- Home

- »

- Automotive & Transportation

- »

-

Construction Equipment Market Size & Share Report, 2030GVR Report cover

![Construction Equipment Market Size, Share & Trends Report]()

Construction Equipment Market Size, Share & Trends Analysis Report By Product (Earth Moving Machinery, Material Handling Machinery), By Equipment Type, By Propulsion Type (ICE, Electric, CNG/LNG), By Power Output, By Engine Capacity, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-118-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Construction Equipment Market Trends

The global construction equipment market size was valued at USD 207.14 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2030. Rapid urbanization in developing countries, coupled with increasing government focus on upgrading the existing infrastructure, is expected to surge construction activities which in turn is increasing demand for excavators, loaders, dump trucks, etc., for construction work. Thus, increasing infrastructure development activities across the globe is anticipated to increase demand for earthmoving and material handling equipment, thereby driving the growth of the global construction equipment market.

Increasing government spending on upgrading the present infrastructure is responsible for increasing construction activities in developing countries. A country such as India is highly focused on enhancing the road infrastructure to facilitate flawless transportation of resources. For instance, in June 2022, the Indian Minister of Road Transport and Highways announced the opening of 15 new national highway projects worth USD 1.7 billion in Patna and Hajipur in Bihar. For instance, in Mach 2023, the government of Singapore announced that it would commence the construction of new terminal 5 (T5) at Changi Airport in 2025. The T5 addition to the existing airport is focused on lowering the air passenger traffic at Changi Airport. This increasing road construction activity is increasing demand for material handling and road construction equipment such as forklifts, pavers, dozers, etc., further supporting the growth of the global construction equipment market.

Technological integration with construction equipment is expected to favor market growth over the forecast period. OEMs have capitalized on this as an opportunity to launch new products and expand their customer base in the construction equipment market. For instance, in January 2023, John Deere announced the launch of farming and building equipment powered by batteries. The company states that when John Deere released new farming and building technologies, factors such as a growing population, dwindling amounts of arable land, and rising greenhouse gas emissions were all considered.

The high cost of product and contractor inclination towards adopting rental equipment are some significant factors expected to hamper the growth of the global construction equipment market. Contractors are inclined towards renting the construction equipment for the specified project's timeline against being in charge of vehicle ownership. Construction equipment ownership ties up a significant amount of capital, impacting other business operations.

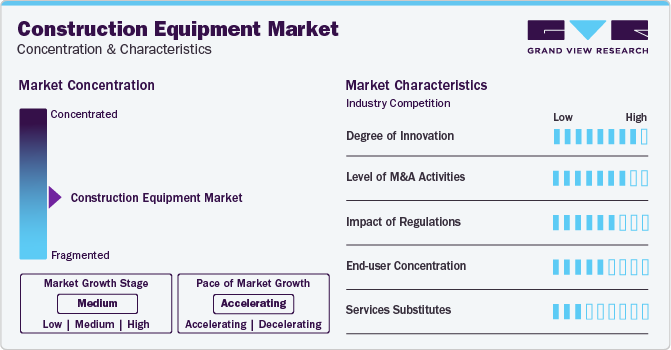

Market Concentration & Characteristics

Industry growth stage is medium, and pace of the industry growth is accelerating. The construction equipment industry is characterized by a high degree of innovation. The advent of autonomous vehicle technology in material handling is expected to open new avenues for industry growth. Adopting autonomous construction equipment ensures operators' safety and helps maintain a safe work environment.

The construction equipment industry is also characterized by a high level of new product launch activity by the companies. This is due to several factors, including increase the availability of their products & services in diverse geographical areas.

Government laws to improve the structure, site, facilities, and use of the buildings is expected to augment industry growth. The Building Standard Act of Japan aims to protect people's lives, health, and property by establishing minimal standards for building locations, designs, and uses.

There are hardly any direct or external substitutes to construction equipment at present. However, there are considerable opportunities for internal substitution over the next few years, such as electrification of construction equipment. Moreover, construction equipment is continuously getting smarter and energy-efficient in line with the advances in technology and the aggressive research & development efforts being undertaken by the OEMs.

Buyers in the construction equipment industry consider factors such as pricing, product quality, features provided, and the brand name before buying the product. Buyers generally enter into long-term contracts with suppliers to provide construction equipment.

Product Insights

The material handling machinery segment led the market and accounted for 38.5% in 2023. The material handling machinery segment growth can be attributed to factors such as the rapid industrialization and rising demand for automation in material handling machinery. In developed countries, completely automated industrial facilities have been established as a result of growing automation adoption and ongoing technological advancements in the market. It is expected that the market for material handling equipment will grow due to the ongoing modernization of industrial infrastructures and facilities to increase their production capacity.

The earthmoving machinery is expected to register a considerable growth rate over the forecast period. The construction sector's growth, both in developed and emerging economies, has significantly contributed to the earthmoving machinery market. Increasing investments in residential, commercial, and industrial construction projects necessitate the use of heavy machinery. Earthmoving equipment facilitates tasks like excavation, grading, and material handling, enabling efficient and timely completion of construction projects.

Propulsion Type Insights

The ICE segment accounted for the largest market revenue share in 2023. ICE generates power using a combustion engine and transfers it to the wheels through a transmission system. These vehicles come equipped with sturdy internal combustion engines capable of delivering substantial torque and horsepower, enabling them to efficiently handle demanding tasks. The power provided by ICE machinery empowers them to tackle heavy loads, operate in rugged terrains, and accomplish tasks that demand substantial force and endurance.

