- Home

- »

- Next Generation Technologies

- »

-

Customer Relationship Management Market Report, 2030GVR Report cover

![Customer Relationship Management Market Size, Share, & Trends Report]()

Customer Relationship Management Market Size, Share, & Trends Analysis Report, By Component, By Solution, By Deployment, By Enterprise Size, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-912-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Market Size & Trends

The global customer relationship management market size was valued at USD 65.59 billion in 2023 and is expected to grow at a significant compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. Ongoing trends such as hyper-personalization of customer service, use of AI and automation, and implementation of robust social media customer service can help reduce costs, increase response times, improve customer satisfaction, and increase the adoption of customer relationship management (CRM) platforms across industries are the major factors that drive the market growth.

The COVID-19 pandemic is likely to impact businesses significantly, suppressing profitability, stifling innovation, and drying up cash flows and financial reserves. However, the growing adoption of digital technology & CRM tools is likely to set the pace for digital transformation and digital optimization of both existing businesses and new businesses. Moreover, the functions and processes of the business are supported by CRM tools in marketing, sales and customer service. These developments are expected to lead to the increased use of cloud technology and work collaboration tools, subsequently aiding in market growth.

Organizational departments such as sales & marketing and customer services & support are increasingly integrating customer relationship management systems with AI to improve customer experience and feedback and develop strong bonds with their customers. For instance, in April 2022, Salesforce, Inc., a cloud-based software company, launched CRM analytics, with new capabilities such as AI-powered insights for sales, marketing, and service teams for every industry, such as BFSI, retail, and IT & telecom, among others.

The search insights within the CRM analytics help Salesforce customers to discover any dataset, dashboard, and next-best groupings related to their search. These developments in CRM solutions and services would likely boost the growth of the market. Customers' increasing use of digital channels to communicate with brands and organizations is anticipated to drive customer relationship management industry growth over the forecast period. According to recent SoftClouds surveys, around 80% of organizations use CRM systems for sales reporting and process automation.

It provides a better understanding of buying behavior and preferences, allowing brands and organizations to implement the best CRM strategies and deliver real-time performance. For instance, in December 2022, Freshworks Inc., a cloud-based software solution for all sizes of businesses, offered Freshdesk Omnichannel and Freshchat to Supara, a leading apparel company, to accelerate e-commerce sales with better response times to customer queries. These initiatives would further drive the growth of the market during the forecast period.

With the growing importance of understanding customer behavior and their preferences, organizations are adopting CRM strategies to deliver the best performance in real-time and stay ahead of their rivals. Rapid shifts in the fields of business intelligence and embedded analytics, the Internet of Things (IoT), and artificial intelligence, and their implementation in CRM solutions are likely to promote product enhancement and innovation among customer relationship management vendors.

For instance, in June 2021, Salesforce.com, Inc. announced new capabilities across digital 360 to help enterprises to boost their digital activities and deliver the next generation of digital experiences, commerce, and marketing. These capabilities and features provided by customer relationship management suites supplement the growth of the customer relationship management industry over the forecast period.

Large corporations have already made significant investments in their respective IT infrastructures. However, due to budget constraints, Small and Medium Businesses (SMBs) have been unable to invest aggressively in setting up IT infrastructure. Futuristic customer relationship management suites also enable enterprises to gauge business performance and track sales trajectories.

The continued digital transformation across various industries is prompting businesses to replace the existing array of solutions required to create, manage, and enhance their digital presence with a unified solution that can serve all purposes. These benefits offered by CRM suites would further drive the customer relationship management market during the forecast period.

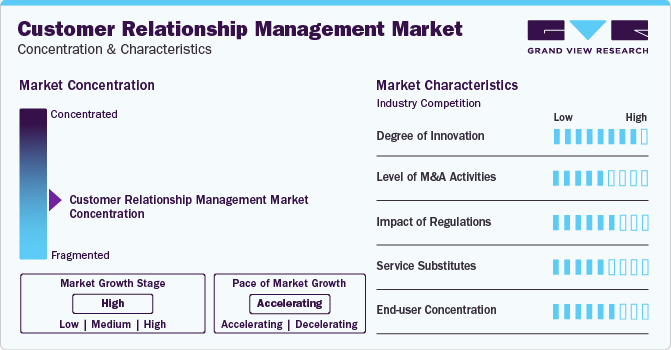

Market Concentration & Characteristics

The growth of the customer relationship management market is high, and the growth’s pace is accelerating. The customer relationship management market is characterized by a high degree of innovation owing to the considerable advancements in omnichannel marketing, customer data management solutions, and big data analytics, among others. Further, the proliferation of cloud platforms and diverse CRM solutions presented by market players is anticipated to create robust opportunities for the CRM market growth.

Companies operating in the customer relationship management market emphasize acquisition of niche market players to expand their business operations and customer base. For instance, in November 2023, real estate marketplace company Zilllow Group, Inc. signed an agreement for the acquisition of Follow Up Boss, a CRM platform for real estate stakeholders, for an undisclosed amount.

