- Home

- »

- Medical Devices

- »

-

Congestive Heart Failure Treatment Devices Market Report 2030GVR Report cover

![Congestive Heart Failure Treatment Devices Market Size, Share & Trends Report]()

Congestive Heart Failure Treatment Devices Market Size, Share & Trends Analysis Report By Product (Ventricular Assist Devices, Counter Pulsation Devices, Pacemakers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-292-1

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

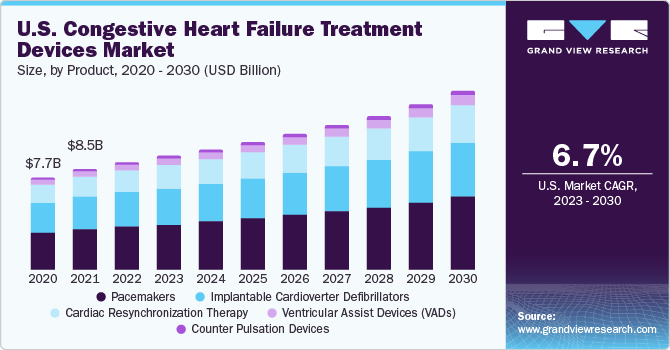

The global congestive heart failure treatment devices market size was valued at USD 26.18 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The increasing prevalence of cardiovascular diseases (CVDs), along with the rising junk food consumption, mental stress incidences, and sedentary lifestyle practices are some of the main causes for the expansion of the CHF treatment devices market. In addition, the steadily rising risk of organ failure and the development of innovative congestive heart failure therapy devices by notable device manufacturers in recent years have created growth avenues for the industry.

As per the Organ Procurement and Transplantation Network, in June 2020, in the U.S., around 3,600 people remained on the list of candidates for a heart transplant. The need for ventricular assist devices has increased due to a rise in the number of heart failure patients. This is expected to present an opportunity for congestive heart failure treatment device makers. Moreover, growth in the occurrence of cardiovascular disorders due to the aging global population, along with a lack of organ donors, are additional factors driving the expansion of the congestive heart failure treatment devices industry.

The World Health Organization estimated that around 18 million deaths globally in 2019 were due to cardiovascular diseases. Thus, rising cases of heart failure and growth in the rate of cardiovascular diseases are anticipated to spur market expansion. Additionally, increasing product approvals are expected to offer lucrative prospects for the expansion of the congestive heart failure therapy devices market.

The number of CVD cases globally is rising due to the growing elderly population. For instance, in November 2021, the Asia Pacific Observatory on Health Systems and Policies reported that by 2050, approximately 25% of the population in this region will be 60 years of age or older. This is attributed to the declining fertility rates and the rising longevity of people in the Asia Pacific, which is also expected to increase the burden of cardiovascular diseases. Consequently, this will drive the demand for more sophisticated and effective treatment procedures, propelling market growth.

The COVID-19 pandemic hurt the growth of the global congestive heart failure treatment devices market. The volume of adult cardiac surgeries performed during the initial wave of the pandemic was significantly reduced. During this period, the Mid-Atlantic region of the United States, including New York, New Jersey, and Pennsylvania, was severely affected, with over 70% decline in the total number of heart surgery cases.

Furthermore, according to the American College of Cardiology, surveys were submitted from 909 inpatient and outpatient centers in 108 countries that offer cardiac diagnostic procedures. Researchers found that operation volumes fell by nearly 65% in April 2020 and around 42% in March 2020, when compared to March 2019 figures. Consequently, the fall in heart surgery procedural numbers resulted in the decreased manufacturing and use of devices for treating congestive heart failure, limiting market growth.

Product Insights

Based on product, the global market is classified into ventricular assist devices, counter pulsation devices, implantable cardioverter defibrillators, pacemakers, and cardiac resynchronization therapy. The implantable cardioverter defibrillator (ICD) segment accounted for the maximum revenue share of 33.78% in 2022 and is expected to expand at a CAGR of 6.2% over the forecast period, owing to its capacity for performing the three essential functions of cardiac pacing, cardioversion, and defibrillation.