The electric construction equipment is anticipated to register the highest CAGR over the forecast period. In contrast to diesel or gasoline-powered construction equipment, electric-based machinery offers significant advantages in terms of lower operating expenses. They necessitate minimal maintenance, and the cost of electricity is generally lower compared to diesel or gasoline. As a result, this factor is anticipated to be a driving force in the market in the coming years. Moreover, governments globally are implementing regulations and providing incentives to promote the widespread adoption of electric construction equipment. For instance, the European Union has made it mandatory for OEMs to install essential ADAS functions, such as cruise control and lane departure warning systems on heavy equipment by 2020.

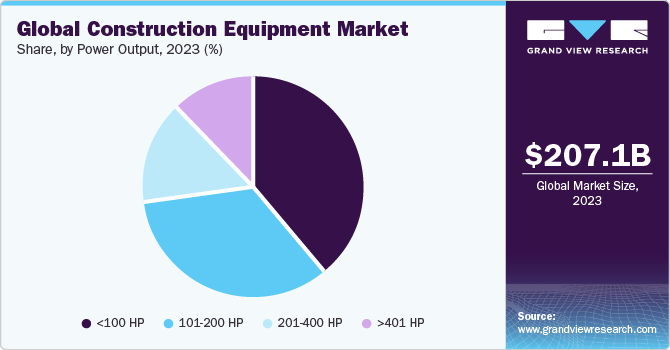

Power Output Insights

<100 HP segment accounted for the largest market share in 2023. <100 HP construction equipment, include mini-excavators, compact wheel loaders, skid steer loaders, and compact track loaders, offer exceptional versatility and maneuverability. Rising use of compact construction equipment in emerging economies such as Asia Pacific, Latin America, and Africa is further anticipated to drive the demand for the market over the forecast period. Infrastructure development, urbanization, and small-scale construction projects have increased the demand for cost-effective, compact, and versatile machinery. Advancements in technology, including operator comfort, improved powertrain efficiency, and automation, are also contributing to the segment’s growth.

The 101-200 HP segment is anticipated to register the highest growth rate over the forecast period. These machines, such as excavators, bulldozers, loaders, and graders, are essential for heavy-duty tasks. Machines in the 101-200 HP range often feature designs that prioritize serviceability, allowing easy access to critical components for maintenance and repairs. Efficient maintenance processes and readily available spare parts contribute to minimizing downtime and maximizing productivity.

Regional Insights

The North America construction equipment market was valued at USD 40.61 billion in 2023. One of the key drivers of the rising demand for construction equipment is the rapid development of smart cities in North America. Government programs such as the Smart Cities Project beneath the U.S. Economic Development Program support the regional construction equipment growth. Technologically advanced construction tools, such as earthmoving, roadbuilding, and material-handling machinery, are increasingly used in the region to develop smart cities efficiently.

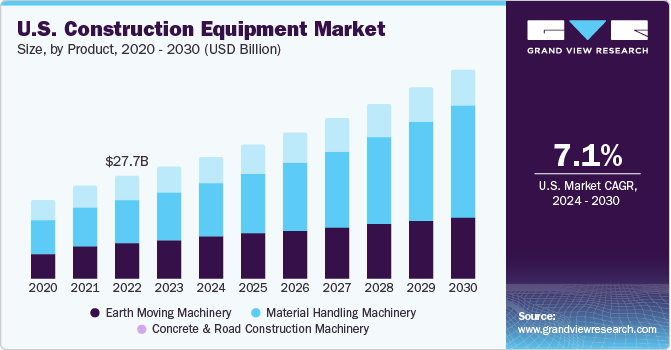

U.S. Construction Equipment Market Trends

The construction equipment market in the U.S. is expected to grow at a CAGR of 7.1% from 2024 to 2030. The growth of construction equipment is ascribed to Due to the increasing investments by manufacturers and suppliers in installing automated equipment in manufacturing facilities and warehouses, the U.S. construction equipment industry is expected to see significant growth. The rise of e-commerce businesses has significantly increased the size of the regional market. Major companies such as Amazon and eBay spend a lot of money building warehouses to store their inventory.

The construction equipment market in Canada is projected to grow due to significant investment in smart grids and smart meters, coupled with the rising awareness regarding greenhouse emissions. The government has launched a smart grid program that addresses the major infrastructure development achieving its goals for an energy framework based on clean energy growth.

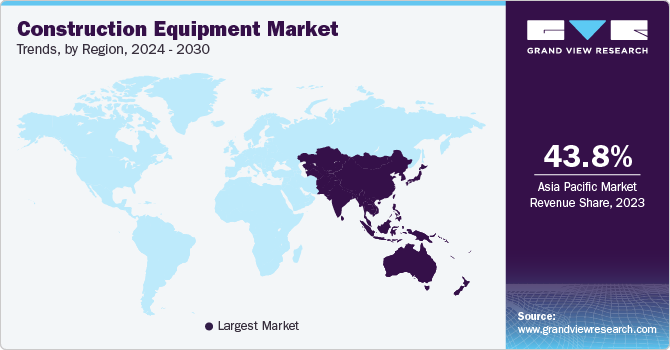

Asia Pacific Construction Equipment Market Trends

The Asia Pacific construction equipment market accounted for a share of 43.8% of the global revenue in 2023. Manufacturers in the Asia Pacific construction equipment market is responding to the situation by offering a wide range of construction equipment models suitable for the diverse construction needs in the region. The strong emphasis on infrastructure development and the need for efficient and adaptable construction machinery are among the other significant drivers driving the growth of the Asia Pacific construction equipment market.