The market is also subject to numerous rules and regulations, such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Digital Personal Data Protection Act of 2023, among others. Market players are required to abide by these rules in the countries where they are applicable.

There are several direct substitutes for customer relationship management solutions. Various technologically advanced platforms offer the same CRM features as traditional CRM solutions that can pose a threat to CRM systems.

Customer relationship management market growth is anticipated to be influenced by the concentration of end-users. The growing demand for customizable CRM solutions to address the specific needs of the end-users may create hurdles for emerging CRM companies that are making considerable efforts to establish their brand image in the global customer relationship management market.

Solution Insights

The customer service segment dominated the market in 2022 and accounted for a revenue share of 23.7%. The key driving factors for the growth of the market include the growing importance of understanding customer behavior and their preferences, rising demand for CRM software and encouraging brands & organizations to continue to adopt CRM strategies to deliver the best service performance in real time. Additionally, the growing use of digital channels using artificial intelligence and its applications by customers to engage with brands and organizations is expected to boost growth during the forecast period.

The CRM analytics segment is anticipated to grow at a significant CAGR of 13.7% and is expected to register promising growth over the forecast period. The availability of multiple platforms and increasing adoption for integration of analytics features in CRM solutions benefit companies to derive rich insights from business data is expected to drive the growth of the segment.

For instance, in July 2021, Genesys, a CRM company that sells customer experience and call center technology to mid- and large-sized businesses, launched new CRM tools to enable swift innovation for AI-driven customer experiences, which include bot development and orchestration, open messaging Application Programming Interface (API), and employee development and feedback, deployed across multiple channels. These features offered by CRM applications would further drive the analytics segment during the forecast period.

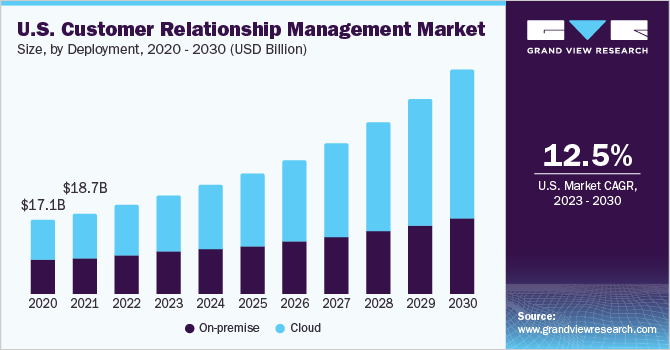

Deployment Insights

The cloud segment dominated the market in 2022 and accounted for a revenue share of 56.1%. Cloud computing provides several advantages, including real-time access, scalability, high flexibility, cost-effectiveness, and low hardware maintenance costs. For instance, in March 2021, Adobe announced a partnership with government agencies in all 50 states (Department of Public Social Services (DPSS) and Center for Disease Control and Prevention (CDC)) to enable digital modernization via Adobe Experience Cloud and Adobe Document Cloud. With this collaboration, governments can improve their online presence by redesigning their websites and apps and ensuring personalized content. These benefits offered by cloud deployment would further drive the segment during the forecast period.

The on-premise segment is anticipated to expand at a significant CAGR of 10.5% during the forecast period. According to a CRM buyer survey conducted by SelectHub, several larger enterprise groups have preferred on-premise as compared to cloud-based deployment. Due to the increasing demand for data privacy, the demand for on-premise customer relationship management solutions has increased. Furthermore, the on-premise model is still the first choice by the largest organizations in the world, as they have business-critical information to be stored on their servers for enhanced data protection. These benefits offered by on-premise deployment would further drive the segment during the forecast period.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of 61.1% in 2022. With the presence of various operational departments in large organizations, customer relationship management software is utilized to help integrate customer data with business process management features and enable users to coordinate with their customer support processes, sales, and marketing, which drive the company’s overall performance. Large Enterprises are particularly seeking CRM software that incorporates artificial intelligence and analytics as part of the efforts to increase workforce efficiency and reduce manual work through automation. These capabilities would further drive the demand for CRM solutions across large enterprises during the forecast period.

The small & medium enterprises segment is expected to grow at a significant CAGR of 15.5% during the forecast period. The segment's expansion can be attributed to the global adoption of a number of government initiatives via digital campaigns such as social media video marketing and search engine marketing. However, due to budget constraints, SMBs have been unable to invest aggressively in establishing IT infrastructure. At this point, cloud-based SaaS can especially assist SMBs in ensuring easy deployment and flexibility while providing a better user experience, which will drive demand for customer relationship management solutions across small businesses during the forecast period.