The rising number of cardiovascular patients and rate of technical developments globally, such as proprietary algorithms that precisely identify and lessen the chance of atrial fibrillation, are driving market expansion. In October 2022, the Centers for Disease Control (CDC), in a press release, estimated that 12.1 million Americans would have atrial fibrillation (AFib) by 2030.

Similarly, as per a research study published in the National Library of Medicine in February 2022, the disease is expected to impact 6–12 million individuals by 2050 in the US and close to 18 million in Europe by 2060. Therefore, the growing prevalence of AFib is anticipated to raise the demand for CHF treatment devices. In October 2023, MicroPort CRM, a leader in cardiac rhythm management devices with global operations based in France, launched its “ULYS” ICD and “INVICTA” defibrillation lead devices in Japan.

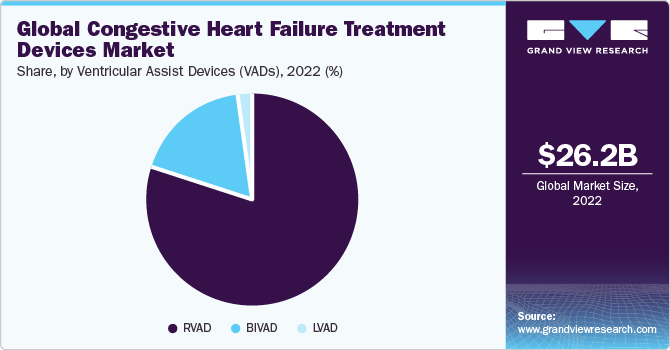

The ventricular assist devices (VADs) segment is anticipated to advance at the highest CAGR of 15.6% over the forecast period due to the increasing number of elderly individuals worldwide afflicted with chronic conditions such as diabetes, stroke, heart disease, neurological disorders, and hypertension. Moreover, the rising incidence of cardiovascular disorders, the increasing risk of organ failure, shortage of organ donors, and postponements in organ transplantation procedures are likely to contribute to the growth of the VAD segment.

In July 2020, Berlin Heart Inc. declared that the EXCOR Pediatric VAD had fulfilled requirements for the Post Market Approval (PMA) granted by the U.S. FDA in June 2017. Adopting VADs improves abidance rates, enhances functionality and durability, and boosts product adoption, hence driving market expansion.

In June 2021, Abbott stated that it had the capacity to support the growing demand for mechanical circulatory support devices to effectively treat advanced heart failure, following Medtronic's decision to discontinue the global distribution and sale of the Medtronic HeartWare ventricular assist device (HVAD). In addition, in February 2020, the FDA granted Abbott the "Breakthrough Device" status for its Fully Implantable Left Ventricular Assist System (FILVAS), which is under development.

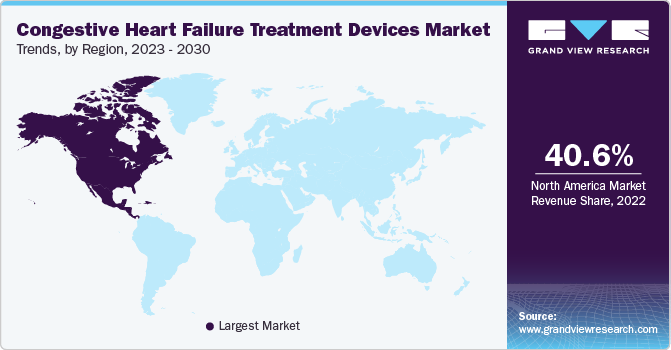

Regional Insights

North America dominated the market in 2022 with a revenue share of 40.55% and is poised to expand at a steady CAGR of 6.8% over the forecast period.The demand for congestive heart failure (CHF) treatment is rising in the region, as target disorders are becoming more common, healthcare costs are steadily growing, and people are becoming more aware about the availability of therapy devices.

Attractive reimbursement rules for therapeutic items and increasing adoption of these devices are other factors anticipated to promote regional revenue growth. The rising incidence of cardiac disorders is the main driver of market expansion. For instance, according to the American Heart Association 2021 magazine, it is projected that over 130 million adults in the US are estimated to have a cardiac condition by 2035.