The construction equipment market in China is projected to grow at a CAGR of 10.9% from 2024 to 2030. Additionally, the recent Regional Comprehensive Economic Partnership (RCEP) free trade agreement of China with Asia Pacific countries, including Japan, South Korea, Australia, and other smaller Southeast Asian countries, is expected to develop advanced transport infrastructure activities in the region, thereby driving the demand for construction equipment.

India construction equipment market is accounted for a 12.5% revenue share of the Asia Pacific market in 2023. The equipment growth can be attributed to the factors such as the improved economic conditions, greater private sector investment, and the development of residential and commercial infrastructure in the country. The construction of roads, railroad lines, airports, and other infrastructure has received significant funding from the U.S. government, necessitating the use of loaders, excavators, and other heavy machinery.

The construction equipment market in Japan is experiencing an increase in the use of forklifts and telescopic handlers due to factors such as technological advancements in telescopic handlers and electrification of construction equipment. Furthermore, government initiatives to boost infrastructure spending, especially related to disaster-resilient structures, have also contributed to the equipment growth in Japan.

Australia construction equipment market is projected to grow at a CAGR of 6.1% from 2024 to 2030. The growing demand for construction equipment in Australia is closely linked to the nation's commitment to investing in infrastructure development and natural resource exploration. This strategic alignment positions loaders as essential equipment for undertaking various tasks, thereby driving the growth of the market.

Europe Construction Equipment Market Trends

The Europe construction equipment market is expected to grow at a CAGR of 8.7% from 2024 to 2030. The European Union and individual countries invest heavily in infrastructure development, leading to increased construction activities and the need for specialized machinery. Investments in infrastructure projects create a favourable opportunity for construction equipment manufacturers and suppliers. Additionally, Europe is experiencing rapid urbanization, with an increasing number of people migrating to cities. Urban development projects, including residential and commercial construction, require a wide range of construction equipment. The need to accommodate the growing population, coupled with the revitalization of existing urban areas, drives the demand for construction equipment.

The construction equipment market in the UK accounted for a 21.6% revenue share of the Europe in 2023. The country growth is ascribed to factors such as the growing government spending under the U.K.’s “Net Zero Strategy" plans and "Build Back Greener". Through substantial investments in infrastructure, expertise, and innovation, the government's growth strategy, "Build Back Better," has assisted in the economic growth.

Germany construction equipment market is expected to grow at a CAGR of 9.5% from 2024 to 2030. In Germany, rising government investment in public infrastructure projects & 'Green Infrastructure Strategy' is anticipated to spur the growth of the construction equipment market. The German government under the federal ministry for housing, urban development, and building aimed at increasing the construction of homes.

The construction equipment market in France is projected to grow owing to the growing renewable energy projects, such as wind farms and solar installation requires construction machinery for site preparation, foundation work, and installation.

MEA Construction Equipment Market Trends

The construction equipment Market in the Middle East and Africa (MEA) region is anticipated to reach USD 13.66 billion by 2030. Substantial increase in government expenditures directed toward infrastructure development and large-scale projects in countries, such as Saudi Arabia, Egypt, the UAE, Kuwait, and Oman, is driving the growth of the MEA construction equipment. The construction industry in emerging nations across the region is experiencing a rapid expansion, creating a wealth of opportunities across residential, infrastructure, and non-residential construction.

The construction equipment market in Saudi Arabia is projected to grow due to support from the government through long-term economic diversification initiatives such as Saudi Vision 2030, the construction industry in Saudi Arabia has proliferated in recent years. By promoting the tourism sector, which entails building new hotels and commercial facilities, Saudi Arabia is diversifying its economic resources to lessen its dependence on crude oil exports.

Key Construction Equipment Company Insights

Some of the key players operating in the market include Caterpillar, Inc., Deere & Company, Sany Heavy Industry Co., Ltd., Komatsu Ltd., and Volvo Construction Equipment AB.

-

Caterpillar, Inc. offers a comprehensive range of construction equipment, including dozers, loaders, and excavators, among others. The company’s machines are renowned for performance, durability, and innovative features.

-

Deere & Companyheavily invests in research & development, introducing advanced technologies and innovative features in its construction equipment. The technological advancements help the company to maintain its competitiveness in the market.

Hyundai Construction Equipment Co., Ltd., HİDROMEK, and Kobelco Construction Machinery Co. Ltd. are some of the emerging market participants in the construction equipment market.

-

Hyundai Construction Equipment Co., Ltd. is engaged in construction equipment manufacturer that covers material handling and construction equipment such as excavators, backhoe loaders, wheel loaders, forklifts, and skid loaders. It is also engaged in manufacturing construction equipment and heavy machinery, such as concrete mixers, bulldozers, cranes, pavers, dredging machinery, and power shovels, used by the construction industry.

-

HİDROMEK is engaged in manufacturing of construction machinery and operates in Turkey. The company sells hydraulic excavators, backhoe loaders, motor graders, wheel loaders, and soil compactors. The company also caters to the used machinery and after-sales service requirements of customers.

Key Construction Equipment Companies:

The following are the leading companies in the construction equipment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these construction equipment companies are analyzed to map the supply network.

- Caterpillar, Inc

- CNH Industrial America LLC.

- Deere & Company

- Doosan Corporation

- Escorts Limited

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

- LIEBHERR

- MANITOU Group

- SANY Group

- Terex Corporation

- AB Volvo

- Wacker Neuson SE

- XCMG Group

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Recent Developments

-

In November 2023, Komatsu Ltd. through its subsidiary, Komatsu America Corp. agreed to acquire American Battery Solutions, Inc., a battery manufacturer based in the U.S. The acquisition of American Battery Solutions, Inc. would allow Komatsu Ltd. to manufacture and develop its own battery-operated mining and construction equipment by integrating American Battery Solutions, Inc.’s battery technology with Komatsu Ltd.’s expertise.

