- Home

- »

- IT Services & Applications

- »

-

Content Management Software Market Size, Industry Report, 2025GVR Report cover

![Content Management Software Market Size, Share & Trends Report]()

Content Management Software Market Size, Share & Trends Analysis Report By End-use (BFSI, Retail), By Type (Solution, Services), By Enterprise Size (Large, SMEs), By Deployment (Cloud, On-premise), By Solution, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-146-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Market Size & Trends

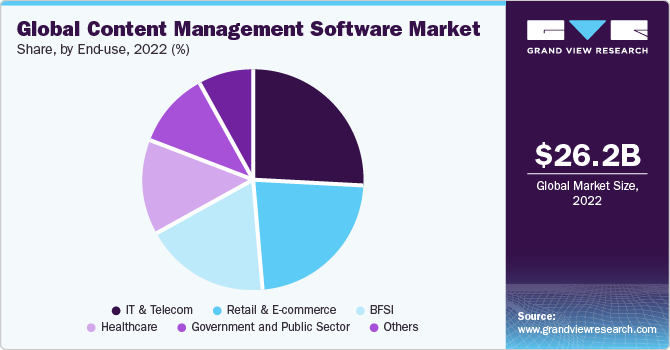

The global content management software market size was estimated at USD 26.19 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The market for content management software (CMS) is primarily driven by the increasing amount of content created by businesses and individual creators. As social media and digital communication channels continue to expand, there is a growing need for solutions that can help organize, store, and distribute large quantities of digital data effectively. Furthermore, companies are actively looking for software that can be integrated with other business applications for enhanced security, visibility, collaboration, and security. Thus, these factors are expected to drive the demand for CMS solutions during the forecast period.

The growing importance of personalized and tailored content is driving the need, for sophisticated software to manage it. Companies are prioritizing the delivery of personalized content experiences for their customers to increase engagement and satisfaction. Key companies are making strategic decisions to integrate advanced technologies in their CMS to help businesses analyze customer behavior, preferences, and demographic information. For instance, in June 2023, IBM Corporation announced its plan to expand its long-term collaboration with Adobe to help companies boost creative potential, accelerate processes, and improve transparency by implementing next-generation Artificial Intelligence (AI) technology including Adobe Firefly and Adobe Sensei GenAI services, Adobe's creative generative AI models.

Thus, the growing initiatives by leading players in the market are expected to strengthen the market growth. The increasing data security concerns and rising regulatory compliances are accelerating the adoption of CMS among businesses. Content management systems with security features including encryption protocols and compliance management assist organizations in adhering to regulations and safeguarding their data against access or breaches, creating a positive outlook for the market. For instance, in September 2023, Hexure, a sales automation software company, announced a partnership with Paperclip, a content management & data Security company. This partnership aims to strengthen application data workflows and streamline operations by integrating Hexure’s sales automation end-uses, FireLight, Paperclip VCF, Paperclip Mojo, and Paperclip SAFE.

The following initiative is expected to help customers in data transmission, transcription, and storage, proving a significant impact on their everyday operations and content management capabilities. Businesses are increasingly recognizing the significance of content management in creating personalized experiences that resonate with their target audience. To orchestrate personalized client journeys, content management systems are increasingly being associated with marketing automation end-uses, thereby supporting market growth. This integration enables automated content distribution based on customer behavior, ensuring that the right content is delivered at the right time through various marketing channels.

For instance, in July 2023, Twilio Inc., a programmable communication tools provider, announced a partnership with Contentful, a content management company, to transform omnichannel consumer engagement with data-driven personalization, allowing organizations to develop personalized content experiences and optimize the customer journey. Businesses can now use their first-party data to personalize content for their consumers due to the new integration between the Twilio Segment and the Contentful Composable Content End Use. Such developments are expected to drive the market growth. The rise of voice-enabled technologies is expected to provide an array of opportunities for product adoption.

