- Home

- »

- Advanced Interior Materials

- »

-

Cryocooler Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Cryocooler Market Size, Share & Trends Report]()

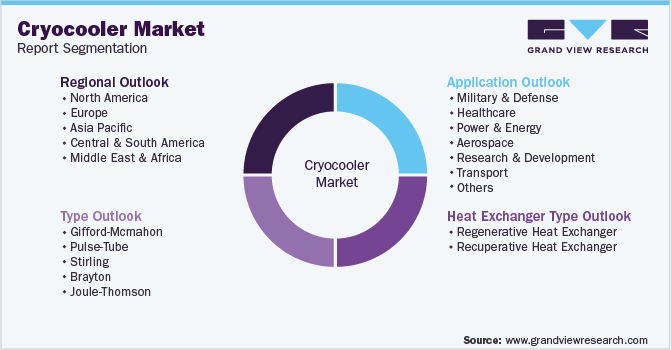

Cryocooler Market Size, Share & Trends Analysis Report By Type (Gifford-Mcmahon, Stirling, Pulse-Tube, Brayton), By Heat Exchanger Type, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-021-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Advanced Materials

Report Overview

The global cryocooler market size was estimated to be USD 2,464.5 million in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 6.7% from 2022 to 2030. The increasing adoption of cryocoolers in cooling down power systems, superconducting magnets, and the semiconductor industry is driving the demand for cryocoolers. The demand for cryocoolers is high in sectors such as healthcare and military & defense across the globe. The COVID-19 pandemic had a negative impact on the growth of the cryocooler market. The pandemic led to the closing of national borders, and the temporary shutting down of industries and markets in 2020.

Supply chain disruptions and restrictions related to manufacturing resulted in an immediate price hike in industrial equipment and machinery. The cryocoolers market witnessed a recovery in 2021. However, at the beginning of 2022, there were fluctuations in the market due to the Russia-Ukraine war. Nevertheless, the market is expected to witness significant growth over the forecast period.

The ongoing R&D and technological developments of cryocoolers have increased their adoption in the healthcare sector for various applications like proton therapy, NMR equipment, and MRI. This is expected to propel the market growth. According to a recent study by Brigham and Women’s Hospital, there has been a dramatic rise in cancer cases among those under 50 years of age. This rising incidence of cancer among individuals across the globe is boosting the use of proton therapy. This, in turn, propels the demand for cryocoolers.

Cryocoolers are now being utilized commercially for cooling down high-temperature superconducting magnets used in cell phone stations in the U.S. High-Temperature Superconducting (HTS) filters are used in these superconducting receivers to produce extremely tiny band-reject filters or bandpass filters with extremely steep skirt slopes. These receivers, when coupled with cryogenically cooled low-noise amplifiers, enable the base station to handle more calls, hear a phone from a greater distance, and enhance call quality. Four U.S based companies - Conductus, Illinois Superconductor, Superconducting Technologies, and Spectral Solutions Inc. - offer this technology.

Type Insights

The Gifford Mcmahon segment accounted for the largest revenue share of 33.4% in 2021 in terms of revenue and is expected to dominate the market over the forecast period. This can be attributed to the low cost of this cryocooler and its unique properties. Gifford McMahon cryocoolers have gained popularity in recent years due to low-performing nitrogen liquefiers, cryo vacuum equipment, helium recondensation facilities, and cryogenic systems for various scientific investigations. These are among the principal applications of cryocoolers.

The stirling segment is expected to witness the fastest CAGR of 8.2% over the forecast period of 2022-2030. This can be attributed to the growing adoption of infrared focal panels in military and defense. Stirling cryocoolers are frequently utilized for military applications, such as cooling requirements for ground-mounted, airborne, and shipboard infrared sensors. The growing demand for night vision cameras commercially due to the rise in thefts and criminal activities is propelling the demand for the cryocooler market.

Heat Exchanger Type Insights

The regenerative heat exchanger segment accounted for the largest market share of 58.9% in 2021 in terms of revenue and is expected to retain its position in the market over the forecast period. Applications involving high temperatures have grown in recent years. Regenerative heat exchangers are now widely used due to the rising demand for waste heat recovery. A system called a regenerative heat exchanger enables fluids to flow over the heat-storage material in a different way for effective heat transfer. This has propelled the demand for the cryocooler market.

The recuperative heat exchanger segment is expected to expand at a CAGR of 6.2% over the forecast period 2022-2030. Separate flow routes for the two fluids are incorporated into the design of recuperative heat exchangers. Direct contact and indirect contact heat exchangers are the two categories into which recuperative heat exchangers are separated. A conductive wall is used in indirect contact heat exchangers to divide the two fluids.