-

In October 2023, CASE Construction Equipment, a brand of CNH Industrial N.V., launched a lineup of small articulated loaders and mini track loaders, providing small contractors with construction-grade power to tackle more jobs with less manual labor.

-

In May 2023, Caterpillar Inc. unveiled the updated Cat D10 Dozer designed for tough construction environments and challenging job sites. The dozer incorporates a load-sensing hydraulics and stator clutch torque converter to effectively transmit power to the ground.

-

In May 2023, Hitachi Construction Machinery Co., Ltd. launched ZAXIS-7 compact excavators designed to enhance task efficiency on urban work sites. The company also launched ZX75US-7 model that featured an ultra-short-tail swing radius, which allowed access to small spaces. In addition, the ZX85USB-7 model, with its swing boom and ultra-short-tail swing radius, enabled productive excavation near walls and guardrails.

Construction Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 223.56 billion

Revenue forecast in 2030

USD 363.23 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, equipment type, propulsion type, power output, engine capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

Caterpillar, Inc.; CNH Industrial America LLC.; Deere & Company; Doosan Corporation; Escorts Limited; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Komatsu Ltd.; KUBOTA Corporation; LIEBHERR; MANITOU Group; SANY Group; Terex Corporation; AB Volvo; Wacker Neuson SE; XCMG Group; Zoomlion Heavy Industry Science&Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction equipment market report on the basis of product, equipment type, propulsion type, power output, engine capacity, and region:

-

Product Outlook (Revenue, USD Million; Volume, Units; 2018 - 2030)

-

Earth Moving Machinery

-

Excavators

-

Wheel

-

Crawler

-

-

Loaders

-

Backhoe Loaders

-

Skid Steer Loaders

-

Crawler/Track Loaders

-

Wheeled Loaders

-

-

Dump Trucks

-

Moto Graders

-

Dozers

-

Wheel

-

Crawler

-

-

-

Material Handling Machinery

-

Crawler Cranes

-

Trailer Mounted Cranes

-

Truck Mounted Cranes

-

Forklift

-

-

Concrete and Road Construction Machinery

-

Concrete Mixer & Pavers

-

Construction Pumps

-

Others

-

-

-

Equipment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Construction Equipment

-

Compact Construction Equipment

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

CNG/LNG

-

-

Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Power Output Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 HP

-

101-200 HP

-

201-400 HP

-

>401 HP

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction equipment market size was estimated at USD 207.14 billion in 2023 and is expected to reach USD 223.56 billion in 2024.

b. The global construction equipment market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 363.23 billion by 2030.

b. The Asia Pacific dominated the construction equipment market with a share of 43.8% in 2023. This is attributable to rising government funding for the development of advanced public infrastructure in the region.

b. Some key players operating in the construction equipment market include Caterpillar, Komastu, Deere and Company, Sany Heavy Industries, Volvo AB, and Hitachi Construction Ltd.

b. The construction equipment sales witnessed strong demand in 2022, owing to increased construction spending worldwide and order backlog that stalled in 2020 due to temporary lockdown imposed by various economies.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Information Procurement

1.2.1. Purchased database.

1.2.2. GVR's internal database

1.2.3. Secondary sources & third - party perspectives

1.2.4. Primary research

1.3. Information Analysis

1.3.1. Data Analysis Models

1.4. Market Formulation & Data Visualization

1.5. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Construction Equipment Market Snapshot, 2023 & 2030

2.2. Product Segment Snapshot, 2023 & 2030

2.3. Propulsion Type Segment Snapshot, 2023 & 2030

2.4. Power Output Segment Snapshot, 2023 & 2030

2.5. Competitive Landscape Snapshot, 2023 & 2030

Chapter 3. Construction Equipment Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Construction Equipment Market - Value Chain Analysis

3.3. Construction Equipment Market - Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Market Opportunity Analysis

3.4. Industry Analysis Tools

3.4.1. Construction Equipment Market - Porter's Analysis

3.4.2. Construction Equipment Market - PESTEL Analysis

Chapter 4. Construction Equipment Market Product Outlook

4.1. Construction Equipment Market Share by Product, 2023 & 2030 (USD Million) (Volume Units)

4.2. Earth Moving Machinery

4.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Volume Units)

4.2.2. Excavators

4.2.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.2.2. Wheel

4.2.2.2.1. Wheel Excavator Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.2.3. Crawler

4.2.2.3.1. Wheel Excavator Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3. Loaders

4.2.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3.2. Backhoe Loaders

4.2.3.2.1. Backhoe Loaders Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3.3. Backhoe Loaders

4.2.3.3.1. Backhoe Loaders Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3.4. Skid Steer Loaders

4.2.3.4.1. Skid Steer Loaders Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3.5. Crawler/Truck Loaders

4.2.3.5.1. Crawler/Truck Loaders Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.3.6. Wheeled

4.2.3.6.1. Wheeled Loaders Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.4. Dump Trucks

4.2.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.5. Moto Graders

4.2.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.6. Dozers

4.2.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.6.2. Wheel

4.2.6.2.1. Wheel Dozers Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.2.6.3. Crawler

4.2.6.3.1. Wheel Dozers Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.3. Material Handling Machinery

4.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Volume Units)

4.3.2. Crawler Cranes

4.3.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.3.3. Trailer Mounted Cranes

4.3.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.3.4. Truck Mounted Cranes

4.3.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.3.5. Forklift

4.3.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.4. Concrete and Road Construction Machinery

