSIGHT Edition, and the high-throughput system, Aquilion Serve SP

Computed Tomography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.95 billion

Revenue forecast in 2030

USD 7.81 billion

Growth rate

CAGR of 7.87% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Canon Medical Systems; NeuroLogica Corp.; Shanghai United Imaging Healthcare Co., Ltd.; Fujifilm Holdings Corp.; Shenzhen Anke High-tech Co., Ltd.; Koning Health; Carestream Dental LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computed Tomography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global computed tomography market report on the basis of technology, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High-end Slice CT

-

Mid-end Slice CT

-

Low-end Slice CT

-

Cone Beam CT (CBCT)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Vascular

-

Neurology

-

Musculoskeletal

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global computed tomography market size was estimated at USD 4.61 billion in 2023 and is expected to reach USD 4.95 billion in 2024.

b. The global computed tomography market is expected to grow at a compound annual growth rate of 7.87% from 2024 to 2030 to reach USD 7.81 billion by 2030.

b. High end slice dominated the computed tomography market with a share of 35.0% in 2023. This is attributable to the factors such as the increasing incidence of cardiovascular disorders and the demand for accurate diagnostic imaging solutions.

b. Some key players operating in the CT market include Koninklijke Philips N.V. ; GE Healthcare; Siemens Healthineers AG; Canon Medical Systems; FUJIFILM Corporation; NeuroLogica Corp; Neusoft Corporation; Koning Corporation; Shenzhen Anke High-Tech Co.

b. Key factors that are driving the computed tomography market growth include the Growing prevalence of various lifestyle-associated chronic diseases such as cancer and cardiovascular conditions and increasing demand for advanced imaging solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."