Furthermore, as per data released by the Heart and Stroke Foundation of Canada in February 2022, 750,000 Canadians were suffering from heart failure at the time, and 100,000 new cases are registered every year. As a result, it is anticipated that as cardiac disorders steadily become more common, more people will use the devices used to treat them, fueling market expansion throughout the projected timeframe.

Additionally, initiatives, including product approvals, are anticipated to boost market expansion. For instance, in April 2022, Abbott received FDA approval for its leadless pacemaker technology with its new Aveir single-chamber VR pacemaker device, which has a longer lifespan than leadless pacemakers currently on the market. Since these approvals bring new, cutting-edge technologies to the industry, it is anticipated that they are likely to spur market growth.

Key Companies & Market Share Insights

Mergers and acquisitions are some of the key growth strategies that advanced players have undertaken. For instance, in October 2023, Walgreens, a US pharmacy chain, and the Cardiovascular Research Foundation (CRF) announced a collaboration to analyze the prevalence of valvular heart disease (VHD) among aged Americans. In February 2023, AstraZeneca announced that it had acquired CinCor Pharma, a US-based company. The agreement is aimed to strengthen AstraZeneca's cardiorenal pipeline through CinCor's proposed medication baxdrostat (CIN-107), an aldosterone synthase inhibitor (ASI) for decreasing blood pressure in treatment-resistant hypertension.

Key Congestive Heart Failure Treatment Devices Companies:

- Medtronic plc

- Boston Scientific Corp.

- Biotronik SE & Co. KG

- Abbott (St. Jude Medical)

Congestive Heart Failure Treatment Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.72 billion

Revenue forecast in 2030

USD 46.58 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic plc; Boston Scientific Corporation; Biotronik SE & Co. KG; Abbott (St. Jude Medical)

Customization scope

Free report customization (equivalent to up to analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

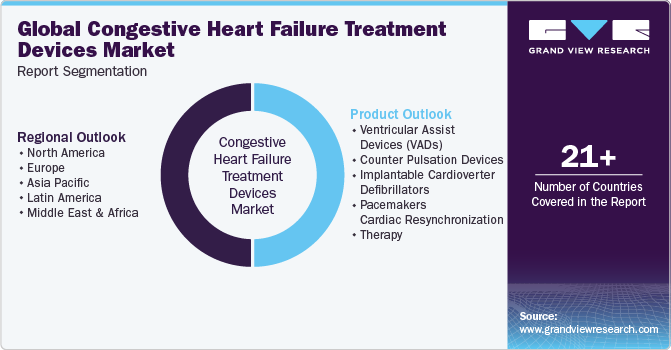

Global Congestive Heart Failure Treatment Devices Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global congestive heart failure treatment devices market report based on product and region:

- Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ventricular Assist Devices (VADs)

-

LVAD

-

RVAD

-

BiVAD

-

-

Counter Pulsation Devices

-

Implantable Cardioverter Defibrillators

-

Transvenous ICD

-

Subcutaneous ICD

-

-

Pacemakers

-

Implantable

-

External

-

-

Cardiac Resynchronization therapy

-

Cardiac Resynchronization Therapy-Defibrillators (CRT-D)

-

Cardiac Resynchronization Therapy-Pacemakers (CRT-P)

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global congestive heart failure treatment devices market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030, reaching USD 46.58 billion by 2030.

b. Implantable cardioverter defibrillators dominated the congestive heart failure treatment device market with a share of 33.78% in 2022. The rising prevalence of cardiovascular diseases, particularly arrhythmias, served as a primary catalyst, amplifying the demand for ICDs as a critical intervention for life-threatening conditions.

b. Some key players operating in the congestive heart failure treatment devices market include Medtronic Plc; Boston Scientific Corporation; Biotronik SE & Co., KG; and St. Jude Medical

b. Key factors that are driving the market growth include rising burden of Cardiovascular Diseases (CVDs), sedentary lifestyles, mental stress, junk food consumption, and favorable reimbursement policies.

b. The global congestive heart failure treatment device market was estimated at USD 26.18 billion in 2022 and is expected to reach USD 27.772 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."