4.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million) (Volume Units)

4.4.2. Concrete Mixer & Pavers

4.4.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.4.3. Construction Pumps

4.4.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.4.4. Others

4.4.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 5. Construction Equipment Market Propulsion Type Outlook

5.1. Construction Equipment Market Share by Propulsion Type, 2023 & 2030 (USD Million)

5.2. ICE

5.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3. Electric

5.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.4. CNG/LNG

5.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 6. Construction Equipment Market Equipment Type Outlook

6.1. Construction Equipment Market Share by Equipment Type, 2023 & 2030 (USD Million)

6.2. Heavy Construction Equipment

6.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3. Compact Construction Equipment

6.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 7. Construction Equipment Market Power Output Outlook

7.1. Construction Equipment Market Share by Power Output, 2023 & 2030 (USD Million)

7.2. <100 HP

7.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.3. 101-200 HP

7.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4. 201-400 HP

7.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.5. >401 HP

7.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 8. Construction Equipment Market Engine Capacity Outlook

8.1. Construction Equipment Market Share by Engine Capacity, 2023 & 2030 (USD Million)

8.2. Up to 250 HP

8.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3. 250-500 HP

8.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4. More than 500 HP

8.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 9. Construction Equipment Market: Regional Outlook

9.1. Construction Equipment Market Share by Region, 2023 & 2030 (USD Million)

9.2. North America

9.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.2.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (Volume, Units)

9.2.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million) (Volume, Units)

9.2.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.2.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.2.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.2.7. U.S.

9.2.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.2.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.2.7.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.2.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.2.7.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.2.7.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.2.8. Canada

9.2.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.2.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.2.8.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.2.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.2.8.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.2.8.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3. Europe

9.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (Volume, Units)

9.3.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million) (Volume, Units)

9.3.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3.7. U.K.

9.3.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.3.7.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.3.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.7.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.7.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3.8. Germany

9.3.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.3.8.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.3.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.8.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.8.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3.9. France

9.3.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.3.9.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.3.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.9.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.9.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3.10. Italy

9.3.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.10.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.3.10.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.3.10.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.10.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.10.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.3.11. Spain

9.3.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.3.11.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.3.11.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.3.11.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.3.11.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.3.11.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (Volume, Units)

9.4.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million) (Volume, Units)

9.4.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4.7. China

9.4.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.4.7.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.4.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.7.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.7.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4.8. India

9.4.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.4.8.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.4.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.8.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.8.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4.9. Japan

9.4.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.4.9.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.4.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.9.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.9.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4.10. Australia

9.4.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.10.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.4.10.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.4.10.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.10.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.10.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.4.11. South Korea

9.4.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.4.11.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.4.11.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.4.11.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.4.11.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.4.11.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.5. Latin America

9.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.5.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (Volume, Units)

9.5.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million) (Volume, Units)

9.5.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.5.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.5.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.5.7. Brazil

9.5.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.5.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.5.7.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.5.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.5.7.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.5.7.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.5.8. Mexico

9.5.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.5.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.5.8.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.5.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.5.8.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.5.8.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.5.9. Argentina

9.5.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.5.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.5.9.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.5.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.5.9.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.5.9.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (Volume, Units)

9.6.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million) (Volume, Units)

9.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.6.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.6.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.6.7. U.A.E.

9.6.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.6.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.6.7.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.6.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.6.7.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.6.7.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.6.8. Saudi Arabia

9.6.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.6.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.6.8.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.6.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.6.8.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.6.8.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

9.6.9. South Africa

9.6.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

9.6.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

9.6.9.3. Market Estimates and Forecast by Equipment Type, 2018 - 2030 (USD Million)

9.6.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

9.6.9.5. Market Estimates and Forecast by Power Output, 2018 - 2030 (USD Million)

9.6.9.6. Market Estimates and Forecast by Engine Capacity, 2018 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Company Categorization