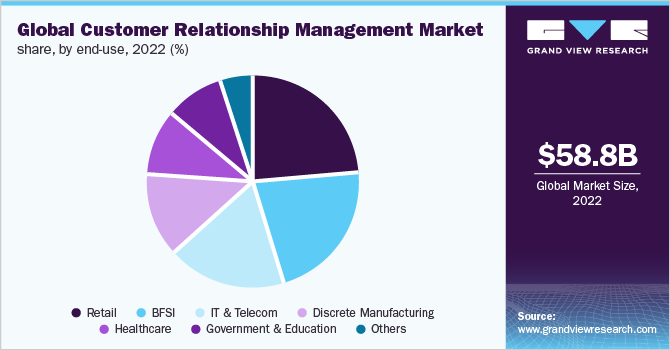

End Use Insights

The retail segment accounted for the largest market share of 23.5% in 2022. The growing online shopping platforms and mobile applications are offering huge customer data to retail companies. These retail companies are shifting towards CRM software and solutions to understand business growth, market trends, and experience. Furthermore, the increasing focus on digital marketing activities and customized advanced IT solutions drive the market’s growth over the forecast period. These developments in the retail segment are expected to drive the market’s growth over the forecast period. Customer relationship management in the hotel industry, hospitality industry, and travel industry is also gaining popularity. The hospitality business thrives on customer feedback and the primary advantage of CRM in the hospitality industry is its ability to streamline customer service.

The IT & telecom segment is expected to expand at a significant CAGR of 15.6% during the forecast period. Customer relationship management solutions in IT & telecom offer brand equity, distribution channels, post-purchase service, and customer exclusivity and support. These benefits allow organizations to continue their business to sustain in this competitive market. Moreover, the unabated growth in the penetration rate of IT technologies in organizational operations has set new parameters for competitors in the marketplace. Digital experiences inculcated and offered by the companies would increase operational productivity and enhance customer engagement in the long run.

Regional Insights

The North American regional market dominated the market in 2022 and accounted for a market share of 43.6%. The key driving factors are the increasing adoption of customer relationship management solutions by several enterprises across the region that rely on the use of advanced technologies and are expected to dominate the market over the forecast period. Furthermore, the continuous adoption of digital transformation across various sectors, including banking, retail, and hospitality, is expected to propel the North America market in the forecast period.

Europe Customer Relationship Management (CRM) Market

Europe's CRM market was expected to hold a market share of around 25% in 2023. The growth of the customer relationship management (CRM) market in Europe can be attributed to digitalization, stringent regulations concerned with business management, the presence of key players operating in the region, and improved customer experience, among others.

U.K. Customer Relationship Management (CRM) Market

U.K. CRM market was estimated to be valued at USD 3,725.1 million in 2023. The growth of the customer relationship management (CRM) market in the U.K. can be attributed to government initiatives, which include partnerships, collaborations, and MoUs, among others. For instance, in October 2022, Salesforce and Crown Commercial Service signed a new Memorandum of Understanding (MoU) that is valid for one year. With the new arrangement, Salesforce's base pricing and discounts will be available to all qualified public sector clients. For clients, the deal translates into huge savings. It will be open for consumer enrollment starting on August 1, 2022.

Germany Customer Relationship Management (CRM) Market

German CRM market was expected to grow at a CAGR of around 14% over the forecast period. The growth of the customer relationship management (CRM) market in Germany can be attributed to companies involved in strategic partnerships aimed at offering improved CRM solutions. For instance, in July 2023, Veeva Systems stated that Veeva Vault MedInquiry is being used as the worldwide medical information management system by Merck KGaA, located in Darmstadt, Germany. Merck KGaA, Darmstadt, Germany, now has a single, worldwide framework for managing medical information thanks to Vault MedInquiry. Teams can satisfy the local and regional regulations of the nations they serve by maintaining links between CRM systems, safety, quality, content, and intake routes.

France Customer Relationship Management (CRM) Market

France's CRM market was estimated to be valued at USD 1,885.2 million in 2023. The growth of the customer relationship management (CRM) market in France can be attributed to factors such as various companies' investments in France aimed at improving the digital infrastructure of the country. For instance, in June 2022, Oracle announced the launch of a second cloud area in France, where it will provide public cloud services to support companies looking to update their infrastructure. Along with the Oracle Cloud Marseille area, Oracle's European partners and customers will have access to a wide range of cloud services with built-in disaster recovery, security, and industry-leading price performance through the new region in La Courneuve, Paris. Oracle's dual-region cloud solution is unusual in that it allows French clients to deploy robust applications across several in-country sites.

Asia Pacific Customer Relationship Management (CRM) Market

Asia Pacific is anticipated to rise as the fastest-developing regional market at a CAGR of 15.6% over the forecast period. The rising demand for innovative CRM solutions from emerging countries such as China and India to improve customer experience is acting as a catalyst for the growth of the regional market. The expansion of the e-commerce industry in Asian countries, such as India, is anticipated to drive the demand for CRM solutions. Moreover, the continuous rise of SMBs in countries like India is placing a strong emphasis on implementing customer relationship management solutions as a part of their efforts to drive their regional and global businesses. Furthermore, CRM is available to almost all in India, owing to the widespread of internet and broadband use throughout the country as well as a reduction in prices. The Indian CRM landscape is also undergoing a major transformation due to the internet revolution in India.

