- Home

- »

- Medical Devices

- »

-

Coronary Heart Disease Diagnostic Imaging Devices Market Report, 2030GVR Report cover

![Coronary Heart Disease Diagnostic Imaging Devices Market Size, Share & Trends Report]()

Coronary Heart Disease Diagnostic Imaging Devices Market Size, Share & Trends Analysis Report By Modality (Computed Tomography, Nuclear Medicine), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-924-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

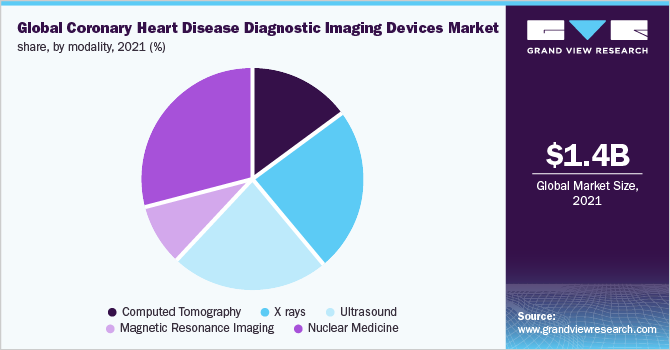

The global coronary heart disease diagnostic imaging devices market size was valued at USD 1.42 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.9% in the forecast period. Cardiovascular Disease (CVD) is considered the leading cause of death in developed nations. According to WHO, nearly, 17.9 million people died due to CVD in 2019, representing nearly 32% of overall deaths in the world. Additionally, the U.S. government spends nearly, 1% of its GDP on the care and treatment of CVD. To improve the death toll, cost of treatment, and reduce the incidence of CVD, there is an alarming need to adopt improved diagnostic and screening techniques for the early detection and identification of such diseases.

Factors such as a rise in cardiovascular diseases, increased need for non-invasive diagnostic techniques, rise in geriatric population, increased risk of coronary artery diseases (CAD) due to increased prevalence of obesity, and are expected to boost the coronary heart disease imaging devices market. Studies suggest that yearly, ~10 million stress tests and ~1 million cardiac catheterizations are performed in the U.S., for the identification of coronary heart disease among patients. However, insufficient reimbursement scenario, lack of skilled professionals, and high cost of medical imaging systems pose a barrier to the market growth.

The outbreak of the COVID-19 pandemic led to the decline in screening conducted at hospitals, diagnostic centers, and ambulatory centers, for CHD. The fear of virus spread also declined any diagnostic or surgical activities at end-use settings. This eventually led to an economic crisis at hospitals, diagnostic centers, clinics, and other end-use settings, which impacted newer installations. The closure of diagnostic centers and inclination towards the diagnosis of only COVID-19-related tests further hampered the diagnostic market. National closures, halt in logistics, economic crunch, sales reduction due to reduced work staff, and a shift in focus to develop a treatment protocol such as virtual care and tele-visits also impacted new product launches or developmental activities. Hence, the pandemic led to a significant dip in the market in 2020. However. It is anticipated to stabilize by mid-2022.

The enormous rise in CVD calls for better diagnostic tools and capabilities. Studies suggest that Italy has the highest prevalence of this disease within the Europe region, followed by Germany, then Spain, and lastly France. The prevalence rate ranges from ~2500 to ~3600 per hundred thousand population. In 2017, it was witnessed that ~2.5% to 3.6% population suffered from some of the other forms of CVD in these regions. Hence it calls for improved diagnosis and technologically advanced imaging devices to prevent the worsening of the disease state.

Modality Insights

Nuclear Medicine accounted for the largest share of 29.0% in 2021 within the modality segment. Factors such as non-invasiveness, clarity of image, accurate detection of disease even at a nascent stage, and increasing adoption among end-users, influence the market growth. A large number of radiologists, are well trained to handle the nuclear medicine device and precisely read the image than any other modality.