10.2. Company Share Analysis, 2023

10.3. Company Heat Map Analysis, 2023

10.4. Strategy Mapping

10.5. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

10.5.1. Caterpillar, Inc.

10.5.1.1. Company Overview

10.5.1.2. Financial Performance

10.5.1.3. Product Benchmarking

10.5.1.4. Recent Developments

10.5.2. CNH Industrial America LLC

10.5.2.1. Company Overview

10.5.2.2. Financial Performance

10.5.2.3. Product Benchmarking

10.5.2.4. Recent Developments

10.5.3. Deere & Company

10.5.3.1. Company Overview

10.5.3.2. Financial Performance

10.5.3.3. Product Benchmarking

10.5.3.4. Recent Developments

10.5.4. Doosan Corporation

10.5.4.1. Company Overview

10.5.4.2. Financial Performance

10.5.4.3. Product Benchmarking

10.5.4.4. Recent Developments

10.5.5. Escorts Limited

10.5.5.1. Company Overview

10.5.5.2. Financial Performance

10.5.5.3. Product Benchmarking

10.5.5.4. Recent Developments

10.5.6. Hitachi Construction Machinery Co., Ltd.

10.5.6.1. Company Overview

10.5.6.2. Financial Performance

10.5.6.3. Product Benchmarking

10.5.6.4. Recent Developments

10.5.7. Hyundai Construction Equipment Co., Ltd.

10.5.7.1. Company Overview

10.5.7.2. Financial Performance

10.5.7.3. Product Benchmarking

10.5.7.4. Recent Developments

10.5.8. J C Bamford Excavators Ltd.

10.5.8.1. Company Overview

10.5.8.2. Financial Performance

10.5.8.3. Product Benchmarking

10.5.8.4. Recent Developments

10.5.9. Komatsu Ltd.

10.5.9.1. Company Overview

10.5.9.2. Financial Performance

10.5.9.3. Product Benchmarking

10.5.9.4. Recent Developments

10.5.10. KUBOTA Corporation

10.5.10.1. Company Overview

10.5.10.2. Financial Performance

10.5.10.3. Product Benchmarking

10.5.10.4. Recent Developments

10.5.11. LIEBHERR

10.5.11.1. Company Overview

10.5.11.2. Financial Performance

10.5.11.3. Product Benchmarking

10.5.11.4. Recent Developments

10.5.12. MANITOU Group

10.5.12.1. Company Overview

10.5.12.2. Financial Performance

10.5.12.3. Product Benchmarking

10.5.12.4. Recent Developments

10.5.13. SANY Group

10.5.13.1. Company Overview

10.5.13.2. Financial Performance

10.5.13.3. Product Benchmarking

10.5.13.4. Recent Developments

10.5.14. Terex Corporation

10.5.14.1. Company Overview

10.5.14.2. Financial Performance

10.5.14.3. Product Benchmarking

10.5.14.4. Recent Developments

10.5.15. AB Volvo

10.5.15.1. Company Overview

10.5.15.2. Financial Performance

10.5.15.3. Product Benchmarking

10.5.15.4. Recent Developments

10.5.16. Wacker Neuson SE

10.5.16.1. Company Overview

10.5.16.2. Financial Performance

10.5.16.3. Product Benchmarking

10.5.16.4. Recent Developments

10.5.17. XCMG Group

10.5.17.1. Company Overview

10.5.17.2. Financial Performance

10.5.17.3. Product Benchmarking

10.5.17.4. Recent Developments

10.5.18. Zoomlion Heavy Industry Science&Technology Co., Ltd.

10.5.18.1. Company Overview

10.5.18.2. Financial Performance

10.5.18.3. Product Benchmarking

10.5.18.4. Recent Developments

List of Tables

Table 1 Construction equipment market — Industry snapshot & key buying criteria, 2018 - 2030

Table 2 Global construction equipment market, 2018 - 2030 (USD Million)

Table 3 Global construction equipment market, by region, 2018 - 2030 (USD Million)

Table 4 Global construction equipment market, by product, 2018 - 2030 (USD Million)

Table 5 Global construction equipment market, by equipment type, 2018 - 2030 (Volume, Units)

Table 6 Global construction equipment market, by propulsion type, 2018 - 2030 (Volume, Units)

Table 7 Global construction equipment market, by power output, 2018 - 2030 (Volume, Units)

Table 8 Global construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 9 Vendor landscape

Table 10 Earth Moving Machinery market, 2018 - 2030 (USD Million)

Table 11 Earth Moving Machinery market, by region, 2018 - 2030 (USD Million)

Table 12 Earth Moving Machinery market, by region, 2018 - 2030 (Volume, Units)

Table 13 Excavators market, 2018 - 2030 (USD Million)

Table 14 Excavators market, by region, 2018 - 2030 (USD Million)

Table 15 Wheel Excavator Market, 2018 - 2030 (USD Million)

Table 16 Crawler Excavator Market, 2018 - 2030 (USD Million)

Table 17 Loader market, 2018 - 2030 (USD Million)

Table 18 Loader market, by region, 2018 - 2030 (USD Million)

Table 19 Backhoe Loader market, 2018 - 2030 (USD Million)

Table 20 Skid Steer Loader market, 2018 - 2030 (USD Million)

Table 21 Crawler/Truck Loader market, 2018 - 2030 (USD Million)

Table 22 Wheeled Loader market, 2018 - 2030 (USD Million)

Table 23 Dump Trucks market, 2018 - 2030 (USD Million)

Table 24 Dump Trucks market, by region, 2018 - 2030 (USD Million)

Table 25 Moto Graders market, 2018 - 2030 (USD Million)

Table 26 Moto Graders market, by region, 2018 - 2030 (USD Million)

Table 27 Dozers market, 2018 - 2030 (USD Million)

Table 28 Dozers market, by region, 2018 - 2030 (USD Million)

Table 29 Wheel Dozers market, 2018 - 2030 (USD Million)

Table 30 Crawler Dozers market, 2018 - 2030 (USD Million)

Table 31 Material Handling Machinery market, 2018 - 2030 (USD Million)

Table 32 Material Handling Machinery market, by region, 2018 - 2030 (USD Million)

Table 33 Crawler Cranes market, 2018 - 2030 (USD Million)

Table 34 Crawler Cranes market, by region, 2018 - 2030 (USD Million)

Table 35 Trailer Mounted Cranes market, 2018 - 2030 (USD Million)

Table 36 Trailer Mounted Cranes market, by region, 2018 - 2030 (USD Million)

Table 37 Truck Mounted Cranes market, 2018 - 2030 (USD Million)

Table 38 Truck Mounted Cranes market, by region, 2018 - 2030 (USD Million)

Table 39 Forklift market, 2018 - 2030 (USD Million)

Table 40 Forklift market, by region, 2018 - 2030 (USD Million)

Table 41 Concrete and Road Construction Machinery market, 2018 - 2030 (USD Million)

Table 42 Concrete and Road Construction Machinery market, by region, 2018 - 2030 (USD Million)

Table 43 Concrete Mixer & Pavers market, 2018 - 2030 (USD Million)

Table 44 Concrete Mixer & Pavers market, by region, 2018 - 2030 (USD Million)

Table 45 Construction Pumps market, 2018 - 2030 (USD Million)