China Customer Relationship Management (CRM) Market

China's CRM market was expected to hold a market share of 24% in Asia Pacific CRM market in 2023. The growth of the customer relationship management (CRM) market in China can be attributed to the major players in the CRM market and the cloud market involved in the strategic partnership, enabling customers in China easy access to CRM solutions. For instance, in November 2023, Alibaba Cloud stated that starting on December 18, 2023, Salesforce Service Cloud, Sales Cloud, and Salesforce Platform would be generally available on Alibaba Cloud. With the launch of Sales Cloud, Service Cloud, and Salesforce Platform, businesses—especially foreign corporations doing business in mainland China—will be better equipped to adapt to changing consumer needs, adhere to the most recent data residency laws, and interact with the distinctive local app ecosystem.

India Customer Relationship Management (CRM) Market

India's CRM market was expected to hold a market share of 24% in 2023 in Asia Pacific CRM market. The growth of the customer relationship management (CRM) market in India can be attributed to the widespread adoption of digital technologies, the need to manage customer data safely, securely, and securely, and the increasing emphasis on customer experience. Furthermore, various digital initiatives are being undertaken by the Indian government to support digital transformation across the nation. For instance, the government launched Bharat Interface for Money (BHIM) to support seamless digital transactions, which is propelling the demand for customer relationship management solutions.

Japan Customer Relationship Management (CRM) Market

Japan's CRM market was estimated to be valued at USD 2,120.6 million in 2023. The growth of the customer relationship management (CRM) market in Japan can be attributed to the high rate of adoption of mobile phones and other connected devices is also making it easier for organizations in Japan to draft innovative marketing strategies and boost sales. The Japanese government has initiated several e-government agendas to promote workforce optimization and enable organizations to use electronic media to communicate with their customers.

Middle East & Africa Customer Relationship Management (CRM) Market

Middle East & Africa CRM market was expected to hold a market share of 5% in 2023. The growth of the customer relationship management (CRM) market in the Middle East & Africa can be attributed to the region attracting top retail and electronics brands, which is creating the need for offering improved customer experience services with the help of CRM solutions. Economies such as Turkey, Egypt, and Saudi Arabia, among others, are witnessing rapid growth of small & medium enterprises, which are implementing CRM solutions to gain insights for better demand forecasting.

Saudi Arabia Customer Relationship Management (CRM) Market

Saudi Arabia's CRM market was expected to have a significant growth rate over the forecast period. The growth of the customer relationship management (CRM) market in Saudi Arabia can be attributed to increased investment in improving the digital infrastructure of the country. For instance, in December 2023, Oracle started a project called "Mostaqbali" (My Future) to teach young Saudis in technological fields in order to prepare them for the most in-demand technology-related employment in the future. The Ministry of Human Resources and Social Development in Saudi Arabia is overseeing the introduction and implementation of the new program, which was developed in partnership with Future Work. By 2027, 50,000 Saudi nationals will have received training and certification in the most recent cloud-based digital technologies, such as artificial intelligence, machine learning, and the Internet of Things (IoT).

Key Companies & Market Share Insights

Some of the key players operating in the market include SAP SE, Salesforce.com, Inc., and Microsoft Corporation

-

Salesforce.com, Inc. provides Customer Relationship Management (CRM) solutions under a platform for developers and customers to develop and run business applications. Its CRM services are categorized as Commerce Cloud, Sales Cloud, Data Cloud, Marketing Cloud, Community Cloud, Analytics Cloud, and App Cloud.

-

SAP SE Customer Relationship Management covers a broad product portfolio, including SAP Commerce Cloud, SAP Upscale Commerce, customer identify and access management, customer data platform, SAP Service Cloud, Integrated Customer Engagement, and SAP Sales Cloud.

Insightly, Inc., Creatio, and CopperCRM, Inc. are some of the emerging market participants in the CRM market.

-

Insightly, Inc. offers CRM solutions for various industry verticals, such as real estate, consulting, technology, and small businesses. Insightly CRM is the company’s CRM solution that can be used to develop custom apps for organizations on the Insightly platform with calculated fields, validation rules, workflow automation, and reports & dashboards. It offers customized views and workflows based on business needs and user preferences.

-

Creatio offers three CRM applications, namely Sales Creatio (sales force automation software), Marketing Creatio (marketing automation tool), and Service Creatio (help desk software).

Key Customer Relationship Management Companies:

- Adobe

- ClickUp

- Copper CRM, Inc.

- Creatio

- Freshworks Inc.

- Insightly Inc.

- Microsoft Corporation

- monday.com

- Nimble

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- SugarCRM Inc.

- Zendesk

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In November 2023, Creatio collaborated with CRM consultancy firm zolution in Singapore to provide its no-code platform to automate the workflows of Zolution’s clients. This will assist its clients in optimizing their CRM strategies and boost customer engagement.