The Computed Tomography segment is expected to witness the fastest growth rate of 7.6% during the forecast period. Cardiac CT reduces nearly 30% rate of subsequent myocardial infarction, and thus, it is among the most prioritized diagnostic test conducted by the physician. Research to develop technologically advanced and noninvasive CT equipment to screen CVD effectively is likely to boost the market growth. However, image interpretation is still considered a critical drawback in this subsegment.

Regional Insights

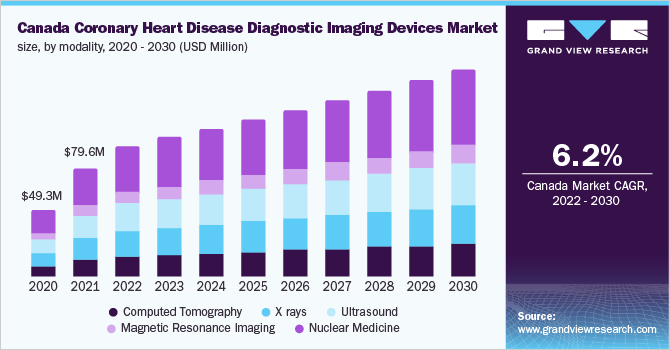

North America dominated the market with a share of 38.1% in 2021 owing to the presence of technologically sound medical staff, improved healthcare expenditure by the government, rise in the number of cancer cases, and an increase in obesity ratio compared to other nations, and increased research and developmental activities. However, the APAC region is said to witness the highest CAGR of 7.4% during the forecast period due to increased research activities to develop new products, improved government investment in healthcare, high demand for advanced imaging devices, and the presence of numerous resellers that provide refurbished equipment at moderate rates. This provides the price-sensitive and unpenetrated market with a large scope for growth.

Competitive Insights

The key players are developing advanced colposcopes to meet the growing prevalence of cervical cancer. Moreover, regional & service portfolio expansions and mergers & acquisitions are key strategic undertakings adopted by these players. Market players are also investing heavily in emerging markets to increase their global footprint and lead the market. Some prominent players in the global coronary heart disease diagnostic imaging devices market include:

-

GE

-

Fujifilm

-

Siemens

-

Toshiba

-

Hitachi

-

Koninklijke Phillips

-

Canon Medical Systems Corporation

-

Analogic Corp

Coronary Heart Disease Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.73 billion

Revenue forecast in 2030

USD 2.96 billion

Growth Rate

CAGR of 6.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Denmark; Netherlands; Poland; Austria; Switzerland; China; Japan; India; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

GE Healthcare; Fujifilm; Siemens; Toshiba; Hitachi; Koninklijke Phillips; Canon Medical Systems Corporation; Analogic Corp

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global coronary heart disease diagnostic imaging devices market report based on modality and region:

-

Coronary Heart Disease Imaging Devices Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography

-

X rays

-

Ultrasound

-

Magnetic Resonance Imaging

-

Nuclear Medicine

-

-

Coronary Heart Disease Imaging Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Netherlands

-

Poland

-

Austria

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

- Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coronary heart disease diagnostic imaging devices market is expected to grow at a compound annual growth rate of 6.9% from 2022 to 2030 to reach USD 2.95 billion by 2030.

b. The global coronary heart disease diagnostic imaging devices market size was estimated at USD 1.42 billion in 2021 and is expected to reach USD 1.73 billion in 2022.

b. Nuclear Medicine accounted for the largest share of 29.0% in 2021 within the modality segment. Factors such as non-invasiveness, clarity of image, accurate detection of disease even at a nascent stage, and increasing adoption among end-users, influence the market growth.

b. Some of the key players operating in the coronary heart disease diagnostic imaging devices market include GE Healthcare, Fujifilm, Siemens Healthineers, Toshiba, Hitachi, Koninklijke Phillips, Canon Medical, and Analogic Corp.

b. Factors such as a rise in cardiovascular diseases, increased need for non-invasive diagnostic techniques, rise in geriatric population, increased risk of coronary artery diseases (CAD) due to increased prevalence of obesity, and are expected to boost the coronary heart disease diagnostic imaging devices market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."