- Home

- »

- Next Generation Technologies

- »

-

Contactless Payment Market Size, Share & Growth Report,2030GVR Report cover

![Contactless Payment Market Size, Share & Trends Report]()

Contactless Payment Market Size, Share & Trends Analysis Report By Type (Smartphone Based Payments, Card Based Payments) By Application (Retail, Transportation, Healthcare, Hospitality), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-217-4

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

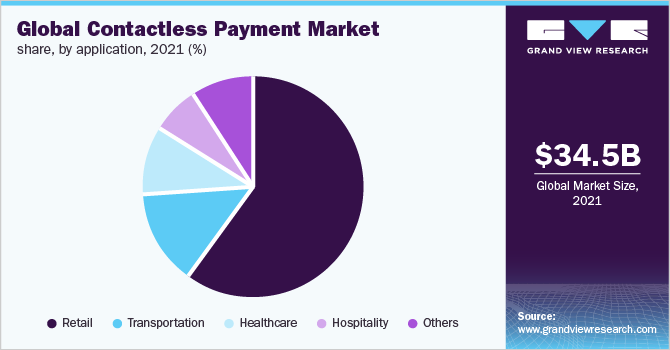

The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030. The growth is attributed to the increasing global adoption of digital payment platforms designed for facilitating customer payments at a faster rate. Contactless payments include intelligent hardware, innovative software, and smart services that improve traditional payment systems and introduce intelligent transactions. Additionally, card issuers are increasingly implementing contactless mechanisms for payment cards across the globe, thereby contributing to the growth of the market.

Customers are gradually focusing on making contactless payments for many of their daily transactions. Leading players worldwide are focusing on making efforts to grow and expand in the increasingly competitive market. For instance, in September 2021, PayPal, Inc. introduced a new all-in-one app called PayPal app, which provides better financial services to its customers. The new PayPal app offers a single dashboard of the customer's accounts, a wallet tab for managing payment instruments, and other financial services to provide a better customer experience.

Continuous product and service innovation and advancements in payment security technologies are the factors supporting market growth. Contactless payment methods, such as contactless cards, digital wallets, QR codes, and Tap to Pay, have emerged, further safeguarding payments and making them simple and effortless. Contactless payment technologies such as Near Field Communication (NFC) and Radio-Frequency Identification (RFID) ensures faster transaction with touch and go and helps to reduce queues. At the same time, the market is anticipated to be driven by the rising demand from consumers and merchants to reduce transaction and billing time.

Contactless payments help to reduce friction and provide a better purchasing experience for customers. Reduced transaction time offers positive results, which also depend upon the number of transactions conducted during peak hours. Moreover, the rising advancements and government initiatives in networking infrastructure to develop intelligent solutions are expected to drive market growth. Several governments around the world are encouraging merchants to adopt advanced payment solutions. Furthermore, increased adoption of technologies to reduce operational costs and provide convenience as well as efficiency services drives the growth of the contactless payment market.

Huge involvement in the cost of deploying contactless payment technologies is expected to limit market growth. Additionally, a lack of trust caused by security concerns, data theft, and unauthorized use of contactless payment methods is expected to restrain the market growth during the forecast period. Rising cyber-attacks and a lack of infrastructure in developing economies are anticipated to restrain market growth. Financial regulators worldwide need to educate and make people aware of contactless payment methods that are secure and scalable, thereby contributing to the growth of the market.

COVID-19 Impact Analysis

The COVID-19 pandemic played a significant role in driving the market growth during the forecast period. The rising awareness among people across the globe has led to the popularity of contactless payment methods. Increasing preference for contactless payment solutions in the wake of the pandemic is opening opportunities for adopting contactless payments. At the same time, several vendors are also adopting contactless payments as a part of their daily use to ensure a safe and secure way of payment for customers.