With the proliferation of virtual assistants and smart speakers, voice-activated content management presents a previously untapped future. Future CMS can leverage natural language processing(NLP) and voice recognition to enable users to create, edit, and manage content through spoken commands. This hands-free approach not only enhances accessibility but also opens avenues for novel content experiences, especially in the context of mobile and IoT devices. In addition, industries, such as retail, IT & telecom, and tourism, are expected to benefit significantly from voice-enabled content strategies that enhance engagement and user experience, supporting market growth.

Type Insights

The solution segment accounted for the largest share of 73.5% in 2022. The segment growth can be attributed to the increasing integration of CMS solutions with real-time collaboration features, allowing multiple users to collaborate on content creation simultaneously. Workflow automation tools were employed to streamline content creation processes, from drafting to approval. Furthermore, the emergence of decentralized content management solutions leveraging blockchain or distributed ledger technologies is expected to drive market growth. These solutions aim to provide increased security, reduce dependency on centralized servers, and enhance content distribution efficiency.

The services segment is expected to grow at a CAGR of 11.7% during the forecast period. Managed content services, in which third-party companies handle various aspects of content management, such as updates, security, and performance monitoring, are becoming increasingly popular among businesses. This allows organizations to concentrate on their primary business activities while ensuring their CMS runs smoothly. Furthermore, as CMS end-users evolve, there is an increasing demand for systems that enable smooth content migration. Service providers provide expertise in transferring material from legacy systems to advanced content management software end-users with low disturbance and data integrity. All these factors are expected to drive the market growth.

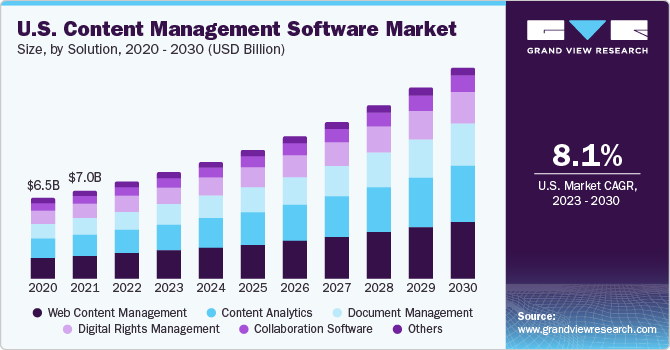

Solution Insights

The web contentmanagement segment accounted for the largest share of 26.5% in 2022 due to AI-driven content optimization and intelligent chatbot integration. AI is used in advanced web content management solutions for not just personalization but also for dynamic content optimization. AI systems analyze user interactions in real-time and adjust content elements, such as images, layout, and calls-to-action, to increase engagement and conversions. Furthermore, these end-users are increasingly utilizing intelligent chatbots to boost user engagement. These chatbots, which are powered by NLP and machine learning (ML), respond to user inquiries in real-time and in a personalized manner. This development is especially prominent in industries where real-time engagement is crucial for consumer satisfaction and conversions, such as e-commerce.

The content analytics segment is expected to grow at a CAGR of 11.7% during the forecast period. The segment growth can be attributed to the growing integration of attribution modeling, which is becoming more advanced in content analytics, to link conversions and user activities to specific content touchpoints. This enables a more precise assessment of the content's contribution to user journeys and conversion funnels. With the growth of visual content, analytics solutions for analyzing photos and videos are rising. To determine the impact of visual features on user engagement, visual content analytics uses picture recognition and video analysis algorithms. This advancement is especially crucial in industries that rely heavily on visual content, such as e-commerce.

Deployment Insights

The cloud segment accounted for the largest share of 54.5% in 2022 due to the availability of several cloud service models, such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). These models offer various benefits, such as scalability, automatic updates, accessibility, and customization, which allow organizations to choose the model that best suits their needs and requirements. The necessity of leveraging technological advances to develop and implement new business models has compelled organizations to reevaluate their current capabilities, structures, and culture. Cloud-based CMS is critical in supporting digital transformation activities by offering a centralized end-use for managing and delivering content across multiple channels, which is further expected to drive segment growth.