Application Insights

The military and defense segment accounted for the largest market share of 21.6% in 2021 and is expected to retain its position in the market over the forecast period. This can be attributed to the large consumption of cryocoolers in defense applications such as night vision technology, ground-mounted, and airborne military applications. The large-scale demand from defense is expected to drive the growth of the cryocooler market.

The healthcare segment is expected to witness the fastest CAGR of 7.8% over the forecast period 2022-2030. This growth is due to the rise in cancer cases and globally increasing health awareness post-COVID-19. According to the American Cancer Society, in 2020, the U.S. had 606,520 cancer deaths and an anticipated 1.8 million new cancer diagnoses. Cancer is the second most common cause of death in the U.S. Increasing cancer cases have propelled the demand for proton therapy, which, in turn, drives the cryocoolers market.

Regional Insights

North America accounted for the largest revenue share of 35.6% in 2021 and currently dominates the market owing to the growing usage of cryocoolers in the healthcare industry and the quick expansion in the use of the systems in the military industry. The majority of cryocoolers are used in the region’s military, medical, research & development, and space applications.

Asia Pacific accounted for a significant revenue share in 2021 and is anticipated to witness the fastest CAGR of 8.0% over the forecast period. This growth is due to several factors, including increasing demand from military and defense sectors in the regions, especially from countries like India, China, Vietnam, and Pakistan. The high population rate in the region is also augmenting the growth of the healthcare sector. Countries such as India and China are the major contributors to the growth of the regional market.

Key Companies & Market Share Insights

The market features various global and regional players, which makes it a competitive market. The world’s leading companies are using partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share. Cryocooler manufacturers are spending extensively on research & development activities to develop advanced products and integrate new technologies and characteristics to conserve energy and improve efficiency.

In January 2021, Clean Power Hydrogen (CPH2) and AFCryo, one of the leading suppliers of cryogenic systems, collaborated for gas separation and hydrogen liquefaction that will provide the industry with a less expensive and more dependable method of producing green hydrogen from renewable sources. For sizes exceeding 1MW, AFCryo created larger cryogenics systems that will serve as the foundation for the electrolyzer technology. Some of the prominent players in the global cryocooler market include:

-

Sumitomo Heavy Industries, Ltd.

-

Advanced Research Systems

-

Chart Industries

-

AMETEK.Inc. (Sunpower Inc.)

-

Cryomech Inc.

-

DH Industries

-

Janis Research Company LLC

-

Brooks Automation

-

Superconductor Technologies Inc.

-

Northrop Grumman

-

RICOR

-

Cobham Missions Systems Wimborne Limited

Recent Developments

- In March 2023, Bluefors acquired Cryomech to become a global leader in cryogenics. The new company was entrusted to provide cryogenic systems for quantum technology, nanotechnology, and scientific research.

Cryocooler Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2,570.5 million

Revenue forecast in 2030

USD 4,404.5 million

Growth Rate

CAGR of 6.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, heat exchanger type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; France; U.K.; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Sumitomo Heavy Industries, Ltd.; Advanced Research Systems; Chart Industries; AMETEK.Inc. (Sunpower Inc.); Cryomech Inc.; DH Industries; Janis Research Company LLC; Brooks Automation; Superconductor Technologies Inc.; Northrop Grumman; RICOR; Cobham Missions Systems Wimborne Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryocooler Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cryocooler market report based on type, heat exchanger type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gifford-Mcmahon

-

Pulse-Tube

-

Stirling

-

Brayton

-

Joule-Thomson

-

-

Heat Exchanger Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Regenerative Heat Exchanger

-

Recuperative Heat Exchanger

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Defense

-

Healthcare

-

Power & Energy

-

Aerospace

-

Research & Development

-

Transport

-

Mining & Metal

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cryocooler market size accounted for USD 2,464.5 million in 2021 and is expected to reach USD 2,570.5 million in 2022.

b. The global cryocooler market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2022 to 2030 to reach USD 4,404.5 million by 2030.

b. North America dominated the cryocooler market with a revenue share of 35.6% in 2021. This can be attributed to the growing healthcare industry and the quick expansion of the military and defence sector

b. Some of the key players operating in the cryocoolers market include Sumitomo Heavy Industries, Ltd, Advanced Research Systems, Chart Industries, and AMETEK. Inc. (Sunpower Inc.), Cryomech Inc., DH Industries, Janis Research Company LLC, Brooks Automation, Superconductor Technologies Inc., Northrop Grumman, RICOR, Cobham Missions Systems Wimborne Limited, among others

b. The key factors that are driving the global cryocooler market include the increasing adoption of cryocoolers in sectors such as healthcare and military & defence across the globe. In addition, the increasing adoption of cryocoolers in cooling down power systems, superconducting magnets and the semiconductor industry are other factors driving the market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."