Type Insights

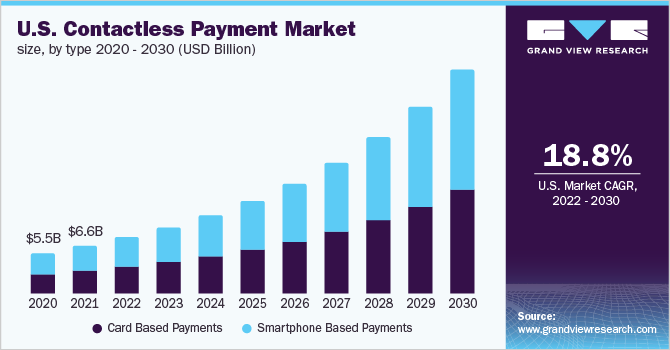

The smartphone-based payments segment led the market and accounted for more than 50.0% share of the global revenue in 2021. The rising penetration of smartphone devices used for making payments among the youth population across the globe is anticipated to generate growth opportunities for the segment. The use of digital wallets for making contactless payments through smartphones has increased the usage of smartphones in everyday tasks and activities. For instance, in the U.S., the smartphone penetration rate reached all the way up to 85.0% in February 2021. Furthermore, innovations in wearables, such as payment bands and payment rings for making contactless payments, are expected to propel the segment's growth.

The card based payments segment is expected to witness significant growth during the forecast period. The growing adoption of contactless cards, such as credit and debit cards for making payments in sectors such as BSFI, retail, transportation, hospitality, and the government, is expected to drive segment growth. Additionally, the acceptance of contactless cards by retailers is becoming more common, worldwide. For instance, in 2021, more than two-thirds of retailers in the U.S. have started accepting contactless payments through contactless cards. Moreover, merchant outlets are also focusing on reducing end-user queues by allowing them to use cards for quick transactions.

Application Insights

The retail segment dominated the market and accounted for more than 59.0% share of the global revenue in 2021. The growth of segment can be attributed to an increase in the number of 'tap-and-go' transactions around the globe. Retailers are adopting numerous innovative technologies, such as social networks, cloud computing, and digital stores, to increase their presence in the market. Moreover, retailers also understand the benefits of contactless payments, which include reduced transaction time, increased revenue, and improved operational efficiency. For instance, according to the global MasterCard study of 2020, 74.0% of retailers worldwide would plan to continue to use contactless payments after the pandemic situation.

The hospitality segment is expected to register the highest CAGR during the forecast period. Moreover, contactless payment is becoming increasingly prevalent throughout the hospitality industry. Hospitality businesses have started adopting some of the most cutting-edge technology while offering their guests a more user-friendly experience. Hospitality businesses have started deploying self-service kiosks that enable customers to pay for purchases without any human interaction with hotel staff. Moreover, hotels and motels are adopting payment solutions owing to the various benefits it offers, such as a high level of customer satisfaction and fast & secure transactions.

Regional Insights

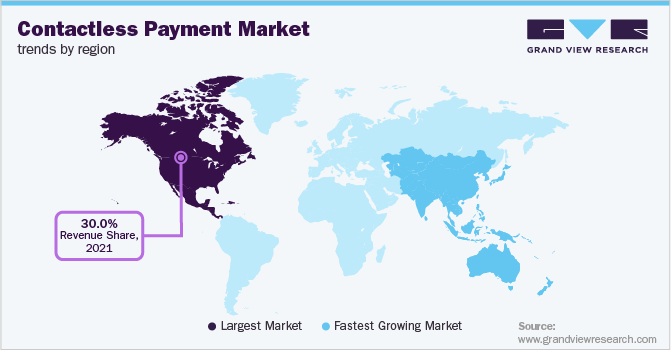

North America led the contactless payment market and accounted for more than a 30.0% share of the global revenue in 2021. North America is witnessing aggressive investments in developing technologically advanced solutions for contactless payments, such as NFCs and RFIDs. Additionally, a growing preference for digitization, the Internet of Things (IoT), and big data is anticipated to drive demand for advanced hardware and software solutions from the incumbents of the contactless payment solution providers within the region, which bodes well for the growth of the regional market. At the same time, consumers in Canada are focusing on adopting digital wallets as it allows them to load their debit card information onto their mobile wallet and pay in a few easy steps.