-

In September 2023, technology company Genesys announced a strategic partnership with Salesforce.com, Inc. to assist businesses in gathering bots, communication channels, and data together for enriched employees and customer experience. The companies will introduce AI-powered CRM solutions that integrate Salesforce Service Cloud called CX Cloud and Genesys Cloud CX from Salesforce.com, Inc. and Genesys.

-

In July 2023, Salesforce announced the general availability of the ‘Sales Planning’ solution for simplifying the creation of end-to-end plans powered by CRM data. This Sales Cloud solution will enable organizations to efficiently distribute territories, compensation, capacity, and quota, among other aspects, thus driving their growth.

-

In July 2023, Creatio and CVM People announced a partnership for maximizing profitability for customers in the United Kingdom through the implementation of no-code-powered CRM and workflow automation. CVM People is a practitioner-led organization specializing in enabling medium-sized to enterprise firms in transforming their customer management capability across the areas of marketing, sales, and service.

-

In July 2023, Creatio and xAfrica announced a partnership aimed at equipping xAfrica with the tools to drive organizational capacity and efficiency for its clients across several major industries and improve their business outcomes. xAfrica is a business consultancy and service provider that specializes in the areas of sales enablement, prospecting, brand awareness, revenue management, and compliance.

-

In July 2023, Copper CRM announced several improvements to its list views experience to make the data easy to comprehend and offer an intuitive and user-friendly appearance. The company has added various design elements to ease navigation and increased the record preview side panel size. In-line editing has also been introduced to smoothen workflow, as well as the choice to create an ‘active list’ or a ‘basic list’ to avoid the use of tags.

-

In June 2023, SugarCRM and sales-i announced a partnership for improving the B2B sales performance in the manufacturing, wholesale, and distribution sectors, through the use of AI and machine learning to offer enhanced customer insights, analytics, and intelligence. The collaboration would instantly centralize sales analytics access for each customer, sales team, branch, and product, benefiting sales in industries such as manufacturing and logistics.

-

In May 2023, Insightly announced the release of its ‘Insightly Modern CRM Checklist’ to aid fast-growing businesses in evaluating their software platforms. The company aims to help businesses understand the evolution of CRM software with changing customer requirements and enquire about features such as mobile access, customization, implementation, security, and cost, among others.

-

In May 2023, SugarCRM announced that its AI-driven CRM platform was selected by Barnardos Australia for modernizing its tech stack and improving its data management, operational visibility, compliance, collaboration, and efficiency. Barnardos is a leading charity in Australia, providing care for children at risk of neglect and abuse. The partnership would enable the charity to build relationships with stakeholders such as case workers, volunteers, caregivers, and funders.

-

In January 2023, Zoho Corporation introduced the latest version of its ‘Bigin’ CRM solution for small businesses. The most significant addition to this version is ‘Team Pipelines’, which enables customer-facing teams to use a single ‘Bigin’ account for managing their distinct operations using a unique set of pipelines and sub-pipelines. Other notable updates include the launch of ‘Connected Pipelines’ and ‘Toppings’, as well as improvements to Bigin’s mobile app.

Customer Relationship Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 65.59 billion

Revenue forecast in 2030

USD 163.16 billion

Growth Rate

CAGR of 13.9% from 2023 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Spain, China, India, Japan, Australia, New Zealand, Brazil, UAE, Saudi Arabia

Key companies profiled

Adobe; ClickUp; Copper CRM, Inc.; Creatio; Freshworks Inc.; Insightly Inc.; Microsoft Corporation; monday.com; Nimble; Oracle Corporation; Salesforce.com, Inc.; SAP SE; SugarCRM Inc.; Zendesk; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Customer Relationship Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global customer relationship management market based on component, solution, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion; 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion; 2018 - 2030)

-

Customer Service

-

Customer Experience Management

-

CRM Analytics

-

Marketing Automation

-

Salesforce Automation

-

Social Media Monitoring

-

Others

-

-

Deployment Outlook (Revenue, USD Billion; 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Discrete Manufacturing

-

Government & Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

New Zealand

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global customer relationship management market size was estimated at USD 58,826.8 million in 2022 and is expected to reach USD 65.59 billion in 2023.

b. The global customer relationship management market is expected to witness a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 163.16 billion by 2030.

b. North America held the largest share of 43.6% in 2022 due to the presence of numerous solution vendors, both big and small, in the region and the rising need by the organizations to offer customized services to their customers.

b. Some key players operating in the CRM market include Salesforce.com, Inc., Microsoft Corporation, ADOBE INC., SAP SE, Oracle Corporation, SugarCRM Inc., Zoho Corporation Pvt. Ltd, Copper CRM, Inc., Insightly Inc., and Creatio.

b. The rising demand for automated engagement with customers, improving the scope of digital operations and enhancing customer experience and services are driving the demand for CRM solutions across various industries globally.