Table 46 Construction Pumps market, by region, 2018 - 2030 (USD Million)

Table 47 Others construction equipment market, 2018 - 2030 (USD Million)

Table 48 Others construction equipment market, by region, 2018 - 2030 (USD Million)

Table 49 Heavy construction equipment market, 2018 - 2030 (USD Million)

Table 50 Heavy construction equipment market, by region, 2018 - 2030 (USD Million)

Table 51 Compact construction equipment market, 2018 - 2030 (USD Million)

Table 52 Compact construction equipment market, by region, 2018 - 2030 (USD Million)

Table 53 ICE construction equipment market, 2018 - 2030 (USD Million)

Table 54 ICE construction equipment market, by region, 2018 - 2030 (USD Million)

Table 55 Electric construction equipment services market, 2018 - 2030 (USD Million)

Table 56 Electric construction equipment services market, by region, 2018 - 2030 (USD Million)

Table 57 CNG/LNG construction equipment services market, 2018 - 2030 (USD Million)

Table 58 CNG/LNG construction equipment services market, by region, 2018 - 2030 (USD Million)

Table 59 Up to 250 HP construction equipment market, 2018 - 2030 (USD Million)

Table 60 Up to 250 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 61 250-500 HP construction equipment market, 2018 - 2030 (USD Million)

Table 62 250-500 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 63 More than 500 HO construction equipment market, 2018 - 2030 (USD Million)

Table 64 More than 500 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 65 <100 HP construction equipment market, 2018 - 2030 (USD Million)

Table 66 <100 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 67 101-200 HP construction equipment market, 2018 - 2030 (USD Million)

Table 68 101-200 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 69 201-400 HP construction equipment market, 2018 - 2030 (USD Million)

Table 70 201-400 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 71 >401 HP construction equipment market, 2018 - 2030 (USD Million)

Table 72 >401 HP construction equipment market, by region, 2018 - 2030 (USD Million)

Table 73 North America construction equipment market, 2018 - 2030 (USD Million)

Table 74 North America construction equipment market, by product, 2018 - 2030 (USD Million)

Table 75 North America construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 76 North America construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 77 North America construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 78 North America construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 79 The U.S. construction equipment market, 2018 - 2030 (USD Million)

Table 80 The U.S. construction equipment market, by product, 2018 - 2030 (USD Million)

Table 81 The U.S. construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 82 The U.S. construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 83 The U.S. construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 84 The U.S. construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 85 Canada construction equipment market, 2018 - 2030 (USD Million)

Table 86 Canada construction equipment market, by product, 2018 - 2030 (USD Million)

Table 87 Canada construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 88 Canada construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 89 Canada construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 90 Canada construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 91 Europe construction equipment market, 2018 - 2030 (USD Million)

Table 92 Europe construction equipment market, by product, 2018 - 2030 (USD Million)

Table 93 Europe construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 94 Europe construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 95 Europe construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 96 Europe construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 97 Germany construction equipment market, 2018 - 2030 (USD Million)

Table 98 Germany construction equipment market, by product, 2018 - 2030 (USD Million)

Table 99 Germany construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 100 Germany construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 101 Germany construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 102 Germany construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 103 The U.K. construction equipment market, 2018 - 2030 (USD Million)

Table 104 The U.K. construction equipment market, by product, 2018 - 2030 (USD Million)

Table 105 The U.K. construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 106 The U.K. construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 107 The U.K. construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 108 The U.K. construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 109 France construction equipment market, 2018 - 2030 (USD Million)

Table 110 France construction equipment market, by product, 2018 - 2030 (USD Million)

Table 111 France construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 112 France construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 113 France construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 114 France construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 115 Italy construction equipment market, 2018 - 2030 (USD Million)

Table 116 Italy construction equipment market, by product, 2018 - 2030 (USD Million)

Table 117 Italy construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 118 Italy construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 119 Italy construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 120 Italy construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 121 Spain construction equipment market, 2018 - 2030 (USD Million)

Table 122 Spain construction equipment market, by product, 2018 - 2030 (USD Million)

Table 123 Spain construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 124 Spain construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 125 Spain construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 126 Spain construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 127 Asia Pacific construction equipment market, 2018 - 2030 (USD Million)

Table 128 Asia Pacific construction equipment market, by product, 2018 - 2030 (USD Million)

Table 129 Asia Pacific construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 130 Asia Pacific construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 131 Asia Pacific construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 132 Asia Pacific construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 133 China construction equipment market, 2018 - 2030 (USD Million)

Table 134 China construction equipment market, by product, 2018 - 2030 (USD Million)

Table 135 China construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 136 China construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 137 China construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 138 China construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 139 India construction equipment market, 2018 - 2030 (USD Million)

Table 140 India construction equipment market, by product, 2018 - 2030 (USD Million)

Table 141 India construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 142 India construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 143 India construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 144 India construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 145 Japan construction equipment market, 2018 - 2030 (USD Million)

Table 146 Japan construction equipment market, by product, 2018 - 2030 (USD Million)

Table 147 Japan construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 148 Japan construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 149 Japan construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 150 Japan construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 151 Australia construction equipment market, 2018 - 2030 (USD Million)

Table 152 Australia construction equipment market, by product, 2018 - 2030 (USD Million)

Table 153 Australia construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 154 Australia construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 155 Australia construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 156 Australia construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 157 South Korea construction equipment market, 2018 - 2030 (USD Million)

Table 158 South Korea construction equipment market, by product, 2018 - 2030 (USD Million)