The on-premises segment is expected to grow at a CAGR of 8.7% over the forecast period. On-premises implementation is preferable for organizations that have extensively invested in legacy systems since it allows them to effortlessly integrate their CMS with existing infrastructure and workflows. Moreover, with growing concerns about data privacy and security, organizations in industries, such as healthcare, banking, and government, are turning to on-premises deployment to maintain complete control over their data and ensure compliance with stringent requirements. All these factors are expected to boost the market growth over the forecast.

Enterprise Size Insights

The small- & medium-sized Enterprises (SMEs) segment held a share of 36.7% in 2022 and is expected to dominate the market during the forecast years. The segment growth can be attributed to the increasing demand for content marketing and CMS solutions with automation features. Content marketing automation streamlines tasks, such as scheduling, social media integration, and analytics. This development emphasizes the necessity for SMEs to implement and measure the impact of their content marketing strategy efficiently. Moreover, several SMEs are engaged in e-commerce activities, and CMS solutions with integrated e-commerce capabilities are gaining traction. These features enable SMEs to manage product information, handle transactions, and maintain an online presence seamlessly, thereby driving market growth.

The large enterprises segment is expected to have a significant CAGR of 9.4% over the forecast period. Large enterprises are shifting away from traditional content management systems to integrated Digital Experience End Uses (DXPs). These systems provide a comprehensive solution that includes content management, analytics, personalization, and omnichannel delivery. This shift indicates the requirement for a unified solution that can coordinate smooth and engaging brand experiences. For instance, in August 2023, Contentful, a content management system provider, announced a partnership with WPP, an advertising agency group. Contentful and WPP partnered to invest strategically in joint product development and innovation to create composable content solutions for accessible and inclusive brand experiences that drive growth. Contentful, as a partner, will give WPP the tools and knowledge to complement WPP's existing services, such as Brand Guardian, an AI-powered accessibility tool from WPP's Wunderman Thompson that natively extends and interacts with Contentful.

End-use Insights

The IT & telecom segmentheld the largest share of 25.8% in 2022 and is expected to dominate the market even during the forecast period. The segment growth can be attributed to the increasing emphasis on agile content development methodologies. CMS end-uses that support rapid content creation, iteration, and deployment are preferred as organizations in this sector often need to respond quickly to market changes and technological advancements. In addition, projects in the IT and telecom sectors frequently require coordination among multiple teams. CMS solutions with robust collaborative capabilities, such as real-time editing, version control, and commenting, are being used to expedite documentation and project management processes, which is further expected to drive market growth.

The BFSI segment is expected to grow at a CAGR of 12.0% over the forecast period. BFSI organizations are implementing CMS solutions that offer omnichannel content delivery. This includes providing consistent and personalized content experiences across several channels, such as websites, mobile applications, email, and social media, to provide a seamless customer journey. For instance, in February 2023, Auriga Spa, a software provider for the omnichannel banking and payments industry, announced a partnership with CMS Business Solutions, a financial technology solutions provider, to work on self-service banking technologies for the Ecuadorian market. CMS Business Solutions will distribute Auriga's WinWebServer (WWS) solution in Ecuador as part of this partnership. The technology enables banks and ATM operators to provide an efficient omnichannel banking experience to their clients, providing 24/7 access to tailored, real-time services while delivering considerable operating efficiencies.

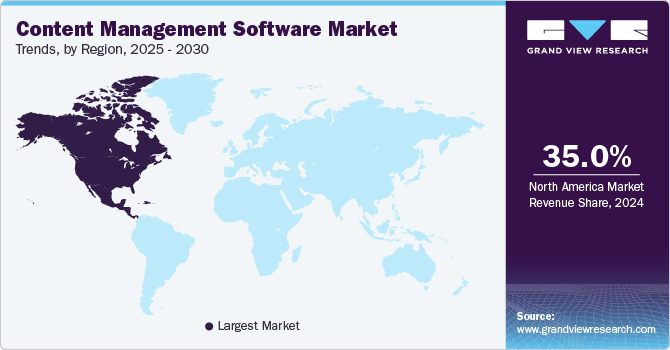

Regional Insights

North America dominated the market with a share of 37.2% in 2022. Businesses in North America are increasingly recognizing the need to provide exceptional client experiences. CMS solutions that offer personalized content distribution, targeted messaging, and seamless multichannel experiences are becoming more popular as businesses prioritize customer-centric initiatives. For instance, in June 2022, Spectrio, Inc. launched Spectrio Cloud, the company's newly updated content management system. The Spectrio Cloud CMS has an improved user experience based on years of user feedback, allowing customers to develop and manage all of their digital experiences and Spectrio, Inc. products from a single end-use. The new Spectrio Cloud CMS contributes to the company's aim to develop a single software solution for its customer engagement type and services.