Table of Contents

Chapter 1. Customer Relationship Management Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Customer Relationship Management Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Customer Relationship Management Market: Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Market Opportunity Analysis

3.5. Customer Relationship Management Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Customer Relationship Management Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Customer Relationship Management Market: Component Movement Analysis, USD Billion, 2023 & 2030

4.3. Solution

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Services

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Customer Relationship Management Market: Solution Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Customer Relationship Management Market: Solution Movement Analysis, USD Billion, 2023 & 2030

5.3. Customer Service

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Customer Experience Management

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. CRM Analytics

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Marketing Automation

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Salesforce Automation

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.8. Social Media Monitoring

5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.9. Others

5.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Customer Relationship Management Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Customer Relationship Management Market: Deployment Movement Analysis, USD Billion, 2023 & 2030

6.3. Cloud

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. On-premise

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Customer Relationship Management Market: Enterprise Size Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Customer Relationship Management Market: Enterprise Size Movement Analysis, USD Billion, 2023 & 2030

7.3. Large Enterprises

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Small & Medium Enterprises (SMEs)

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Customer Relationship Management Market: End Use Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Customer Relationship Management Market: End Use Movement Analysis, USD Billion, 2023 & 2030

8.3. BFSI

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Retail

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Healthcare

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. IT & Telecom

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.7. Discrete Manufacturing

8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.8. Government & Education

8.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.9. Others

8.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Customer Relationship Management Market: Regional Estimates & Trend Analysis

9.1. Customer Relationship Management Market Share by Region, 2023 & 2030 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.2.9. Mexico

9.2.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.2.9.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.2.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.2.9.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.2.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.10. Spain

9.3.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.3.10.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.3.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.3.10.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.3.10.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.11. New Zealand

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.5. South America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.5.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6.8. Saudi Arabia

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Solution, 2018 - 2030 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Positioning

10.4. Company Market Share Analysis

10.5. Company Heat Map Analysis

10.6. Strategy Mapping

10.6.1. Expansion

10.6.2. Mergers & Acquisition

10.6.3. Partnerships & Collaborations

10.6.4. New Product Launches

10.6.5. Research And Development

10.7. Company Profiles

10.7.1. Adobe

10.7.1.1. Participant’s Overview

10.7.1.2. Financial Performance

10.7.1.3. Product Benchmarking

10.7.1.4. Recent Developments

10.7.2. ClickUp

10.7.2.1. Participant’s Overview

10.7.2.2. Financial Performance

10.7.2.3. Product Benchmarking

10.7.2.4. Recent Developments

10.7.3. Copper CRM, Inc.

10.7.3.1. Participant’s Overview

10.7.3.2. Financial Performance

10.7.3.3. Product Benchmarking

10.7.3.4. Recent Developments

10.7.4. Creatio

10.7.4.1. Participant’s Overview

10.7.4.2. Financial Performance

10.7.4.3. Product Benchmarking

10.7.4.4. Recent Developments

10.7.5. Freshworks Inc.

10.7.5.1. Participant’s Overview

10.7.5.2. Financial Performance

10.7.5.3. Product Benchmarking

10.7.5.4. Recent Developments

10.7.6. Insightly Inc.

10.7.6.1. Participant’s Overview

10.7.6.2. Financial Performance

10.7.6.3. Product Benchmarking

10.7.6.4. Recent Developments

10.7.7. Microsoft Corporation

10.7.7.1. Participant’s Overview

10.7.7.2. Financial Performance

10.7.7.3. Product Benchmarking

10.7.7.4. Recent Developments

10.7.8. monday.com

10.7.8.1. Participant’s Overview

10.7.8.2. Financial Performance

10.7.8.3. Product Benchmarking

10.7.8.4. Recent Developments

10.7.9. Nimble

10.7.9.1. Participant’s Overview

10.7.9.2. Financial Performance

10.7.9.3. Product Benchmarking

10.7.9.4. Recent Developments

10.7.10. Oracle Corporation

10.7.10.1. Participant’s Overview

10.7.10.2. Financial Performance

10.7.10.3. Product Benchmarking

10.7.10.4. Recent Developments

10.7.11. Salesforce.com, Inc.

10.7.11.1. Participant’s Overview

10.7.11.2. Financial Performance

10.7.11.3. Product Benchmarking

10.7.11.4. Recent Developments

10.7.12. SAP SE

10.7.12.1. Participant’s Overview

10.7.12.2. Financial Performance

10.7.12.3. Product Benchmarking

10.7.12.4. Recent Developments

10.7.13. SugarCRM Inc.

10.7.13.1. Participant’s Overview

10.7.13.2. Financial Performance

10.7.13.3. Product Benchmarking

10.7.13.4. Recent Developments

10.7.14. Zendesk

10.7.14.1. Participant’s Overview

10.7.14.2. Financial Performance

10.7.14.3. Product Benchmarking

10.7.14.4. Recent Developments

10.7.15. Zoho Corporation Pvt. Ltd.

10.7.15.1. Participant’s Overview

10.7.15.2. Financial Performance

10.7.15.3. Product Benchmarking

10.7.15.4. Recent Developments

List of Tables

Table 1 Customer relationship management market 2018 - 2030 (USD Billion)