Asia Pacific is expected to emerge as the fastest-growing regional market during the forecast period. The presence and concentration of prominent mobile wallet providers such as Alipay, Paytm, Phone Pe and Google Pay provide a high potential for the contactless payment market in the Asia Pacific. Moreover, favorable economic conditions and growth of the mobile wallets in various retail applications create more expansion opportunities, which, in turn, boosts Asia Pacific market growth. At the same time, the initiatives pursued by the government of Japan to transform financial services into a digital platform are expected to drive the growth of the contactless payment market during the forecast period.

Key Companies & Market Share Insights

The vendors operating in the contactless payment market mainly used initiatives such as partnerships and collaborations to launch new products, and expand as well as offer contactless payment solutions to various end users. Demand for contactless payments is attributed to the ability of simplified payments at a faster rate. For instance, in December 2021, Visa Inc. launched India’s roadmap to strengthen payment security. This program aims at securing India’s dynamic digital payments ecosystem from emerging threats and cyberattacks.

Numerous digital wallet solution providers, such as Google Pay and Samsung Pay, offer their contactless services at no charge to consumers as well as merchants. Vendors are also focusing on business strategies, such as partnerships. For instance, IDEMIA announced its partnership with Soft Space in March 2022 to enable contactless payment acceptance. This collaboration aims to accept mobile wallet and card payments across the world by simply converting a tablet or smartphone into a point-of-sale (POS) terminal by merchants and acquirers. Some of the prominent players in the global contactless payment market include:

-

Thales

-

Visa Inc.

-

Giesecke & Devrient GmbH

-

MasterCard

-

Apple Inc.

-

PayPal Holdings Inc.

-

American Express Company

-

Amazon.com, Inc.

-

Alibaba.com.

-

PayU

Contactless Payment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 40.62 billion

Revenue forecast in 2030

USD 164.15 billion

Growth rate

CAGR of 19.1% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

Thales; Visa Inc.; Giesecke&Devrient GmbH; MasterCard; Apple Inc.; PayPal Holdings Inc.; American Express Company; Amazon.com, Inc.; Alibaba.com.; PayU

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contactless Payment Market Segmentation

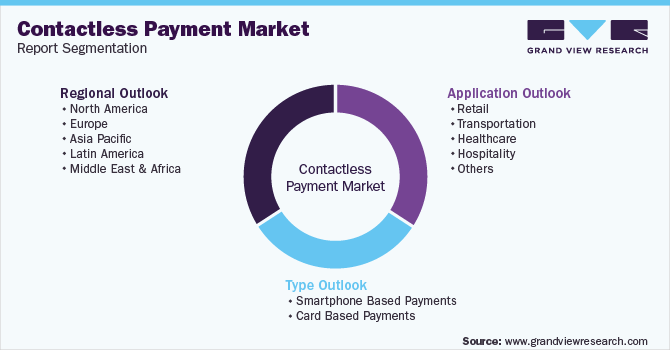

The report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global contactless payment market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphone Based Payments

-

Card Based Payments

-

Credit Cards

-

Debit Cards

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Consumer Electronics

-

Fashion & Garments

-

Others

-

-

Transportation

-

Healthcare

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global contactless payment market size was estimated at USD 34.55 billion in 2021 and is expected to reach USD 40.62 billion in 2022.

b. The global contactless payment market is expected to grow at a compound annual growth rate of 19.1% from 2022 to 2030 and is expected to reach USD 164.15 billion by 2030.

b. North America dominated the contactless payment market with a share of 30.7% in 2021. This is attributable to the early penetration and adoption of contactless payments in several North American countries.

b. Some key players operating in the contactless payment market include Thales, Visa Inc., Giesecke & Devrient GmbH; Mastercard; Apple Inc.; PayPal Holdings Inc.; American Express Company; Amazon.com, Inc.; Alibaba.com., PayU.

b. Key factors that are driving the market growth include increasing adoption of digital payment platforms, growing customer convenience for low-value payment, and technology innovation in contactless payment devices and services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."