Asia Pacific is anticipated to rise as the fastest-developing regional market at a CAGR of 13.2% from 2023 to 2030due to the rise of e-commerce that has prompted the adoption of CMS end-uses that address the unique requirements of online businesses. Content marketing features are being prioritized within CMS to assist product information management, content personalization, and efficient online sales strategies. Furthermore, cloud adoption is on the rise in the Asia Pacific region, with organizations leveraging cloud-based CMS solutions for scalability and flexibility. Cloud-native CMS end-uses allow businesses to scale their digital presence, accommodate traffic spikes, and manage content efficiently in a cost-effective manner. All these factors are expected to drive the market growth in the region.

Key Companies & Market Share Insights

The key players are investing significant resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, key business strategies, product benchmarking, and business overview. Companies can be seen engaging in mergers & acquisitions, new product launches, and partnerships to strengthen their product offering, acquire new customers, gain a competitive advantage, and capture more market shares. For instance, in March 2023, Yext, Inc., a software company, announced the inclusion of Content Generation in its Knowledge Graph product.

Yext, Inc. asserts that the Knowledge Graph is the market's first content management system that develops its material automatically and proactively. Content Generation uses multiple large language models, including GPT-3, and existing information from a customer's Knowledge Graph to autonomously produce and suggest vibrant, business-specific content that is on-brand and compatible with writing styles or structures found throughout an organization's content library. Some of the prominent players in the global content management software market include:

Key Content Management Software Companies:

- Adobe

- Awmous

- Box

- Broadcom, Inc.

- Contentful

- HubSpot, Inc.

- Hyland Software, Inc.

- Kentico Software

- Lexmark International, Inc.

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- Sitecore

- WordPress

- Xerox Corporation

Content Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.80 billion

Revenue forecast in 2030

USD 57.29 billion

Growth rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, solution, deployment, enterprise size, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe; Awmous; Box; Broadcom, Inc.;Contentful; HubSpot, Inc.; Hyland Software, Inc.; Kentico Software; Lexmark International, Inc.; Microsoft Corp.; Open Text Corp.; Sitecore; WordPress; Xerox Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the content management software market report based on type, solution, deployment, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Document Management

-

Web Content Management

-

Collaboration Software

-

Digital Rights Management

-

Content Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium sized Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government and Public Sector

-

Healthcare

-

IT & Telecom

-

Retail and E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content management software market size was estimated at USD 26.19 billion in 2022 and is expected to reach USD 28.80 billion in 2023.

b. The global content management software market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 57.29 billion by 2030

b. The web content management accounted for the largest market share of 26.5% in 2022. The segment growth is increasing Artifical Intelligence (AI) driven content optimization, and intelligent chatbots integration. AI is used in advanced web content management solutions for not just personalization but also dynamic content optimization. AI systems analyze user interactions in real time and adjust content elements such as images, layout, and calls-to-action to increase engagement and conversions.

b. Some key players operating in the market are Adobe; Awmous; Box; Broadcom, Inc.; Contentful; HubSpot, Inc.; Hyland Software, Inc.; Kentico Software; Lexmark International, Inc.; Microsoft Corporation; Open Text Corporation; Sitecore; Wordpress; Xerox Corporation

b. Key factors that are driving the market growth include increasing data security concerns and rising regulatory compliances are accelerating the adoption of content management software among businesses. Content management systems with security features including encryption protocols and compliance management, assist organizations in adhering to regulations and safeguarding their data against access or breaches, creating a positive outlook for the content management software market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."