Table 2 Global customer relationship management market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global customer relationship management market estimates and forecasts by component, 2018 - 2030 (USD Billion)

Table 4 Global customer relationship management market estimates and forecasts by solution, (USD Billion), 2018 - 2030

Table 5 Global customer relationship management market estimates and forecasts by services, (USD Billion), 2018 - 2030

Table 6 Global customer relationship management market estimates and forecasts by deployment, (USD Billion), 2018 - 2030

Table 7 Global customer relationship management market estimates and forecasts by enterprise size, (USD Billion), 2018 - 2030

Table 8 Global customer relationship management market estimates and forecasts by end use, 2018 - 2030 (USD Billion)

Table 9 Component market by region, 2018 - 2030 (USD Billion)

Table 10 Solution market by region, 2018 - 2030 (USD Billion)

Table 11 Services market by region, 2018 - 2030 (USD Billion)

Table 12 Solution market by region, 2018 - 2030 (USD Billion)

Table 13 Customer service market by region, 2018 - 2030 (USD Billion)

Table 14 Customer experience management market by region, 2018 - 2030 (USD Billion)

Table 15 CRM analytics market by region, 2018 - 2030 (USD Billion)

Table 16 Marketing automation market by region, 2018 - 2030 (USD Billion)

Table 17 Salesforce automation market by region, 2018 - 2030 (USD Billion)

Table 18 Social media monitoring market by region, 2018 - 2030 (USD Billion)

Table 19 Others market by region, 2018 - 2030 (USD Billion)

Table 20 Deployment market by region, 2018 - 2030 (USD Billion)

Table 21 Cloud market by region, 2018 - 2030 (USD Billion)

Table 22 On premise market by region, 2018 - 2030 (USD Billion)

Table 23 Enterprise Size market by region, 2018 - 2030 (USD Billion)

Table 24 Large Enterprises market by region, 2018 - 2030 (USD Billion)

Table 25 Small and Medium Enterprises market by region, 2018 - 2030 (USD Billion)

Table 26 End-use market by region, 2018 - 2030 (USD Billion)

Table 27 BFSI market by region, 2018 - 2030 (USD Billion)

Table 28 Retail market by region, 2018 - 2030 (USD Billion)

Table 29 Healthcare market by region, 2018 - 2030 (USD Billion)

Table 30 IT & telecom market by region, 2018 - 2030 (USD Billion)

Table 31 Discrete manufacturing market by region, 2018 - 2030 (USD Billion)

Table 32 Government & education market by region, 2018 - 2030 (USD Billion)

Table 33 Others market by region, 2018 - 2030 (USD Billion)

Table 34 North America customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 35 North America customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 36 North America customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 37 North America customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 38 North America customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 39 U.S. customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 40 U.S. customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 41 U.S. customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 42 U.S. customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 43 U.S. customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 44 Canada customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 45 Canada customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 46 Canada customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 47 Canada customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 48 Canada customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 49 Mexico customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 50 Mexico customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 51 Mexico customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 52 Mexico customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 53 Mexico customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 54 Europe customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 55 Europe customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 56 Europe customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 57 Europe customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 58 Europe customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 59 U.K. customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 60 U.K. customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 61 U.K. customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 62 U.K. customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 63 U.K. customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 64 Germany customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 65 Germany customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 66 Germany customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 67 Germany customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 68 Germany customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 69 France customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 70 France customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 71 France customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 72 France customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 73 France customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 74 Spain customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 75 Spain customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 76 Spain customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 77 Spain customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 78 Spain customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 79 Asia Pacific customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 80 Asia Pacific customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 81 Asia Pacific customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 82 Asia Pacific customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 83 Asia Pacific customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 84 China customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 85 China customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 86 China customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 87 China customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 88 China customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 89 India customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 90 India customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 91 India customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 92 India customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 93 India customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 94 Japan customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 95 Japan customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 96 Japan customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 97 Japan customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 98 Japan customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 99 Australia customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 100 Australia customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 101 Australia customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 102 Australia customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 103 Australia customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 104 New Zealand customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 105 New Zealand customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 106 New Zealand customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 107 New Zealand customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 108 New Zealand customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 109 South America customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 110 South America customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 111 South America customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 112 South America customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 113 South America customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 114 Brazil customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 115 Brazil customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 116 Brazil customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 117 Brazil customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 118 Brazil customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 119 MEA customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 120 MEA customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 121 MEA customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 122 MEA customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 123 MEA customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 124 UAE customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 125 UAE customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 126 UAE customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 127 UAE customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 128 UAE customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 129 Saudi Arabia customer relationship management market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 130 Saudi Arabia customer relationship management market, by solution, 2018 - 2030 (Revenue, USD Billion)

Table 131 Saudi Arabia customer relationship management market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 132 Saudi Arabia customer relationship management market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 133 Saudi Arabia customer relationship management market, by end use, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 Customer Relationship Management Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/3)

Fig. 9 Segment Snapshot (2/3)

Fig. 10 Segment Snapshot (3/3)

Fig. 11 Competitive Landscape Snapshot

Fig. 12 Customer Relationship Management Market: Industry Value Chain Analysis

Fig. 13 Customer Relationship Management Market: Market Dynamics

Fig. 14 Customer Relationship Management Market: PORTER’s Analysis

Fig. 15 Customer Relationship Management Market: PESTEL Analysis

Fig. 16 Customer Relationship Management Market Share by Component, 2023 & 2030 (USD Billion)

Fig. 17 Solution Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Services Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Customer Relationship Management Market, by Solution: Market Share, 2023 & 2030

Fig. 20 Customer Service Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Customer Experience Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 CRM Analytics Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Marketing Automation Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Salesforce Automation Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Social Media Monitoring Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Customer Relationship Management Market Share by Deployment, 2023 & 2030 (USD Billion)

Fig. 28 Cloud Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 On premise Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Customer Relationship Management Market, by Enterprise Size: Market Share, 2023 & 2030

Fig. 31 Large Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 32 Small and Medium Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 33 Customer Relationship Management Market Share by End Use, 2023 & 2030 (USD Billion)

Fig. 34 BFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Retail Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Healthcare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 IT & Telecom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Discrete Manufacturing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Government & Education Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Regional Marketplace: Key Takeaways

Fig. 42 Regional Marketplace: Key Takeaways

Fig. 43 North America Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 44 U.S. Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 Canada Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 Mexico Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Europe Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 U.K. Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030,) (USD Billion)

Fig. 49 Germany Customer Relationship Management Market Estimates and Forecasts, (2018 - 2030,) (USD Billion)

Fig. 50 France Customer Relationship Management Market Estimates and Forecasts, (2018 - 2030,) (USD Billion)

Fig. 51 Spain Customer Relationship Management Market Estimates and Forecasts, (2018 - 2030,) (USD Billion)

Fig. 52 Asia Pacific Customer Relationship Management Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 53 China Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Japan Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 India Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 New Zealand Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Australia Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 South America Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Brazil Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 MEA Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Saudi Arabia Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 UAE Customer Relationship Management Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Key Company Categorization

Fig. 64 Company Market Positioning

Fig. 65 Key Company Market Share Analysis, 2023

Fig. 66 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Customer Relationship Management Component Outlook (Revenue, USD Billion; 2018 - 2030)

- Solution

- Services

- Customer Relationship Management Solution Outlook (Revenue, USD Billion; 2018 - 2030)

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Customer Relationship Management Deployment Outlook (Revenue, USD Billion; 2018 -2030)

- On-premise

- Cloud

- Customer Relationship Management Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

- Large Enterprise

- SME

- Customer Relationship Management End Use Outlook (Revenue, USD Billion; 2018 - 2030)

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- Customer Relationship Management Regional Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

- North America Customer Relationship Management Market, by Component

- Solution

- Services

- North America Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- North America Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- North America Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- North America Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- U.S.

- U.S. Customer Relationship Management Market, by Component

- Solution

- Services

- U.S. Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- U.S. Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- U.S. Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- U.S. Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- U.S. Customer Relationship Management Market, by Component

- Canada

- Canada Customer Relationship Management Market, by Component

- Solution

- Services

- Canada Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Canada Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- Canada Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- Canada Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- Canada Customer Relationship Management Market, by Component

- Mexico

- Mexico Customer Relationship Management Market, by Component

- Solution

- Services

- Mexico Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Mexico Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- Mexico Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- Mexico Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- Mexico Customer Relationship Management Market, by Component

- North America Customer Relationship Management Market, by Component

- Europe

- Europe Customer Relationship Management Market, by Component

- Solution

- Services

- Europe Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Europe Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- Europe Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- Europe Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- U.K.

- U.K. Customer Relationship Management Market, by Component

- Solution

- Services

- U.K. Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- U.K. Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- U.K. Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- U.K. Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- U.K. Customer Relationship Management Market, by Component

- Germany

- Germany Customer Relationship Management Market, by Component

- Solution

- Services

- Germany Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Germany Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- Germany Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- Germany Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- Germany Customer Relationship Management Market, by Component

- France

- France Customer Relationship Management Market, by Component

- Solution

- Services

- France Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- France Customer Relationship Management Market, by Deployment

- On-premise

- Cloud

- France Customer Relationship Management Market, by Enterprise Size

- Large Enterprise

- SME

- France Customer Relationship Management Market, by End Use

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Discrete Manufacturing

- Government & Education

- Others

- France Customer Relationship Management Market, by Component

- Spain

- Spain Customer Relationship Management Market, by Component

- Solution

- Services

- Spain Customer Relationship Management Market, by Solution

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Social Media Monitoring

- Others

- Spain Customer Relationship Management Market, by Deployment

- On-premise

- Cloud