Table 159 South Korea construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 160 South Korea construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 161 South Korea construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 162 South Korea construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 163 Latin America construction equipment market, 2018 - 2030 (USD Million)

Table 164 Latin America construction equipment market, by product, 2018 - 2030 (USD Million)

Table 165 Latin America construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 166 Latin America construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 167 Latin America construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 168 Latin America construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 169 Brazil construction equipment market, 2018 - 2030 (USD Million)

Table 170 Brazil construction equipment market, by product, 2018 - 2030 (USD Million)

Table 171 Brazil construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 172 Brazil construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 173 Brazil construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 174 Brazil construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 175 Mexico construction equipment market, 2018 - 2030 (USD Million)

Table 176 Mexico construction equipment market, by product, 2018 - 2030 (USD Million)

Table 177 Mexico construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 178 Mexico construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 179 Mexico construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 180 Mexico construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 181 Argentina construction equipment market, 2018 - 2030 (USD Million)

Table 182 Argentina construction equipment market, by product, 2018 - 2030 (USD Million)

Table 183 Argentina construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 184 Argentina construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 185 Argentina construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 186 Argentina construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 187 Middle East & Africa construction equipment market, 2018 - 2030 (USD Million)

Table 188 Middle East & Africa construction equipment market, by product, 2018 - 2030 (USD Million)

Table 189 Middle East & Africa construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 190 Middle East & Africa construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 191 Middle East & Africa construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 192 Middle East & Africa construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 193 The U.A.E. construction equipment market, 2018 - 2030 (USD Million)

Table 194 The U.A.E. construction equipment market, by product, 2018 - 2030 (USD Million)

Table 195 The U.A.E. construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 196 The U.A.E. construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 197 The U.A.E. construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 198 The U.A.E. construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 199 Saudi Arabia construction equipment market, 2018 - 2030 (USD Million)

Table 200 Saudi Arabia construction equipment market, by product, 2018 - 2030 (USD Million)

Table 201 Saudi Arabia construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 202 Saudi Arabia construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 203 Saudi Arabia construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 204 Saudi Arabia construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

Table 205 South Africa construction equipment market, 2018 - 2030 (USD Million)

Table 206 South Africa construction equipment market, by product, 2018 - 2030 (USD Million)

Table 207 South Africa construction equipment market, by propulsion type, 2018 - 2030 (USD Million)

Table 208 South Africa construction equipment market, by equipment type, 2018 - 2030 (USD Million)

Table 209 South Africa construction equipment market, by power output, 2018 - 2030 (USD Million)

Table 210 South Africa construction equipment market, by engine capacity, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market segmentation and scope

Fig. 2 Construction equipment market, 2018 - 2030 (USD Million)

Fig. 3 Construction equipment market - Value chain analysis

Fig. 4 Construction equipment market - Market dynamics

Fig. 5 Construction equipment market - Key market driver impact

Fig. 6 Construction equipment market - Key market restraint impact

Fig. 7 Construction equipment market - Key opportunities prioritized.

Fig. 8 Construction equipment market - Porter’s five forces analysis

Fig. 9 Construction equipment market - PESTEL analysis

Fig. 10 Construction equipment market, by product, 2023

Fig. 11 Construction equipment market, by equipment type, 2023

Fig. 12 Construction equipment market, by propulsion type, 2023

Fig. 13 Construction equipment market, by power output, 2023

Fig. 14 Construction equipment market, by engine capacity, 2023

Fig. 15 Construction equipment market, by region, 2023

Fig. 16 Construction equipment market - Regional takeaways

Fig. 17 North America construction equipment market - Key takeaways

Fig. 18 Europe construction equipment market - Key takeaways

Fig. 19 Asia Pacific construction equipment market - Key takeaways

Fig. 20 Latin America construction equipment market - Key takeaways

Fig. 21 Middle East & Africa construction equipment market - Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Product Outlook (Revenue, USD Million, 2018 - 2030)

- Earth Moving Machinery

- Excavators

-

- Wheel

- Crawler

-

- Loaders

-

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

-

- Dump Trucks

- Moto Graders

- Dozers

-

- Wheel

- Crawler

-

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- Equipment Type Outlook (Revenue, USD Million, 2018 - 2030)

- Heavy Construction Equipment

- Compact Construction Equipment

- Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- CNG/LNG

- Power Output Outlook (Revenue, USD Million, 2018 - 2030)

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- Region Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- North America Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- North America Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- North America Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- North America Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- U.S.

- U.S. Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- U.S. Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- U.S. Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- U.S. Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- U.S. Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- U.S. Construction Equipment Market, by Product

- Canada

- Canada Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- Canada Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- Canada Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- Canada Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- Canada Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- Canada Construction Equipment Market, by Product

- North America Construction Equipment Market, by Product

- Europe

- Europe Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- Europe Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- Europe Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- Europe Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- Europe Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- U.K.

- U.K. Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- U.K. Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- U.K. Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- U.K. Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- U.K. Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- U.K. Construction Equipment Market, by Product

- Germany

- Germany Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- Germany Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- Germany Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- Germany Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- Germany Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- Germany Construction Equipment Market, by Product

- France

- France Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- France Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- France Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- France Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- France Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- France Construction Equipment Market, by Product

- Italy

- Italy Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

- Italy Construction Equipment Market, by Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

- Italy Construction Equipment Market, by Propulsion Type

- ICE

- Electric

- CNG/LNG

- Italy Construction Equipment Market, by Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

- Italy Construction Equipment Market, by Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

- Italy Construction Equipment Market, by Product

- Spain

- Spain Construction Equipment Market, by Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers